2025 MAJOR Price Prediction: Bitcoin Could Reach $100,000 as Institutional Adoption Accelerates

Introduction: Market Position and Investment Value of MAJOR

Major (MAJOR) is a "Play to Earn" game built on Telegram with a unique concept and implementation, designed to enhance the popularity of the TON platform and blockchain. Since its launch in November 2024, the project has achieved remarkable growth, attracting over 70 million users on Telegram, with more than 30 million connecting their TON wallets to the game. As of December 22, 2025, MAJOR's market capitalization has reached approximately $11.44 million, with a circulating supply of 85 million tokens and a current price hovering around $0.11435. This innovative "Play to Earn" asset is playing an increasingly significant role in the Telegram-based gaming ecosystem and blockchain adoption.

This article will provide a comprehensive analysis of MAJOR's price trends for 2025-2030, integrating historical patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging cryptocurrency project.

I. MAJOR Price History Review and Market Status

MAJOR Historical Price Evolution Trajectory

- November 28, 2024: MAJOR reached its all-time high (ATH) of $1.54344, marking the peak of its initial market cycle following launch.

- October 10, 2025: MAJOR declined to its all-time low (ATL) of $0.02741, representing a significant correction from its peak.

- December 22, 2025: Current price stands at $0.11435, showing recovery from the ATL with a 76.59% increase from the lowest point.

MAJOR Current Market Conditions

As of December 22, 2025, MAJOR is trading at $0.11435 with a 24-hour trading volume of $112,587.08. The token has demonstrated a 1.2% positive movement in the last 24 hours, climbing from an intraday low of $0.10939 to a high of $0.11869. Over the 1-hour period, MAJOR exhibits stronger momentum with a 2.01% increase.

The token maintains a fully diluted valuation (FDV) of $11,435,000, with a circulating market capitalization of $9,719,750. With 85 million MAJOR tokens in circulation out of a total and maximum supply of 100 million (85% circulation ratio), the project demonstrates a measured token release schedule.

MAJOR ranks 1,190th by market capitalization with a market dominance of 0.00035%. The token is distributed across 173,019 holders and is actively traded on 12 exchanges. The 30-day performance shows strong bullish sentiment with a 52.54% gain, though year-to-date performance reflects a -81.61% decline from its November 2024 peak.

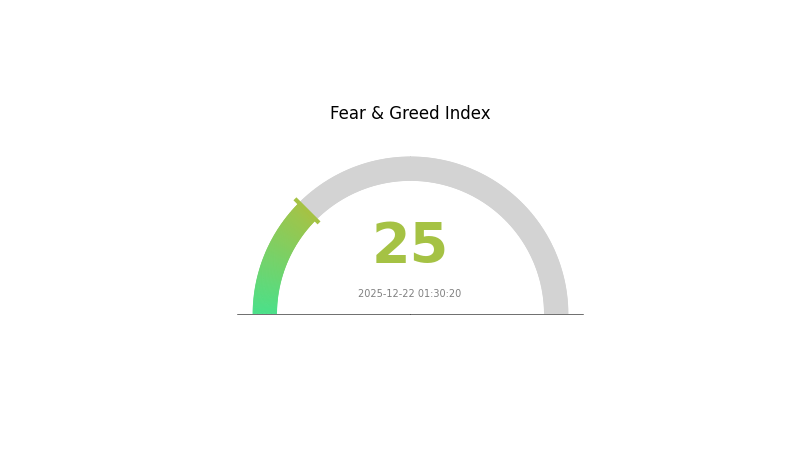

Current market conditions suggest extreme fear sentiment (VIX at 25), indicating volatility and potential risk considerations in the broader market environment.

Click to view current MAJOR market price

MAJOR 市场情绪指标

2025-12-22 恐惧与贪婪指数:25(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with a Fear and Greed Index reading of 25. This level indicates investors are deeply concerned about market conditions, often driven by significant volatility, regulatory uncertainties, or broader economic pressures. During periods of extreme fear, historically savvy investors have found contrarian opportunities, as assets may become oversold. However, caution remains warranted as the market sentiment reflects genuine uncertainty. Traders should carefully assess their risk tolerance and consider diversifying their portfolios on Gate.com while monitoring key support levels and market developments closely.

