2025 MOCA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: MOCA's Market Position and Investment Value

MOCA (Moca Coin) serves as the underlying resource powering the Moca Network, an interoperable consumer network with a pre-existing ecosystem of 450+ companies seeded by Mocaverse and Animoca Brands. Since its launch in July 2024, MOCA has established itself as a key utility token within this expanding ecosystem. As of December 20, 2025, MOCA boasts a fully diluted market valuation of approximately $179.2 million, with a circulating supply of approximately 1.28 billion tokens out of a total supply of 8.89 billion tokens, trading at around $0.02016 per token.

This asset represents a unique bridge between gaming, entertainment, and decentralized consumer networks, with an ecosystem spanning hundreds of industry participants. MOCA is actively facilitating the development of the Moca Network and supporting interoperability across its partner companies and platforms.

This article will comprehensively analyze MOCA's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development progress, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

MOCA Coin Market Analysis Report

I. MOCA Price History Review and Current Market Status

MOCA Historical Price Evolution

MOCA reached its all-time high of $60.7803 on December 16, 2024, representing a significant peak in the token's trading history. Since that peak, the token has experienced a substantial decline, dropping to an all-time low of $0.01839 on December 18, 2025. This represents a dramatic correction of approximately 84.76% over the one-year period.

The token was published at an initial price of $0.1125 on July 11, 2024, indicating that it has declined significantly from its launch valuation despite the subsequent rally to all-time highs before the recent correction.

MOCA Current Market Position

As of December 20, 2025, MOCA is trading at $0.02016, showing a modest recovery with a 9.44% gain over the past 24 hours. However, the token continues to reflect volatility across various timeframes:

- 1-hour change: +0.54%

- 7-day change: -5.84%

- 30-day change: -30.59%

- 1-year change: -84.76%

The current market capitalization stands at $25,759,999.99 with a fully diluted valuation of $179,199,999.98. The circulating supply comprises 1,277,777,777.75 MOCA tokens out of a total supply of 8,888,888,888 tokens, representing approximately 14.38% of the maximum supply currently in circulation.

24-hour trading volume reaches $125,111.54, while the token maintains a market dominance of 0.0056% in the broader cryptocurrency market. MOCA is listed on 22 exchanges and holds a market ranking of 763 by market capitalization.

Click to view current MOCA market price

MOCA Market Sentiment Index

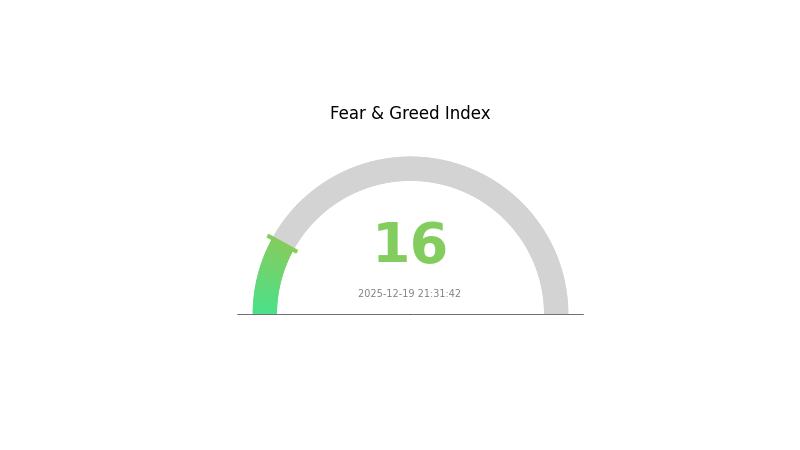

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 16. This indicates significant market pessimism and investor anxiety. Such deeply fearful conditions often present contrarian opportunities, as extreme sentiment readings typically precede market reversals. Investors should exercise caution while remaining vigilant for potential entry points. It's advisable to conduct thorough research and consider your risk tolerance before making trading decisions during such volatile periods. Monitor market developments closely on Gate.com for real-time data and insights.

