2025 HOPPY Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: HOPPY's Market Position and Investment Value

HOPPY (HOPPY) is a memecoin launched on the Ethereum blockchain, paying homage to an internet meme based on the famous comic book The Night Riders published in 2012 by artist and illustrator Matt Furie. As of December 24, 2025, HOPPY has achieved a market capitalization of $3,004,147.29 with a circulating supply of 420.69 billion tokens, currently trading at approximately $0.000007141. This community-driven asset, characterized by its organic growth strategy through meme propagation and cultural engagement, is establishing itself within the memecoin ecosystem.

The HOPPY roadmap features three phases: Phase One focuses on organic community building through meme content creation, Phase Two targets reaching 100,000 token holders, and Phase Three aims to expand its influence across the broader meme universe. With 18,735 active holders and listed on 11 exchanges including Gate.com, HOPPY demonstrates growing market participation and accessibility.

This article will comprehensively analyze HOPPY's price trajectory from 2025 through 2030, incorporating historical price patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies tailored to this emerging memecoin asset.

HOPPY (HOPPY) Market Analysis Report

I. HOPPY Price History Review and Current Market Status

HOPPY Historical Price Trajectory

HOPPY is a memecoin launched on the Ethereum blockchain that has experienced significant price volatility since its inception. The token reached its all-time high (ATH) of $0.000305 on November 20, 2024, followed by a substantial correction. Subsequently, the token touched its all-time low (ATL) of $0.000005346 on December 17, 2025, representing a decline of approximately 98.25% from its peak.

HOPPY Current Market Status

As of December 24, 2025, HOPPY is trading at $0.000007141, reflecting a modest recovery from recent lows. The token exhibits the following market characteristics:

Price Performance:

- 1-hour change: -0.03%

- 24-hour change: +0.64%

- 7-day change: +24.04%

- 30-day change: +0.44%

- Year-to-date change: -93.13%

Market Capitalization Metrics:

- Current market cap: $3,004,147.29

- Fully diluted valuation (FDV): $3,004,147.29

- Market cap to FDV ratio: 100% (indicating 100% circulating supply)

- Market dominance: 0.000094%

- 24-hour trading volume: $23,981.56

Supply Dynamics:

- Circulating supply: 420,690,000,000 HOPPY tokens

- Total supply: 420,690,000,000 HOPPY tokens

- Maximum supply: 420,690,000,000 HOPPY tokens

- Supply circulation ratio: 100%

Community Metrics:

- Active holders: 18,735

- Trading pairs available: 11 exchanges

- Current market ranking: #1,865

24-hour Price Range:

- High: $0.000007458

- Low: $0.000007001

The 7-day price appreciation of 24.04% indicates recent positive momentum following the December 17 capitulation low, though the token remains significantly below its all-time high established in November 2024.

Click to view current HOPPY market price

HOPPY Market Sentiment Index

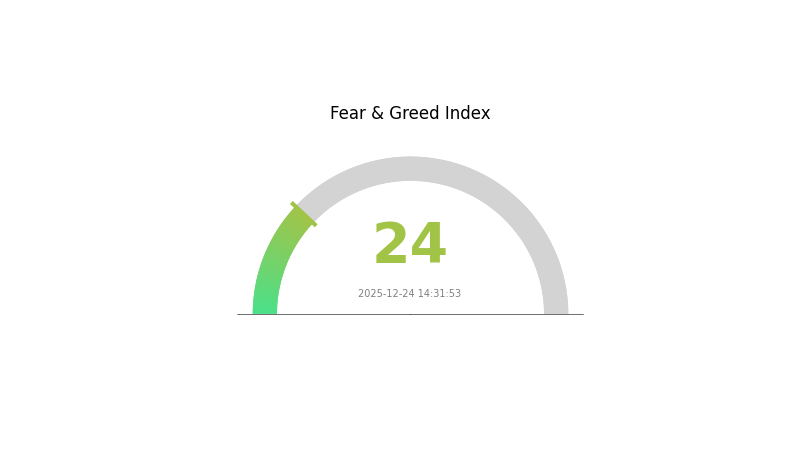

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index standing at 24. This indicates significant market pessimism and heightened risk aversion among investors. When fear reaches such extremes, it often presents contrarian opportunities for long-term investors. Market volatility is likely elevated, and asset prices may be experiencing downward pressure. Traders should exercise caution and consider their risk tolerance carefully. This sentiment typically reflects broader market uncertainty, making it an important period to reassess portfolio strategies and investment positions on Gate.com.