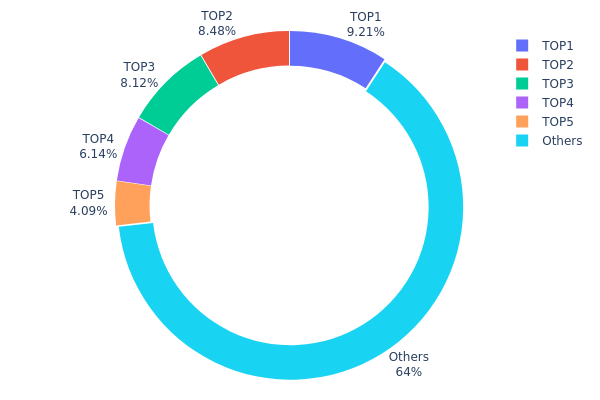

MAJOR Holdings Distribution

The address holdings distribution chart represents the concentration pattern of MAJOR tokens across blockchain addresses, illustrating how the total token supply is allocated among top holders and the remaining market participants. This metric serves as a critical indicator for assessing tokenomics health, decentralization levels, and potential market manipulation risks within the ecosystem.

Current analysis reveals moderate concentration characteristics in MAJOR's holder structure. The top five addresses collectively control approximately 36.03% of the circulating supply, with the largest holder commanding 9.21% and the second-largest holding 8.47%. While these individual positions remain below the 10% threshold typically considered concerning for single-entity dominance, the cumulative concentration warrants attention. The remaining 63.97% distributed among other addresses demonstrates a relatively fragmented holder base, suggesting the token maintains a reasonably decentralized distribution pattern compared to highly concentrated assets where top holders exceed 50% ownership.

From a market structure perspective, MAJOR's distribution profile indicates limited risk of severe price manipulation by individual whale holders. The dispersion across multiple stakeholders reduces the likelihood of coordinated dumping events or artificial price suppression. However, the concentration among the top five holders suggests these addresses possess meaningful influence over short-term price dynamics and liquidity conditions. The token's holder diversification reflects a maturing market composition, with institutional participation and diverse retail ownership preventing excessive centralization while maintaining sufficient liquidity depth for sustainable ecosystem development.

Click to view current MAJOR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | UQAEi4...zPkU7i | 9000.01K | 9.21% |

| 2 | UQB7Uw...wqOEz1 | 8282.74K | 8.47% |

| 3 | UQBmoe...5E5Uii | 7933.61K | 8.12% |

| 4 | UQDckH...wSGwFA | 6002.37K | 6.14% |

| 5 | UQCTkT...CngrdP | 4000.00K | 4.09% |

| - | Others | 62475.60K | 63.97% |

Core Factors Influencing MAJOR's Future Price

II. Core Factors Impacting MAJOR's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: MAJOR's price trends are significantly influenced by central bank policies and interest rate expectations. Interest rate changes, particularly from the U.S. Federal Reserve, directly affect MAJOR's valuation. Higher interest rates typically create headwinds for risk assets, while lower rates tend to provide support. The Federal Reserve's monetary policy stance—whether tightening, easing, or maintaining current levels—represents a critical driver of price movements.

-

Inflation Hedge Properties: MAJOR exhibits characteristics of a hard asset that benefits in inflationary environments. High fiscal deficits combined with interest rate decline cycles provide support for hard assets like MAJOR. The current U.S. fiscal deficit at approximately 7% of GDP, alongside widespread central bank easing globally, enhances MAJOR's allocation value as a store of value against currency debasement.

-

Geopolitical Factors: International tensions, trade policies, and sanctions regimes significantly impact MAJOR's market dynamics. Tariff policies, trade disputes, and potential geopolitical escalations create uncertainty that influences both currency strength and commodity valuations. Additionally, changes in sanctions policies directly affect global monetary dynamics and investment flows into alternative assets.

Currency Strength Dynamics

-

U.S. Dollar Correlation: MAJOR's price typically exhibits negative correlation with U.S. dollar strength. When the Bloomberg Dollar Index (BBDXY) strengthens, MAJOR prices generally face downward pressure. Conversely, dollar weakness tends to support MAJOR valuations. The relationship reflects MAJOR's nature as a monetary asset whose appeal increases when fiat currency confidence weakens.

-

Global Reserve Asset Status: Central banks worldwide view hard assets like MAJOR as monetary reserves. Since 2008, global central banks have maintained consistent net purchasing positions, with accelerated accumulation in recent years. This institutional demand from monetary authorities provides structural support to MAJOR prices independent of short-term market fluctuations.

