2025 LIME Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of LIME

LIME (iMe Lab) is an intelligent platform that integrates Telegram-based communication software, cryptocurrency wallets, and DeFi tools, designed to empower users with accessible crypto management capabilities. Since its launch in 2021, the project has established itself as a bridge connecting mainstream communities with the crypto ecosystem. As of December 2025, LIME's market capitalization stands at approximately $5.20 million, with a circulating supply of around 757.55 million tokens, currently trading at $0.005223 per token.

This asset, characterized as a "Telegram-integrated DeFi platform," is playing an increasingly vital role in democratizing cryptocurrency access and management through user-friendly interfaces across Android and iOS devices. The platform enables seamless token trading and exchange functionality, positioning itself at the intersection of communication and decentralized finance.

This article will provide a comprehensive analysis of LIME's price trajectory through 2030, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for market participants.

iMe Lab (LIME) Market Analysis Report

I. LIME Price History Review and Current Market Status

LIME Historical Price Evolution Trajectory

-

2021: Launch and initial growth phase, reaching an all-time high of $0.271381 on November 20, 2021, representing the peak of investor enthusiasm during the project's early momentum.

-

2022: Market correction period, declining from highs to an all-time low of $0.00400618 on November 10, 2022, as the broader cryptocurrency market experienced significant downward pressure.

-

2023-2025: Extended consolidation phase, with LIME trading substantially below its historical peak, reflecting prolonged market challenges and reduced trading activity.

LIME Current Market Posture

As of December 24, 2025, LIME is trading at $0.005223, representing a significant decline of approximately 98.08% from its all-time high. The token exhibits the following characteristics:

Price Movement Overview:

- 1-hour change: +0.13%

- 24-hour change: -0.92%

- 7-day change: -3.51%

- 30-day change: -14.03%

- 1-year change: -89.84%

Market Capitalization Metrics:

- Fully Diluted Valuation (FDV): $5,202,520.62

- Current Market Cap: $3,956,664.71

- Market Cap to FDV Ratio: 76.05%

- 24-hour Trading Volume: $30,390.51

- Market Dominance: 0.00016%

Token Supply Details:

- Circulating Supply: 757,546,374.64 tokens (76.05% of total supply)

- Total Supply: 996,079,000 tokens

- Max Supply: 996,079,000 tokens

- Active Holders: 949

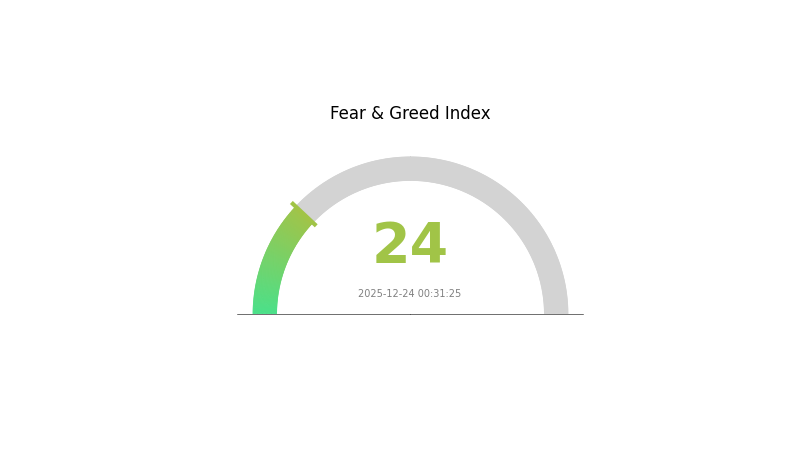

The token trades within a narrow 24-hour range of $0.0051 to $0.005314, indicating low volatility but constrained price action. The current market sentiment reflects "Extreme Fear" conditions (VIX: 24), suggesting cautious market positioning across the broader cryptocurrency ecosystem.

Click to view current LIME market price

LIME Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and potential selling pressure across digital assets. During such periods, investors often become overly cautious, creating opportunities for contrarian investors. The extreme fear sentiment typically reflects heightened market volatility and uncertainty. Risk-averse investors may consider defensive positions, while experienced traders might view this as a potential accumulation opportunity. Monitor market developments closely and ensure proper risk management before making investment decisions.

