2025 OGN Price Prediction: Expert Analysis and Market Forecast for Origin Token's Future Growth

Introduction: OGN's Market Position and Investment Value

Origin Protocol (OGN) serves as the governance and value-accrual token for one of Ethereum's longest-standing DeFi projects, featuring a multichain feature set that unlocks vast opportunities for yield generation across the space. Since its inception in 2020, OGN has established itself as a permissionless and composable asset within the decentralized finance ecosystem. As of December 2025, OGN boasts a market capitalization of $44.53 million, with a circulating supply of approximately 651.78 million tokens, trading at $0.03159. This innovative token, recognized as a "sustainable, user-first yield protocol asset," is playing an increasingly pivotal role in decentralized yield generation and on-chain governance mechanisms.

This article will provide a comprehensive analysis of OGN's price trajectory and market dynamics through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors. Our analysis aims to deliver professional price forecasts and actionable investment strategies for market participants seeking exposure to this established DeFi protocol token, with particular attention to its staking mechanisms, governance participation, and yield distribution model.

Origin Protocol (OGN) Market Analysis Report

I. OGN Price History Review and Market Status

OGN Historical Price Trajectory

-

2021: All-time high of $3.35 reached on April 8, 2021, marking the peak of the project's initial market enthusiasm during the early DeFi boom period.

-

2021-2025: Extended bear market period, with the token experiencing significant depreciation over the following years as market conditions evolved and competition intensified within the DeFi space.

-

2025: Reached all-time low of $0.02590906 on October 11, 2025, representing a decline of approximately 92.27% from its historical peak. The token has subsequently recovered slightly from this bottom.

OGN Current Market Position

Price Performance:

- Current Price: $0.03159 (as of December 20, 2025)

- 24-Hour Price Range: $0.03061 - $0.03186

- 24-Hour Change: +2.17%

- 7-Day Change: -9.41%

- 30-Day Change: -19.66%

- 1-Year Change: -70.30%

Market Capitalization and Supply:

- Circulating Market Cap: $20,589,711.81

- Fully Diluted Valuation (FDV): $44,531,312.49

- Circulating Supply: 651,779,418 OGN (46.24% of total supply)

- Total Supply: 1,409,664,846 OGN

- Market Dominance: 0.0013%

- Market Ranking: #856

Trading Activity:

- 24-Hour Trading Volume: $99,091.38

- Volume/Market Cap Ratio: Indicating relatively modest trading activity

- Listed on 29 Exchanges

- Token Holders: 45,495

Short-term Price Movement:

- 1-Hour Change: +0.32%

- Recent volatility reflects modest intraday fluctuations with a slight upward bias in the immediate short term

Check current OGN market price on Gate.com

II. Origin Protocol Ecosystem Overview

Project Foundation and Core Value Proposition

Origin Protocol stands as one of Ethereum's longest-established DeFi projects, built on a foundation of permissionless and composable products designed for deep integration with emerging blockchain primitives. The protocol's architecture focuses on yield generation opportunities across multiple blockchain networks through its multichain feature set.

The ecosystem prioritizes sustainable, user-first product development, with all offerings structured to simplify reward distribution to OGN stakers while maintaining protocol efficiency and scalability.

OGN Token Function and Utility

OGN serves as the dual-purpose governance and value-accrual token within Origin's yield ecosystem:

Staking Mechanism:

- OGN can be locked for periods ranging from 1 month to 1 year

- Stakers receive xOGN in proportion to the amount staked and lock-up duration

- xOGN holders gain both economic rights and voting power throughout the staking period

- The staking model creates aligned incentives between token holders and protocol success

Economic Structure:

- Performance fees collected from yield-generating products are distributed as follows: 50% allocated to OGN stakers as additional rewards, 50% deployed to purchase flywheel tokens that enhance yields from underlying protocols

- This fee distribution mechanism creates continuous value accrual for long-term stakers

Governance Authority:

- OGN stakers collectively form the Origin DAO

- DAO members exercise voting rights on protocol proposals and treasury allocation decisions

- Origin Protocol emphasizes fully on-chain governance to ensure sustainable and inclusive decision-making structures

Market Sentiment Context

As of December 20, 2025, the broader market sentiment registers at "Extreme Fear" (VIX: 20), which typically correlates with increased volatility and risk aversion across digital asset markets. This macro sentiment backdrop provides context for individual token performance patterns during this period.

