2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

Introduction: MLN's Market Position and Investment Value

Enzyme (MLN), as a key player in the DeFi asset management ecosystem, has made significant strides since its inception in 2017. As of 2025, Enzyme's market capitalization has reached $23,901,507, with a circulating supply of approximately 2,997,054 tokens, and a price hovering around $7.975. This asset, often referred to as the "DeFi asset management pioneer," is playing an increasingly crucial role in decentralized finance and on-chain investment strategies.

This article will comprehensively analyze Enzyme's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. MLN Price History Review and Current Market Status

MLN Historical Price Evolution

- 2018: All-time high reached, price peaked at $258.26

- 2020: Market downturn, price hit all-time low of $1.79

- 2021-2025: Gradual recovery and stabilization, price fluctuating between $5 and $20

MLN Current Market Situation

As of October 4, 2025, MLN is trading at $7.975. The token has shown a mixed performance across different time frames. In the past 24 hours, MLN has seen a modest gain of 0.73%, while the 7-day performance shows a more significant increase of 9.09%. However, the 30-day trend indicates a slight decline of 0.22%. The 1-year performance reveals a substantial decrease of 48.74%, reflecting the broader market challenges faced by many cryptocurrencies.

The current market capitalization of MLN stands at $23,901,507, ranking it at 1011th position in the global cryptocurrency market. With a circulating supply of 2,997,054.208354686 MLN, which is equal to its total and maximum supply, the token has reached its full distribution.

The 24-hour trading volume for MLN is $57,820.18843, indicating moderate market activity. The current price is significantly below the all-time high of $258.26 recorded on January 4, 2018, but well above the all-time low of $1.79 seen on March 13, 2020.

Click to view the current MLN market price

MLN Market Sentiment Indicator

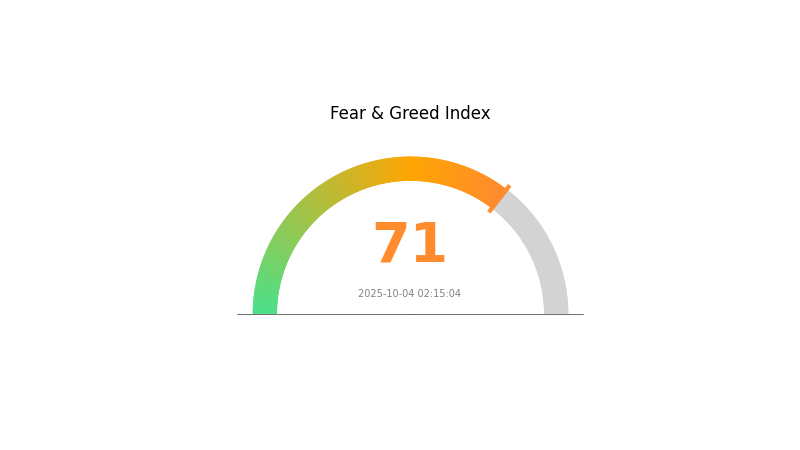

2025-10-04 Fear and Greed Index: 71 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 71. This indicates high investor optimism and potentially overbought conditions. While positive sentiment can drive prices higher, it's crucial to remain cautious. Experienced traders often view extreme greed as a signal to consider taking profits or reducing exposure. Remember, market sentiment can shift rapidly, so stay informed and manage your risk accordingly. Gate.com offers tools and resources to help navigate these market conditions effectively.

MLN Holdings Distribution

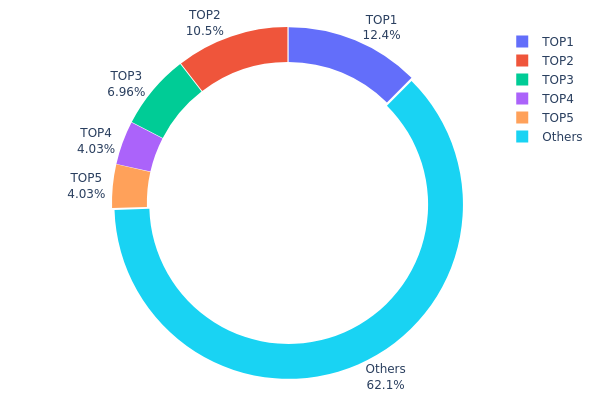

The address holdings distribution data for MLN reveals a moderately concentrated ownership structure. The top 5 addresses collectively hold 37.9% of the total MLN supply, with the largest holder controlling 12.44%. This concentration level suggests a relatively balanced distribution, as no single address holds an overwhelming majority.

However, the presence of two addresses holding over 10% each (12.44% and 10.45% respectively) indicates potential influence over market dynamics. While not alarmingly centralized, this concentration could impact price volatility and liquidity, especially if these large holders decide to make significant moves. The remaining 62.1% distributed among other addresses provides some counterbalance, contributing to a degree of decentralization in the MLN ecosystem.

Overall, the current MLN holdings distribution reflects a market with moderate centralization. This structure suggests a balance between influential large holders and a diverse base of smaller participants, potentially contributing to market stability while maintaining some risk of price manipulation.