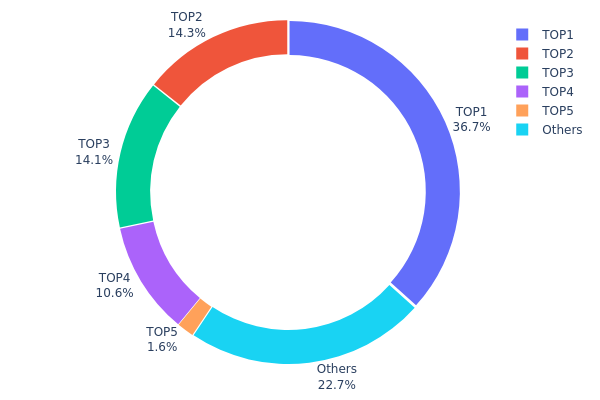

LIME Holdings Distribution

The address holdings distribution map illustrates the concentration of LIME token ownership across blockchain addresses, revealing the decentralization characteristics and potential market structure dynamics of the token. By analyzing the top holders and their respective percentages of total supply, we can assess the level of wealth concentration and evaluate systemic risks associated with token distribution.

The current LIME holdings distribution exhibits pronounced concentration characteristics. The top four addresses collectively control approximately 75.67% of the circulating supply, with the leading address alone holding 36.67% of all tokens. This concentration level presents a notable centralization pattern, particularly given that the top holder's position significantly exceeds typical decentralization benchmarks. The distribution further reveals a substantial gap between major holders and mid-tier participants, as the fifth-largest address holds merely 1.60%, indicating a steep hierarchical structure rather than a gradual distribution curve. The remaining 22.73% distributed among other addresses suggests modest liquidity fragmentation at lower ownership tiers.

This pronounced concentration structure carries material implications for market dynamics and price discovery mechanisms. Concentrated holdings among a limited number of addresses create potential vulnerability to significant price movements triggered by large-scale transactions from major holders. The top holders possess considerable influence over token liquidity and market sentiment, potentially enabling coordinated actions that could affect price stability. Furthermore, the substantial gap between the largest holders and remaining market participants may constrain organic price discovery and limit the token's resistance to manipulation. The current distribution pattern reflects relatively low decentralization, suggesting that LIME's on-chain governance structure and market maturity remain dependent on a limited set of stakeholders, warranting continued monitoring of holder behavior and distribution evolution.

Click to view current LIME holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2912...fcbf7b | 18338.62K | 36.67% |

| 2 | 0x707f...ac6e05 | 7148.98K | 14.29% |

| 3 | 0x6cae...4d6898 | 7044.85K | 14.08% |

| 4 | 0x4de8...f6caae | 5318.47K | 10.63% |

| 5 | 0x54dd...4ccac6 | 800.00K | 1.60% |

| - | Others | 11349.07K | 22.73% |

Core Factors Influencing LIME's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Monetary policy adjustments and interest rate changes affect investment attractiveness. Rate fluctuations directly influence capital allocation toward cryptocurrency assets like LIME, particularly when traditional investment yields decline.

-

Inflation Hedge Properties: LIME demonstrates "digital gold" characteristics in inflationary environments, providing risk-hedging functionality. During periods of elevated inflation, investors increasingly turn to cryptocurrencies as a store of value, potentially driving demand for LIME tokens.

-

Geopolitical Factors: Geopolitical uncertainty increases demand for LIME investments. Rising global tensions and political instability typically strengthen the appeal of decentralized digital assets as alternatives to traditional financial systems.

Supply Mechanism

Based on data collected from Gate.com as of November 2025, LIME's current market metrics reveal:

-

Current Circulating Supply: Approximately 755,247,051 tokens in circulation, with a market capitalization of $6,255,376 USD.

-

Market Sentiment Context: The current market sentiment registers as "Extreme Fear" on the fear and greed index, suggesting potential supply-demand imbalances that may influence future price movements.

Market Outlook and Price Forecasts

Multiple price scenarios present varying growth trajectories based on different adoption and market conditions:

-

Base Case Scenario: Token prices ranging from $0.008886905 to $0.011393467 USD, corresponding to sustained user and functionality growth.

-

Optimistic Scenario: Price range of $0.011393467 to $0.013635556 USD, assuming large-scale adoption and positive market catalysts.

Three、2025-2030 LIME Price Forecast

2025 Outlook

- Conservative Forecast: $0.00501-$0.00522

- Neutral Forecast: $0.00522

- Optimistic Forecast: $0.00673 (requires sustained market momentum and positive sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Recovery and growth phase with gradual price appreciation and increasing market adoption

- Price Range Forecast:

- 2026: $0.00466-$0.00818 (14% upside potential)

- 2027: $0.00474-$0.00849 (35% upside potential)

- 2028: $0.00413-$0.01098 (49% upside potential)

- Key Catalysts: Ecosystem development, increased institutional interest, and broader market recovery cycles

2029-2030 Long-term Outlook

- Base Case: $0.00685-$0.00938 (79% upside by 2029, assuming steady adoption)