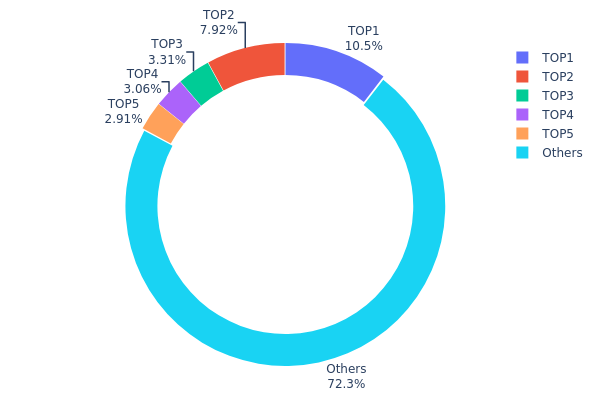

HOPPY Token Distribution

The address holding distribution represents the concentration of HOPPY tokens across blockchain wallets, serving as a critical indicator of market structure and potential systemic risks. This metric reveals how token ownership is dispersed among network participants, with significant implications for decentralization and price stability.

Current analysis of HOPPY's top five addresses demonstrates moderate concentration characteristics. The leading address commands 10.49% of total supply, while the second and third addresses hold 7.92% and 3.30% respectively. Combined, the top five addresses control approximately 27.68% of all HOPPY tokens in circulation, indicating that the remaining 72.32% of supply is distributed among the broader holder base. This distribution pattern suggests a relatively balanced ecosystem compared to highly concentrated tokens, though the top two addresses warrant monitoring as individual large stakeholders.

The current address distribution reflects a reasonably decentralized market structure with distributed ownership reducing acute manipulation risks. The substantial holding by "Others" representing over 72% of the supply demonstrates genuine community participation and liquidity availability. However, the concentrated positions held by the top addresses indicate potential volatility catalysts, as coordinated movements from major holders could influence short-term price dynamics. Overall, HOPPY's distribution suggests a developing but established token ecosystem with acceptable decentralization metrics and manageable concentration risk profiles for participants and market observers.

Click to view current HOPPY token holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5c69...3972f5 | 44143916.14K | 10.49% |

| 2 | 0x9642...2f5d4e | 33319894.48K | 7.92% |

| 3 | 0x68be...eae63b | 13911357.99K | 3.30% |

| 4 | 0x126d...1e2ffa | 12874558.94K | 3.06% |

| 5 | 0xc053...1099b1 | 12248484.42K | 2.91% |

| - | Others | 304191788.02K | 72.32% |

Core Factors Affecting HOPPY's Future Price

II. Core Factors Impacting HOPPY's Future Price Trajectory

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve policy decisions and FOMC meetings are critical variables influencing future price movements. Long-term traders should closely monitor economic data releases, particularly as quarterly transitions approach, as seasonal volatility may significantly impact price.

-

Altcoin Market Cycles: The broader altcoin bull market represents a key factor for HOPPY's price trajectory. During altcoin bull markets, capital tends to flow more toward alternative coins rather than Bitcoin, creating potential opportunities for price appreciation in tokens like HOPPY.

-

Overall Cryptocurrency Market Trends: HOPPY's price is primarily influenced by market demand, economic data, and policy changes within the broader cryptocurrency ecosystem. The overall cryptocurrency market sentiment and trend direction serves as the primary driver for individual token performance.

Risk Considerations: FOMC meetings and major economic data releases represent key variables for future price movements. Market reactions to these events can be unpredictable and may result in significant volatility.

III. 2025-2030 HOPPY Price Forecast

2025-2026 Outlook

- Conservative Forecast: $0.00001

- Neutral Forecast: $0.00001

- Optimistic Forecast: $0.00001 (requires increased market adoption and liquidity expansion)

2027-2028 Mid-term Perspective

- Market Stage Expectation: Consolidation phase with gradual accumulation as the token establishes stronger market fundamentals and trading infrastructure on platforms like Gate.com

- Price Range Predictions:

- 2027: $0.00001 (8% appreciation)

- 2028: $0.00001 (18% appreciation)

- Key Catalysts: Enhanced tokenomics implementation, expanded exchange listings, growing community engagement, and improved market sentiment

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00001 (44% appreciation by 2029 with sustained market conditions)

- Optimistic Scenario: $0.00001 (54% appreciation by 2030 with favorable blockchain ecosystem development)

- Transformative Scenario: $0.00001 (contingent on breakthrough partnerships, significant protocol upgrades, and mainstream adoption acceleration)

