2025 HT Price Prediction: Expert Analysis and Market Forecast for Huobi Token's Future Performance

Introduction: HT's Market Position and Investment Value

Huobi Token (HT) serves as the ecosystem token of the Huobi Global platform, functioning as a decentralized digital asset based on Ethereum. Since its launch in 2018, HT has established itself as an integral part of the Huobi ecosystem. As of December 2025, HT maintains a market capitalization of approximately $23.09 million, with a circulating supply of around 109.4 million tokens and a price holding steady at $0.2111. This asset, nicknamed "ham," plays an increasingly important role across the Huobi Global ecosystem, offering holders access to ecological rewards and benefiting from continuous token repurchase and burn mechanisms that enhance scarcity.

This article will provide a comprehensive analysis of HT's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

HT (Huobi Token) Market Analysis Report

I. HT Price History Review and Current Market Status

HT Historical Price Evolution

- May 2021: HT reached its all-time high of $39.66, representing peak market valuation during the bull market cycle.

- 2021-2025: Extended bear market period, with significant price depreciation from historical highs.

- June 2025: HT declined to its all-time low of $0.145929, marking the lowest price point in token history.

HT Current Market Condition

As of December 20, 2025, HT is trading at $0.2111 with a market capitalization of $23,093,430.00 and a fully diluted valuation of $43,060,271.94. The token currently ranks 811st by market cap with a market dominance of 0.0013%.

Recent Price Performance:

- 1-hour change: -0.52%

- 24-hour change: +0.38%

- 7-day change: -1.22%

- 30-day change: -12.52%

- 1-year change: -80.15%

The token's 24-hour trading volume stands at $12,299.83, with a price range between $0.2069 (low) and $0.2174 (high). HT has a circulating supply of 109,395,689.25 tokens out of a total supply of 203,980,445 tokens and a maximum supply cap of 500,000,000 tokens, representing 21.88% of fully diluted supply in circulation.

The token maintains 55,890 unique holders and is actively traded on 1 exchange platform. Current market sentiment reflects extreme fear conditions (VIX: 20).

Visit HT Market Price on Gate.com for real-time pricing and trading information.

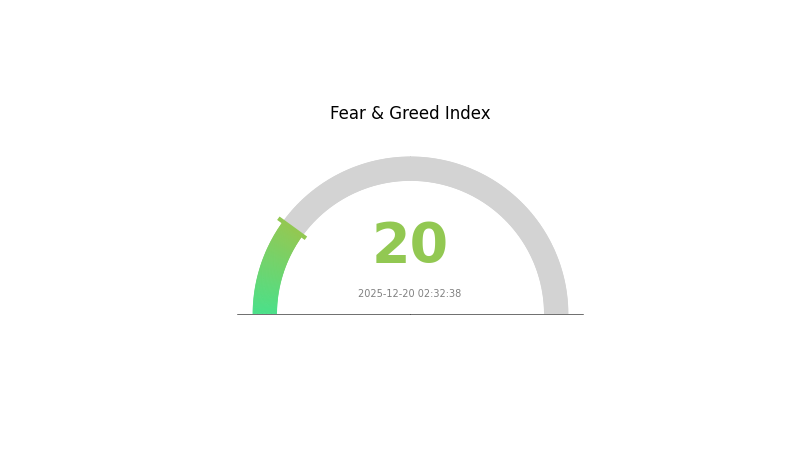

HT Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear sentiment today. With the index at just 20 points, investor confidence has hit critically low levels, indicating widespread panic and negative market outlook. This severe fear environment typically presents both significant risks and potential opportunities for strategic investors. Market participants should exercise caution and consider their risk tolerance carefully. Such extreme readings often precede market reversals, making this a crucial time to monitor price movements and market developments closely on Gate.com.

HT Holdings Distribution

The address holdings distribution map illustrates how HT tokens are concentrated across different wallet addresses on the blockchain, providing critical insights into token ownership structure and market concentration risk. By analyzing the distribution of the top holders relative to the total token supply, this metric reveals the degree of decentralization and potential market manipulation vulnerabilities within the HT ecosystem.

Current data demonstrates significant concentration risk, with the top two addresses collectively controlling 97.63% of all HT tokens in circulation. The leading address alone holds 78.12% of the total supply, representing an exceptionally high level of centralization. This extreme concentration suggests that HT's token distribution remains heavily skewed toward a limited number of holders, which may indicate these positions are held by the project team, institutional stakeholders, or locked reserves. The second-largest address controls an additional 19.51%, further reinforcing the oligopolistic structure of token ownership.

Beyond the top two addresses, the remaining holdings become increasingly dispersed. Addresses ranked third through fifth collectively account for only 0.84% of the supply, while other addresses hold just 1.53%. This sharp disparity underscores a two-tier ownership structure where governance and price discovery mechanisms are disproportionately influenced by a minimal number of large stakeholders. Such extreme concentration elevates the risk of coordinated market actions and reduces the resilience of the network's decentralization objectives. The current distribution pattern suggests limited practical decentralization despite HT's blockchain infrastructure, with market dynamics heavily dependent on the activities and decisions of the largest token holders.

Visit HT Holdings Distribution on Gate.com for current data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000000 | 390604.31K | 78.12% |

| 2 | 0x1870...dda12e | 97585.04K | 19.51% |

| 3 | 0xd004...4bf9d4 | 2294.36K | 0.45% |

| 4 | 0xc882...84f071 | 1309.03K | 0.26% |

| 5 | 0x9fcc...8c19fe | 690.39K | 0.13% |

| - | Others | 7516.86K | 1.53% |

II. Core Factors Affecting HT's Future Price

Market Demand and Trading Volume

- Exchange Listing Impact: Listing on major exchanges typically generates short-term price volatility, with historical data showing new token listings experiencing 10-30% price fluctuations.

- Liquidity Effects: HT's price movement is influenced by overall market liquidity and trading flow, with the token showing moderate short-term momentum relative to recent price highs and lows.

Market Sentiment and Technical Factors

- Price Action: Macro price trends display sustained downward pressure on 4-hour charts, with the token challenging or losing key psychological support levels.

- Leverage Indicators: Derivatives market sentiment, particularly large trader long leverage ratios, serves as a key emotional indicator influencing short-term price movements.

Long-Term Development Prospects

- Project Application: Long-term price trends depend on HT's actual application utility and technological innovation within its ecosystem.

- Market Trends: Overall cryptocurrency market direction and sentiment play a significant role in determining HT's price trajectory, with short-term fluctuations often driven by news events and market emotions.

III. 2025-2030 HT Price Forecast

2025 Outlook

- Conservative Forecast: $0.1140 - $0.2111

- Base Case Forecast: $0.2111

- Optimistic Forecast: $0.3061 (requiring sustained platform growth and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation and consolidation phase with incremental price appreciation driven by ecosystem expansion

- Price Range Forecast:

- 2026: $0.2198 - $0.3052 (22% potential upside)

- 2027: $0.1550 - $0.3946 (33% potential upside)

- 2028: $0.3112 - $0.4262 (60% potential upside)

- Key Catalysts: Platform utility enhancement, institutional adoption, trading volume growth, and strengthening of the underlying ecosystem fundamentals

2029-2030 Long-term Outlook

- Base Case Scenario: $0.3708 - $0.5466 (81% potential upside by 2029; assuming stable market conditions and consistent platform performance)

- Optimistic Scenario: $0.2740 - $0.5944 (119% potential upside by 2030; assuming accelerated adoption and strong market recovery)

- Transformative Scenario: $0.5944+ (assuming breakthrough partnerships, significant protocol upgrades, or major market expansion events)

- 2030-12-20: HT approaches $0.5944 (demonstrating sustained long-term growth trajectory with increased market confidence)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.3061 | 0.2111 | 0.11399 | 0 |

| 2026 | 0.30515 | 0.2586 | 0.21981 | 22 |

| 2027 | 0.39462 | 0.28187 | 0.15503 | 33 |

| 2028 | 0.42619 | 0.33825 | 0.31119 | 60 |

| 2029 | 0.54657 | 0.38222 | 0.37075 | 81 |

| 2030 | 0.59442 | 0.46439 | 0.27399 | 119 |

HT (Huobi Token) Professional Investment Strategy and Risk Management Report

I. Executive Summary

HT is the abbreviation of Huobi Token, representing Huobi's global ecosystem points. As a decentralized digital asset based on Ethereum with a total supply cap of 500 million tokens, HT serves as a critical hub supporting Huobi's global business operations and ecosystem applications. As of December 20, 2025, HT is trading at $0.2111, with a market capitalization of approximately $23.09 million and a circulation supply of 109.4 million tokens.

II. Current Market Status Analysis

Price Performance

| Metric | Value |

|---|---|

| Current Price | $0.2111 |

| 24H Change | +0.38% |

| 7D Change | -1.22% |

| 30D Change | -12.52% |

| 1Y Change | -80.15% |

| All-Time High | $39.66 (May 12, 2021) |

| All-Time Low | $0.145929 (June 22, 2025) |

HT has experienced significant depreciation, declining 80.15% over the past year, though showing modest recovery signals in short-term timeframes.

Market Metrics

- Market Capitalization: $23,093,430.00 (current market cap)

- Fully Diluted Valuation: $43,060,271.94

- 24H Trading Volume: $12,299.83

- Circulating Supply Ratio: 21.88%

- Total Holders: 55,890

- Market Dominance: 0.0013%

- Current Ranking: #811 by market cap

III. Project Fundamentals

Token Utility and Ecosystem Functions

HT operates as Huobi's native ecosystem token with the following applications:

- Ecosystem Integration: Used across multiple scenarios within Huobi's platform and broader ecosystem

- Holder Benefits: Token holders enjoy corresponding rights and benefits across Huobi's full ecosystem

- Sub-Token Rewards: Holders receive rewards in ecosystem sub-tokens

- Scarcity Mechanism: Benefits from Huobi's continuous repurchase and burn mechanisms that enhance token scarcity

Technical Specifications

- Blockchain: Ethereum

- Token Standard: ERC-20 compliant

- Contract Address: 0x6f259637dcd74c767781e37bc6133cd6a68aa161

- Maximum Supply: 500,000,000 HT

- Initial Launch Price: $1.49

- Launch Date: January 23, 2018

Ecosystem Positioning

HT serves as a foundational token supporting Huobi Group's global operations, functioning as an important hub within the ecosystem framework. The token's value proposition is directly tied to the health and expansion of Huobi's platform services.

IV. HT Professional Investment Strategy and Risk Management

HT Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Ecosystem believers, long-term crypto allocators, and institutional participants seeking exposure to exchange ecosystem tokens.

Operational Recommendations:

- Dollar-cost averaging (DCA): Accumulate HT over extended periods during market volatility to reduce entry point risk

- Ecosystem participation: Actively engage with Huobi platform services to maximize HT utility and reward generation

- Portfolio allocation: Position HT as a satellite holding (2-5% of crypto portfolio) rather than a core position, given market volatility

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure, non-custodial storage with direct access to ecosystem benefits

- Implement hardware wallet backup solutions for long-term security

- Maintain small trading reserves on Gate.com for active trading operations

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor $0.145 (all-time low support) and $0.25 resistance; utilize 50-day and 200-day moving averages for trend confirmation

- Volume Analysis: Track 24-hour volume patterns; increased volume above $15,000 signals potential breakout opportunities; declining volume below $8,000 suggests weakening momentum

Wave Trading Key Points:

- Risk/reward ratio: Maintain minimum 1:2 ratio for entry positions; place stops at recent swing lows

- Volatility windows: Monitor 24-hour price ranges; capitalize on intraday moves within the 0.38% daily volatility range

HT Risk Management Framework

(1) Asset Allocation Principles

| Investor Type | HT Allocation |

|---|---|

| Conservative | 1-2% of portfolio |

| Active | 3-5% of portfolio |

| Professional | 5-8% of portfolio |

These allocations reflect HT's market capitalization position (#811) and liquidity characteristics.

(2) Risk Mitigation Strategies

- Diversification Hedge: Maintain balanced exposure across different asset classes and market caps; avoid concentration risk

- Trailing Stop-Loss Strategy: Implement automated exits at 15-20% below entry points to protect capital during adverse price movements

(3) Secure Storage Solutions

- Self-Custody Wallet: Gate.com Web3 Wallet provides non-custodial, user-controlled storage with integrated ecosystem access

- Exchange Custody: Maintain trading positions on Gate.com for immediate liquidity and active management capability

- Security Considerations: Enable two-factor authentication on all accounts; never share private keys or recovery phrases; verify all transaction destinations before confirmation; perform regular security audits

V. Potential Risks and Challenges

HT Market Risks

- Extreme Price Volatility: HT has declined 80.15% year-over-year despite modest short-term recovery, indicating significant downside exposure and unpredictable price movements

- Low Liquidity: 24-hour trading volume of $12,299 creates limited exit liquidity during market stress; large position exits may experience substantial slippage

- Correlation to Exchange Performance: HT value is directly correlated to Huobi's operational success and market share; platform challenges negatively impact token valuation

HT Regulatory Risks

- Exchange Regulatory Pressures: Global cryptocurrency exchange regulations continue to evolve; compliance challenges affecting Huobi operations directly impact HT utility and adoption

- Token Classification Uncertainty: Regulatory bodies may classify HT differently across jurisdictions, potentially affecting trading and holding rights

- Jurisdictional Restrictions: Certain regions restrict or prohibit exchange token trading; compliance changes could limit HT market access

HT Technology Risks

- Smart Contract Vulnerability: As an Ethereum-based token, HT faces potential smart contract bugs or vulnerabilities affecting token functionality or security

- Blockchain Network Dependency: HT relies on Ethereum network stability; network congestion or upgrades may impact transaction speed and cost efficiency

- Ecosystem Platform Risk: Technical failures or performance degradation of Huobi platform infrastructure could reduce HT utility and demand

VI. Conclusions and Action Recommendations

HT Investment Value Assessment

HT represents a specialized ecosystem token with significant depreciation over the past year (-80.15%), currently trading near historical lows at $0.2111. The token's value proposition is fundamentally tied to Huobi's operational success and market competitiveness. While the low price and small market capitalization ($23.09M) present potential recovery opportunities for risk-tolerant investors, the limited trading liquidity and concentrated user base create substantial volatility. The token functions primarily as an ecosystem utility rather than a standalone investment asset, making it most suitable for active Huobi platform users rather than passive investors.

HT Investment Recommendations

✅ Beginners: Consider small exploratory positions (under 1% of portfolio) only after gaining Huobi platform experience; prioritize understanding token utility before deploying capital; utilize Gate.com for accessible trading and education.

✅ Experienced Investors: Implement cautious accumulation during established support levels; employ DCA strategy to average entry costs; maintain strict position sizing (3-5% maximum allocation) and disciplined stop-loss protocols; actively monitor ecosystem developments.

✅ Institutional Investors: Conduct thorough due diligence on Huobi operational metrics and regulatory compliance status; consider HT as a satellite ecosystem exposure rather than core allocation; structure positions through professional custody solutions; maintain active engagement with platform developments.

HT Trading Participation Methods

- Gate.com Spot Trading: Direct purchase and sale of HT tokens with competitive pricing and deep liquidity; access to real-time market data and trading tools

- Dollar-Cost Averaging Programs: Systematically accumulate HT over defined periods through automated recurring purchases to mitigate timing risk

- Staking and Ecosystem Participation: Engage with Huobi ecosystem features to generate token rewards and maximize utility value beyond price speculation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions according to their individual risk tolerance and seek professional financial guidance. Never invest funds you cannot afford to lose completely.

FAQ

Will hot coin reach $1?

HOT coin reaching $1 is possible but requires substantial ecosystem growth, mainstream adoption of Holochain applications, and strong market acceptance. With 177 billion circulating tokens, achieving this milestone depends on significant development momentum and increased utility adoption.

What is the price of HT?

The current price of Huobi Token (HT) is $0.20449 USD as of December 20, 2025. HT has increased by 6.45% in the past 24 hours, reflecting strong market momentum and investor confidence in the token.

What is the price prediction for hot token in 2025?

In 2025, HOT is expected to reach $0.002895 in a bullish scenario, but could decline to $0.0003408 if momentum weakens. This prediction is based on current market analysis and technical indicators.

Where to Find Alpha in the 2025 Crypto Spot Market

why is crypto crashing and will it recover ?

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 CHZ Price Prediction: Will Chiliz Soar to New Heights in the Crypto Sports Market?

2025 BRETTPrice Prediction: Analyzing Future Market Trends, Challenges, and Growth Potential

Understanding Bitcoin Futures: A Complete Trading Guide

How to Purchase Propichain Tokens: A Step-by-Step Guide

Secure Your Bitcoin with Self-Controlled Wallet Solutions

Discover the Pudgy Penguins NFT Collection: A Comprehensive Guide

Understanding Decentralized Crypto Lending Solutions