2025 MAGIC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MAGIC's Market Position and Investment Value

Magic (MAGIC) serves as the native utility token of the Treasure ecosystem, a comprehensive platform positioned at the intersection of DeFi, NFT, and gaming. Since its launch in December 2021, MAGIC has established itself as a fundamental resource within the Treasure metaverse, enabling the activation and monetization of NFTs across interconnected gaming and DeFi protocols. As of December 2025, MAGIC maintains a market capitalization of approximately $32.64 million with a circulating supply of around 317.36 million tokens, currently trading at $0.0939. This utility token, recognized as the "power currency" of the Treasure ecosystem, continues to play an increasingly vital role in bridging DeFi primitives, NFT assets, and gaming mechanics through its innovative resource model that connects MAGIC tokens, in-game Treasures, and Legion NFTs.

This article provides a comprehensive analysis of MAGIC's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment guidance for market participants.

MAGIC Token Market Analysis Report

I. MAGIC Price History Review and Current Market Status

MAGIC Historical Price Trajectory

- February 2022: MAGIC reached its all-time high of $6.32, representing peak market optimism during the NFT and gaming sector boom.

- October 2021: MAGIC hit its all-time low of $0.01999252, marking the lowest point in the token's trading history.

- 2024-2025: The token has experienced sustained downward pressure, declining approximately 80.13% over the past year from historical peaks.

MAGIC Current Market Performance

As of December 19, 2025, MAGIC is trading at $0.09389, reflecting modest upward movement of 0.25% over the past 24 hours. However, the token exhibits broader weakness with a 7-day decline of 18.33% and a 30-day decrease of 19.08%. The 1-hour price action shows minimal downward momentum of -0.03%.

Market Capitalization and Supply Metrics:

- Current market capitalization: $29,796,695.48

- Fully diluted valuation: $32,644,336.46

- Circulating supply: 317,357,497.88 MAGIC tokens (91.27% of total supply)

- Total supply: 347,687,042.97 MAGIC tokens

- Maximum supply: 347,714,007 MAGIC tokens

- 24-hour trading volume: $267,719.85

Holder Distribution: MAGIC maintains an active holder base of 412,725 addresses, with the token trading across 40 different exchanges. The market capitalization represents approximately 0.0010% of the total cryptocurrency market dominance.

Price Range: Within the current 24-hour trading session, MAGIC has fluctuated between a low of $0.08887 and a high of $0.09675.

Click to view current MAGIC market price

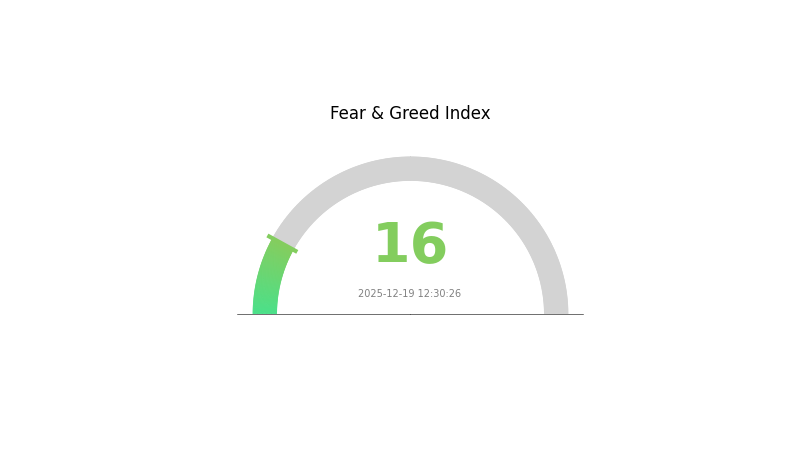

MAGIC Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This significantly low reading indicates intense market pessimism and panic selling pressure. Investors are overwhelmingly risk-averse, creating substantial market volatility. Such extreme fear conditions often present unique opportunities for contrarian investors, as historically, markets tend to recover from these deeply oversold levels. Monitor market developments closely and consider your risk tolerance before making investment decisions. Professional advice is recommended for portfolio management during such volatile periods.