- Optimistic Case: $0.00995-$0.01094 (90% upside by 2030, assuming accelerated ecosystem growth and market expansion)

- Transformative Case: $0.01094+ (2030, assuming breakthrough in technology implementation and mainstream adoption)

- 2025-12-24: LIME remains in consolidation phase (current market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00673 | 0.00522 | 0.00501 | 0 |

| 2026 | 0.00818 | 0.00597 | 0.00466 | 14 |

| 2027 | 0.00849 | 0.00708 | 0.00474 | 35 |

| 2028 | 0.01098 | 0.00779 | 0.00413 | 49 |

| 2029 | 0.01051 | 0.00938 | 0.00685 | 79 |

| 2030 | 0.01094 | 0.00995 | 0.00686 | 90 |

iMe Lab (LIME) Professional Investment Analysis Report

I. Executive Summary

iMe Lab (LIME) is an intelligent platform that integrates Telegram-based communication software, encrypted wallet functionality, and DeFi tools. The project aims to empower Telegram users through DeFi capabilities, enabling easy cryptocurrency management within a user-friendly and secure interface. The platform bridges mainstream and crypto communities by combining rich communication features with integrated crypto exchange functionality.

Key Data (as of December 24, 2025):

- Current Price: $0.005223

- 24H Change: -0.92%

- Market Capitalization: $3,956,664.71

- Fully Diluted Valuation: $5,202,520.62

- Circulating Supply: 757,546,374.64 LIME

- Total Supply: 996,079,000 LIME

- Market Rank: 1,683

II. Project Overview

Project Vision and Mission

iMe Lab is positioned as a bridge between mainstream and cryptocurrency communities through its Telegram-integrated platform. The core mission is to democratize access to DeFi tools by embedding crypto functionality into a familiar communication interface.

Core Features

Communication Platform: Built on Telegram infrastructure, offering rich new functions and enhanced communication possibilities.

Integrated Crypto Wallet: Allows users to manage digital assets directly within the communication app with minimal friction.

DeFi Tools Integration: Android and iOS users can execute token swaps and trades with just two clicks, with support for protocols like Uniswap.

Multi-functionality Ecosystem: Beyond trading, the platform provides entertainment and financial management capabilities.

Blockchain Infrastructure

- Blockchain Network: Binance Smart Chain (BSC)

- Contract Address: 0x7bc75e291e656e8658d66be1cc8154a3769a35dd

- Available Exchanges: Listed on 6 exchanges, including Gate.com

III. Market Performance Analysis

Price Performance Metrics

| Time Period | Change Percentage | Change Amount |

|---|---|---|

| 1 Hour | +0.13% | +$0.000006781 |

| 24 Hours | -0.92% | -$0.000048498 |

| 7 Days | -3.51% | -$0.000189996 |

| 30 Days | -14.03% | -$0.000852375 |

| 1 Year | -89.84% | -$0.046184480 |

Historical Price Extremes

- All-Time High: $0.271381 (November 20, 2021)

- All-Time Low: $0.00400618 (November 10, 2022)

- Current Price vs ATH: Down 98.08%

- Current Price vs ATL: Up 30.30%

Market Position

- Market Dominance: 0.00016%

- 24H Trading Volume: $30,390.51

- Circulating Supply Ratio: 76.05%

- Holder Count: 949 addresses

- Market Cap to FDV Ratio: 76.05%

IV. LIME Professional Investment Strategy and Risk Management

LIME Investment Methodology

(1) Long-Term Hold Strategy

Given the project's fundamental focus on DeFi accessibility and Telegram integration, this strategy suits investors with extended investment horizons.

-

Target Investors: Community enthusiasts, long-term believers in Telegram-integrated DeFi solutions

-

Operational Recommendations:

- Accumulate during periods of market weakness and negative sentiment

- Maintain holdings during development phases and platform upgrades

- Monitor community growth and user adoption metrics on Telegram channels

-

Storage Solution: Utilize professional custodial services or Gate Web3 Wallet for secure long-term asset management

(2) Active Trading Strategy

For active traders interested in volatility opportunities:

-

Technical Analysis Tools:

- Volume Analysis: Assess trading volume trends against price movements to confirm directional strength

- Moving Averages: Use 20-day and 50-day MAs to identify trend reversals and support/resistance levels

-

Swing Trading Considerations:

- Monitor for breakout opportunities above previous resistance levels

- Watch for significant deviations from the token's historical volatility patterns

- Execute trades on Gate.com where LIME maintains listing status

LIME Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Aggressive Investors: 3-5% portfolio allocation maximum

- Professional Investors: Position sizing based on quantitative risk models and correlation analysis

