2025 NKN Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: NKN's Market Position and Investment Value

NKN (New Kind of Network) is a blockchain-driven open, decentralized network infrastructure and ecosystem designed to optimize network resource allocation and transmission efficiency. Since its launch in 2020, NKN has established itself as a novel approach to decentralizing network transmission capabilities. As of December 2025, NKN's market capitalization has reached approximately $9.41 million, with a circulating supply of around 795.48 million tokens, currently trading at $0.01183. This innovative asset, recognized for its unique contribution to blockchain infrastructure alongside Ethereum's computing capabilities and IPFS/Filecoin's storage solutions, is increasingly playing a vital role in decentralized network services and bandwidth optimization.

This article provides a comprehensive analysis of NKN's price dynamics and market trends, examining historical performance patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for investors interested in this network infrastructure asset.

NKN Price Analysis Report

I. NKN Price History Review and Market Status

NKN Historical Price Evolution

NKN reached its all-time high (ATH) of $1.44 on April 10, 2021, representing the peak of market enthusiasm during that period. Since then, the token has experienced a significant long-term decline. Over the past year, NKN has depreciated by 86.97%, falling from higher levels to its current price of $0.01183 as of December 22, 2025. The all-time low (ATL) of $0.00667819 was recorded on March 13, 2020, during the early market volatility period.

NKN Current Market Status

As of December 22, 2025, NKN is trading at $0.01183, with a 24-hour trading volume of $15,840.02. The token has experienced a 1.16% decline over the past 24 hours and a 4.36% decrease over the past 7 days. The 30-day performance shows a further 13.88% decline.

Market Capitalization Metrics:

- Current Market Cap: $9,410,552.79

- Fully Diluted Valuation (FDV): $9,410,565.34

- Market Dominance: 0.00029%

- Circulating Supply: 795,482,061.83 NKN (79.55% of maximum supply)

- Maximum Supply: 1,000,000,000 NKN

Trading Activity:

- 24-hour High: $0.01207

- 24-hour Low: $0.01141

- Hourly Change: +0.08%

- Number of Token Holders: 18,260

- Available on 19 exchanges

Click to view current NKN market price

NKN Market Sentiment Indicator

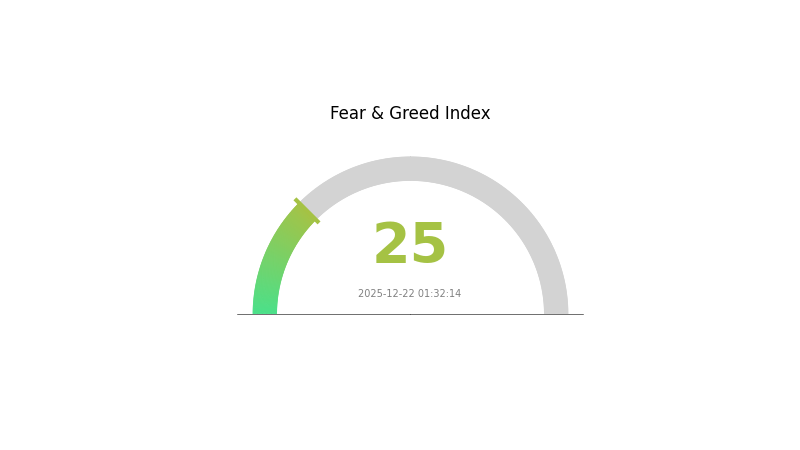

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The NKN market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates widespread investor pessimism and market uncertainty. During such periods, risk-averse traders typically reduce positions, while contrarian investors may view this as a potential buying opportunity. The extreme fear sentiment suggests significant market volatility and possible capitulation. Investors should exercise caution and conduct thorough due diligence before making trading decisions. Monitor market developments closely on Gate.com for real-time updates and analysis.

NKN Holdings Distribution

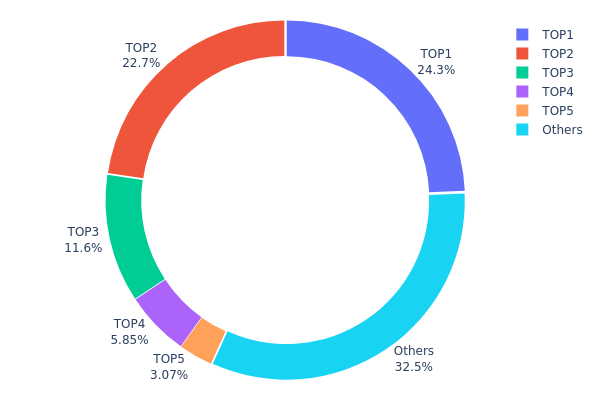

The address holdings distribution chart illustrates the concentration of NKN tokens across wallet addresses, revealing the degree of wealth concentration within the network. This metric is instrumental in assessing the decentralization level of the protocol and identifying potential risks associated with token concentration among large holders.

NKN exhibits a pronounced concentration pattern in its current token distribution. The top five addresses collectively hold approximately 67.47% of all tokens in circulation, with the largest holder commanding 24.28% and the second-largest controlling 22.70%. This two-address concentration of nearly 47% represents a significant centralization point within the ecosystem. While the remaining 32.53% distributed among other addresses suggests a broader holder base, the top-tier dominance indicates a structure where a limited number of entities exert considerable influence over the asset's supply dynamics.

This concentrated distribution architecture carries implications for market structure and stability. Large holder concentration typically increases volatility susceptibility, as substantial liquidation or accumulation activities by top addresses can trigger pronounced price movements. Furthermore, the significant holdings by a handful of addresses may amplify the potential for coordinated market actions, though institutional custody solutions and protocol-aligned incentive structures can mitigate such risks. The current distribution reflects a transitional state within NKN's ecosystem—while centralization risks exist, the presence of a meaningful secondary distribution base provides some resilience against extreme manipulation scenarios.

View current NKN holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 169983.87K | 24.28% |

| 2 | 0x03cc...31b587 | 158921.08K | 22.70% |

| 3 | 0x3f7f...e33ee6 | 81148.49K | 11.59% |

| 4 | 0x9b0c...ba8d46 | 40928.39K | 5.84% |

| 5 | 0xa9d1...1d3e43 | 21489.33K | 3.06% |

| - | Others | 227528.85K | 32.53% |

II. Core Factors Affecting NKN's Future Price

Supply and Demand Dynamics

- Market Supply and Demand: Supply and demand dynamics represent one of the primary factors influencing NKN's price trajectory. Changes in token circulation and market absorption capacity directly impact price movements.

- Historical Performance: Following the Initial Exchange Offering (IEO), NKN's price experienced volatility but demonstrated an overall upward trend, reflecting how supply-demand equilibrium shapes long-term value accumulation.

- Current Market Sentiment: Market sentiment driven by news, social media discussions, and investor confidence continues to create price fluctuations, with investor confidence levels directly correlating to demand pressures.

Regulatory Environment

- Regulatory Dynamics: Regulatory developments, including ETF approvals and government policies, represent critical factors that can significantly influence NKN's price trajectory and institutional adoption rates.

Technology Development and Ecosystem Building

- Core Protocol Upgrades: NKN's long-term value depends fundamentally on the upgrade progress of its core protocol and improvements in network performance. These technical enhancements serve as the essential foundation for sustained value creation.

- Network Performance Improvements: Enhancements to network performance and infrastructure strengthen the project's competitive positioning and long-term viability in the decentralized network space.

III. NKN Price Forecast 2025-2030

2025 Outlook

- Conservative Prediction: $0.0064 - $0.01186

- Neutral Prediction: $0.01186 (average price)

- Optimistic Prediction: $0.01649 (requires sustained network adoption and increased enterprise partnerships)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with moderate growth trajectory, characterized by incremental network expansion and increasing institutional interest.

- Price Range Forecast:

- 2026: $0.01191 - $0.02041 (19% upside potential)

- 2027: $0.0102 - $0.01798 (46% cumulative growth)

- 2028: $0.01587 - $0.02346 (49% cumulative growth)

- Key Catalysts: Expansion of decentralized communication infrastructure adoption, strategic partnerships with major technology platforms, and increased developer ecosystem participation.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01253 - $0.0226 (73% cumulative growth by 2029), assuming steady mainstream adoption of NKN's network infrastructure and stable macroeconomic conditions.

- Optimistic Scenario: $0.01747 - $0.0315 (82% cumulative growth by 2030), contingent upon significant enterprise integration and breakthrough adoption metrics.

- Transformational Scenario: $0.0315+ (exceptional upside), contingent upon NKN becoming foundational infrastructure for Web3 communications standards and achieving critical mass adoption across multiple industries.

- 2030-12-31: NKN trades near $0.02157 (average), reflecting normalized market valuation post-growth cycle.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01649 | 0.01186 | 0.0064 | 0 |

| 2026 | 0.02041 | 0.01417 | 0.01191 | 19 |

| 2027 | 0.01798 | 0.01729 | 0.0102 | 46 |

| 2028 | 0.02346 | 0.01764 | 0.01587 | 49 |

| 2029 | 0.0226 | 0.02055 | 0.01253 | 73 |

| 2030 | 0.0315 | 0.02157 | 0.01747 | 82 |

NKN Investment Strategy and Risk Management Report

IV. NKN Professional Investment Strategy and Risk Management

NKN Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Users interested in decentralized network infrastructure and bandwidth sharing economics, with moderate to high risk tolerance

- Operational Recommendations:

- Accumulate NKN tokens during market downturns when prices are below historical averages, as the project targets fundamental infrastructure needs

- Dollar-cost averaging (DCA) approach over 6-12 months to reduce timing risk and benefit from price volatility

- Store tokens in secure, non-custodial solutions while monitoring network development milestones and ecosystem adoption

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Monitor 20-day and 50-day moving averages to identify trend reversals and support/resistance levels

- Relative Strength Index (RSI): Use RSI(14) to identify overbought conditions above 70 and oversold conditions below 30

- Wave Trading Key Points:

- Trade within the 24-hour range ($0.01141 - $0.01207) for quick profits during low volatility periods

- Monitor volume changes; increased volume above 15,840 NKN/24h indicates potential breakout opportunities

NKN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Combine NKN holdings with established blockchain infrastructure tokens to reduce single-asset risk

- Position Sizing: Never allocate more than 5% to any single speculative asset; maintain clear stop-loss orders at 10-15% below entry price

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for convenient trading and staking when available

- Cold Storage Method: For long-term holdings exceeding 6 months, utilize offline storage solutions to minimize exchange counterparty risk

- Security Precautions: Enable two-factor authentication (2FA) on all exchange accounts, use hardware-secured private keys, never share seed phrases or private keys with third parties

V. NKN Potential Risks and Challenges

NKN Market Risk

- Extreme Price Volatility: NKN has declined 86.97% over the past year, demonstrating severe price instability with potential for further downside

- Low Trading Volume: 24-hour volume of only 15,840 NKN indicates thin liquidity; large trades may cause significant price slippage

- Small Market Capitalization: At $9.41 million market cap (ranking 1,205), NKN is susceptible to manipulation and sudden price crashes

NKN Regulatory Risk

- Cryptocurrency Regulatory Uncertainty: Global regulatory frameworks for blockchain network services remain undefined; regulatory crackdowns could impact project viability

- Bandwidth Sharing Legal Status: Regulatory bodies may challenge the legal status of incentivized bandwidth-sharing networks in certain jurisdictions

- Classification Ambiguity: Unclear whether NKN tokens qualify as utilities, securities, or other classifications varies by country

NKN Technical Risk

- Network Adoption Risk: Success depends on achieving critical mass of node operators; slow adoption threatens economic model viability

- Consensus Mechanism Scalability: While highly scalable mechanisms are claimed, real-world performance at scale remains unproven

- Dynamic Routing Security: Complex routing protocols introduce potential vulnerability vectors for network attacks or data integrity issues

VI. Conclusions and Action Recommendations

NKN Investment Value Assessment

NKN presents an ambitious vision to decentralize network infrastructure through bandwidth incentives, targeting a fundamental gap in blockchain technology (following compute and storage). However, the token faces significant headwinds: 86.97% annual decline, minimal trading liquidity, low market capitalization, and unproven network adoption. The project's technical innovation in dynamic routing and scalable consensus shows promise, but execution risk remains substantial. Long-term value depends on ecosystem maturation and achieving widespread node operator participation, which remains uncertain.

NKN Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through dollar-cost averaging on Gate.com; focus on understanding the project's networking model before increasing exposure

✅ Experienced Investors: Employ technical analysis combined with fundamental monitoring of network metrics; maintain strict 10-15% stop-loss discipline given volatility

✅ Institutional Investors: Conduct detailed due diligence on developer activity, node distribution, and adoption metrics; consider this as a high-risk, speculative allocation only

NKN Trading Participation Methods

- Spot Trading: Purchase NKN directly on Gate.com with limit orders to control entry prices given low liquidity

- Gate.com Platform: Access NKN trading pairs with competitive fees and secure custody options

- Position Monitoring: Set price alerts at key psychological levels ($0.01, $0.02) to capture major moves

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the future of NKN?

NKN is projected to reach 79% of its total supply within five years. As network adoption accelerates and infrastructure expands, NKN has strong potential for growth through decentralized connectivity solutions and increasing enterprise partnerships in the blockchain ecosystem.

What is the highest price of NKN?

The highest price of NKN was $1.48, reached on April 9, 2021. This represents the peak historical price for NKN in its trading history.

What factors influence NKN price predictions?

NKN price predictions are influenced by market sentiment, trading volume, technological developments, and user adoption trends. Network upgrades and broader crypto market conditions also significantly impact price movements.

What is NKN's price prediction for 2025?

NKN is expected to trade between $0.003735 and $0.01184 in 2025. If it reaches the upper target of $0.01184, it could represent a 0.31% increase from current levels.

How does NKN compare to other blockchain projects in terms of price potential?

NKN shows competitive price potential ranging from $0.0282 to $0.0484. Its decentralized communication focus and interoperability advantages position it favorably against similar blockchain projects in the market.

2025 OCTA Price Prediction: Analyzing Market Trends and Growth Potential in the Digital Asset Space

2025 NATIX Price Prediction: Analyzing Market Trends and Potential Growth Factors

Render Token Future Insights: Can RNDR Hit $50 by 2030?

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

Explore Castle Age: Your Ultimate Web3 Gaming Adventure Guide

Innovative Blockchain Security and Monitoring Tools for Web3

Crypto Market Update: XRP Climbs Amid Bitcoin's Recovery

Understanding NFTs: A Comprehensive Guide in German Language

Exploring Web3: A Comprehensive Guide to Decentralized Web Technologies