Click to view the current MLN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x28c6...f21d60 | 369.02K | 12.44% |

| 2 | 0xf977...41acec | 310.00K | 10.45% |

| 3 | 0x1c36...37d2c7 | 206.39K | 6.96% |

| 4 | 0x3c75...383a6a | 119.59K | 4.03% |

| 5 | 0xd2dd...e6869f | 119.36K | 4.02% |

| - | Others | 1839.74K | 62.1% |

Key Factors Influencing MLN's Future Price

Supply Mechanism

- Halving Events: Bitcoin's total supply is programmatically limited to 21 million coins, with automatic "block reward halving" occurring every four years. The most recent halving took place in April 2024, reducing miner rewards from 6.25 BTC to 3.125 BTC.

- Historical Patterns: Previous halvings have historically triggered significant price increases - the first three resulted in gains of 8,000%, 2,800%, and 640% respectively.

- Current Impact: Since the April 2024 halving, Bitcoin's price has risen from about $26,000 to nearly $90,000 in November 2024, a 246% increase in seven months. It further broke through $109,000 in January 2025, accumulating a total increase of over 323%.

Institutional and Whale Dynamics

- Institutional Holdings: In January 2024, the U.S. officially approved multiple spot Bitcoin ETFs, opening doors for mainstream capital. Funds including BlackRock (IBIT), Fidelity (FBTC), Grayscale (GBTC conversion), ARK (ARKB), Bitwise (BITB), and WisdomTree (BTCW) have attracted over $40 billion in net inflows to date.

- Corporate Adoption: Companies like MicroStrategy and Metaplanet have included Bitcoin on their balance sheets, reinforcing its role as a strategic asset.

- National Policies: Some countries, such as Bhutan, have engaged in Bitcoin mining activities, indicating a trend towards "hyperbitcoinization".

Macroeconomic Environment

- Monetary Policy Impact: The increasing institutional participation, regulatory clarity, and the approval of U.S. ETFs are key drivers for potential price growth.

- Inflation Hedge Properties: Bitcoin's limited supply and decentralized nature position it as a potential hedge against inflation and currency devaluation.

- Geopolitical Factors: Global economic trends and geopolitical issues continue to influence Bitcoin's perceived value as a safe-haven asset.

Technological Development and Ecosystem Building

- ETF Approvals: The launch of spot Bitcoin ETFs in the U.S. has provided a low-friction entry point for long-term capital from retirement funds, endowments, and family offices.

- Ecosystem Growth: The increasing adoption of Bitcoin in various financial products and services is expanding its ecosystem and potential use cases.

III. MLN Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $5.955 - $7.94

- Neutral prediction: $7.94 - $9.50

- Optimistic prediction: $9.50 - $11.2748 (requires strong market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $10.42979 - $15.64469

- 2028: $7.5548 - $15.1096

- Key catalysts: Technological advancements, wider institutional adoption, and overall crypto market trends

2030 Long-term Outlook

- Base scenario: $12.00 - $15.94467 (assuming steady growth and market stability)

- Optimistic scenario: $15.94467 - $19.93084 (assuming strong market performance and increased MLN utility)

- Transformative scenario: $19.93084 - $25.00 (assuming breakthrough innovations and mainstream crypto adoption)

- 2030-12-31: MLN $15.94467 (projected average price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 11.2748 | 7.94 | 5.955 | 0 |

| 2026 | 13.06606 | 9.6074 | 7.0134 | 20 |

| 2027 | 15.64469 | 11.33673 | 10.42979 | 42 |

| 2028 | 15.1096 | 13.49071 | 7.5548 | 69 |

| 2029 | 17.58919 | 14.30015 | 12.01213 | 79 |

| 2030 | 19.93084 | 15.94467 | 9.72625 | 99 |

IV. MLN Professional Investment Strategies and Risk Management

MLN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with a high risk tolerance

- Operational advice:

- Accumulate MLN during market dips

- Set price targets and stick to your investment plan

- Store MLN in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor MLN's correlation with the broader crypto market

- Set strict stop-loss orders to manage downside risk

MLN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Enzyme wallet

- Security precautions: Use two-factor authentication, store private keys offline

V. MLN Potential Risks and Challenges

MLN Market Risks

- Volatility: MLN price can experience significant fluctuations

- Liquidity: Limited trading volume may lead to slippage

- Competition: Emergence of new DeFi asset management platforms

MLN Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter DeFi regulations

- Compliance requirements: Possible need for KYC/AML implementation

- Cross-border restrictions: Varying legal status in different jurisdictions

MLN Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability issues: Ethereum network congestion may affect performance

- Upgrade risks: Protocol changes could impact token value or functionality

VI. Conclusion and Action Recommendations

MLN Investment Value Assessment

MLN offers exposure to the growing DeFi asset management sector, with potential for long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

MLN Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and asset management ✅ Experienced investors: Consider MLN as part of a diversified DeFi portfolio ✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments closely

MLN Trading Participation Methods

- Spot trading: Buy and sell MLN on Gate.com

- DeFi integration: Participate in Enzyme protocol to manage assets

- Staking: Explore staking options if available through official Enzyme platforms

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts suggesting it could reach $140,652. Chainlink follows with a prediction of $62.60.

What is mln crypto?

MLN is the native token of Enzyme, a decentralized asset management platform. It enables governance, protocol operations, and ensures security within the Enzyme ecosystem.

Will Enzyme go up?

Yes, Enzyme is predicted to go up. Based on current analysis, the price is expected to reach $8.33 by November 1, 2025, representing a 4.18% increase.

What is the price prediction for NMR 2025?

NMR is predicted to trade between $16.15 and $24.03 in 2025, with potential for a 38.86% increase to reach the upper target of $24.03.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks