2025 LA Price Prediction: Expert Analysis and Market Forecast for Los Angeles Real Estate

Introduction: LA's Market Position and Investment Value

Lagrange (LA) is a Zero-Knowledge Coprocessing protocol that enables verifiable computations at big data scale across various blockchains. Since its inception, it has established itself as an innovative solution in the blockchain ecosystem. As of December 2025, LA has achieved a market capitalization of approximately $292.6 million, with a circulating supply of 193 million tokens and a current price hovering around $0.2926. This protocol, recognized for its hyper-scalable proving capabilities, is playing an increasingly crucial role in cross-chain interoperability and applications requiring complex computations over large datasets.

This article will provide a comprehensive analysis of LA's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this emerging zero-knowledge technology asset.

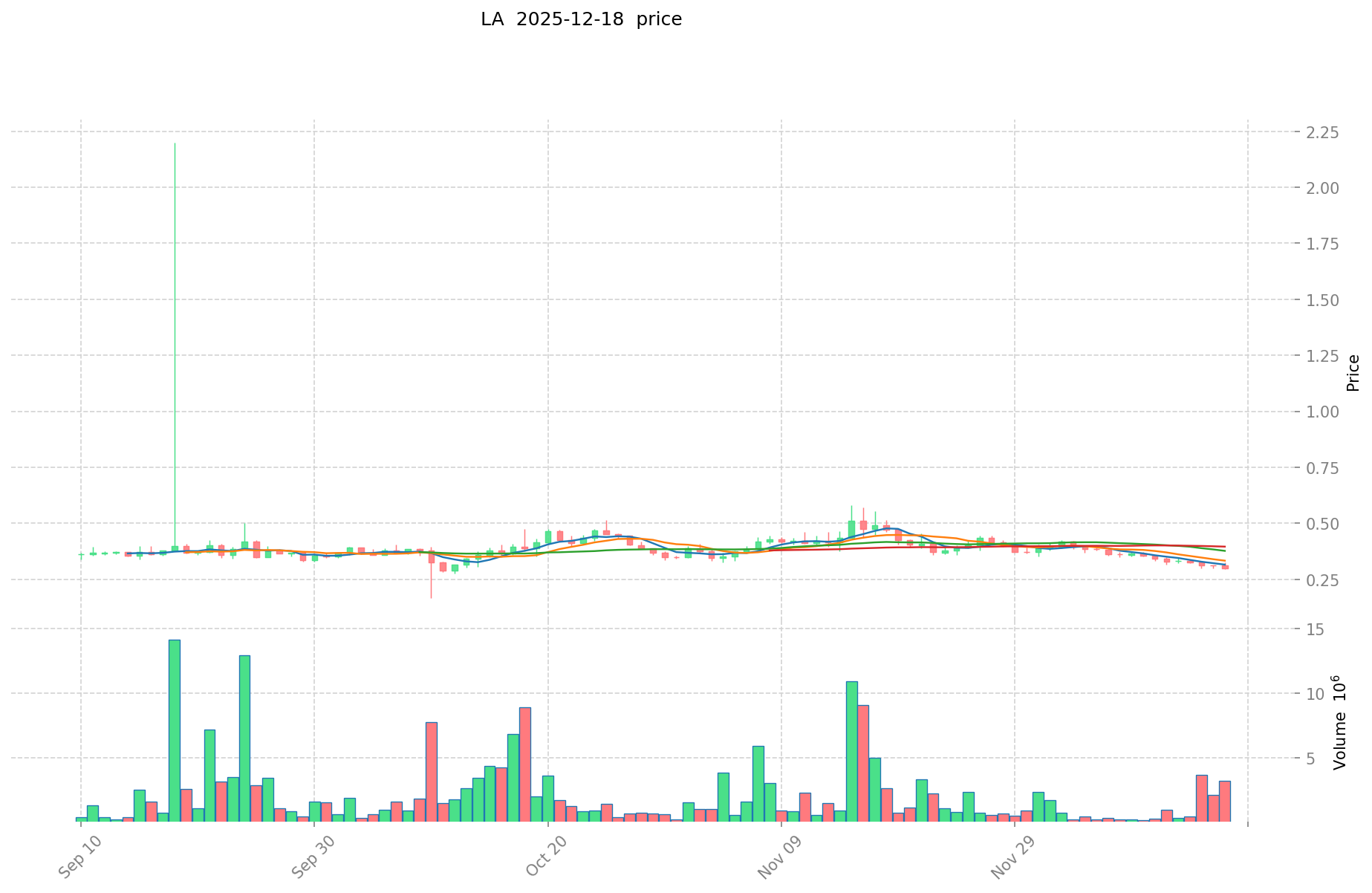

I. LA Price History Review and Current Market Status

LA Historical Price Evolution

Based on the available data, Lagrange (LA) has experienced significant price volatility since its launch:

- September 2025: LA reached its all-time high (ATH) of $2.20, marking the peak of its price performance.

- October 2025: LA declined to its all-time low (ATL) of $0.1647, representing a substantial correction from the peak.

- December 2025: LA is currently trading at $0.2926, showing partial recovery from the ATL but maintaining a significant discount from its historical high.

LA Current Market Status

As of December 18, 2025, Lagrange (LA) is trading at $0.2926, reflecting a 24-hour decline of -6.13%. The token has demonstrated mixed performance across different timeframes: a slight 1-hour gain of +0.21%, a 7-day loss of -12.47%, a 30-day decline of -41.99%, and a 1-year decline of -45.19%.

The token's market capitalization stands at approximately $56.47 million, with a fully diluted valuation (FDV) of $292.60 million, indicating a circulating supply ratio of 19.3%. The 24-hour trading volume reaches $1,062,674.75, demonstrating moderate liquidity across the market. LA maintains a market dominance of 0.0094%, ranking 466th among all cryptocurrencies.

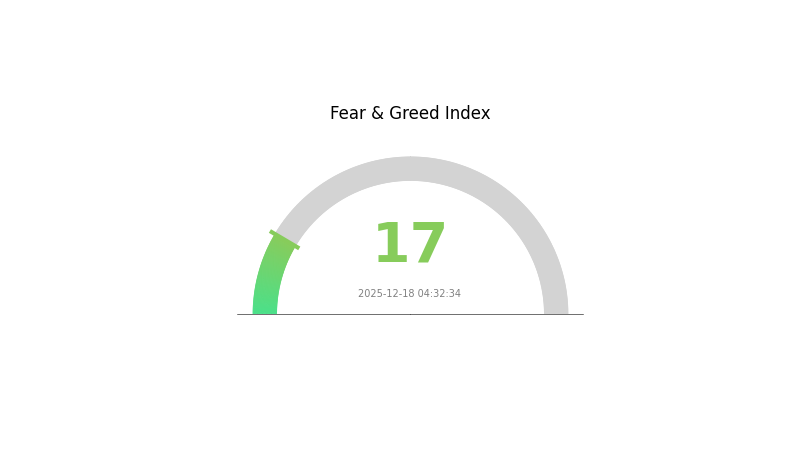

The current market sentiment indicates "Extreme Fear" with a VIX reading of 17, reflecting broader market anxiety. The token has attracted a community of 1,198 holders and is listed on 34 different exchanges globally.

Click to view current LA market price

LA Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear as the index plummets to 17. This indicates severe negative sentiment among investors, with panic selling potentially creating opportunities for contrarian investors. Market volatility remains elevated, suggesting caution is warranted. Such extreme readings often precede significant market movements, making it crucial to monitor developments closely. Consider dollar-cost averaging strategies rather than lump-sum investments during this period of heightened uncertainty.

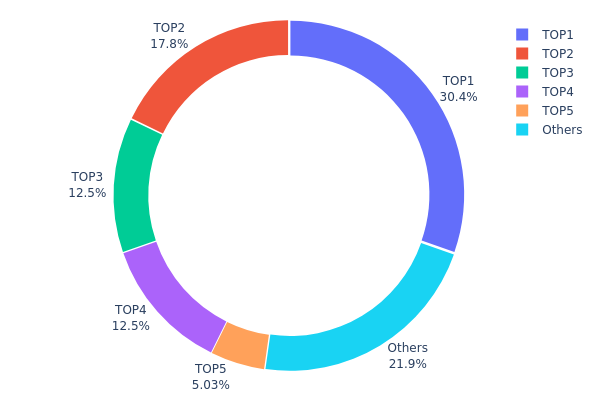

LA Holdings Distribution

The address holdings distribution represents the concentration of LA token ownership across the blockchain network, measured by the percentage of total supply held by individual addresses. This metric serves as a critical indicator for assessing token decentralization, market structure integrity, and potential vulnerability to coordinated selling pressure or price manipulation. By analyzing the top addresses and their respective holdings, market participants can evaluate the degree of wealth concentration and the stability of the underlying asset's on-chain ecosystem.

LA currently exhibits significant concentration risk, with the top four addresses controlling approximately 73.08% of the total circulating supply. The largest holder (0xaec3...87c073) commands 30.36% of all LA tokens, while the second and third addresses maintain substantial positions at 17.82% and 12.45% respectively. This pronounced concentration within a small number of addresses suggests limited token distribution and raises concerns about potential market manipulation or sudden liquidation events. The remaining 21.9% dispersed among other addresses further underscores the oligopolistic structure of LA's current holder base, indicating that meaningful price movements could be triggered by coordinated actions from just a handful of wallet addresses.

The existing concentration pattern presents elevated systemic risk to LA's market stability. With over 73% of the token supply consolidated among four addresses, the decentralization characteristics of the asset remain substantially compromised. This structure amplifies vulnerability to flash crashes, whale-driven volatility, and reduced liquidity resilience during periods of market stress. For long-term sustainability and institutional adoption, LA would benefit from improved token distribution mechanisms and broader stakeholder participation to establish a more resilient and genuinely decentralized market foundation.

Click to view current LA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xaec3...87c073 | 291563.77K | 30.36% |

| 2 | 0xcd1a...89f9dc | 171136.68K | 17.82% |

| 3 | 0x1891...231738 | 119578.37K | 12.45% |

| 4 | 0x9c13...3c3a83 | 119578.37K | 12.45% |

| 5 | 0x269e...249105 | 48285.11K | 5.02% |

| - | Others | 210165.71K | 21.9% |

II. Core Factors Influencing LA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: The Federal Reserve's policy trajectory remains a critical variable shaping asset price movements. As of December 2025, the Fed has completed its rate-cutting cycle with the third and final rate cut of the year, reducing the federal funds rate target range to 3.50%–3.75%. Market expectations show approximately 76% probability of the Fed maintaining rates in January 2026, while futures markets suggest roughly 68% probability of two or more rate cuts within the new year. This policy uncertainty creates a favorable environment for alternative investments, as lower interest rates reduce the opportunity cost of holding non-yielding assets.

-

Inflation Hedge Properties: Core inflation indicators have risen over the past three months, with Core CPI inflation rebounding above 3% after dipping below that level from March to June. This persistent inflation backdrop, combined with declining real yields, supports the case for assets perceived as inflation hedges. The combination of lower nominal rates and sticky inflation expectations means real rates remain in a range favorable for alternative asset allocation.

-

Geopolitical Factors: Rising geopolitical tensions and trade uncertainties have elevated risk-off sentiment globally. These factors drive investors toward alternative assets and diversification strategies, particularly as central banks worldwide accelerate their own monetary policy adjustments. The uncertain policy environment creates cyclical waves of risk-aversion that can trigger flight-to-safety positioning.

Market Sentiment and Institutional Flows

-

Institutional Positioning: Asset management institutions continue to demonstrate sustained interest in diversifying reserves beyond traditional dollar-denominated assets. This structural shift reflects concerns about currency volatility, fiscal sustainability, and the need for portfolio de-risking amid macroeconomic uncertainty.

-

Investor Risk Assessment: Current market conditions are characterized by a blend of caution and opportunistic positioning. Investors are closely monitoring upcoming economic data releases—including employment figures, wage growth, and inflation metrics—to assess the true trajectory of economic resilience and inform decisions about future monetary policy expectations.

III. 2025-2030 LA Price Forecast

2025 Outlook

- Conservative Forecast: $0.2645 - $0.2907

- Base Case Forecast: $0.2907

- Optimistic Forecast: $0.30524 (requires sustained market momentum)

2026-2028 Medium-term Outlook

- Market Phase Expectations: Gradual accumulation phase with consolidation patterns, characterized by incremental price discovery and potential volatility.

- Price Range Predictions:

- 2026: $0.28307 - $0.34564

- 2027: $0.17699 - $0.38617

- 2028: $0.20531 - $0.5062

- Key Catalysts: Ecosystem development initiatives, institutional adoption acceleration, and macroeconomic recovery tailwinds supporting risk assets.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.30537 - $0.58493 (assuming steady protocol upgrades and moderate market expansion)

- Optimistic Scenario: $0.43009 - $0.5062 (with accelerated mainstream adoption and positive regulatory developments)

- Transformative Scenario: $0.44153 - $0.55318 (under conditions of breakthrough technological achievements and substantial institutional inflows)

- 2030-12-31: LA reaches $0.55318 (peak consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.30524 | 0.2907 | 0.26454 | 0 |

| 2026 | 0.34564 | 0.29797 | 0.28307 | 1 |

| 2027 | 0.38617 | 0.3218 | 0.17699 | 10 |

| 2028 | 0.5062 | 0.35399 | 0.20531 | 21 |

| 2029 | 0.58493 | 0.43009 | 0.30537 | 47 |

| 2030 | 0.55318 | 0.50751 | 0.44153 | 73 |

Lagrange (LA) Professional Investment Strategy and Risk Management Report

IV. LA Professional Investment Strategy and Risk Management

LA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in Zero-Knowledge coprocessing technology and cross-chain interoperability solutions; investors with medium to long-term investment horizons (12+ months)

- Operational Recommendations:

- Accumulate LA tokens during market downturns, particularly when prices fall below $0.25, leveraging the current -41.99% 30-day decline

- Dollar-cost averaging (DCA) approach with fixed monthly investments to reduce timing risk

- Store tokens securely on Gate.com or utilize Gate Web3 Wallet for enhanced security and accessibility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key levels at $0.2888 (24h low) and $0.3263 (24h high); trade bounces off support with stop-losses below $0.26

- Moving Averages: Use 50-day and 200-day MAs to identify trend direction; LA's -12.47% 7-day performance suggests ongoing downtrend requiring careful entry timing

- Wave Trading Key Points:

- Capitalize on 24-hour volatility range of approximately 3.75% ($0.2888-$0.3263) for short-term scalping

- Monitor volume trends on Gate.com; current 24h volume of $1.06M indicates moderate liquidity suitable for position sizing up to 5% of portfolio

LA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Position Sizing Control: Limit individual LA positions to recommended allocation percentages; never exceed 10% of total portfolio despite promising technology fundamentals

- Stop-Loss Implementation: Set stops at 15-20% below entry price; current annual decline of -45.19% emphasizes importance of disciplined exit strategies

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet recommended for active traders requiring frequent access and lower transaction friction on Gate.com

- Cold Storage Approach: Transfer majority holdings to hardware-secured solutions for positions exceeding $10,000 or long-term accumulation strategies

- Security Considerations: Never share private keys; enable two-factor authentication on all exchange accounts; verify smart contract addresses before token transfers; LA operates on ERC-20 standard (Ethereum network) with contract address 0x0fc2a55d5bd13033f1ee0cdd11f60f7efe66f467

V. LA Potential Risks and Challenges

LA Market Risk

- Price Volatility: LA has experienced significant drawdowns with -6.13% in 24 hours, -12.47% over 7 days, and -45.19% annually, indicating high volatility unsuitable for risk-averse investors

- Liquidity Risk: With 1,198 token holders and trading on only 34 exchanges, liquidity concentration creates execution risk for large position exits; significant sell pressure could trigger price cascades

- Market Sentiment Risk: Current market emotion shows limited institutional adoption; retail-dominated trading creates susceptibility to sentiment-driven price swings

LA Regulatory Risk

- Evolving Regulatory Framework: Zero-knowledge protocols face increasing regulatory scrutiny globally regarding privacy implications and compliance requirements

- Jurisdictional Uncertainty: As cross-chain interoperability infrastructure, LA may face differing regulatory treatments across multiple blockchain ecosystems and geographical regions

- Compliance Requirements: Future regulatory mandates could impose operational constraints on LA's decentralized node network infrastructure

LA Technology Risk

- Proof Generation Complexity: Off-chain ZK proof generation at scale presents potential security vulnerabilities if cryptographic implementations contain flaws or consensus mechanisms fail