III. 2025-2030 MAJOR Price Forecast

2025 Outlook

- Conservative Forecast: $0.0870 - $0.0900

- Neutral Forecast: $0.0900 - $0.1145

- Optimistic Forecast: $0.1145 - $0.1511 (requires sustained positive market sentiment and ecosystem development)

2026-2028 Medium-term Outlook

- Market Phase Expectations: Potential accumulation and recovery phase with gradual price appreciation driven by fundamental improvements and market re-engagement.

- Price Range Predictions:

- 2026: $0.0823 - $0.1421

- 2027: $0.1113 - $0.1965

- 2028: $0.1536 - $0.2187

- Key Catalysts: Enhanced protocol adoption, ecosystem expansion, institutional interest recovery, and positive regulatory developments that support market confidence and investment flows.

2029-2030 Long-term Outlook

- Base Case: $0.1157 - $0.2218 (assumes moderate market growth and steady ecosystem adoption)

- Optimistic Case: $0.1576 - $0.2944 (assumes accelerated mainstream adoption and strong market recovery)

- Transformative Case: $0.2944+ (assumes breakthrough technological achievements, major partnerships, or significant market-wide bull cycle conditions)

Note: Price forecasts are subject to significant market volatility and unpredictable factors. Monitor real-time data on Gate.com for accurate market information and investment decision-making.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15109 | 0.11446 | 0.08699 | 0 |

| 2026 | 0.14207 | 0.13277 | 0.08232 | 16 |

| 2027 | 0.19651 | 0.13742 | 0.11131 | 20 |

| 2028 | 0.21873 | 0.16697 | 0.15361 | 46 |

| 2029 | 0.22177 | 0.19285 | 0.11571 | 68 |

| 2030 | 0.29438 | 0.20731 | 0.15756 | 81 |

MAJOR Token Investment Report

IV. MAJOR Professional Investment Strategy and Risk Management

MAJOR Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Crypto enthusiasts and believers in Telegram-based gaming ecosystems who have a high risk tolerance and extended investment horizons

- Operational Recommendations:

- Accumulate MAJOR tokens during market downturns when prices show technical support levels, particularly when the token trades below its 30-day average

- Hold positions through market cycles, leveraging the project's growing user base (70 million+ users) and the 30 million+ connected TON wallets as fundamental growth drivers

- Reinvest any transaction rewards or NFT exchange proceeds back into token positions to compound gains

(2) Active Trading Strategy

- Price Action Framework:

- 24-hour volatility tracking: Monitor the 1.2% daily change and 2.01% hourly movements to identify entry and exit points

- Historical resistance levels: Use the all-time high of $1.54344 (recorded November 28, 2024) as a primary resistance target and the recent low of $0.10939 (24-hour) as dynamic support

- Wave Trading Key Points:

- Identify and trade between the 24-hour low ($0.10939) and high ($0.11869) range for short-term scalping opportunities

- Watch for breaks above the $0.11869 level with volume confirmation, signaling potential sustained upward momentum

MAJOR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA) approach: Spread capital deployment across multiple purchase intervals to mitigate the impact of short-term price volatility and the token's -81.61% year-to-date decline

- Position sizing discipline: Maintain strict stop-loss orders at 15-20% below entry prices to protect against sudden market corrections or negative regulatory developments

(3) Secure Storage Solutions

- Exchange Custody: Secure your MAJOR tokens on Gate.com, which offers professional-grade security infrastructure, insurance coverage, and seamless trading capabilities for converting positions

- Self-Custody Approach: Transfer MAJOR to a personal TON-compatible wallet for extended holding periods, ensuring you maintain private key control and maximize security

- Security Considerations: Enable multi-factor authentication on all exchange accounts, never share private keys or seed phrases, and consider hardware wallet solutions for substantial holdings

V. MAJOR Potential Risks and Challenges

MAJOR Market Risks

- Extreme price volatility: The token has experienced an 81.61% decline over one year and a 52.54% gain over 30 days, indicating highly unpredictable price movements that can result in substantial losses

- Low liquidity and trading volume: With only $112,587 in 24-hour trading volume and limited exchange listings (12 exchanges), the token faces significant liquidity constraints that may impede large position exits

- Market concentration risk: As a relatively new Telegram gaming token, MAJOR's valuation is heavily dependent on continued user engagement and network effects, creating concentration risk among speculative investors