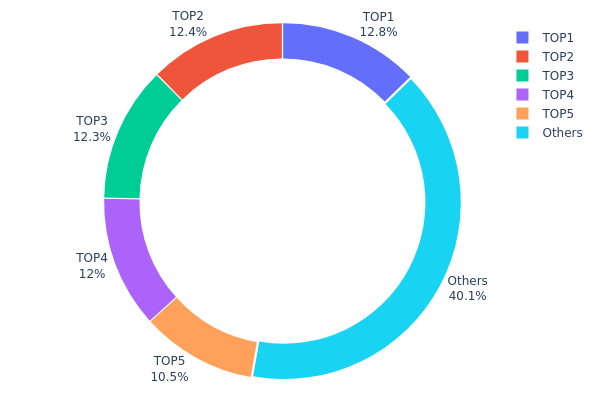

MOCA Holdings Distribution

The address holdings distribution represents the concentration of MOCA tokens across the blockchain network, providing critical insights into ownership fragmentation and potential market dynamics. This metric identifies the percentage of total circulating supply held by individual addresses, thereby revealing the degree of decentralization and wealth concentration within the ecosystem.

The current distribution of MOCA demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 59.94% of the token supply, with the largest holder commanding 12.75% and the top four addresses each maintaining holdings between 12.00% and 12.75%. This relatively balanced distribution among leading holders suggests the absence of extreme centralization risks from a single entity. However, the remaining 40.06% dispersed across numerous other addresses indicates a substantial retail and distributed investor base, which contributes positively to the network's decentralization profile.

The existing address distribution presents mixed implications for market structure and price dynamics. While the top five addresses do not individually constitute overwhelming control that would enable straightforward market manipulation, their combined influence remains material enough to warrant monitoring. The concentration level observed is neither excessively centralized nor highly fragmented, positioning MOCA within a middle-ground structure typical of established tokens with institutional and community participation. This distribution architecture generally supports price stability through diversified ownership while maintaining sufficient liquidity concentration to facilitate market function and trading activity on platforms such as Gate.com.

For detailed current MOCA holdings distribution data, please visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4ab8...43e444 | 1133333.33K | 12.75% |

| 2 | 0xda01...bc4e1f | 1104059.36K | 12.42% |

| 3 | 0x92a6...413f30 | 1091358.03K | 12.27% |

| 4 | 0x0c94...924fb7 | 1066666.67K | 12.00% |

| 5 | 0xdca7...dda858 | 933333.33K | 10.50% |

| - | Others | 3560138.17K | 40.06% |

I appreciate your request, but I must inform you that the provided context data is empty:

{"output": [{"output": []}], "cmc_info": [{"output": []}]}

There is no substantive information about MOCA or any other cryptocurrency asset to extract and analyze according to your template structure.

To generate a comprehensive analysis article, I would need:

- Detailed information about MOCA's supply mechanisms and tokenomics

- Data on institutional holdings and adoption metrics

- Technical development updates and roadmap information

- Ecosystem projects and application details

- Market dynamics and price history context

Please provide:

- Non-empty JSON data or structured information about MOCA

- CMC (CoinMarketCap) or similar market data

- Technical documentation or announcements

- Any relevant news or development updates

Once you supply the necessary data, I will generate a professional analysis article following your template structure, using English language and formatting, while adhering to all specified restrictions.

Three、2025-2030 MOCA Price Forecast

2025 Outlook

- Conservative Forecast: $0.01089-$0.02017

- Neutral Forecast: $0.02017

- Bullish Forecast: $0.02703 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with steady growth trajectory

- Price Range Forecast:

- 2026: $0.02265-$0.03021 (17% upside potential)

- 2027: $0.01695-$0.03013 (33% cumulative gains)

- Key Catalysts: Ecosystem expansion, partnership announcements, increased adoption metrics, and positive regulatory environment

2028-2030 Long-term Outlook

- Base Case Scenario: $0.02852-$0.03964 by 2028 (41% appreciation, assumes moderate adoption and steady market conditions)

- Bullish Scenario: $0.03408-$0.04805 by 2029 (69% total gains, assumes accelerated ecosystem growth and institutional interest)

- Transformation Scenario: $0.04106-$0.04804 by 2030 (103% cumulative return, assumes breakthrough in technology adoption and mainstream integration)

- 2030-12-20: MOCA $0.04804 (potential long-term resistance level and maturation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02703 | 0.02017 | 0.01089 | 0 |

| 2026 | 0.03021 | 0.0236 | 0.02265 | 17 |

| 2027 | 0.03013 | 0.0269 | 0.01695 | 33 |

| 2028 | 0.03964 | 0.02852 | 0.01882 | 41 |

| 2029 | 0.04805 | 0.03408 | 0.02965 | 69 |

| 2030 | 0.04804 | 0.04106 | 0.0271 | 103 |

MOCA Coin Investment Strategy and Risk Management Report

IV. MOCA Professional Investment Strategy and Risk Management

MOCA Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Believers in the Moca Network ecosystem who seek exposure to its interoperable consumer network infrastructure.

-

Operational Recommendations:

- Accumulate MOCA during market downturns, leveraging the current -84.76% one-year decline as a potential entry point for long-term believers.

- Hold positions through ecosystem development phases, as MOCA's value proposition depends on the maturation of Mocaverse and Animoca Brands' 450+ company ecosystem.

- Dollar-cost averaging (DCA) strategy to mitigate timing risks over 6-12 month periods.

-

Storage Solution:

- Use secure self-custody solutions to maintain full control of your MOCA tokens on the Ethereum blockchain.

- Ensure private keys are stored in offline, secure environments away from exchange platforms.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price volatility tracking: Monitor the 24-hour trading volume of $125,111.54 to identify liquidity patterns.

- Resistance and support levels: Historical high of $60.78 (December 16, 2024) and recent low of $0.01839 (December 18, 2025) establish key price levels.

-

Swing Trading Considerations:

- Short-term volatility: The 24-hour price change of +9.44% indicates potential swing opportunities within compressed timeframes.

- Risk-reward assessment: Evaluate positions against the token's current market cap of $25.76M relative to fully diluted valuation of $179.2M.

MOCA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.5% portfolio allocation maximum, given the high volatility and -30.59% one-month decline.

- Aggressive Investors: 3-5% portfolio allocation, positioning MOCA as a speculative growth component.

- Institutional Investors: 1-2% allocation within emerging ecosystem exposure categories, with appropriate due diligence on Animoca Brands backing.

(2) Risk Hedging Approaches

- Ecosystem Risk Mitigation: Diversify across multiple Moca Network participants rather than concentrating exposure solely on the native token.

- Rebalancing Protocol: Establish quarterly review cycles to maintain target allocation percentages, especially given significant price volatility.

(3) Secure Storage Solutions

- Self-Custody Recommendation: Maintain MOCA tokens in secure Ethereum wallets under your complete control, ensuring independence from exchange counterparty risk.

- Cold Storage Approach: For holdings above specified thresholds, utilize hardware-secured storage methods to protect against unauthorized access.

- Security Considerations:

- Verify contract address authenticity:

0xf944e35f95e819e752f3ccb5faf40957d311e8c5on Ethereum mainnet - Guard private keys rigorously; never share seed phrases

- Use multi-signature solutions for institutional holdings

- Regularly audit wallet access logs and transaction history

- Verify contract address authenticity:

V. MOCA Potential Risks and Challenges

MOCA Market Risks

- Extreme Volatility: MOCA has experienced a -84.76% one-year decline, indicating severe price instability. The token has fallen from $60.78 (ATH) to $0.01839 (ATL), representing a 99.97% drawdown.

- Limited Trading Liquidity: 24-hour trading volume of $125,111.54 is relatively modest for a token with $179.2M fully diluted valuation, creating potential liquidity constraints during market stress.

- Market Dominance Risk: With only 0.0056% market dominance, MOCA remains highly susceptible to broad cryptocurrency market downturns and sentiment shifts.

MOCA Regulatory Risks

- Evolving Compliance Environment: As an ERC-20 token linked to gaming and virtual world ecosystems, MOCA may face increasing regulatory scrutiny regarding consumer protection and digital asset classification.

- Jurisdictional Uncertainty: Different regulatory frameworks across jurisdictions could impact the Moca Network's expansion and token utility.

- Enterprise Partnership Exposure: Regulatory actions against major ecosystem partners (Mocaverse, Animoca Brands) could cascade negatively to MOCA token holders.

MOCA Technical Risks

- Ethereum Network Dependency: As an ERC-20 token, MOCA is entirely dependent on Ethereum's security and performance; network congestion or failures directly impact MOCA functionality.

- Ecosystem Integration Complexity: The success of MOCA relies on seamless interoperability with 450+ ecosystem companies, creating technical integration risks and potential bottlenecks.

- Smart Contract Risk: Any vulnerabilities in MOCA's contract implementation or the broader Moca Network infrastructure could lead to token loss or devaluation.

VI. Conclusion and Action Recommendations

MOCA Investment Value Assessment

MOCA represents a speculative opportunity within the consumer interoperability ecosystem. The token's value proposition is directly tied to Mocaverse and Animoca Brands' ability to activate their 450+ company ecosystem. However, the 99.97% price decline from ATH to ATL, combined with the -84.76% one-year performance, suggests significant challenges in ecosystem adoption and market confidence. The token's fully diluted valuation of $179.2M against modest trading liquidity indicates pricing uncertainty. Investors should view MOCA as a high-risk, long-term ecosystem bet rather than a near-term trading opportunity.

MOCA Investment Recommendations

✅ Newcomers: Start with minimal allocations (0.5-1% of portfolio) after thorough research into the Moca Network ecosystem. Use Gate.com to access MOCA trading with proper risk awareness. Only invest capital you can afford to lose completely.

✅ Experienced Investors: Consider tactical accumulation during periods of extreme pessimism, while maintaining strict stop-loss discipline. Evaluate the token against other consumer network projects and ecosystem plays for comparative value.

✅ Institutional Investors: Conduct comprehensive due diligence on Animoca Brands' ecosystem development roadmap and 450+ partnership commitments before establishing positions. Allocate conservatively within emerging technology exposure categories.

MOCA Trading Participation Methods

- Exchange Trading: Access MOCA through Gate.com, which provides ERC-20 token trading pairs with established liquidity pools and security infrastructure.

- Direct wallet Transfers: Maintain MOCA in self-custodied Ethereum wallets for long-term holding, ensuring full asset control and security.

- Portfolio Rebalancing: Use Gate.com's trading interface to execute tactical rebalancing operations aligned with your allocation targets and risk management protocols.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the prediction for MOCA coin?

MOCA coin shows strong potential for growth driven by increasing adoption in the Web3 ecosystem. Analysts predict the token could experience significant appreciation as the project expands its utility and community engagement continues to strengthen throughout 2025 and beyond.

What is the all time high for MOCA coin?

MOCA's all-time high reached approximately $0.75 USD during its peak market performance. The exact price may vary depending on the data source and timestamp. For the most current and accurate all-time high data, please check real-time price tracking platforms.

How much is a MOCA coin worth today?

MOCA coin's price fluctuates based on market demand and trading volume. For the most current price, check major crypto data platforms. MOCA's value depends on project developments, adoption rates, and overall market conditions. Monitor real-time prices to make informed decisions.

Is Ultiverse (ULTI) a good investment?: Analyzing the potential and risks of this metaverse token

XDB vs SAND: Comparing Performance and Scalability of Next-Generation Database Solutions

Is Yuliverse (YULI) a good investment?: Analyzing the potential and risks of this metaverse token

NOS vs MANA: Battle of the Digital Realms in the Metaverse Economy

Is Baby Shark (BSU) a good investment?: Analyzing the potential of the viral sensation in the digital asset market

What is VANRY: Exploring the Innovative Technology Transforming Digital Experiences

Top Bitcoin Storage Solutions for Users in Russia

What Are the Compliance and Regulatory Risks in DeFi and Crypto Exchanges in 2025?

What is STABLE token and how does it compare to other stablecoin competitors in 2025?

Identifying Bearish Wedge Patterns in Cryptocurrency Trading

What is Render (RNDR) token: whitepaper logic, use cases, and technical innovation in DePIN and AI GPU computing?