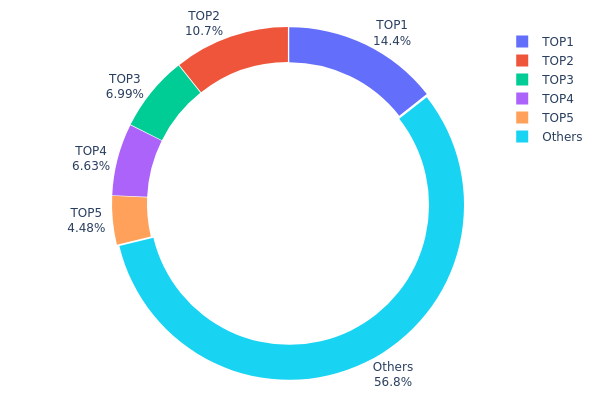

MAGIC Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the top wallet addresses on the blockchain, revealing the degree of decentralization and potential market structure risks. By analyzing the proportion of tokens held by major addresses relative to total circulating supply, this metric provides critical insights into whether token distribution exhibits healthy diversity or concerning concentration patterns that could impact market stability and price discovery mechanisms.

MAGIC demonstrates a moderate concentration profile, with the top five addresses collectively holding 43.14% of tokens, while the remaining addresses account for 56.86% of supply. The largest holder (0x76ec...78fbd3) commands 14.41% of total holdings, followed by 0xf977...41acec with 10.66%. This distribution pattern suggests that while significant capital is concentrated in institutional or early investor hands, the token base retains reasonable fragmentation. However, the combined weight of the top five addresses—particularly the top two exceeding 25%—warrants attention regarding potential market influence, especially during periods of high volatility or low trading liquidity.

The current address distribution reflects a blockchain ecosystem with moderate decentralization characteristics. The substantial portion held by "Others" (56.86%) indicates that MAGIC maintains a relatively distributed holder base, reducing the acute risk of price manipulation by any single entity. Nevertheless, the presence of large institutional or whale wallets introduces systemic considerations: coordinated moves by top-tier holders could generate notable price pressure, while their long-term holding behaviors may signal confidence in project fundamentals. The existing concentration level appears sustainable for market operations, though continued monitoring of top address movements remains prudent for risk assessment.

Click to view current MAGIC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x76ec...78fbd3 | 42492.35K | 14.41% |

| 2 | 0xf977...41acec | 31451.26K | 10.66% |

| 3 | 0x5a52...70efcb | 20605.33K | 6.98% |

| 4 | 0xb38e...82891d | 19542.58K | 6.62% |

| 5 | 0xbfa4...8dc62d | 13205.04K | 4.47% |

| - | Others | 167517.67K | 56.86% |

II. Core Factors Influencing MAGIC's Future Price

Supply Mechanism

-

Game-Centric Emission Model: Treasure has historically utilized a gaming-focused distribution mechanism (Bridgeworld mining/halving mechanism) to distribute MAGIC to players and stakers. This design created initial network effects while also generating cyclical selling pressure, as in-game reward acquisition is easier than long-term holding.

-

Historical Patterns: The continuous supply of game rewards to the market has created persistent downward pressure on price despite demand from players and NFT buyers. The emission model has produced periodic cycles aligned with gameplay seasons and broader crypto market cycles.

-

Current Impact: A critical community proposal (TIP-42) aims to reallocate Bridgeworld emissions toward supporting Treasure Chain staking models and EigenLayer-style restaking opportunities. This would fundamentally transform MAGIC's narrative from a "pure utility token" to collateral/yield-bearing infrastructure services. If implemented, this reallocation would substantially alter supply dynamics, staking incentives, and the token's potential value appreciation. The maximum supply is on the scale of hundreds of millions, with current circulation around 316.8 million MAGIC at approximately $0.11924 per token.

Institutional and Major Holder Dynamics

-

Institutional Adoption: MAGIC serves as a utility and governance token designed to function as a reserve currency within the Treasure ecosystem for in-game economic functions, marketplace purchases, and DAO governance. Treasure positions MAGIC as the economic adhesive between collaborative games and shared NFT tools.

-

Ecosystem Integration: Success hinges on partnerships and integrations that establish MAGIC as the preferred collateral or settlement token across multiple games and tools within the Treasure ecosystem. Major game integrations utilizing MAGIC as a collateral layer would significantly enhance utility and demand.

-

Liquidity Enhancement Prospects: Increasing liquidity through additional major exchange trading pairs or deeper liquidity pools would reduce slippage for large chain-based participants, potentially supporting broader adoption and price stability.

Macroeconomic Environment

-

Monetary Policy Impact: The U.S. Federal Reserve's interest rate decisions and quantitative easing measures influence overall cryptocurrency market sentiment and capital availability. Current macroeconomic headwinds, including elevated long-term interest rates and concerns about inflation persistence, create uncertainty for risk assets like gaming tokens.

-

Market Sentiment Drivers: MAGIC's price is substantially influenced by broader cryptocurrency market sentiment, NFT market cycles, and gaming sector adoption trends. Market fluctuations are primarily driven by high trading activity during token emission periods and sentiment surrounding NFTs and cryptocurrency more broadly.

Technology Development and Ecosystem Building

-

Governance Restructuring: The proposed reallocation of emissions from Bridgeworld to staking and infrastructure roles represents the most clear pathway to improving long-term fundamentals. Successful execution would create favorable staking/custody demand for MAGIC, potentially supporting multiple-fold price growth over 12-36 months relative to current levels relative to current levels.

-

Multi-Game Ecosystem Expansion: DeFi, NFT, and payment applications across the Treasure ecosystem drive MAGIC's investment value. The ecosystem includes core products such as Bridgeworld and Trove, alongside collaborative partner games that can adopt MAGIC as their economic foundation.

-

Ecosystem Applications: MAGIC functions within a diverse ecosystem on Arbitrum blockchain, serving roles in gaming economies, NFT marketplaces, and potential infrastructure services through restaking mechanisms. The ecosystem's ability to create persistent utility—through consumption mechanisms, collateral roles, and fees rather than temporary rewards—directly influences token value.

III. 2025-2030 MAGIC Price Forecast

2025 Outlook

- Conservative Forecast: $0.07697 - $0.09386

- Base Case Forecast: $0.09386

- Optimistic Forecast: $0.09949 (requires sustained market stability and increased adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual accumulation and consolidation phase with moderate growth trajectory as the asset gains wider recognition and integration.

- Price Range Predictions:

- 2026: $0.08797 - $0.12761

- 2027: $0.09981 - $0.13233

- 2028: $0.09901 - $0.12713

- Key Catalysts: Ecosystem expansion, increased institutional interest, platform utility enhancements, and broader market sentiment recovery.

2029-2030 Long-term Outlook

- Base Scenario: $0.09226 - $0.14588 (assumes moderate adoption growth and stable macroeconomic conditions)

- Optimistic Scenario: $0.12040 - $0.14881 (assumes accelerated ecosystem development and positive regulatory environment)

- Transformative Scenario: $0.14881+ (assumes breakthrough technological advances, mass market adoption, and favorable market cycles)

- 2030-12-19: MAGIC projected at $0.13528 average (consolidation within broader uptrend with 44% cumulative gain from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09949 | 0.09386 | 0.07697 | 0 |

| 2026 | 0.12761 | 0.09668 | 0.08797 | 2 |

| 2027 | 0.13233 | 0.11214 | 0.09981 | 19 |

| 2028 | 0.12713 | 0.12224 | 0.09901 | 30 |

| 2029 | 0.14588 | 0.12468 | 0.09226 | 32 |

| 2030 | 0.14881 | 0.13528 | 0.1204 | 44 |

MAGIC Token Investment Analysis Report

IV. MAGIC Professional Investment Strategy and Risk Management

MAGIC Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Ecosystem believers and metaverse gaming enthusiasts who understand DeFi and NFT fundamentals

- Operational Recommendations:

- Accumulate during market downturns, as MAGIC has declined 80.13% over the past year, potentially offering entry opportunities for long-term believers

- Participate actively in Treasure ecosystem activities including gaming, mining, and Bridgeworld participation to maximize token utility

- Hold MAGIC for governance participation in the Treasure ecosystem, as the protocol is managed by token holders

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current price of $0.09389 with 24-hour range between $0.08887 and $0.09675 provides short-term trading bands

- Volume Analysis: Current 24-hour volume of $267,719.85 indicates relatively thin liquidity requiring cautious position sizing

- Wave Trading Key Points:

- Monitor the historical resistance level at $0.15-0.20 range as potential upside targets

- Watch for volatility spikes during ecosystem announcements or gaming updates that could trigger rapid price movements

MAGIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Aggressive Investors: 3-5% of portfolio allocation

- Professional Investors: Up to 10% with proper hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance MAGIC holdings with other gaming and metaverse tokens to reduce concentration risk

- Position Sizing: Implement strict position limits given the token's high volatility (80.13% annual decline) and thin trading volume

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and ecosystem participation

- Cold Storage Approach: For long-term holdings, consider secure non-custodial storage solutions to protect against exchange risks

- Security Precautions: Enable two-factor authentication, use hardware security keys, never share private keys, and verify smart contract addresses before approving transactions

V. MAGIC Potential Risks and Challenges

MAGIC Market Risk

- Extreme Volatility: MAGIC has experienced an 80.13% decline over the past year and 19.08% decline over the past month, indicating high price volatility unsuitable for risk-averse investors