MAJOR Regulatory Risks

- Telegram platform policy changes: Regulatory scrutiny of Telegram's operations in various jurisdictions could negatively impact the gaming ecosystem and token utility

- Gaming regulation uncertainty: Potential future regulations regarding play-to-earn mechanics and cryptocurrency rewards in gaming applications may restrict the project's operations or token distribution mechanisms

- Cross-border compliance challenges: The project's global user base exposes it to divergent regulatory frameworks across different countries, creating potential operational and compliance risks

MAJOR Technical Risks

- Smart contract vulnerabilities: As a TON-based token, MAJOR is exposed to potential security vulnerabilities in its smart contract code or the underlying TON blockchain infrastructure

- User adoption sustainability: The project's success depends on maintaining engagement among the 70 million users; declining active participation could erode token demand and utility

- Blockchain scalability concerns: High volumes of transactions during peak gaming periods could strain TON network resources, potentially causing delays or increased transaction costs

VI. Conclusion and Action Recommendations

MAJOR Investment Value Assessment

MAJOR represents a speculative investment opportunity within the emerging Telegram gaming ecosystem. While the project demonstrates significant user adoption (70 million+ users) and engagement metrics (30 million+ connected wallets), investors should recognize that the token has experienced severe volatility and an 81.61% annual decline. The project's fundamental value proposition centers on play-to-earn gaming mechanics and NFT exchange utility within a rapidly evolving platform environment. Success depends heavily on sustained user engagement, regulatory approval, and the continued viability of the broader TON ecosystem. The token should be viewed as a high-risk, speculative asset rather than a stable investment vehicle.

MAJOR Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) using dollar-cost averaging to reduce timing risk, prioritize educational research on Telegram gaming economics, and maintain conservative position sizes with clear stop-loss discipline.

✅ Experienced Investors: Consider tactical positions (3-5% allocation) using technical analysis-based entry points around the 24-hour support level, employ wave trading strategies within established price ranges, and maintain strict risk management protocols with defined profit-taking targets.

✅ Institutional Investors: Conduct comprehensive due diligence on TON blockchain fundamentals, evaluate MAJOR's competitive positioning within the gaming ecosystem, and structure positions with appropriate hedging strategies while maintaining regulatory compliance monitoring.

MAJOR Trading Participation Methods

- Direct Exchange Trading: Purchase MAJOR on Gate.com by depositing supported cryptocurrencies (such as USDT or TON), converting to MAJOR, and executing buy/sell orders through the platform's advanced trading interface

- In-Game Acquisition: Earn MAJOR tokens directly through gameplay and user participation in the official Telegram gaming application, eliminating the need for direct cryptocurrency exchange transactions

- NFT Trading Integration: Utilize MAJOR tokens as payment for NFT number exchanges and Telegram username transactions within the gaming platform ecosystem, providing practical utility beyond speculation

Cryptocurrency investments carry extreme risk of total loss. This report does not constitute financial advice. All investors should conduct independent due diligence, assess their personal risk tolerance, and consult qualified financial advisors before making investment decisions. Never invest capital that you cannot afford to lose completely.

FAQ

What is the price prediction for major?

Major is expected to trade between $0.07480 and $0.3030 by 2030. If it hits the upper target, it could rise by 170.97%. This prediction is based on current market analysis and technical indicators.

What is the price of major token in 2026?

The major token is projected to reach $0.070 to $0.100 in 2026, reflecting anticipated significant price appreciation based on market analysis and growth trajectory.

Why is major coin falling?

Major coin is falling due to reduced risk exposure by institutional investors and declining hash rate from mining farm closures in China. Market trading volume has decreased, keeping prices under pressure near support levels.

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

What is SLP: Understanding the Speech-Language Pathology Profession and Its Impact on Communication Disorders

Is Heroes of Mavia (MAVIA) a good investment?: Analyzing Growth Potential and Risk Factors in this Play-to-Earn Gaming Token

Is Wam (WAM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Antmons (AMS) a good investment?: Analyzing the potential of this emerging play-to-earn blockchain game

What is GRBE: Exploring the Revolutionary Gene Regulation Breakthrough in Epigenetics

How to Set Price Alerts for Cryptocurrency on Mobile and Desktop

ONG price prediction analysis: Is Ontology Gas undervalued after token burning?

Introduction to Spark Token and Flare Network for Beginners

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

Can You Mine Bitcoin on Your Smartphone?