- Cross-Chain Bridge Risk: Interoperability infrastructure depends on secure bridge protocols; vulnerabilities in cross-chain messaging could expose protocol to exploits

- Network Adoption Risk: LA's utility depends on application developers integrating the protocol; low adoption would limit token demand and economic sustainability

VI. Conclusion and Action Recommendations

LA Investment Value Assessment

Lagrange presents an innovative technological solution addressing a critical gap in cross-chain verifiable computation, positioning LA at the intersection of Zero-Knowledge cryptography and blockchain interoperability—two high-growth sectors. The protocol's hyper-parallel proving approach could unlock significant efficiency gains for enterprise applications requiring complex big-data computations across multiple blockchains.

However, significant headwinds temper this narrative: the -45.19% annual decline, concentrated holder base (1,198 addresses), and limited exchange presence suggest nascent market development with execution risks. The fully diluted valuation of $292.6M against only $1.06M daily volume raises liquidity concerns. At $0.2926, LA trades 86.7% below its all-time high of $2.2 (reached September 18, 2025), indicating either fundamental reassessment or market immaturity.

LA represents a high-risk, high-potential-reward investment suitable only for investors with deep conviction in Zero-Knowledge technology adoption and substantial risk tolerance.

LA Investment Recommendations

✅ Beginners: Start with minimal 1% portfolio allocation through Gate.com's dollar-cost averaging program; use educational resources to understand Zero-Knowledge coprocessing fundamentals before scaling exposure

✅ Experienced Investors: Accumulate 3-5% positions targeting the $0.22-$0.25 support levels; implement strict 20% stop-losses; consider pairing LA with positions in established ZK protocols for comparative analysis

✅ Institutional Investors: Conduct thorough due diligence on LA team, node operator decentralization, and commercial partnerships; evaluate positions against portfolio ZK and interoperability exposure; utilize Gate.com's institutional liquidity services for large block trades

LA Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of LA tokens with real-time pricing; ideal for long-term accumulation given moderate daily volume

- Gate.com Trading Tools: Utilize advanced order types (limit orders, stop-loss orders) to execute sophisticated trading strategies; monitor technical indicators within Gate.com's analytical platform

- Portfolio Diversification: Combine LA purchases with stablecoin holdings to maintain dry powder for accumulation during deeper drawdowns; never maintain LA as sole holding

Disclaimer: Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consulting professional financial advisors is strongly recommended. Never invest funds you cannot afford to lose completely. LA's -45.19% annual decline demonstrates cryptocurrency's inherent volatility and potential for substantial capital loss.

FAQ

What is the Lagrange price prediction for 2030?

Lagrange is predicted to reach a maximum price of $3.05 in early 2030 and may dip to $2.97 by month's end, based on current market trends and technical analysis.

Can gala coins reach $1?

Yes, Gala coins could potentially reach $1 with sufficient market adoption and growth. However, this would require significant increases in trading volume and positive market sentiment driving the price upward over time.

Can a gala reach $5?

Yes, GALA has the potential to reach $5 by 2025 based on growth projections and market performance. This price target is achievable given favorable conditions and increased adoption in the gaming ecosystem.

Does Bluzelle have a future?

Yes, Bluzelle demonstrates strong fundamentals and positive technical indicators suggesting a promising future. Its decentralized database solutions address real market needs, positioning it well for long-term growth potential.

U vs DOT: Understanding the Different Safety Standards for Motorcycle Helmets

2025 MINA Price Prediction: Analyzing Growth Potential and Market Trends for the Lightweight Blockchain

2025 VFY Price Prediction: Analyzing Market Trends and Future Growth Potential for Virtual Finance Yield Token

How Has ZEC's Recent Price Surge Affected Its On-Chain Metrics and Exchange Flows?

How to Analyze a Cryptocurrency Project's Fundamentals: 5 Key Factors to Consider

2025 VFYPrice Prediction: Analyzing Market Trends and Future Value Potential of VFY in a Shifting Crypto Landscape

Unlocking Flash Loan Opportunities for DeFi Arbitrage

How to Connect the Arbitrum Network to MetaMask – A Comprehensive Guide

Examining How the BTC/USDT Pair Operates on Trading Platforms

P2P Platform Now Accepts Afghan Afghanis for Trading

Guide to Participating and Claiming Rewards from SEI Network Airdrop