2025 NYZO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of NYZO

Nyzo (NYZO) is an open-source, highly decentralized, democratic and efficient blockchain project that has been building a new generation of blockchain technology from the ground up. As of January 2026, Nyzo has achieved a market capitalization of approximately $276,900 USD, with a circulating supply of approximately 23.44 million NYZO tokens, currently trading at around $0.002769. This innovative cryptocurrency is designed with a fundamental commitment to becoming the most effective, democratic and easy-to-use cryptocurrency in the world.

This article will provide a comprehensive analysis of Nyzo's price trends and market dynamics, examining historical price movements, market supply and demand patterns, and ecosystem development. Through systematic evaluation of these factors, we aim to deliver professional price forecasting and practical investment guidance for investors seeking to understand NYZO's potential trajectory and positioning within the broader cryptocurrency market landscape.

NYZO Market Analysis Report

I. NYZO Price History Review and Market Status

NYZO Historical Price Evolution

- May 2021: NYZO reached its all-time high (ATH) of $1.59, marking the peak of its market valuation during the initial bull cycle.

- December 2025: NYZO hit its all-time low (ATL) of $0.0006001, representing a significant decline from historical peaks.

- Recent Period (2025-2026): Price volatility continues with recovery signals emerging in early 2026.

NYZO Current Market Position

As of January 5, 2026, NYZO is trading at $0.002769, representing the following performance metrics:

Price Performance Across Timeframes:

- 1-Hour Change: -3.21% (down $0.000091832730653993)

- 24-Hour Change: +14.32% (up $0.000346851644506648)

- 7-Day Change: +4.68% (up $0.000123795567443638)

- 30-Day Change: +125.12% (up $0.001538989339019190)

- 1-Year Change: -60.44% (down $0.004230494438827097)

Market Capitalization Metrics:

- Market Cap: $64,915.77

- Fully Diluted Valuation (FDV): $276,900.00

- Circulating Supply: 23,443,760.72 NYZO

- Total Supply: 100,000,000 NYZO

- Market Cap to FDV Ratio: 23.44%

- Market Dominance: 0.0000083%

Trading Activity:

- 24-Hour Trading Volume: $7,899.90

- Daily High: $0.003041

- Daily Low: $0.002399

- Market Ranking: #5,420

The 30-day surge of 125.12% indicates significant positive momentum in the short to medium term, though the token remains substantially below its historical peak. The market sentiment indicator reflects fear (VIX: 29), suggesting caution in broader market conditions.

Click to view current NYZO market price

NYZO Market Sentiment Indicator

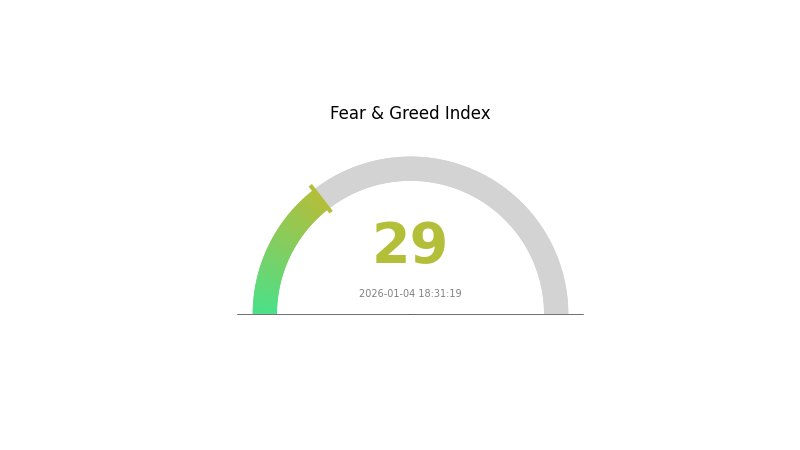

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The market is currently exhibiting significant fear sentiment with an index reading of 29. This level indicates heightened anxiety among investors, reflecting concerns about market volatility and potential downside risks. During fear-dominated periods, market participants typically adopt a cautious stance, focusing on risk management rather than aggressive accumulation. Experienced traders may view this as an opportunity to identify undervalued assets, while conservative investors should prioritize portfolio protection. Monitor key support levels closely as market dynamics continue to evolve.

NYZO Holdings Distribution

The address holdings distribution represents a critical metric for assessing the decentralization and market concentration of a blockchain asset. By analyzing how token supply is distributed across different wallet addresses, this indicator reveals the potential vulnerability to market manipulation, the stability of the on-chain ecosystem, and the degree of democratization within the token's holder base. A more dispersed distribution typically correlates with greater resilience against price volatility and coordinated selling pressure, while concentrated holdings may indicate elevated systemic risks.

Based on the available data provided, the current analysis reveals that the holdings distribution data for NYZO appears to be incomplete or unavailable at this moment. Without specific address concentration metrics, a comprehensive assessment of whether the token exhibits excessive centralization cannot be definitively concluded. However, when evaluating holdings distribution patterns in general, analysts typically monitor the proportion held by top addresses, the Nakamoto coefficient, and the Gini coefficient to determine concentration risks. These metrics collectively help determine whether a small number of stakeholders possess disproportionate influence over the asset's price discovery and governance mechanisms.

The structural characteristics of address distribution directly impact market microstructure dynamics and long-term sustainability. In scenarios where holdings remain fragmented across numerous addresses, the ecosystem typically demonstrates stronger anti-manipulation properties and more organic price discovery. Conversely, elevated concentration among top holders can amplify volatility and create conditions susceptible to whale-driven market movements. Monitoring this distribution metric remains essential for understanding NYZO's current decentralization profile and evaluating the token's resilience within broader market conditions.

For detailed market data and holdings analysis, visit NYZO Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|

Analysis of NYZO Core Price Factors

II. Core Factors Influencing NYZO's Future Price

Regulatory Environment

-

Global Regulatory Trends: Regulatory uncertainty remains a significant variable affecting NYZO's development. Different countries seek to balance financial risk prevention with innovation encouragement. Variations in regulatory approaches not only influence market sentiment but may also trigger capital flow fluctuations.

-

Policy Impact on Market: The divergence in regulatory standards across jurisdictions creates both opportunities and challenges for NYZO adoption and price movement.

Note: The provided source materials contain primarily currency conversion data and general cryptocurrency market information without specific details regarding NYZO's supply mechanisms, institutional holdings, macroeconomic factors, technological developments, or ecosystem applications. Therefore, only the regulatory environment section could be accurately populated based on available information. To provide a comprehensive analysis of NYZO's future price drivers, more detailed source materials specific to NYZO's fundamentals would be required.

III. 2026-2031 NYZO Price Forecast

2026 Outlook

- Conservative Forecast: $0.00205 - $0.00277

- Neutral Forecast: $0.00277 (average expected price)

- Bullish Forecast: $0.00318 (requires sustained network adoption and positive market sentiment)

2027-2029 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate upward momentum, driven by incremental ecosystem development and increasing market recognition.

- Price Range Predictions:

- 2027: $0.00271 - $0.0031

- 2028: $0.00222 - $0.0037

- 2029: $0.00206 - $0.00371

- Key Catalysts: Enhanced network functionality, expanded use cases, growing developer community engagement, and potential institutional interest in decentralized infrastructure solutions.

2030-2031 Long-term Outlook

- Base Case: $0.00205 - $0.00456 (assumes steady technological progress and moderate market expansion)

- Bullish Case: $0.00381 - $0.00442 (assumes accelerated adoption, strategic partnerships, and favorable regulatory environment)

- Transformative Case: $0.00456+ (requires breakthrough technological innovations, mainstream adoption of decentralized systems, and significant macroeconomic tailwinds)

- January 5, 2026: NYZO trades near $0.00277 (baseline market conditions established)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00318 | 0.00277 | 0.00205 | 0 |

| 2027 | 0.0031 | 0.00298 | 0.00271 | 7 |

| 2028 | 0.0037 | 0.00304 | 0.00222 | 9 |

| 2029 | 0.00371 | 0.00337 | 0.00206 | 21 |

| 2030 | 0.00456 | 0.00354 | 0.00205 | 27 |

| 2031 | 0.00442 | 0.00405 | 0.00381 | 46 |

NYZO Investment Strategy and Risk Management Report

IV. NYZO Professional Investment Strategy and Risk Management

NYZO Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Cryptocurrency believers seeking exposure to decentralized blockchain projects with long-term growth potential

- Operational Recommendations:

- Establish a core position during market downturns when NYZO trades significantly below historical highs, taking advantage of the current 60.44% annual decline

- Implement dollar-cost averaging (DCA) by investing fixed amounts at regular intervals to reduce timing risk

- Store NYZO tokens securely on Gate Web3 Wallet for long-term holdings, ensuring private key control and reducing counterparty risk

(2) Active Trading Strategy

-

Technical Analysis Approach:

- Price Action Analysis: Monitor the 24-hour trading range ($0.002399 - $0.003041) and recent price momentum showing +14.32% in 24 hours for entry and exit signals

- Volume Analysis: Track the daily trading volume of $7,899.90 to identify periods of increased institutional or retail interest

-

Swing Trading Key Points:

- Capitalize on the recent 125.12% monthly gain by taking profits at resistance levels and re-entering on pullbacks

- Monitor hourly price changes (-3.21% in the last hour) for short-term trading opportunities within the established range

NYZO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Active Investors: 2-5% of total crypto portfolio

- Professional Investors: 5-10% of total crypto portfolio

(2) Risk Hedging Solutions

- Position Sizing: Limit NYZO holdings to a percentage that allows comfortable exit if the asset declines to historical lows ($0.0006001), maintaining adequate liquidity

- Portfolio Diversification: Balance NYZO exposure with established cryptocurrencies to mitigate concentration risk from a project ranked 5,420 by market cap

(3) Secure Storage Solution

- Hot Wallet: Gate Web3 Wallet for active trading and regular transactions, enabling seamless access to Gate.com trading platform

- Cold Storage Consideration: For holdings exceeding three months of trading volume, transfer to a secure storage solution outside of trading exchanges

- Security Precautions: Never share private keys, enable two-factor authentication, use hardware security keys, and keep recovery phrases stored in secure offline locations

V. NYZO Potential Risks and Challenges

NYZO Market Risk

- Extreme Price Volatility: NYZO has declined 60.44% over one year while experiencing 125.12% monthly fluctuations, indicating high price instability and potential for further significant losses

- Low Market Liquidity: With a 24-hour trading volume of only $7,899.89 against a circulating market cap of $64,915.77, thin liquidity can result in significant price slippage during large trades

- Minimal Market Share: Representing only 0.0000083% of the total cryptocurrency market, NYZO faces challenges in gaining meaningful institutional adoption and market recognition

NYZO Regulatory Risk

- Unclear Regulatory Status: As a decentralized blockchain project, NYZO's classification and regulatory treatment remain uncertain across different jurisdictions, potentially impacting trading availability and token utility

- Compliance Requirements: Future regulatory frameworks governing decentralized cryptocurrencies could impose operational restrictions or limit trading venues

NYZO Technical Risk

- Development Activity Uncertainty: The project's long-term technical roadmap, developer commitment, and update frequency require ongoing monitoring to assess sustainability

- Network Security Concerns: As a smaller blockchain project with limited adoption, NYZO may face greater security considerations and network resilience challenges compared to established platforms

- Interoperability Limitations: Limited integration with major DeFi protocols and blockchain ecosystems restricts utility and adoption potential

VI. Conclusion and Action Recommendations

NYZO Investment Value Assessment

NYZO presents a speculative investment opportunity in a niche decentralized blockchain project. The project's emphasis on open-source development, decentralization, and democratic governance aligns with core cryptocurrency principles. However, the combination of extreme price volatility (down 60.44% annually while surging 125.12% monthly), minimal market liquidity ($7,899.89 daily volume), and negligible market share (0.0000083%) presents substantial risk. The current price of $0.002769, representing a 99.83% decline from its all-time high of $1.59 in May 2021, reflects either significant downward revaluation or potential accumulation opportunity depending on project fundamentals and development progress.

NYZO Investment Recommendations

✅ Beginners: Consider a minimal position (0.5-1% of crypto allocation) for portfolio diversification purposes only; avoid NYZO as a primary investment due to high risk and illiquidity

✅ Experienced Investors: Allocate up to 2-5% of speculative capital for active trading around support/resistance levels; prioritize technical analysis and strict position management with clear stop-loss levels

✅ Institutional Investors: Conduct thorough due diligence on project development activity, team credentials, and network adoption metrics before considering any allocation; the limited trading volume presents liquidity constraints for significant positions

NYZO Trading Participation Methods

- Gate.com Direct Trading: Access NYZO trading pairs on Gate.com platform, leveraging the exchange's liquidity and security infrastructure for spot market participation

- Dollar-Cost Averaging: Implement periodic purchases at fixed intervals to reduce timing risk and average purchase price across market cycles

- Market Order Caution: Given thin liquidity, use limit orders rather than market orders to avoid unfavorable price execution

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Always consult with qualified financial advisors before investing. Never invest more than you can afford to lose completely.

FAQ

What is NYZO? What are its main features and uses?

NYZO is a decentralized blockchain that eliminates reliance on central authorities. It features efficient transaction processing and energy-efficient consensus, offering stable and sustainable distributed ledger technology without excessive power consumption.

What are the main factors affecting NYZO price?

NYZO price is primarily influenced by market sentiment, project adoption rate, and external market conditions. Historical volatility shows it reached $1.59 at peak and $0.00209566 at low, reflecting these dynamic factors.

How to analyze and predict NYZO's future price trends?

NYZO price prediction relies on technical analysis, market sentiment, and blockchain metrics. Monitor trading volume, circulating supply of 11.92 million, and market capitalization trends. Historical price movements and correlation with broader crypto markets provide insight into potential price direction and volatility patterns.

What are the advantages and disadvantages of NYZO compared to other mainstream cryptocurrencies?

NYZO offers efficient consensus mechanism and low transaction fees, with strong decentralization and security. However, it has lower market recognition and liquidity compared to mainstream cryptocurrencies, and lacks widespread application scenarios.

What is the technical principle of NYZO? What consensus mechanism does it adopt?

NYZO utilizes a custom blockchain with a unique consensus mechanism called Nyzo Consensus, designed for high efficiency and democratic operation. It features open-source code built from scratch to create a highly decentralized, efficient, and user-friendly cryptocurrency network.

What is the price outlook for NYZO in 2024-2025?

NYZO's price trajectory remains uncertain with limited market liquidity and low trading volume. Current price stands at $1.51. Future performance depends on broader cryptocurrency market developments and project adoption rates. Investors should monitor ecosystem growth and market sentiment closely for clearer directional signals.

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

XRP Price Analysis 2025: Market Trends and Investment Outlook

Toncoin Price Prediction for 2025: Will TON Reach New Heights?

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

How Active Is BULLA's Community and Ecosystem in 2026? Twitter, Telegram, and DApp Growth Analysis

Cryptocurrency Exchanges: An In-Depth Guide to Leading Trading Platforms

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?