2025 NBLU Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of NBLU

NuriTopia (NBLU) is a metaverse platform developed by NuriFlex Group that integrates virtual and real worlds to facilitate social connections and reward user participation in both real-life and fantasy activities. Since its launch in 2023, the project has established itself as a unique player in the metaverse ecosystem. As of December 2025, NBLU has achieved a market capitalization of approximately $23.33 million USD, with a circulating supply of around 2.22 billion tokens and a current price hovering at $0.0046653. This innovative asset, recognized for its "avatar-based social interaction and content trading" characteristics, is playing an increasingly important role in the Web3 social and metaverse sectors.

This article will provide a comprehensive analysis of NBLU's price trends and market dynamics, combining historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors through 2030.

I. NBLU Price History Review and Market Status

NBLU Historical Price Movement Trajectory

- May 2024: NBLU reached its all-time high (ATH) of $0.01740432 on May 25, 2024, marking a significant peak in the token's trading history.

- November 2025: NBLU hit its all-time low (ATL) of $0.00035163 on November 24, 2025, representing a substantial decline from its historical maximum.

- December 2025: The token has recovered partially from its lowest point, currently trading at $0.0046653 as of December 22, 2025.

NBLU Current Market Status

As of December 22, 2025, NBLU is trading at $0.0046653, reflecting a 24-hour decline of 6.69%. The token demonstrates notable short-term volatility, with a 1-hour gain of 0.44% contrasting against the daily loss. Over a 7-day period, NBLU has surged 468.90%, and the 30-day performance shows an impressive 919.95% increase, indicating strong recovery momentum from recent lows. On an annualized basis, NBLU has gained 89.34% over the past year.

The token's 24-hour trading range spans from $0.0036595 to $0.0051058, with a 24-hour trading volume of $33,880.28. NBLU's fully diluted market capitalization stands at $23,326,500, with a circulating market cap of $10,369,057.13. The token has a circulating supply of 2,222,591,715 NBLU out of a total maximum supply of 5,000,000,000, representing a 44.45% circulation ratio.

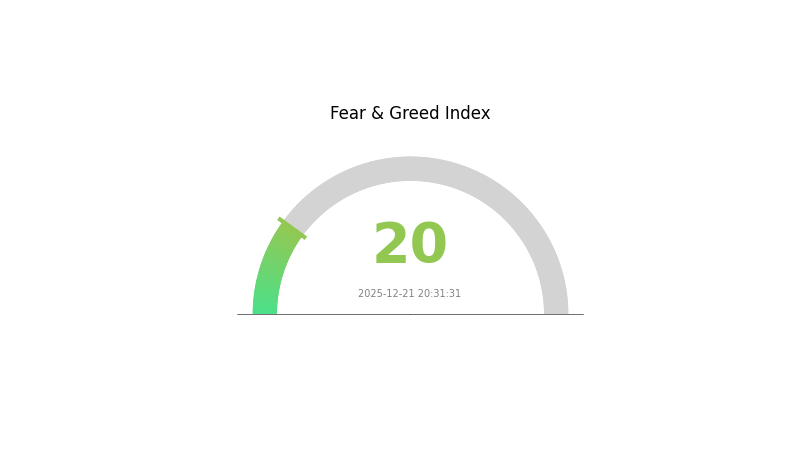

NBLU currently ranks at position 1152 in the overall cryptocurrency market by market cap, with a market dominance of 0.00072%. The token is held by 17,671 addresses and is supported across 2 exchange platforms. Market sentiment indicators show extreme fear levels (VIX: 20) in the broader crypto market environment as of December 21, 2025.

Click to view the current NBLU market price

NBLU Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

The current Fear & Greed Index has dropped to 20, reflecting extreme fear in the market. When the index reaches such lows, it typically signals panic selling and capitulation among investors. This level often presents contrarian opportunities for long-term investors, as extreme fear can mark potential market bottoms. However, caution is still advised, as further downside may occur before sentiment stabilizes. Monitor key support levels and macroeconomic indicators closely during this period of heightened market anxiety.

Click to view the current Fear & Greed Index

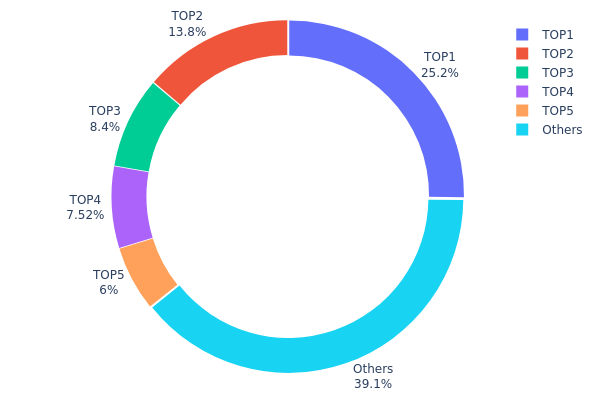

NBLU Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the top holders and their proportional stakes, we can assess whether token supply is overly concentrated among a limited number of addresses, which has significant implications for market stability and governance dynamics.

NBLU currently exhibits moderate concentration characteristics. The top five addresses collectively hold approximately 60.91% of total supply, with the leading address commanding 25.17% and the second-largest holder accounting for 13.82%. While the remaining 39.09% is distributed among other addresses, the substantial stakes held by the top two addresses represent a notable concentration point. This distribution pattern suggests that NBLU has not reached extreme centralization levels, yet the presence of several large holders with double-digit ownership percentages warrants attention. The gap between the top holder and subsequent addresses indicates potential influence concentration among early investors or strategic stakeholders.

The current address distribution presents measurable implications for market dynamics. Concentrated holdings among a limited number of addresses could amplify price volatility if major stakeholders execute large transactions simultaneously. Furthermore, the centralized ownership structure may influence governance outcomes and strategic decision-making within the NBLU ecosystem. The 39.09% allocation to other addresses demonstrates a degree of decentralization that provides some market resilience; however, the concentration among the top five holders suggests that significant price movements or liquidity events could be substantially influenced by the actions of these major stakeholders. Overall, NBLU's holder distribution reflects a partially decentralized asset structure with meaningful concentration risks that merit continuous monitoring.

Click to view current NBLU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc3af...d7fa87 | 1258658.28K | 25.17% |

| 2 | 0xb774...caf406 | 691341.71K | 13.82% |

| 3 | 0xe0d7...74ba85 | 420000.00K | 8.40% |

| 4 | 0x4456...5612e5 | 376250.00K | 7.52% |

| 5 | 0x5336...c52a7b | 300000.00K | 6.00% |

| - | Others | 1953750.00K | 39.09% |

II. Core Factors Affecting NBLU's Future Price

Supply Mechanism

- Supply Surplus: The current dominant factor influencing price trends is oversupply in the market. Domestic production capacity remains at elevated levels, which exerts downward pressure on prices.

- Current Impact: Supply overhang continues to weigh on price movements, with market conditions expected to maintain weak volatility in the near term as excess inventory levels persist.

Three、2025-2030 NBLU Price Forecast

2025 Outlook

- Conservative Forecast: $0.0042 - $0.00466

- Neutral Forecast: $0.00466

- Optimistic Forecast: $0.00522 (requiring sustained market interest and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with steady growth trajectory, characterized by increasing adoption and strengthening fundamentals

- Price Range Forecast:

- 2026: $0.00272 - $0.00564

- 2027: $0.00275 - $0.00709

- 2028: $0.00347 - $0.00848

- Key Catalysts: Project milestone achievements, expanding partnership ecosystem, enhanced liquidity on platforms like Gate.com, growing institutional interest, and improving market sentiment

2029-2030 Long-term Outlook

- Base Case: $0.00616 - $0.01042 (assuming moderate adoption growth and stable market conditions)

- Optimistic Case: $0.00843 - $0.01296 (assuming accelerated ecosystem expansion and increased mainstream adoption)

- Transformative Case: $0.01296+ (assuming breakthrough technological developments and significant paradigm shifts in market perception)

- 2030-12-22: NBLU demonstrating 90% cumulative growth potential (strong upside trajectory established)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00522 | 0.00466 | 0.0042 | 0 |

| 2026 | 0.00564 | 0.00494 | 0.00272 | 6 |

| 2027 | 0.00709 | 0.00529 | 0.00275 | 13 |

| 2028 | 0.00848 | 0.00619 | 0.00347 | 32 |

| 2029 | 0.01042 | 0.00734 | 0.00616 | 57 |

| 2030 | 0.01296 | 0.00888 | 0.00843 | 90 |

NBLU Investment Strategy and Risk Management Report

IV. NBLU Professional Investment Strategy and Risk Management

NBLU Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Investors with medium to long-term horizons who believe in the metaverse ecosystem and Web3 social integration trends

- Operational Recommendations:

- Establish a core position during market downturns when NBLU trades significantly below its all-time high of $0.0174

- Implement dollar-cost averaging (DCA) to mitigate volatility impacts, given the token's 24-hour price fluctuation of -6.69%

- Set a 2-3 year holding period to capture ecosystem development value as NuriFlex Group develops its virtual-real integrated platform

(2) Active Trading Strategy

- Technical Analysis Considerations:

- Price Action: Monitor the 24-hour trading range ($0.0036595 - $0.0051058) and 7-day performance (+468.90%) to identify momentum shifts

- Volume Analysis: Current 24-hour volume of $33,880.28 provides guidance on liquidity levels; position sizing should account for relatively lower trading volumes compared to major tokens

- Swing Trading Key Points:

- Capitalize on the strong 7-day gain (+468.90%) by identifying pullback opportunities near support levels

- Consider resistance near the all-time high ($0.0174) as a key profit-taking zone for short-term traders

NBLU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional Investors: 8-15% of portfolio allocation

(2) Risk Hedging Strategies

- Volatility Management: Implement stop-loss orders at 15-20% below entry points given NBLU's demonstrated price swings

- Diversification Approach: Balance NBLU positions with stable, large-cap cryptocurrencies to offset metaverse sector concentration risk

(3) Secure Storage Solutions

- Self-Custody Recommendation: Use Gate.com's Web3 Wallet for secure asset management with multi-signature protection capabilities

- Cold Storage Considerations: For long-term holders, consider hardware wallet solutions for significant holdings to minimize smart contract risks

- Security Best Practices: Enable two-factor authentication on all exchange accounts; maintain recovery phrases in secure, offline locations; never share private keys or seed phrases

V. NBLU Potential Risks and Challenges

NBLU Market Risk

- Price Volatility: NBLU has experienced extreme volatility, with a 1-year performance of +89.34% but significant recent pullbacks (-6.69% in 24 hours), exposing investors to unpredictable swings

- Liquidity Risk: With only 2 exchange listings and relatively modest 24-hour trading volume of $33,880.28, the token faces liquidity constraints that could impact entry/exit execution at desired price levels

- Market Cap Pressure: The fully diluted valuation of $23.33 million positions NBLU as a micro-cap token, making it susceptible to rapid valuation fluctuations and sentiment-driven price movements

NBLU Regulatory Risk

- Metaverse Regulatory Uncertainty: As the metaverse sector remains largely unregulated globally, future regulatory frameworks could impact platform operations and token utility

- Geographic Compliance: Different jurisdictions may impose varying restrictions on NFT trading, avatar creation, and virtual asset transactions within the NURITOPIA platform

- Securities Classification: Depending on regulatory evolution, NBLU tokens could face reclassification as securities, triggering listing delisting or trading restrictions on certain platforms

NBLU Technology Risk

- Platform Development Execution: Success depends entirely on NuriFlex Group's ability to deliver the promised virtual-real integrated platform features and avatar interaction systems

- Smart Contract Vulnerabilities: The BSC-based token contract requires ongoing security auditing to prevent exploits that could compromise user funds or token integrity

- Scalability Challenges: As user adoption increases, the platform must demonstrate adequate infrastructure capacity to support real-life and fantasy activity rewards mechanisms without performance degradation

VI. Conclusion and Action Recommendations

NBLU Investment Value Assessment

NBLU represents a speculative investment opportunity within the metaverse and Web3 social platforms sector. The token's aggressive 7-day and 30-day performance (+468.90% and +919.95% respectively) indicates strong recent momentum but also suggests elevated risk. With a market cap of $10.37 million and circulation of approximately 44.45% of total supply, NBLU exhibits characteristics typical of early-stage ecosystem tokens. The platform's value proposition—integrating virtual avatars with real-world activity rewards—addresses a legitimate gap in social gaming platforms. However, execution risk remains substantial given the project's early development stage and limited historical track record.

NBLU Investment Recommendations

✅ Beginners: Start with micro-allocations (1-2% of portfolio) through dollar-cost averaging on Gate.com; avoid leveraged positions; focus on understanding the NURITOPIA platform roadmap before increasing exposure

✅ Experienced Investors: Implement a structured 3-5% portfolio allocation with defined entry points near support levels; use technical analysis to identify swing trading opportunities; maintain strict stop-loss discipline given volatility levels

✅ Institutional Investors: Conduct comprehensive due diligence on NuriFlex Group's development timeline, technical architecture, and revenue models; consider initial 5-10% positions with staged increases upon successful platform milestones and ecosystem expansion evidence

NBLU Trading Participation Methods

- Direct Trading on Gate.com: Purchase NBLU directly through Gate.com's spot trading interface using major cryptocurrency pairs (USDT, ETH); benefit from competitive trading fees and advanced order types

- Liquidity Pool Participation: Provide liquidity on decentralized platforms to earn trading fees, though this exposes capital to impermanent loss during price movements

- Long-term Staking Opportunities: Monitor NURITOPIA ecosystem announcements for potential staking or reward programs that provide passive income while supporting platform security

Cryptocurrency investment carries extreme risk and potential for substantial loss. This report does not constitute investment advice. Investors must conduct independent research and consult qualified financial advisors before making investment decisions. Never invest amounts exceeding your loss tolerance or financial capacity.

FAQ

What is NBLU and what is its current price?

NBLU (Nuritopia) is a cryptocurrency token with a current price of $0.00049094. Its market capitalization stands at $1.08 million, with 24-hour trading volume of $46,953. As of December 21, 2025, NBLU represents an emerging digital asset in the Web3 ecosystem.

What are expert price predictions for NBLU in 2025 and 2026?

Expert predictions suggest NBLU may experience volatility through 2025-2026. Technical analysis indicates potential downward pressure, with forecasts ranging from $0.002-$0.004 range. Market sentiment and adoption metrics will significantly influence actual price movements during this period.

What factors could influence NBLU's future price performance?

NBLU's price is influenced by market sentiment, trading volume, adoption rates, regulatory developments, and broader crypto market trends. Technical indicators and project milestones also play significant roles in price movements.

How does NBLU compare to other similar tokens in the market?

NBLU distinguishes itself through superior tokenomics and stronger community adoption. With robust trading volume and consistent market performance, NBLU outpaces comparable tokens in utility and growth potential, positioning it as a leading choice for investors seeking value and stability.

What is the tokenomics and use case of NBLU?

NBLU is a governance and utility token that enables community participation and voting on project decisions. It incentivizes ecosystem engagement and serves as a utility token for accessing platform services and features.

2025 LM Price Prediction: Analyzing Market Trends and Factors Shaping the Future of Lithium Metals

Is Metahero (HERO) a Good Investment?: Analyzing the Potential and Risks of this Metaverse Token in 2023

Is ZTX (ZTX) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is LeisureMeta (LM) a good investment?: Analyzing the potential of this virtual real estate platform in the metaverse market

2025 LAUNCHCOIN Price Prediction: Bullish Trends and Key Factors Driving Potential Growth

2025 HQ Price Prediction: Analyzing Market Trends and Factors Shaping the Future Value

Explore Castle Age: Your Ultimate Web3 Gaming Adventure Guide

Innovative Blockchain Security and Monitoring Tools for Web3

Crypto Market Update: XRP Climbs Amid Bitcoin's Recovery

Understanding NFTs: A Comprehensive Guide in German Language

Exploring Web3: A Comprehensive Guide to Decentralized Web Technologies