2025 OSHI Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of OSHI

Phantom of the Kill (OSHI) is a blockchain-based gaming token that powers an innovative tactical RPG experience blending strategy with drama. Since its launch in 2023, OSHI has established itself as a key asset within the Web3 gaming ecosystem. As of December 2025, OSHI maintains a market capitalization of approximately $4.37 million USD, with a circulating supply of 144,970,000 tokens trading at $0.030117. This innovative gaming token is playing an increasingly vital role in the Play-to-Earn and GameFi landscape.

The Phantom of the Kill -Alternative Imitation- game integrates Web3 elements with an established mobile gaming franchise that has surpassed 6 million downloads. Players can earn crypto assets through gameplay, train Killer Princesses as NFTs, and trade them on decentralized marketplaces, creating a comprehensive economy that rewards active participation and strategic engagement.

This article will provide a comprehensive analysis of OSHI's price trajectory through 2030, incorporating historical price patterns, market dynamics, ecosystem development, and macroeconomic factors. By examining on-chain metrics and trading activity available on Gate.com, we will deliver professional price forecasts and actionable investment strategies for both novice and experienced crypto investors seeking exposure to the gaming and NFT sectors.

I. OSHI Price History Review and Current Market Status

OSHI Historical Price Evolution Trajectory

- October 10, 2023: OSHI reached its all-time low (ATL) of $0.0058, marking a significant bottom in the token's price discovery phase.

- April 3, 2024: OSHI achieved its all-time high (ATH) of $0.069436, representing a peak valuation period for the token.

- December 24, 2025: OSHI trades at $0.030117, positioned between its historical extremes with a year-to-date performance of +10.22%.

OSHI Current Market Status

As of December 24, 2025, OSHI is trading at $0.030117 with a 24-hour trading volume of $16,761.11. The token demonstrates moderate daily volatility, with a 24-hour price change of +0.47%. Short-term performance shows slight upward momentum in the 1-hour timeframe (+0.03%), while medium-term trends indicate consolidation with a 7-day decline of -2.92% and a 30-day decline of -2.97%.

OSHI maintains a fully diluted market capitalization of $30.12 million against a circulating market cap of $4.37 million. With 144.97 million tokens in circulation out of a total supply of 1 billion tokens, the circulating supply represents approximately 14.50% of the total token supply. The token is held by 1,261 unique addresses, and the market emotion indicator reflects extreme fear (VIX: 24), suggesting a cautious market sentiment.

Click to view current OSHI market price

OSHI Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index plunging to 24. This indicates investors are highly risk-averse, presenting potential opportunities for contrarian traders. When fear reaches such extreme levels, market bottoms often form, attracting long-term investors seeking entry points. However, caution remains essential as volatility may persist. Monitor key support levels closely and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment data to make informed trading decisions during this turbulent period.

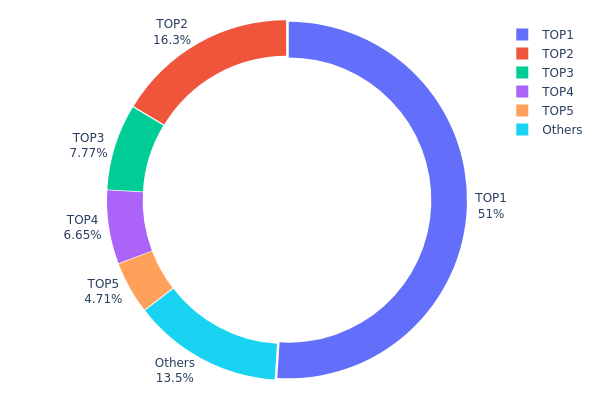

OSHI Holdings Distribution

The address holdings distribution represents the concentration of token ownership across the network, revealing the degree of decentralization and potential market structure risks. By analyzing the top holders' positions relative to total supply, this metric provides critical insights into liquidity dynamics, governance concentration, and vulnerability to large-scale sell-offs.

OSHI currently exhibits pronounced concentration characteristics. The top address holds 51.02% of the total supply, representing a significant portion of circulating tokens. Combined with the second and third-largest holders, the top three addresses control approximately 75.11% of all OSHI tokens. This level of concentration indicates a highly centralized ownership structure, with the dead address (0x0000...00dead) accounting for over half the supply, which may represent burned tokens or locked liquidity. The remaining top-five holders collectively represent 86.47% of the supply, while other addresses account for only 13.53%, further underscoring the skewed distribution pattern.

The concentration level presents material implications for market structure and price stability. Extreme concentration increases vulnerability to sudden liquidation events or coordinated selling pressure from major holders, potentially triggering significant price volatility. The dominant position of the dead address suggests intentional token burn mechanisms; however, the substantial holdings of addresses ranked 2-5 create counterparty risks that could materially impact market dynamics. This distribution pattern reflects a relatively low degree of decentralization, with the token supply heavily concentrated among a limited number of stakeholders, indicating a market structure that remains vulnerable to large holder actions and characterized by limited retail participation in the broader holder base.

Click to view current OSHI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 510000.00K | 51.02% |

| 2 | 0x3343...694176 | 163257.66K | 16.33% |

| 3 | 0x9d37...1b1b6e | 77632.45K | 7.76% |

| 4 | 0x7436...c6d7b0 | 66467.00K | 6.65% |

| 5 | 0xe81e...462d54 | 47112.15K | 4.71% |

| - | Others | 135002.86K | 13.53% |

II. Core Factors Affecting OSHI's Future Price

Technology Development and Ecosystem Building

-

3D Card ARPG Game Design: Phantom of the Kill (OSHI) is positioned as a 3D card ARPG game with emphasis on gameplay quality over pure financial returns. The project aims to deliver engaging gaming experiences through real-time strategy combat and multi-hero modes, moving away from the traditional "Play-to-Earn" model that plagued earlier GameFi projects.

-

GameFi Industry Paradigm Shift: The entire GameFi sector is undergoing a fundamental transformation from "Play-to-Earn" mechanics toward "Gameplay First" philosophy. This shift directly impacts OSHI's competitive positioning, as projects prioritizing authentic gaming experiences over unsustainable yield mechanisms are gaining market traction and user retention.

-

Ecosystem Applications: OSHI operates within the broader GameFi ecosystem, competing alongside established projects like Axie Infinity (AXS), Illuvium (ILV), and Star Atlas. Traditional gaming publishers including Ubisoft and Square Enix are entering the Web3 gaming space, potentially increasing overall industry credibility and adoption rates that could benefit emerging projects like OSHI.

Market Dynamics and Industry Health

The GameFi sector's overall performance directly influences OSHI's price trajectory. As of December 8, 2025, the GameFi sector faced significant headwinds with total market capitalization declining 7% to $9.2 billion and daily trading volumes falling 9% to $5.54 billion. Market sentiment remained in the "fear" zone, though early 2025 showed promise with daily active users reaching 1.49 million in April (72.4% growth rate).

New project influx continues despite market pressure—51 new GameFi projects launched in April 2025 alone—indicating sustained industry innovation and competition for user attention and capital allocation. As of November 2025, OSHI's token market capitalization stood at approximately $4.5 million, reflecting early-stage positioning within a competitive landscape.

III. 2025-2030 OSHI Price Forecast

2025 Outlook

- Conservative Forecast: $0.02078 - $0.03012

- Neutral Forecast: $0.03012

- Optimistic Forecast: $0.03524 (requires sustained market recovery and increased adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with incremental growth driven by ecosystem development and market stabilization

- Price Range Forecasts:

- 2026: $0.01928 - $0.04346 (8% upside potential)

- 2027: $0.01942 - $0.04454 (26% upside potential)

- 2028: $0.02189 - $0.05411 (37% upside potential)

- Key Catalysts: Increased protocol utility, strategic partnerships, mainstream adoption milestones, and overall market sentiment improvement

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02481 - $0.06822 (assumption: moderate ecosystem growth and stable regulatory environment)

- Optimistic Scenario: $0.04173 - $0.06492 (assumption: significant platform expansion and institutional interest)

- Transformational Scenario: $0.05796+ (extreme favorable conditions: breakthrough technological innovations, widespread enterprise adoption, and major market capitalization expansion)

- 2030-12-31: OSHI potential to reach $0.06492 (92% cumulative appreciation from current levels, representing substantial long-term value creation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03524 | 0.03012 | 0.02078 | 0 |

| 2026 | 0.04346 | 0.03268 | 0.01928 | 8 |

| 2027 | 0.04454 | 0.03807 | 0.01942 | 26 |

| 2028 | 0.05411 | 0.0413 | 0.02189 | 37 |

| 2029 | 0.06822 | 0.04771 | 0.02481 | 58 |

| 2030 | 0.06492 | 0.05796 | 0.04173 | 92 |

Phantom of the Kill (OSHI) Investment Strategy and Risk Management Report

IV. OSHI Professional Investment Strategy and Risk Management

OSHI Investment Methodology

(1) Long-Term Holding Strategy

- Target Investor Profile: GameFi enthusiasts and blockchain game believers seeking exposure to Play-to-Earn mechanics

- Operational Recommendations:

- Accumulate OSHI tokens during periods of market consolidation below historical resistance levels

- Monitor the game's active user base and NFT marketplace trading volume as key performance indicators

- Establish a position sizing plan that aligns with your overall portfolio allocation to emerging gaming tokens

(2) Active Trading Strategy

- Technical Analysis Approaches:

- Price Action Analysis: Track support and resistance levels around the $0.030 range and monitor 24-hour trading volumes for breakout signals

- Trend Evaluation: Analyze the 7-day and 30-day performance indicators to identify momentum shifts in OSHI's valuation

- Trading Considerations:

- Exercise caution during low liquidity periods, as the token shows modest 24-hour volume of approximately $16,761

- Monitor correlation with broader GameFi market sentiment and blockchain gaming adoption trends

OSHI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Active Investors: 2-5% of total crypto portfolio allocation

- Professional Investors: 5-10% of total crypto portfolio allocation with structured position management

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance OSHI exposure with established blockchain gaming tokens and broader cryptocurrency holdings to reduce concentration risk

- Position Sizing Controls: Implement stop-loss orders at 15-20% below entry points to manage downside exposure and protect capital

(3) Secure Storage Solutions

- Hot Wallet Strategy: Gate.com Web3 wallet is recommended for frequent traders requiring convenient access to OSHI tokens on the Polygon network

- Cold Storage Consideration: For long-term holders, consider transferring OSHI to secure self-custody solutions for enhanced security protection

- Security Best Practices: Never share private keys or seed phrases; enable multi-factor authentication on exchange accounts; verify contract addresses before transactions (OSHI Contract: 0x09cad96bc28f55e9253cfb9a84a3a1ab79061e54 on Polygon)

V. OSHI Potential Risks and Challenges

OSHI Market Risk

- Limited Liquidity: With a 24-hour trading volume of approximately $16,761 and only 1,261 token holders, OSHI demonstrates relatively low liquidity, which may result in significant slippage during large trades or rapid price movements

- Price Volatility: The token has experienced a -2.92% decline over 7 days and -2.97% over 30 days, indicating ongoing price pressure in the current market environment

- Market Capitalization Concerns: With a fully diluted valuation of $30.12 million against 1 billion total supply tokens, OSHI represents a small-cap asset with elevated volatility characteristics

OSHI Regulatory Risk

- Gaming Regulation Uncertainty: The GameFi sector faces increasing regulatory scrutiny globally regarding its classification as gambling or securities, which could impact OSHI's operational framework

- Play-to-Earn Model Challenges: Regulatory bodies in multiple jurisdictions have expressed concerns about reward mechanisms in blockchain games, potentially affecting OSHI's earning structure

- NFT Classification: The conversion of in-game characters to NFTs may trigger varying regulatory interpretations across different jurisdictions regarding digital asset ownership and taxation

OSHI Technical Risk

- Polygon Network Dependency: OSHI operates exclusively on the Polygon blockchain, creating concentration risk associated with the network's stability and security protocols

- Smart Contract Vulnerability: As a newer blockchain game token, ongoing audits and testing of smart contracts are essential to mitigate potential exploits or code vulnerabilities

- Game Development Execution: The project's success depends on the continuous development and maintenance of "Phantom of the Kill -Alternative Imitation-," with any significant delays or quality issues potentially affecting token value

VI. Conclusion and Action Recommendations

OSHI Investment Value Assessment

Phantom of the Kill (OSHI) represents exposure to the blockchain gaming sector through a mobile game title with over 6 million downloads in its original form. The Play-to-Earn mechanics and NFT character trading offer legitimate utility, though the token demonstrates characteristics typical of emerging GameFi projects: limited liquidity, modest trading volumes, and concentrated holder distribution. The price has recovered approximately 10.22% over the past year from its low of $0.0058, though short-term momentum remains negative. Investment viability depends significantly on game adoption rates and successful NFT marketplace development.

OSHI Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) through Gate.com to gain exposure to GameFi mechanics; focus on understanding the game mechanics before increasing exposure

✅ Experienced Investors: Implement a structured dollar-cost averaging approach during consolidation periods; monitor game statistics, user growth metrics, and NFT trading volumes as fundamental indicators

✅ Institutional Investors: Conduct thorough due diligence on Studio FgG's development roadmap, player retention metrics, and revenue sustainability before considering allocation; require transparent governance structures and regular audits

OSHI Trading Participation Methods

- Exchange Trading: Purchase OSHI on Gate.com with convenient fiat on-ramps and spot trading pairs; utilize limit orders to manage entry and exit points given moderate liquidity conditions

- In-Game Acquisition: Participate in "Phantom of the Kill -Alternative Imitation-" gameplay, earn rewards, and potentially acquire OSHI through earned in-game assets

- NFT Marketplace Engagement: Convert trained Killer Princesses into NFTs and trade characters on the project's marketplace to experience the full Play-to-Earn ecosystem

Cryptocurrency investment carries extreme risk and is highly volatile. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Consult with professional financial advisors before committing capital. Never invest funds you cannot afford to lose entirely.

FAQ

Will toshi coin reach 1 dollar?

Toshi coin has potential to reach $1 by 2030 according to analyst predictions. Current market conditions and development progress suggest significant long-term growth opportunity for this cryptocurrency asset.

Does Toshi have a future?

Yes, Toshi has strong potential for growth. As the face of Base ecosystem with growing adoption and community support, it's positioned for significant upside. Early momentum suggests bullish prospects ahead.

Is toshi a meme coin?

Yes, Toshi (TOSHI) is a meme coin on the Base blockchain. It gained popularity through viral community engagement and decentralized governance, combining meme culture with blockchain innovation.

Why is the toshi coin dropping?

Toshi coin is experiencing downward pressure due to market volatility and speculative trading activity. Price fluctuations are common in emerging tokens. Monitor project developments and trading volume for better market understanding.

What are the main risks of investing in Toshi coin?

Toshi coin carries risks including extreme price volatility, limited liquidity, regulatory uncertainty, and project execution challenges. Market sentiment and speculative trading can amplify losses. Investors should carefully assess their risk tolerance before participating.

How does Toshi compare to other cryptocurrencies?

Toshi offers unique tokenomics and community-driven features distinct from major cryptocurrencies. While smaller in market cap than Bitcoin or Ethereum, Toshi demonstrates strong growth potential with emerging utility and increasing adoption in the Web3 ecosystem.

What is the current market cap and total supply of Toshi?

As of December 23, 2025, Toshi has a market cap of $138.34 million with a total supply of 420,690,000,000 TOSHI tokens. The current price stands at $0.00 per token.

2025 ENJ Price Prediction: Analyzing Market Trends and Potential Growth Factors for Enjin Coin

2025 CWS Price Prediction: Analyzing Market Trends and Potential Growth Factors for Crowns

2025 GCOIN Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

KARRAT vs ENJ: A Comprehensive Comparison of Two Leading Gaming Token Projects

2025 AGLD Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Is Vulcan Forged (PYR) a good investment?: A Comprehensive Analysis of Gaming Token Prospects and Market Potential

What is RARI: A Comprehensive Guide to the Decentralized Art NFT Platform

What is BLD: A Comprehensive Guide to Binaural Beat Lucid Dreaming Techniques

Understanding TRC20: The Token Standard on the TRON Blockchain

What is HIFI: A Complete Guide to High-Fidelity Audio Systems and Technology

What is ADP: A Comprehensive Guide to Adenosine Diphosphate and Its Role in Cellular Energy