OGN Market Sentiment Indicator

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, assets are often oversold, presenting potential opportunities for contrarian investors. However, caution is advised as market volatility may persist. Monitor key support levels closely and consider dollar-cost averaging strategies. Track sentiment shifts on Gate.com's market data platform for real-time updates on market conditions.

OGN Holdings Distribution

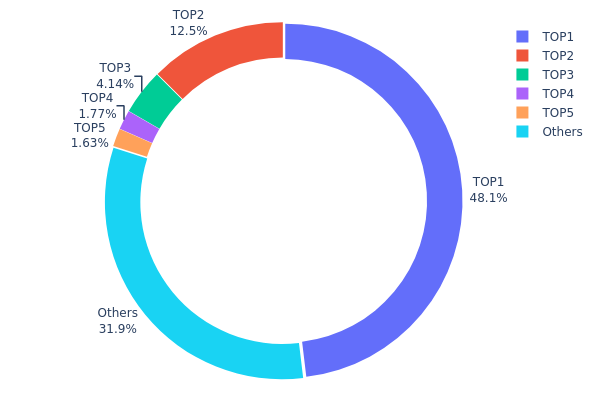

The address holdings distribution chart illustrates the concentration of OGN tokens across blockchain addresses, providing critical insights into the token's decentralization level and market structure. This metric reveals how OGN supply is distributed among individual wallet addresses, with larger concentrations indicating higher centralization risk and potential vulnerability to price manipulation or sudden sell-offs.

The current OGN holdings distribution exhibits significant concentration concerns. The top address controls 48.10% of the circulating supply, representing an exceptionally high degree of centralization that substantially exceeds healthy decentralization benchmarks. When combined with the second-largest holder at 12.48%, these two addresses account for approximately 60.58% of total OGN tokens. The top five addresses collectively hold 68.10% of the token supply, while the remaining 31.90% is distributed among other market participants. This distribution pattern indicates that OGN's supply is heavily concentrated in a small number of addresses, predominantly likely representing exchange wallets, institutional holdings, or project reserves.

Such pronounced concentration creates material implications for market dynamics and price stability. The dominance of a single entity controlling nearly half of the token supply presents elevated risks of sudden liquidation events, price volatility, and potential market manipulation. The skewed distribution suggests limited depth in retail decentralization and raises questions about true market participation. For investors and analysts, this concentration metric underscores the importance of monitoring large holder movements, as transactions from top addresses could trigger significant price fluctuations and market instability.

View current OGN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6389...e45c57 | 678131.90K | 48.10% |

| 2 | 0xf977...41acec | 176000.00K | 12.48% |

| 3 | 0x29e7...ab57bd | 58421.52K | 4.14% |

| 4 | 0x6890...269ff3 | 24923.36K | 1.76% |

| 5 | 0x76ec...78fbd3 | 22963.78K | 1.62% |

| - | Others | 449224.28K | 31.9% |

Key Factors Affecting OGN's Future Price Movement

Market Sentiment and Investor Confidence

-

Investor Sentiment Impact: OGN's price trajectory is directly influenced by investor emotions and confidence levels. When market participants anticipate widespread adoption or major technological breakthroughs, positive sentiment can drive price appreciation.

-

Adoption Announcements: Large-scale adoption announcements and significant technological advances serve as major catalysts for price increases, whereas market uncertainty tends to suppress valuations.

Market Concentration and Volatility Dynamics

-

Token Distribution Effects: The distribution pattern of OGN holdings significantly impacts price volatility. Concentrated holdings among fewer participants create conditions for coordinated price movements, while highly dispersed ownership across many holders tends to result in more chaotic and unpredictable price action lacking clear directional trends.

-

Holder Behavior Influence: The concentration of large holders provides increased potential for concentrated forces to influence price movements, contributing to market volatility patterns that differ substantially based on ownership structure.

Three、2025-2030 OGN Price Forecast

2025 Outlook

- Conservative Forecast: $0.02401 - $0.03159

- Neutral Forecast: $0.03159

- Optimistic Forecast: $0.03633 (requires sustained market stability and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.02479 - $0.04788

- 2027: $0.03356 - $0.05238

- 2028: $0.04105 - $0.06064

- Key Catalysts: Platform adoption acceleration, ecosystem expansion, integration with emerging decentralized commerce solutions, and overall cryptocurrency market sentiment improvement

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04024 - $0.05955 (assumes steady market conditions and moderate protocol advancement)

- Optimistic Scenario: $0.05365 - $0.06905 (assumes successful scaling implementations and increased institutional adoption)

- Transformative Scenario: $0.06905+ (requires breakthrough partnerships, mainstream commerce integration, and favorable macroeconomic conditions supporting digital asset markets)

- December 20, 2025: OGN trading within established support and resistance levels (current market stabilization phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03633 | 0.03159 | 0.02401 | 0 |

| 2026 | 0.04788 | 0.03396 | 0.02479 | 7 |

| 2027 | 0.05238 | 0.04092 | 0.03356 | 29 |

| 2028 | 0.06064 | 0.04665 | 0.04105 | 47 |

| 2029 | 0.05955 | 0.05365 | 0.04024 | 69 |

| 2030 | 0.06905 | 0.0566 | 0.03509 | 79 |

Origin Protocol (OGN) Professional Investment Strategy and Risk Management Report

IV. OGN Professional Investment Strategy and Risk Management

OGN Investment Methodology

(1) Long-term Hold Strategy

- Target Investors: DeFi yield enthusiasts, governance-focused participants, and institutional investors seeking exposure to sustainable yield protocols

- Operational Recommendations:

- Accumulate OGN during market downturns to benefit from the staking model's long-term value accrual

- Stake OGN for xOGN to participate in voting rights and economic rewards from Origin's yield products

- Maintain lock-up periods between 1 month to 1 year based on individual liquidity needs and conviction levels

- Reinvest earned rewards to compound returns through the protocol's sustainable reward structure

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour and 7-day volatility patterns (currently 2.17% in 24H and -9.41% in 7D) to identify entry and exit opportunities

- Volume Monitoring: Track 24-hour trading volume (99,091.38 units) to assess market liquidity and trend strength

- Wave Trading Key Points:

- Capitalize on short-term volatility around resistance (0.03186) and support (0.03061) levels

- Execute defensive positions when faced with longer-term headwinds (-70.3% YoY decline indicates sustained downtrend)

OGN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% portfolio allocation, focusing exclusively on staking rewards with minimal trading activity

- Active Investors: 5-10% portfolio allocation, combining staking positions with opportunistic trading based on technical signals

- Professional Investors: 10-15% portfolio allocation, implementing hedged strategies with diversified yield products and governance participation

(2) Risk Hedging Solutions

- Diversified Yield Exposure: Distribute OGN holdings across multiple lock-up periods (1 month, 3 months, 6 months, and 1 year) to reduce concentration risk and maintain flexible liquidity

- Governance Participation Hedging: Use xOGN voting rights to influence protocol decisions that may protect or enhance token value

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 wallet offers convenient access for active staking and trading while maintaining reasonable security standards

- Self-Custody Approach: Transfer OGN to private wallets for long-term holders prioritizing security over accessibility

- Security Precautions: Enable multi-signature authentication, maintain offline backups of private keys, regularly verify contract addresses on official sources, and avoid phishing attempts through third-party links

V. OGN Potential Risks and Challenges

OGN Market Risks

- Severe Long-term Underperformance: The token has declined 70.3% over the past year and 19.66% over 30 days, indicating sustained bearish pressure and potential loss of market confidence

- Low Market Liquidity: With a market cap of only $20.59 million and 45,495 token holders, OGN faces relatively thin trading volumes that could amplify price volatility during significant redemptions

- Competitive Pressure from Yield Alternatives: The proliferation of alternative DeFi yield protocols may commoditize yields and reduce OGN's competitive advantage

OGN Regulatory Risks

- Governance Token Classification: Regulatory authorities in various jurisdictions may classify xOGN voting tokens as securities, potentially subjecting Origin Protocol to stringent compliance requirements

- DeFi Protocol Oversight: Increasing regulatory scrutiny of DeFi protocols could impose operational constraints or compliance costs affecting protocol profitability and token value

OGN Technical Risks

- Smart Contract Vulnerabilities: As a protocol accepting performance fees and managing distributed rewards, any smart contract vulnerabilities could result in fund loss or exploitation

- Multi-chain Integration Complexity: Origin's multi-chain feature set introduces additional attack surfaces and integration risks across different blockchain networks

VI. Conclusions and Action Recommendations

OGN Investment Value Assessment

Origin Protocol represents a mature DeFi project with a sustainable staking model and user-aligned incentive structures. However, the project faces significant headwinds: a 70.3% year-over-year price decline suggests reduced market sentiment and competitive challenges in an increasingly crowded DeFi yield space. While the staking mechanism and governance participation offer long-term value accumulation potential, the current market capitalization and trading volumes indicate limited liquidity. Investors should view OGN as a high-risk, conviction-based position rather than a core portfolio holding.

OGN Investment Recommendations

✅ Beginners: Start with small exposure (1-3% of crypto allocation) through Gate.com's staking feature, committing to a 1-month lock-up period to understand the mechanics before scaling investment

✅ Experienced Investors: Consider 5-8% allocation using a laddered staking strategy across multiple lock-up periods, combine with active monitoring of governance proposals that could influence protocol economics

✅ Institutional Investors: Evaluate 10-15% allocation with comprehensive due diligence on smart contract audits, governance participation plans, and multi-chain risk assessment

OGN Trading Participation Methods

- Gate.com Spot Trading: Purchase OGN directly on Gate.com's spot market for immediate exposure, enabling flexible entry and exit based on technical signals

- Staking Program: Lock OGN for xOGN on Origin Protocol to earn performance fee distributions and participate in governance votes

- Liquidity Provision: For advanced participants, provide OGN liquidity in DeFi pools to earn trading fees while maintaining underlying token exposure

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the OGN forecast for 2025?

OGN is anticipated to trade between $6.99 and $7.23 in 2025, with an average price of $7.09. Market sentiment suggests steady consolidation in this range as adoption and network metrics develop throughout the year.

What is the price forecast for OGN?

OGN price forecasts range from $5.00 to $16.00, with an average target of $9.92, representing potential 41% upside from current levels. Market analysts expect positive momentum driven by ecosystem growth and adoption trends.

What is the future of OGN stock?

OGN is expected to experience positive growth momentum. According to current forecasts, OGN shares are projected to rise approximately 9.15% and reach $7.63 per share by early 2026. Long-term, increasing adoption and market expansion suggest continued upward potential for OGN's valuation.

Is Organon a good stock to buy?

Organon has experienced significant challenges with share price declines and dividend reductions. However, its biosimilars and NEXPLANON products show growth potential. The stock presents a mixed outlook suitable for value-focused investors with risk tolerance.

How Does Crypto Fund Flow Impact Market Sentiment and Price Movements?

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

How To Start Crypto Yield Farming: Top Tips

USD1 stablecoin on Gate: Analysis and Investment Opportunities for WLFI Token

Maximize Your Crypto Assets Wealth: Gate.com VIP Management Strategies in 2025

APR vs Interest Rate in DeFi: What Crypto Investors Need to Know

How to Set Price Alerts for Cryptocurrency on Mobile and Desktop

ONG price prediction analysis: Is Ontology Gas undervalued after token burning?

Introduction to Spark Token and Flare Network for Beginners

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

Can You Mine Bitcoin on Your Smartphone?