Note: The forecasted price levels remain relatively stable across the projection period, suggesting a consolidation-focused outlook. Investors should monitor fundamental developments, regulatory changes, and market liquidity metrics to assess actual performance against these projections.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00001 | 0.00001 | 0 | 0 |

| 2026 | 0.00001 | 0.00001 | 0 | 5 |

| 2027 | 0.00001 | 0.00001 | 0.00001 | 8 |

| 2028 | 0.00001 | 0.00001 | 0.00001 | 18 |

| 2029 | 0.00001 | 0.00001 | 0.00001 | 44 |

| 2030 | 0.00001 | 0.00001 | 0.00001 | 54 |

HOPPY Investment Strategy and Risk Management Report

I. Project Overview

Basic Information

HOPPY is a memecoin launched on the Ethereum blockchain that pays homage to an internet meme based on the famous comic book "The Night Riders," published in 2012 by artist and illustrator Matt Furie.

Key Metrics (as of December 24, 2025):

- Current Price: $0.000007141

- Market Capitalization: $3,004,147.29

- Circulating Supply: 420,690,000,000 HOPPY

- Total Supply: 420,690,000,000 HOPPY

- Market Ranking: 1865

- 24-Hour Trading Volume: $23,981.56

- Number of Holders: 18,735

- Blockchain: Ethereum (ERC-20)

- Contract Address: 0x6e79b51959cf968d87826592f46f819f92466615

Project Roadmap

HOPPY features a three-phase roadmap:

- Phase One: The fun begins through spreading memes with new content, with the community building itself organically.

- Phase Two: Focus on reaching 100,000 token holders.

- Phase Three: Aims to take over the meme universe.

II. Market Performance Analysis

Price Movement Trends

| Time Period | Change Percentage | Price Change |

|---|---|---|

| 1 Hour | -0.03% | -$0.000000002 |

| 24 Hours | +0.64% | +$0.000000045 |

| 7 Days | +24.04% | +$0.000001384 |

| 30 Days | +0.44% | +$0.000000031 |

| 1 Year | -93.13% | -$0.000096804 |

Historical Price Levels

- All-Time High (ATH): $0.000305 (November 20, 2024)

- All-Time Low (ATL): $0.000005346 (December 17, 2025)

- 24-Hour High: $0.000007458

- 24-Hour Low: $0.000007001

- Launch Price: $0.00021888

Market Capitalization and Liquidity

- Market Cap: $3,004,147.29

- Fully Diluted Valuation (FDV): $3,004,147.29

- Market Cap to FDV Ratio: 100%

- Market Dominance: 0.000094%

- Average 24-Hour Volume: $23,981.56

- Number of Trading Exchanges: 11

III. HOPPY Professional Investment Strategy and Risk Management

HOPPY Investment Methodology

(1) Long-Term Holding Strategy

Suitable Investors:

- Community-focused memecoin enthusiasts

- Investors with high risk tolerance

- Users interested in supporting meme culture initiatives

Operational Recommendations:

- Enter positions during market consolidation phases, particularly when prices are near support levels

- Maintain a diversified portfolio where HOPPY represents only a small percentage of overall holdings

- Track community engagement metrics and social media activity as indicators of project momentum

- Consider dollar-cost averaging for regular investment over time rather than lump-sum purchases

Storage Solution:

- Store tokens in secure, self-custody solutions with strong security protocols

- Enable two-factor authentication on all exchange accounts before withdrawal

- Maintain offline backups of private keys in secure locations

(2) Active Trading Strategy

Technical Analysis Tools:

- Candlestick Charts: Monitor 4-hour and daily timeframes to identify trend reversals and support/resistance levels

- Volume Analysis: Track trading volume spikes as confirmation signals for price movements

- Moving Averages: Use 20-day and 50-day moving averages to identify trend direction

Wave Trading Key Points:

- Identify support levels around $0.000006500 and resistance near $0.000008000 based on recent price action

- Execute buy orders when price bounces from support with increasing volume confirmation

- Set take-profit targets at identified resistance levels, typically capturing 15-25% gains per wave

HOPPY Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Maximum 0.5-1% of portfolio allocation to HOPPY and similar high-risk memecoins

- Active Investors: Maximum 2-3% of portfolio allocation with structured stop-loss protocols

- Professional Investors: Maximum 5% allocation with sophisticated risk hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit individual transaction size to no more than 1-2% of total portfolio to minimize catastrophic loss potential

- Profit Taking: Implement systematic profit-taking at predetermined price levels to lock in gains and reduce exposure

