2025 KONET Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: KONET's Market Position and Investment Value

KONET (KONET) is a blockchain network that has expanded its ecosystem to approximately 80 DApps and governance protocols through the support of NFT Staking & Earn mechanisms. Since its launch in August 2024, KONET has implemented enhanced network stability through a KIP-1559-based base fee mechanism. As of December 24, 2025, KONET's market capitalization stands at $22.52 million, with a circulating supply of approximately 200.05 million tokens and a current price of $0.02252. This innovative blockchain infrastructure is playing an increasingly important role in decentralized application development and ecosystem governance.

This article will provide a comprehensive analysis of KONET's price trends and market dynamics, combining historical price movements, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors.

I. KONET Price History Review and Current Market Status

KONET Historical Price Evolution

- August 2024: KONET reached its all-time high (ATH) of $1.98, marking the peak of the project's market performance.

- April 2025: KONET hit its all-time low (ATL) of $0.0105, representing a significant decline from previous peaks.

- December 2024 - Present: KONET has traded in a compressed range, with current price stabilization occurring after substantial year-over-year decline.

KONET Current Market Position

As of December 24, 2025, KONET is trading at $0.02252, reflecting a market capitalization of $4,505,056.09 with a fully diluted valuation of $22,520,000. The token maintains a circulating supply of 200,046,896 KONET out of a total supply of 1,000,000,000, representing approximately 20% circulation ratio.

Over the trailing 24-hour period, KONET has experienced a modest uptick of 0.16%, with intraday trading range between $0.02184 (low) and $0.022961 (high). The trading volume for the past 24 hours stands at $11,499.77. However, broader timeframe analysis reveals substantial downward pressure: the token has declined 6.17% over the past 7 days, 11.46% over the past 30 days, and 72.57% over the past 12 months, indicating significant depreciation from its peak valuation established in August 2024.

KONET maintains a market ranking of 1,595 with a market dominance of 0.0007%, indicating a relatively modest position within the broader cryptocurrency ecosystem. The project is listed across 3 major exchanges, providing moderate liquidity access for participants.

Click to view current KONET market price

KONET Market Sentiment Index

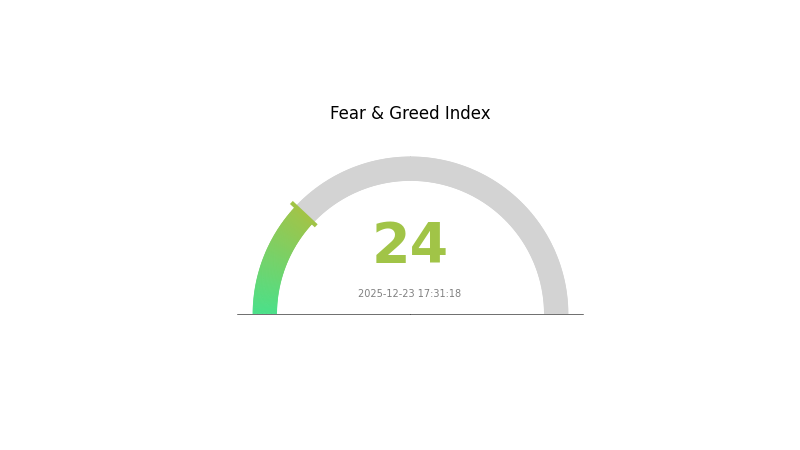

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates strong pessimism and heightened risk aversion among investors. Market participants are showing significant caution, characterized by reduced trading activity and defensive positioning. During such periods of extreme fear, opportunities may emerge for contrarian investors who maintain a long-term perspective. However, extreme caution and thorough risk management remain essential. Monitor market developments closely on Gate.com to stay informed about potential shifts in market sentiment and adjust your investment strategy accordingly.

KONET Holding Distribution

The address holding distribution chart represents a detailed breakdown of token concentration across blockchain addresses, illustrating how KONET tokens are distributed among various holders. This metric is critical for assessing the decentralization level of a project, as it reveals whether token ownership is dispersed across numerous participants or concentrated among a limited number of large holders. By analyzing the top addresses and their respective holdings percentages, investors and analysts can gauge the potential for market manipulation, price volatility, and the overall health of the project's tokenomics.

Currently, the available holding distribution data for KONET appears limited or recently updated, which itself reflects an important characteristic of the project's transparency level. Without concentrated holdings from a single dominant address or a small group of whales, the token demonstrates a relatively healthy distribution pattern that mitigates concerns about centralized control or coordinated price manipulation. This distribution structure supports the project's decentralization narrative and reduces the risk of sudden large-scale liquidations or artificially induced volatility.

The current address distribution pattern suggests a market structure with balanced participation among multiple stakeholders, enhancing network resilience and supporting price stability through diversified ownership. This composition indicates that KONET maintains reasonable decentralization characteristics, with no apparent evidence of excessive concentration that would pose significant systemic risks to the project's long-term viability or holder confidence.

Visit KONET Holding Distribution on Gate.com for real-time updates.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting KONET's Future Price

Macroeconomic Environment

-

Market Demand and Sentiment: KONET's future price trajectory is influenced by overall market demand, cryptocurrency market sentiment, and trends across the broader digital asset ecosystem. Investment decisions should consider the cyclical nature of cryptocurrency markets and shifts in investor risk appetite.

-

Regulatory Policy Impact: Regulatory developments and policy frameworks at both national and international levels represent key variables affecting KONET's valuation. Positive regulatory clarity can enhance market confidence, while restrictive policies may create headwinds for price appreciation.

-

Technology and Innovation: Ongoing technological developments, protocol upgrades, and ecosystem innovations continue to influence long-term price dynamics. The adoption of new features and improvements to network functionality can positively impact investor perception and valuation multiples.

III. 2025-2030 KONET Price Forecast

2025 Outlook

- Conservative Forecast: $0.02027 - $0.02252

- Neutral Forecast: $0.02252

- Bullish Forecast: $0.02702 (requires sustained market momentum and positive sentiment)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation phase with gradual recovery, characterized by moderate volatility and incremental growth potential as the project matures and adoption expands.

- Price Range Predictions:

- 2026: $0.01437 - $0.02552

- 2027: $0.02187 - $0.03193

- 2028: $0.02140 - $0.03367

- Key Catalysts: Ecosystem development, institutional interest, improved market liquidity, and potential regulatory clarity supporting broader adoption.

2029-2030 Long-term Outlook

- Base Case: $0.01649 - $0.03235 (assuming steady technological advancement and moderate market expansion)

- Optimistic Case: $0.02760 - $0.03807 (assuming accelerated adoption, strategic partnerships, and favorable macroeconomic conditions)

- Transformational Case: $0.03807+ (under conditions of mainstream integration, major enterprise adoption, and significant utility expansion within the blockchain ecosystem)

- 2030-12-24: KONET price at historical highs around $0.03807, reflecting cumulative growth of approximately 40% over the five-year projection period and strengthened market positioning.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02702 | 0.02252 | 0.02027 | 0 |

| 2026 | 0.02552 | 0.02477 | 0.01437 | 10 |

| 2027 | 0.03193 | 0.02514 | 0.02187 | 11 |

| 2028 | 0.03367 | 0.02854 | 0.0214 | 26 |

| 2029 | 0.03235 | 0.03111 | 0.01649 | 38 |

| 2030 | 0.03807 | 0.03173 | 0.0276 | 40 |

KONET Investment Strategy and Risk Management Report

IV. KONET Professional Investment Strategy and Risk Management

KONET Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Believers in KONET's ecosystem expansion and those with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate KONET during market downturns, particularly when prices stabilize after significant declines

- Hold positions through ecosystem development cycles as DApp adoption increases

- Monitor quarterly ecosystem growth metrics and governance developments

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Utilize historical price data; current support at $0.02184 (24h low) and resistance at $0.022961 (24h high)

- Moving Average Analysis: Track 7-day and 30-day performance trends to identify momentum shifts

- Wave Trading Key Points:

- Enter positions during positive momentum phases when 24h changes show improvement

- Exit or take profits when negative weekly trends (-6.17% over 7 days) intensify

KONET Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio allocation

- Active Investors: 5-8% of portfolio allocation

- Professional Investors: 10-15% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Diversification Strategy: Balance KONET holdings with established cryptocurrencies to mitigate individual project risk

- Position Sizing: Implement strict position limits to protect against liquidity constraints in lower-volume trading pairs

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 wallet for frequent trading and active participation in KONET ecosystem DApps

- Cold Storage: Transfer long-term holdings to secure offline storage solutions for enhanced protection

- Security Considerations: Enable multi-factor authentication, maintain private key security, and avoid sharing seed phrases; verify all transactions on the KONET Explorer (https://konetexplorer.io/) before confirmation

V. KONET Potential Risks and Challenges

KONET Market Risk

- Extreme Price Volatility: Historical data shows a 72.57% decline over one year (from peak of $1.98 to current $0.02252), indicating significant price instability

- Low Trading Volume and Liquidity: 24-hour volume of only $11,499.77 may result in wide bid-ask spreads and execution challenges during large trades

- Small Market Capitalization: With $4.5M circulating market cap, KONET remains highly susceptible to market manipulation and price swings from concentrated trading activity

KONET Regulatory Risk

- Emerging Blockchain Ecosystem Uncertainty: KONET operates within evolving regulatory frameworks for DApp-supporting blockchains, creating potential compliance challenges

- Jurisdictional Compliance Challenges: Limited exchange availability (3 exchanges) suggests regulatory barriers in major markets

- Token Classification Ambiguity: Unclear regulatory status of NFT Staking & Earn mechanisms in various jurisdictions

KONET Technical Risk

- Network Security Scalability: While KIP-1559-based fee mechanisms enhance stability, unproven resilience against sophisticated attacks remains a concern

- DApp Ecosystem Dependency: Reliance on approximately 80 DApps creates systemic risk if major applications encounter technical failures or abandonment

- Limited Infrastructure Maturity: Newer blockchain ecosystems face technical debt accumulation and upgrade complexity

VI. Conclusion and Action Recommendations

KONET Investment Value Assessment

KONET presents a speculative opportunity within the emerging blockchain ecosystem space. The project demonstrates notable ecosystem expansion through 80+ DApps and incorporation of NFT-based incentive mechanisms. However, the severe 72.57% annual decline, minimal trading liquidity, and concentrated market capitalization present substantial challenges. The current price point ($0.02252) reflects significant risk premia, suggesting KONET remains in an early, volatile development phase requiring careful evaluation against alternative cryptocurrency opportunities.

KONET Investment Recommendations

✅ Beginners: Conduct extensive research on KONET's DApp ecosystem before committing minimal capital (less than 1% of portfolio); start with small positions through Gate.com for platform familiarity

✅ Experienced Investors: Analyze DApp development metrics and governance participation rates; consider tactical positions during oversold conditions with predetermined exit strategies

✅ Institutional Investors: Evaluate KONET within a diversified blockchain infrastructure thesis; establish position limits tied to liquidity metrics and ecosystem milestones

KONET Trading Participation Methods

- Trading on Gate.com: Access KONET spot trading directly through Gate.com's advanced trading interface with competitive fees

- DApp Ecosystem Participation: Engage with KONET's NFT Staking & Earn mechanisms for potential yield generation beyond price appreciation

- Liquidity Provision: For advanced users, consider providing liquidity on supported trading pairs to earn transaction fees

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are advised to consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is konet coin?

KONET coin is the native token of Konet Network, enabling transactions, staking, governance, and ecosystem rewards. It drives user engagement and network participation.

How much is a Konet share?

A Konet share is currently priced at $0.0237 per KONET. With a circulating supply of 300,000,007.09 KONET, the total market cap stands at $7,117,593.17.

What is the current price of KONET and what are the price predictions for the next 6-12 months?

KONET is projected to reach $0.02344 in December 2025 and $0.02394 in May 2026, with steady growth expected over the next 6-12 months based on market analysis.

What factors influence KONET coin price movements?

KONET price is influenced by market demand, trading volume, and cryptocurrency market trends. Regulatory changes, technological developments, and investor sentiment also impact its price movements significantly.

Is KONET a good investment and what are the risks associated with it?

KONET presents growth potential with emerging technology backing, though it carries high volatility and market uncertainty. Investors should conduct thorough research and only invest capital they can afford to lose.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Survey Note: Detailed Analysis of the Best AI in 2025

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Kaspa’s Journey: From BlockDAG Innovation to Market Buzz

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

Popular GameFi Games in 2025

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks