2025 NUM Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: NUM's Market Position and Investment Value

Numbers Protocol (NUM) serves as the native token of a decentralized photo network that creates community, value and trust for digital media. As of December 2025, NUM has established itself as a digital asset focused on enabling users to purchase, gift, and register copyright for images and videos on a distributed platform. The token's market capitalization currently stands at approximately $6.85 million, with a circulating supply of 853.51 million NUM tokens, trading at around $0.008024.

This asset, recognized for its role in decentralized media ownership and digital rights management, is increasingly gaining traction in the intersection of blockchain technology and digital content protection. NUM is playing an increasingly critical role in facilitating transparent and community-driven value distribution for digital media creators.

This article will provide a comprehensive analysis of NUM's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors.

Numbers Protocol (NUM) Market Analysis Report

I. NUM Price History Review and Current Market Status

NUM Historical Price Evolution

-

November 2021: NUM reached its all-time high of $2.52 on November 28, 2021, representing the peak of the token's historical valuation during the 2021 bull market cycle.

-

2022-2024: Following the 2021 peak, NUM experienced a significant decline throughout the subsequent bear market and consolidation periods, with the token losing substantial value over the extended market downturn.

-

December 2025: NUM reached its all-time low of $0.00532095 on December 8, 2025, marking an 85.75% decline over the one-year period and reflecting the current challenging market environment.

NUM Current Market Status

As of December 23, 2025, NUM is trading at $0.008024, reflecting a notable 24-hour gain of 10.12% with an intraday range between $0.007165 and $0.008122. The token has demonstrated resilience in recent days, gaining 9.86% over the past 30 days and 0.35% over the week, though it remains down 85.75% year-over-year from December 2024 levels.

The token maintains a market capitalization of approximately $6.85 million with a fully diluted valuation of $6.93 million. The circulating supply stands at 853,512,333 NUM tokens (85.35% of total supply), with a maximum supply cap of 1 billion tokens. Daily trading volume reached $30,039, indicating moderate liquidity conditions.

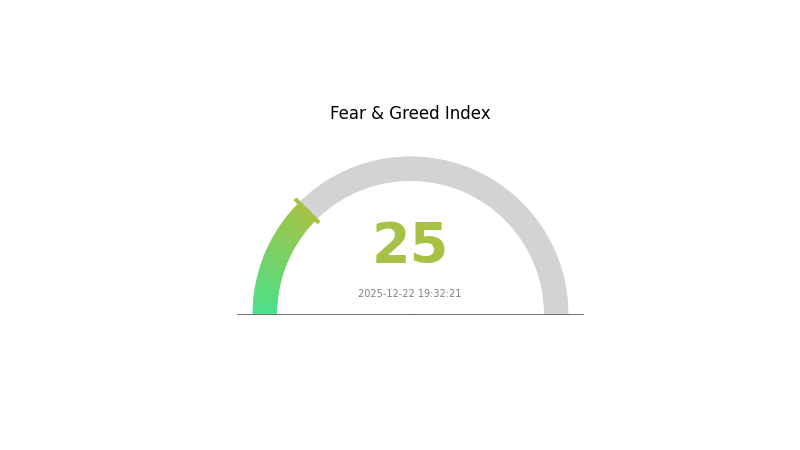

NUM ranks 1,361st by market capitalization globally and holds a 0.00021% market dominance. The token is supported by 1,824 active holders and maintains a market share position typical for mid-tier altcoins. Current market sentiment reflects "Extreme Fear" conditions with a VIX reading of 25.

Numbers Protocol operates as a decentralized photo network designed to create community, value, and trust for digital media. NUM serves as the native token enabling users to purchase, gift, register copyright, and perform additional functions on images and videos within the ecosystem.

View current NUM market price on Gate.com

Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting 25. This historically represents a strong capitulation phase where panic selling dominates investor sentiment. During such periods, risk-averse traders tend to exit positions rapidly, creating heightened market volatility. However, extreme fear often signals potential buying opportunities for contrarian investors who maintain conviction in long-term fundamentals. Market participants should exercise caution, implement strict risk management strategies, and avoid emotional decision-making during such heightened uncertainty periods on Gate.com and other trading platforms.

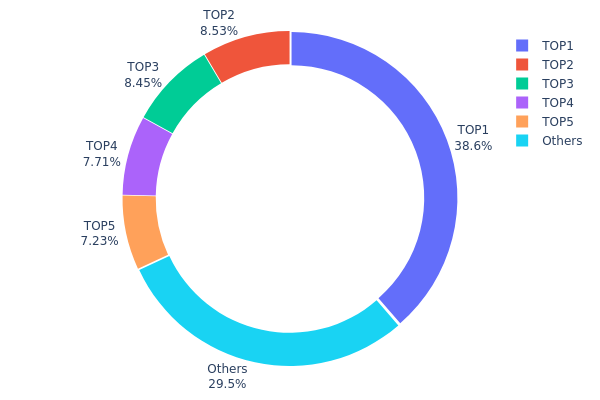

NUM Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the blockchain network by analyzing the top token holders and their respective share of total supply. This metric serves as a critical indicator for assessing market structure, decentralization levels, and potential systemic risks within the ecosystem.

NUM's current distribution profile exhibits notable concentration characteristics. The top holder (0x7b8f...16ea19) commands 38.62% of the total supply with 91.44 million tokens, representing a significant concentration in a single address. When combined with the second and third largest holders, the top three addresses collectively control 55.59% of circulating tokens. This concentration level indicates a moderate to high degree of centralization, with the top five addresses accounting for 70.52% of the supply, leaving only 29.48% distributed among other network participants.

This pronounced concentration raises several structural considerations. The elevated holdings among top addresses create potential price volatility vectors, as substantial token transfers or liquidations from these positions could meaningfully impact market dynamics. The distribution pattern suggests that NUM's market structure remains highly dependent on the decisions and actions of principal stakeholders. However, the presence of a relatively distributed long tail (29.48% held by others) provides some degree of resilience and suggests the token has achieved a baseline level of network participation beyond elite holders.

Click to view current NUM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7b8f...16ea19 | 91438.04K | 38.62% |

| 2 | 0x99c2...c78399 | 20200.02K | 8.53% |

| 3 | 0x2c42...907380 | 20000.00K | 8.44% |

| 4 | 0xca9a...499a46 | 18246.03K | 7.70% |

| 5 | 0x9642...2f5d4e | 17122.28K | 7.23% |

| - | Others | 69718.14K | 29.48% |

II. Core Factors Influencing NUM's Future Price

Supply Mechanism

-

Halving Schedule: Cryptocurrencies with structured supply reduction mechanisms, such as Bitcoin's halving events occurring every four years, have historically demonstrated significant price movements. Following the 2024 halving, inflation rates dropped below 1%, with the next halving expected in 2028, potentially triggering another appreciation cycle.

-

Historical Patterns: Supply constraints have consistently influenced price trajectories. As exchange reserves decline relative to total supply, supply-demand imbalances tend to drive price appreciation.

-

Current Impact: Limited circulating supply relative to growing institutional demand creates upward price pressure. For instance, exchange holdings have declined significantly, concentrating assets among long-term holders.

Institutional and Whale Dynamics

-

Institutional Adoption: Major financial institutions and asset managers have entered the market through approved exchange-traded funds and direct holdings. BlackRock, Fidelity, and other prominent firms have strengthened market legitimacy and contributed to institutional capital inflows.

-

Government Policy: The Trump administration has adopted a pro-cryptocurrency stance, appointing cryptocurrency supporters to key financial positions and pledging to establish the United States as a "Bitcoin global center." This policy environment represents a significant shift toward regulatory clarity and market development.

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve rate reduction expectations significantly influence cryptocurrency valuations. Current market consensus suggests high probabilities of further rate cuts through the end of 2025, supporting risk asset appreciation. Declining real interest rates typically benefit non-yielding assets like cryptocurrencies.

-

Inflation Hedge Characteristics: Cryptocurrencies, particularly those with fixed supplies, demonstrate value preservation properties during inflationary environments. As global debt levels rise and central banks maintain accommodative policies, the appeal of supply-constrained digital assets increases as diversification tools.

-

Geopolitical Factors: International tensions and financial sanctions drive demand for alternative asset classes perceived as resistant to government control or freezing. Central banks globally have increased precious metals and diversified reserves partly due to geopolitical risk concerns, creating parallel demand dynamics for cryptocurrencies.

-

USD Weakness: The dollar index has declined over 10% year-to-date due to rate cut expectations and trade policy uncertainty. Historically, cryptocurrency valuations move inversely to dollar strength, providing additional tailwinds during periods of USD depreciation.

III. 2025-2030 Price Forecast Analysis

2025 Outlook

- Conservative Forecast: $0.00667 - $0.00804

- Neutral Forecast: $0.00804 - $0.01013

- Bullish Forecast: $0.01013 (requires sustained market momentum)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual appreciation

- Price Range Predictions:

- 2026: $0.00536 - $0.01136 (13% upside potential)

- 2027: $0.00767 - $0.01114 (27% cumulative gain)

- Key Catalysts: Increased institutional adoption, ecosystem development, and positive regulatory environment

2028-2030 Long-term Outlook

- Base Case: $0.00876 - $0.01357 (33% appreciation by 2028, assumes steady market conditions)

- Bullish Case: $0.01194 - $0.01790 (61% total gain by 2030, requires accelerated adoption and market expansion)

- Transformative Case: $0.01382 - $0.01790 (51-61% upside by 2029-2030, assumes breakthrough technological innovations and mainstream integration)

Note: All price predictions should be monitored regularly on Gate.com and cross-referenced with current market conditions. Historical volatility suggests actual prices may deviate significantly from these forecasts.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01013 | 0.00804 | 0.00667 | 0 |

| 2026 | 0.01136 | 0.00909 | 0.00536 | 13 |

| 2027 | 0.01114 | 0.01022 | 0.00767 | 27 |

| 2028 | 0.01357 | 0.01068 | 0.00876 | 33 |

| 2029 | 0.01382 | 0.01212 | 0.00618 | 51 |

| 2030 | 0.0179 | 0.01297 | 0.01194 | 61 |

Numbers Protocol (NUM) Investment Strategy and Risk Management Report

IV. NUM Professional Investment Strategy and Risk Management

NUM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term vision of decentralized photo networks and digital media ownership

- Operation Recommendations:

- Accumulate NUM tokens during market downturns to build a core portfolio position

- Implement dollar-cost averaging (DCA) to reduce timing risk and smooth entry prices over extended periods

- Store tokens securely in cold storage solutions for extended holding periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 1H, 24H, and 7D price trends to identify momentum shifts and reversal patterns

- Support and Resistance Levels: Track historical price levels at $0.008122 (24H high) and $0.007165 (24H low) for intraday trading decisions

- Swing Trading Key Points:

- Take advantage of the 10.12% 24-hour price volatility to execute buy orders near support and sell orders near resistance

- Monitor volume trends relative to the 24-hour volume of approximately 30,039 units to confirm price movements

NUM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-7% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine NUM holdings with stablecoins and other established cryptocurrencies to reduce concentration risk

- Stop-Loss Orders: Set automated stop-loss orders at 15-20% below entry price to limit downside exposure

(3) Secure Storage Solutions

- Exchange Storage: Utilize Gate.com's secure custody services for active trading positions

- Self-Custody Option: Transfer NUM to personal wallets supported on BSC and ETH chains for long-term holding with enhanced security

- Security Considerations: Enable two-factor authentication on all exchange accounts, maintain offline backup of private keys, and verify contract addresses before token transfers

V. NUM Potential Risks and Challenges

NUM Market Risk

- Extreme Price Volatility: NUM has experienced an 85.75% decline over the past year, reflecting significant downside risk and market uncertainty

- Low Liquidity: Daily trading volume of approximately 30,039 units may restrict large transaction execution and increase slippage costs

- Limited Market Capitalization: With a market cap of $6,848,582, NUM remains susceptible to sharp price movements from concentrated trading activity

NUM Regulatory Risk

- Evolving Regulatory Framework: Governments worldwide continue developing cryptocurrency regulations that could impact token utility and trading accessibility

- Digital Media Compliance: Regulatory authorities may impose new requirements on platforms handling digital copyright and media ownership verification

- Jurisdictional Restrictions: Certain countries may restrict or ban trading of NUM tokens, limiting market access and liquidity

NUM Technology Risk

- Smart Contract Vulnerabilities: Technical flaws in the BSC and ETH blockchain implementations could expose users to security breaches or fund loss

- Network Adoption Risk: The success of Numbers Protocol depends on achieving critical mass of users and photographers, which remains uncertain

- Scalability Challenges: As the decentralized photo network grows, the blockchain infrastructure may face congestion and performance degradation

VI. Conclusion and Action Recommendations

NUM Investment Value Assessment

Numbers Protocol (NUM) represents a niche opportunity in the decentralized digital media space, targeting the growing intersection of copyright protection and blockchain technology. While the project addresses a legitimate use case for photographers and content creators seeking transparent media ownership verification, the token faces significant headwinds including extreme price depreciation (-85.75% annually), modest market capitalization, and limited trading liquidity. The project's long-term viability depends on successful ecosystem adoption and regulatory clarity around digital copyright management on blockchain networks.

NUM Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of portfolio) through Gate.com's spot trading platform to understand project mechanics before committing larger capital

✅ Experienced Investors: Consider scaling into positions during technical support levels around $0.007165, implementing systematic DCA strategies to build positions at multiple price points

✅ Institutional Investors: Conduct thorough due diligence on project adoption metrics, developer activity on GitHub, and competitive positioning within the digital media blockchain space before institutional allocation

NUM Trading Participation Methods

- Spot Trading: Purchase NUM directly on Gate.com using BTC, ETH, or stablecoins for immediate ownership

- Chain-Based Transactions: Transfer NUM between BSC and ETH networks using supported addresses to optimize transaction costs and liquidity preferences

- Portfolio Rebalancing: Periodically adjust NUM holdings relative to overall cryptocurrency portfolio allocation based on risk tolerance and market conditions

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is NUM crypto?

NUM is a cryptocurrency designed to reward users for creating, archiving, and verifying content on blockchain. It incentivizes content creation and management through a transparent, secure network system.

What is the current price of NUM and its market cap?

As of December 22, 2025, NUM is trading at $0.0045 with a market cap of $6.241 million, reflecting steady market valuation.

What factors could influence NUM price prediction in 2025?

NUM's 2025 price depends on AI adoption, token unlock schedules, and vault integration developments. Market sentiment toward AI sector and overall crypto market conditions will significantly impact price movements.

Is NUM a good investment for long-term growth?

NUM has shown limited market adoption and modest trading volume. While it operates in an emerging sector, its small market cap and relatively nascent development suggest moderate long-term growth potential compared to established cryptocurrencies.

What are the risks associated with NUM price volatility?

NUM price volatility can cause unexpected price swings leading to potential losses. High volatility increases hedging costs, complicates financial planning, and creates operational challenges for market participants.

How does NUM compare to other similar cryptocurrencies?

NUM specializes in digital content authenticity verification through blockchain, differentiating it from traditional cryptocurrencies. Unlike Bitcoin and Ethereum focused on value exchange, NUM targets content provenance and trust. Its niche positioning in content verification provides unique utility compared to mainstream cryptocurrencies.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Avalanche (AVAX) 2025 Price Analysis and Market Trends

Latest analysis and investment prospects for Toncoin price in June 2025

Sui Price Market Analysis and Long-term Investment Potential in 2025

Where to Find Alpha in the 2025 Crypto Spot Market

Bitcoin Cash (BCH) Price Analysis and Investment Outlook for 2025

Horizontally Scaling Blockchain Architecture: A Deep Dive into Solana's Innovations

How to Purchase XRP in India: A Step-by-Step Guide

Can XRP Reach a Value of $1000 by 2024?

Comprehensive Guide to Token Functionality on Solana

Integrating USDT Stablecoin into the Solana Ecosystem