(3) Secure Storage Solution

- Custodial Exchange Wallets: Utilize Gate.com's secure platform for active trading with built-in security features and insurance coverage

- Self-Custody Approach: For long-term holdings, transfer tokens to personal wallet addresses with strong encryption and backup protocols

- Security Considerations: Never share private keys or seed phrases; use hardware-based solutions for storing large quantities; enable withdrawal whitelisting on exchanges; verify all transaction addresses before confirmation

IV. HOPPY Potential Risks and Challenges

HOPPY Market Risks

- Extreme Volatility: HOPPY has experienced a -93.13% decline over one year, indicating extreme price instability typical of memecoin assets. Price can swing dramatically based on minimal market catalysts.

- Low Liquidity: With only $23,981.56 in 24-hour trading volume against a market cap of $3 million, the token suffers from thin liquidity, making large orders susceptible to significant slippage.

- Concentration Risk: With only 18,735 token holders, the asset is highly concentrated among early investors, creating vulnerability to large sell-offs and potential pump-and-dump scenarios.

HOPPY Regulatory Risks

- Memecoin Classification: Regulatory authorities may increasingly scrutinize memecoins as speculative assets without underlying utility, potentially restricting trading or delisting on regulated platforms.

- Exchange Listing Risk: Trading availability across only 11 exchanges creates vulnerability to exchange delistings, which could severely restrict exit opportunities.

- Compliance Uncertainty: Evolving global cryptocurrency regulations could affect the token's compliance status and future trading ability.

HOPPY Technical Risks

- Smart Contract Vulnerability: As an ERC-20 token on Ethereum, the contract remains subject to potential code vulnerabilities or exploits that could result in fund loss.

- Network Congestion: During high Ethereum network activity, transaction fees could become prohibitive for small transactions, reducing trading efficiency.

- Limited Development Activity: The project shows minimal active development or technical upgrades, creating stagnation risk and potential obsolescence.

V. Conclusion and Action Recommendations

HOPPY Investment Value Assessment

HOPPY operates as a speculative memecoin with significant volatility and limited fundamental utility. The project's primary value proposition rests on community enthusiasm and cultural narratives rather than technical innovation or revenue-generating mechanisms. While the three-phase roadmap provides directional goals, the project remains highly experimental. The token's 93% decline over one year and extreme concentration among few holders present substantial risk factors. Investment should be considered only for users with exceptional risk tolerance and capital they can afford to lose entirely.

HOPPY Investment Recommendations

✅ Beginners: Avoid HOPPY as a primary investment vehicle. If interested, allocate no more than 0.25-0.5% of total portfolio in speculative positions, treat as a learning experience, and be prepared for complete loss of capital.

✅ Experienced Investors: Consider HOPPY only as a small speculative position within a broader diversified portfolio. Implement strict stop-loss orders at 30-40% below entry price. Use technical analysis to identify high-probability entry points during support zone bounces.

✅ Institutional Investors: HOPPY presents insufficient scale and liquidity for meaningful institutional allocation. The concentration risk and regulatory uncertainty make institutional involvement inadvisable.

HOPPY Trading Participation Methods

- Exchange Trading on Gate.com: Execute direct spot purchases and sales through Gate.com's platform, which offers reliable order matching and secure custody options for HOPPY trading pairs.

- Price Monitoring and Alerts: Use Gate.com's price alert features to track key levels ($0.000006000, $0.000008000) and automate trading decisions based on predetermined signals.

- Portfolio Tracking: Utilize Gate.com's portfolio management tools to monitor HOPPY holdings alongside other positions and maintain risk visibility.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. We strongly recommend consulting with professional financial advisors before making any investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

How high can HOPPY go?

HOPPY is predicted to reach approximately $0.0₅7184 by December 25, 2025. Long-term projections suggest potential for significant growth depending on market adoption and utility expansion. Price trajectory will depend on trading volume, community engagement, and overall market conditions.

Is HOPPY a good coin?

HOPPY shows promising fundamentals with growing community support and active development. Price predictions indicate potential gains in the long term. Strong trading activity and solid project backing make it a noteworthy investment opportunity in the crypto space.

What is HOPPY and what problem does it solve?

HOPPY is a smart mobility platform addressing urban challenges like air quality decline, traffic congestion, and parking issues. It provides sustainable transportation solutions to reduce environmental pollution and improve city traffic flow.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential

Ethereum Co-Founder Vitalik on the Creator Token Dilemma: Why Non-Tokenized DAOs Are the Key