2025 LMWR Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: LMWR's Market Position and Investment Value

LimeWire (LMWR) is a blockchain-based platform reshaping the creator economy by enabling content creators, artists, and brands to build membership communities and establish sustainable revenue streams through exclusive content and tradable digital assets. Since its public launch in May 2023, LMWR has achieved significant milestones, including successful strategic and public token sales exceeding $17.5 million with backing from prominent investors such as Kraken Ventures, Crypto.com Capital, GSR, and Arrington Capital. As of December 21, 2025, LMWR's market capitalization stands at approximately $21.43 million, with a circulating supply of 368.48 million tokens and a current price of $0.03386. This utility token, embedded deeply within the LimeWire ecosystem, is playing an increasingly crucial role in facilitating fan participation, content monetization, and creator success across the decentralized creator economy.

This article provides a comprehensive analysis of LMWR's price trajectory from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for crypto asset investors.

LimeWire (LMWR) Market Analysis Report

I. LMWR Price History Review and Current Market Status

LMWR Historical Price Evolution

- May 2023: LimeWire token launched with an initial offering price of $0.3022

- April 2024: LMWR reached its all-time high (ATH) of $1.8075 on April 3, 2024, representing significant early growth momentum

- December 2025: LMWR declined to its all-time low (ATL) of $0.03162 on December 19, 2025, marking an 88.64% decline from its peak

LMWR Current Market Position

Price Performance (As of December 21, 2025)

- Current Price: $0.03386

- 24-Hour Change: +2.26% ($0.000748 increase)

- 1-Hour Change: +1.81% ($0.000602 increase)

- 7-Day Change: -12.73%

- 30-Day Change: -18.39%

- 1-Year Change: -88.64%

Market Capitalization & Valuation

- Market Cap (Current Circulating Supply): $12,476,572.54

- Fully Diluted Valuation (FDV): $21,434,912.81

- Market Cap to FDV Ratio: 36.85%

- Market Dominance: 0.00066%

- 24-Hour Trading Volume: $150,340.51

- Market Ranking: #1,070

Token Supply Metrics

- Circulating Supply: 368,475,266.97 LMWR (36.85% of total)

- Total Supply: 633,045,269 LMWR

- Maximum Supply: 1,000,000,000 LMWR

- Number of Holders: 11,866

- Listed Exchanges: 13

Price Range Metrics

- 24-Hour High: $0.03649

- 24-Hour Low: $0.03246

- Distance from ATH: -81.26% below peak

- Distance from ATL: +7.08% above recent low

View current LMWR market price

LMWR Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 20. This indicates heightened market anxiety and significant selling pressure across digital assets. When fear levels reach such extremes, experienced investors often view this as a potential accumulation opportunity, as oversold conditions typically precede market recoveries. However, caution is warranted as further downside remains possible. Monitor key support levels closely and consider dollar-cost averaging into positions rather than making large lump-sum investments during such volatile periods. Stay informed through Gate.com's real-time market data.

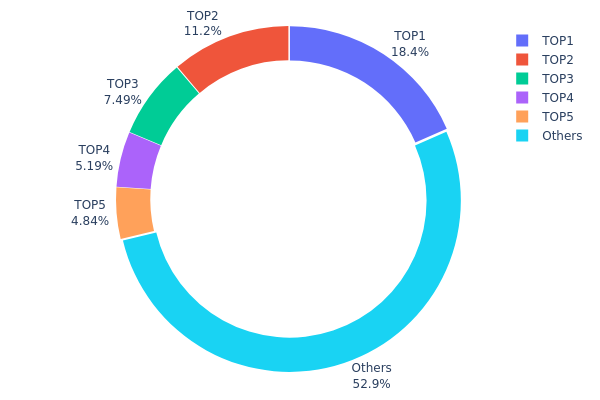

LMWR Holdings Distribution

The address holdings distribution chart illustrates how LMWR tokens are allocated across blockchain addresses, serving as a critical metric for assessing token concentration risk and the degree of decentralization within the network. By analyzing the distribution patterns of top holders versus distributed addresses, investors and analysts can evaluate the potential for market manipulation, price volatility, and the overall health of the token's ecosystem structure.

LMWR currently exhibits moderate concentration characteristics, with the top five addresses collectively controlling 47.12% of total token supply. The largest holder (0xdeeb...1e3ed9) commands 18.41% of circulating tokens, followed by the second-largest address holding 11.20%. While this concentration level warrants attention, the distribution is not extreme compared to many emerging tokens. The remaining 52.88% of tokens dispersed across other addresses demonstrates a reasonably fragmented holder base, which provides some safeguard against single-entity manipulation and suggests a degree of decentralization in token ownership structure.

The current holdings distribution reflects a market structure with balanced risk characteristics. Although the top five addresses represent a notable portion of total supply, the presence of a substantial distributed holder base mitigates extreme concentration concerns. This configuration suggests relatively stable on-chain governance dynamics and reduces the probability of coordinated price manipulation through concentrated selling pressure. The distribution pattern indicates an evolving ecosystem with institutional or strategic stakeholder positioning alongside a growing community of retail token holders, contributing to a relatively resilient market microstructure.

Click to view current LMWR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdeeb...1e3ed9 | 116576.93K | 18.41% |

| 2 | 0x782c...f75a04 | 70944.90K | 11.20% |

| 3 | 0x4afb...a8a7c4 | 47425.26K | 7.49% |

| 4 | 0x352a...4fe37e | 32851.70K | 5.18% |

| 5 | 0x9b0c...ba8d46 | 30640.73K | 4.84% |

| - | Others | 334605.75K | 52.88% |

II. Core Factors Influencing LMWR's Future Price

Macroeconomic Environment

-

Market Sentiment Impact: LMWR's price is significantly influenced by investor sentiment and market psychology. As a digital asset in the Web3 and AI ecosystem, it responds to broader cryptocurrency market trends and investor behavior patterns.

-

Regulatory Environment: Policy and regulatory changes play a crucial role in price movements. The regulatory landscape for cryptocurrencies continues to evolve across different jurisdictions, which can create both opportunities and headwinds for LMWR's valuation.

-

Technology Innovation Trends: Technological advancements and innovations in the blockchain and AI sectors influence investor confidence and long-term value expectations for LMWR.

Three、2025-2030 LMWR Price Forecast

2025 Outlook

- Conservative Forecast: $0.0294 - $0.03379

- Neutral Forecast: $0.03379

- Optimistic Forecast: $0.03582 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual accumulation, transitioning toward recovery momentum

- Price Range Forecast:

- 2026: $0.02645 - $0.04698

- 2027: $0.0319 - $0.04376

- Key Catalysts: Protocol upgrades, increased adoption metrics, market sentiment recovery, and institutional interest in the asset class

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03386 - $0.05629 (assuming steady ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.04586 - $0.05128 (assumes accelerated adoption, positive regulatory environment, and strengthened market fundamentals)

- Transformative Scenario: $0.0518 (extreme favorable conditions including breakthrough technological innovation, widespread mainstream adoption, and sustained bull market conditions)

- December 21, 2030: LMWR projected to achieve potential appreciation of approximately 48% from baseline reference, reflecting cumulative positive market dynamics over the five-year period

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03582 | 0.03379 | 0.0294 | 0 |

| 2026 | 0.04698 | 0.0348 | 0.02645 | 2 |

| 2027 | 0.04376 | 0.04089 | 0.0319 | 20 |

| 2028 | 0.05629 | 0.04233 | 0.03386 | 25 |

| 2029 | 0.05128 | 0.04931 | 0.04586 | 45 |

| 2030 | 0.0518 | 0.0503 | 0.03169 | 48 |

LimeWire (LMWR) Professional Investment Analysis Report

IV. LMWR Professional Investment Strategy and Risk Management

LMWR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Content creators, brand advocates, and long-term believers in the creator economy platform

- Operational Recommendations:

- Accumulate LMWR tokens during market downturns to build a substantial position over time

- Participate actively in the LimeWire ecosystem to understand token utility and governance benefits

- Set price targets based on platform adoption milestones and community growth metrics

(2) Active Trading Strategy

- Market Analysis Tools:

- Support and Resistance Levels: Monitor the historical range between $0.03162 (ATL on December 19, 2025) and $1.8075 (ATH on April 3, 2024) to identify key trading zones

- Volume Analysis: Track the 24-hour trading volume of $150,340.51 to identify liquidity conditions and potential breakout opportunities

- Wave Trading Key Points:

- Capitalize on short-term price volatility within weekly and monthly trends

- Use the current 24-hour positive momentum (+2.26%) as an entry signal for tactical positions

LMWR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio

- Active Investors: 3-7% of total portfolio

- Professional Investors: 5-10% of total portfolio with diversified entry points

(2) Risk Hedging Solutions

- Position Sizing: Limit individual LMWR positions to prevent catastrophic losses given the -88.64% year-over-year decline

- Stop-Loss Orders: Set protective stops at key technical levels to mitigate downside exposure

(3) Secure Storage Solutions

- Hot Wallet Method: For frequent traders, utilize Gate.com's web wallet for convenient access to trading pairs while maintaining security protocols

- Cold Storage Approach: For long-term holders, transfer LMWR tokens to self-custody solutions after purchase on Gate.com

- Security Best Practices: Never share private keys, enable two-factor authentication on exchange accounts, and regularly verify contract addresses before transactions

V. LMWR Potential Risks and Challenges

LMWR Market Risk

- Extreme Price Volatility: LMWR has experienced a dramatic decline of 88.64% over the past year, falling from approximately $0.3022 (launch price) to current levels around $0.03386, indicating severe market sentiment challenges

- Low Market Capitalization: With a total market cap of only $21.43 million and fully diluted valuation at the same level, LMWR remains highly susceptible to large capital flows and liquidity shocks

- Limited Trading Volume: The 24-hour trading volume of $150,340.51 is relatively modest, which may constrain entry and exit liquidity for larger positions

LMWR Regulatory Risk

- Creator Economy Classification Uncertainty: Evolving global regulations regarding creator platforms and token-based incentive systems could impact the platform's operational model

- Geographic Restrictions: Different jurisdictions may impose varying restrictions on LMWR token sales and usage, limiting market expansion opportunities

- Compliance Requirements: Enhanced regulatory scrutiny on blockchain-based platforms could necessitate costly compliance infrastructure updates

LMWR Technology Risk

- Smart Contract Vulnerabilities: As an ERC-20 token operating on the Ethereum network, LMWR depends on both Ethereum's security and LimeWire's smart contract integrity

- Platform Scalability: The platform must efficiently handle growing user bases and transaction volumes without performance degradation

- Token Economics Sustainability: Long-term viability depends on maintaining balanced tokenomics as platform usage scales and user dynamics evolve

VI. Conclusion and Action Recommendations

LMWR Investment Value Assessment

LimeWire presents a contrarian opportunity within the creator economy segment, backed by credible venture capital supporters including Kraken Ventures, Crypto.com Capital, GSR, and Arrington Capital. However, the token has experienced significant value erosion, declining 88.64% annually, suggesting either fundamental platform challenges or market cycle positioning. The project's integration of blockchain technology for exclusive content ownership and creator monetization addresses genuine market demands, but execution risk remains high. The current low circulating market cap and modest trading volume indicate limited institutional adoption, creating both liquidity risks and potential asymmetric upside if platform adoption accelerates.

LMWR Investment Recommendations

✅ Beginners: Start with micro-sized positions (0.5-1% of portfolio) acquired gradually through Gate.com's spot trading, focusing on understanding the LimeWire platform before committing additional capital.

✅ Experienced Investors: Consider tactical accumulation during technical support levels, combine with active platform participation to evaluate real-world adoption metrics, and implement disciplined position management with predetermined exit criteria.

✅ Institutional Investors: Conduct detailed due diligence on platform user growth metrics, creator retention rates, and revenue models before positioning; consider the risk-reward profile relative to larger-cap alternative investments.

LMWR Trading Participation Methods

- Direct Spot Trading: Purchase LMWR directly on Gate.com using fiat or cryptocurrency pairs, with access to real-time market data and order execution

- Dollar-Cost Averaging: Execute regular fixed-amount purchases over extended periods to reduce timing risk and smooth entry prices

- Ecosystem Participation: Create content on the LimeWire platform to earn tokenized rewards while developing firsthand understanding of platform value proposition

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Consult qualified financial advisors before making investment decisions. Never invest more than you can afford to lose.

FAQ

Does LimeWire crypto have a future?

Yes, LimeWire crypto shows strong growth potential. Price predictions suggest it could reach $1.8 by 2026. With increasing market adoption and positive trends, the future outlook appears optimistic.

What happened to LimeWire crypto?

LimeWire's $LMWR token was revived in 2021 as a Web3 brand after the original platform shut down in 2011. An Austrian company acquired the brand rights and relaunched it as a decentralized platform for the crypto ecosystem.

What is the all time high for LimeWire coin?

The all-time high for LimeWire coin is $1.92, representing the peak price reached since its launch in the market.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

Analysis of GT coin price and investment prospects in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

Explore Castle Age: Your Ultimate Web3 Gaming Adventure Guide

Innovative Blockchain Security and Monitoring Tools for Web3

Crypto Market Update: XRP Climbs Amid Bitcoin's Recovery

Understanding NFTs: A Comprehensive Guide in German Language

Exploring Web3: A Comprehensive Guide to Decentralized Web Technologies