- Thin Liquidity: With 24-hour trading volume of only $267,719.85 and a market cap of approximately $29.8 million, large orders can significantly impact price movements

- Market Sentiment Dependency: As a gaming and metaverse token, MAGIC is highly sensitive to broader gaming industry trends and cryptocurrency market cycles

MAGIC Regulatory Risk

- Evolving Gaming Regulations: Different jurisdictions continue to develop frameworks for gaming tokens and NFTs, potentially impacting protocol operations

- Securities Classification Uncertainty: Regulatory authorities may reclassify tokens used for governance and resource allocation, affecting trading and holding conditions

- Geographic Compliance: Certain jurisdictions may restrict access to Treasure ecosystem services, limiting the user base and token utility

MAGIC Technology Risk

- Smart Contract Vulnerabilities: As MAGIC operates on Arbitrum and interacts with multiple NFT and gaming contracts, potential security flaws could impact token value and ecosystem functionality

- Arbitrum Network Dependency: The token operates exclusively on Arbitrum, creating single-chain risk exposure; cross-chain expansion delays could limit adoption

- Ecosystem Adoption Risk: The token's value depends on active participation in Treasure ecosystem games and DeFi protocols; declining user engagement would severely impact token utility

VI. Conclusion and Action Recommendations

MAGIC Investment Value Assessment

MAGIC functions as a utility token powering the Treasure metaverse ecosystem at the intersection of DeFi, NFT, and gaming. The token's intrinsic value derives from ecosystem participation, governance rights, and NFT activation functions. However, the 80.13% annual decline reflects market challenges in the gaming and metaverse sectors. Current valuation may present opportunities for long-term believers in blockchain gaming, but the token remains highly speculative with significant execution risks for the ecosystem.

MAGIC Investment Recommendations

✅ Beginners: Start with minimal position sizes (1-2% of crypto allocation) focusing on understanding the Treasure ecosystem before increasing exposure. Only invest capital you can afford to lose completely.

✅ Experienced Investors: Consider tactical accumulation during extreme weakness while maintaining disciplined position management. Actively monitor ecosystem developments and governance proposals affecting token utility.

✅ Institutional Investors: Conduct thorough due diligence on Treasure protocol's technical architecture, team execution, and gaming adoption metrics before establishing positions. Use Gate.com institutional services for efficient execution and custody solutions.

MAGIC Trading Participation Methods

- On-Chain Trading: Trade MAGIC directly on Arbitrum through integrated DEX protocols within the Treasure ecosystem

- Centralized Exchange: Trade on Gate.com and other listed exchanges with proper risk management and position sizing

- Ecosystem Participation: Earn MAGIC through gaming activities, mining participation, and Bridgeworld engagement for hands-on ecosystem exposure

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and conduct thorough research. Consult with professional financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Will magic coin reach $1?

MAGIC token is projected to reach $0.93584 by 2032 based on current market trends and indicators. While it may approach $1, reaching that exact target is unlikely given present market conditions and momentum.

What factors could drive MAGIC token price up in the future?

MAGIC token price could rise through increased ecosystem adoption, strategic partnerships, growing trading volume, positive regulatory developments, and enhanced utility within the platform.

What are the risks and challenges for MAGIC price growth?

MAGIC price growth faces risks from market competition, potential trading volume decline, and broader economic downturns affecting collector demand. Gaming market saturation and shifting user preferences also pose challenges.

How does MAGIC compare to other gaming/metaverse tokens in terms of price potential?

MAGIC offers strong price potential driven by Treasure Metaverse growth and gaming utility. With a $34.572M market cap, it's positioned competitively. High user demand and staking mechanisms via Atlas Mine support sustained appreciation in the gaming economy.

Exploring Decentralized Gaming Platforms on Blockchain

Is Magic (MAGIC) a good investment? An In-Depth Analysis of Token Fundamentals, Market Performance, and Future Potential

2025 MAGIC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Open Loot Explained: Core Whitepaper Logic and Gaming Applications

What Are Credentials in Crypto and Web3 ?

2025 MAGICPrice Prediction: Analyzing Market Trends and Future Growth Potential for MAGIC Token in the Crypto Ecosystem

Unlocking Profits: How to Capitalize on Flash Loan Opportunities

The Future of Fiat Currencies: Understanding Their Value Decline

Exploring the Cheems Meme Coin: What Makes It Unique?

Dropee Question of the Day for 20 december 2025

Guide to Obtaining DeFi Loans: A Deep Dive into Crypto Decentralized Lending