(2) Risk Hedging Solutions

- Diversification Strategy: Maintain exposure to multiple blockchain platforms and use cases to reduce single-asset concentration risk

- Stop-Loss Implementation: Establish predetermined exit points at 15-25% loss levels to contain downside exposure

(3) Secure Storage Solutions

- Hot wallet Solution: Gate Web3 Wallet for frequent trading and platform interaction

- Cold Storage Approach: Hardware-based solutions for holdings exceeding active trading amounts, enabling offline asset management

- Security Considerations: Never share private keys, enable multi-signature authentication where available, and use strong password management practices

V. Potential Risks and Challenges

LIME Market Risks

- Severe Historical Drawdown: Token value has declined 89.84% over one year and 98.08% from all-time high, indicating significant downside volatility risk

- Low Trading Volume: 24-hour volume of $30,390.51 creates liquidity constraints and potential slippage on larger transactions

- Small Market Capitalization: $3.96M market cap increases vulnerability to price manipulation and reduces institutional adoption likelihood

LIME Regulatory Risks

- Telegram Platform Uncertainty: Ongoing regulatory scrutiny of Telegram in various jurisdictions may impact platform accessibility and user base growth

- DeFi Compliance Requirements: Expanding DeFi regulations globally could restrict functionality or require operational modifications

- Cross-Border Restrictions: Certain geographic markets may impose restrictions on Telegram-based financial services

LIME Technology Risks

- Smart Contract Vulnerability: Security audits and technical implementation details are not provided in available documentation

- Integration Dependencies: Platform reliance on Telegram infrastructure creates operational risks if Telegram experiences service disruptions

- Scalability Concerns: Current architecture may face challenges as user adoption increases

VI. Conclusions and Action Recommendations

LIME Investment Value Assessment

iMe Lab presents a conceptually innovative approach to DeFi accessibility through Telegram integration. However, the project faces significant market headwinds evidenced by its 89.84% annual decline and 98% drawdown from historical peaks. The extremely low trading volume and modest market capitalization create additional liquidity concerns. Success depends critically on achieving meaningful Telegram user adoption and regulatory acceptance across multiple jurisdictions. The current valuation may present opportunistic entry points for risk-tolerant investors with high conviction in the Telegram-DeFi integration thesis, but substantial execution risks remain.

LIME Investment Recommendations

✅ For Beginners: Start with minimal allocation (0.1-0.5% of portfolio) to gain platform exposure and understand the Telegram-DeFi use case without material risk exposure. Trade exclusively on Gate.com for established liquidity.

✅ For Experienced Investors: Consider 2-3% portfolio allocation with defined entry/exit strategies. Employ technical analysis to identify accumulation opportunities during downtrends. Monitor project developments, GitHub activity, and community engagement metrics.

✅ For Institutional Investors: Conduct comprehensive due diligence on smart contract security, regulatory compliance frameworks, and user acquisition roadmap before any significant positioning. Establish position sizing based on quantitative risk models.

LIME Trading Participation Methods

- Direct Purchase on Gate.com: Access LIME trading pairs with established liquidity and reliable settlement mechanisms

- DeFi Protocol Interaction: Utilize the integrated Uniswap functionality within iMe's mobile apps (iOS and Android) for direct token swaps

- Community Participation: Engage with iMe's ecosystem through Reddit community (/r/iMeSmartPlatform) and Twitter (@ImePlatform) to monitor project developments and community sentiment

Cryptocurrency investments carry extreme risk. This analysis does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Always consult with qualified financial professionals before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

What is LIME cryptocurrency and what is its current price?

LIME is a cryptocurrency with a current price of $0.01 as of December 24, 2025. It has experienced a 7.69% decline over the past week, with circulating supply of 996M tokens and 1.16% change in the last 24 hours.

What factors influence LIME price predictions and market trends?

LIME price predictions are influenced by energy costs, transportation expenses, supply chain conditions, regulatory changes, and overall economic factors. Market demand, production capacity, and global economic trends also significantly impact price movements and market trends.

How high could LIME price potentially reach in the next 1-2 years?

LIME could potentially reach up to $0.006152 in the next 1-2 years based on current market trends and technical analysis forecasts.

What are the risks and challenges for LIME price growth?

Market volatility, regulatory uncertainties, and limited adoption adoption are primary challenges. Competition from alternative cryptocurrencies and fluctuating trading volume may also impact price momentum and long-term growth potential.

How does LIME compare to other similar cryptocurrencies in terms of price potential?

LIME demonstrates strong price potential, with forecasts suggesting it could reach $0.01771 by 2030, offering significant upside compared to many similar cryptocurrencies in the market.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks