2025 PARTI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of PARTI

Particle Network (PARTI) serves as a leading chain abstraction infrastructure in Web3, addressing the fragmentation of users, data, and liquidity across multiple blockchains. Since its launch, PARTI has emerged as a significant player in the ecosystem with its core technology, Universal Accounts, enabling a unified account and balance for users throughout the entire Web3 landscape. As of December 2025, PARTI has achieved a market capitalization of approximately $24.57 million, with a circulating supply of 233 million tokens trading at around $0.1055. This innovative protocol, recognized for its chain abstraction capabilities, is playing an increasingly critical role in enabling seamless multi-chain interactions and improving user experience across decentralized applications.

This article provides a comprehensive analysis of PARTI's price trajectory from 2025 through 2030, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors interested in this emerging Web3 infrastructure asset.

Particle Network (PARTI) Market Analysis Report

I. PARTI Price History Review and Current Market Status

PARTI Historical Price Movement

Based on available data, Particle Network (PARTI) has experienced significant price volatility since its launch:

- March 25, 2025: All-time high (ATH) reached at $0.44305, marking the peak of market enthusiasm for the project.

- October 10, 2025: All-time low (ATL) recorded at $0.03239, representing a substantial correction from the peak.

- Current Period (December 2025): Token trading at $0.10546, reflecting a recovery from the yearly lows but still trading significantly below the all-time high.

PARTI Current Market Position

As of December 20, 2025, PARTI demonstrates the following market characteristics:

Price Performance:

- Current Price: $0.10546

- 24-hour Change: +4.67%

- 7-day Change: +3.36%

- 30-day Change: +77.27%

- 1-year Change: -74.40%

Market Capitalization Metrics:

- Market Cap: $24,572,180

- Fully Diluted Valuation: $105,460,000

- Market Cap to FDV Ratio: 23.3%

- Market Dominance: 0.0032%

Trading Activity:

- 24-hour Trading Volume: $854,396.27

- Token Holders: 172,356

- Available on 37 exchanges

Token Distribution:

- Circulating Supply: 233,000,000 PARTI (23.3% of total)

- Total Supply: 1,000,000,000 PARTI

- Max Supply: 1,000,000,000 PARTI

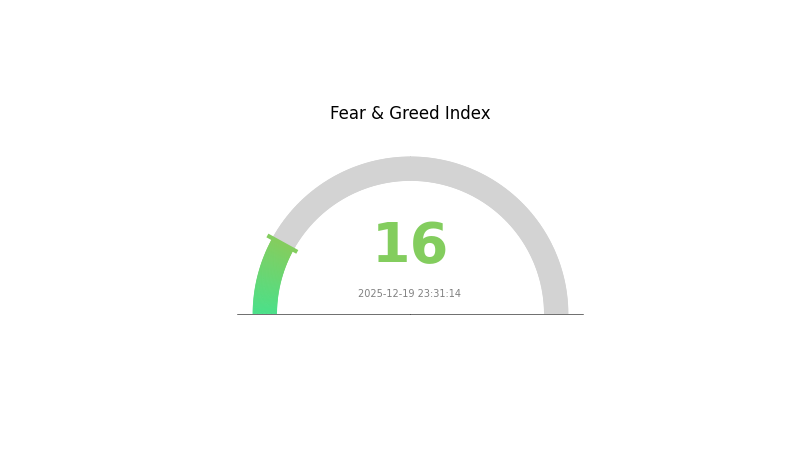

Market Sentiment: Current market sentiment indicates "Extreme Fear" with a volatility index (VIX) reading of 16, suggesting heightened market uncertainty and cautious investor positioning.

Click to view current PARTI market price on Gate.com

PART I Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index dropping to 16. This exceptionally low reading indicates widespread market pessimism and risk aversion among investors. During such periods, panic selling often dominates, creating potential buying opportunities for contrarian investors. The extreme fear sentiment suggests assets may be oversold, though caution remains essential. Traders should monitor key support levels and consider their risk tolerance carefully. Market conditions remain highly volatile, making it crucial to maintain disciplined portfolio management strategies.

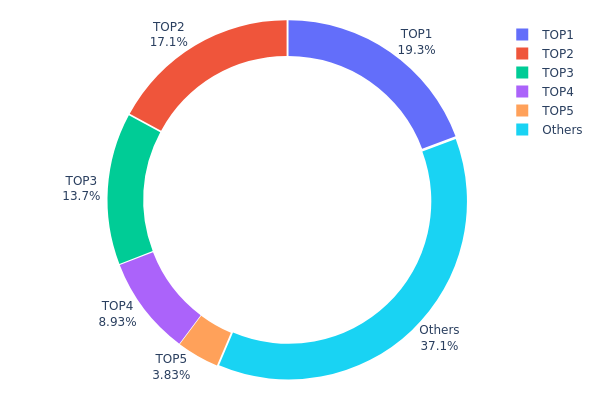

PARTI Holdings Distribution

The address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical on-chain metric for assessing market structure and decentralization levels. By analyzing the distribution pattern, investors can evaluate potential risks associated with token concentration and understand the underlying liquidity dynamics of the asset.

Current data reveals a moderate concentration pattern in PARTI's holder base. The top five addresses collectively control approximately 62.91% of total token supply, with the largest holder commanding 19.32% of circulating tokens. The top three addresses alone account for 50.16% of holdings, indicating a notable concentration in the upper tier. However, the "Others" category represents 37.09% of total supply distributed across numerous addresses, suggesting a meaningful degree of decentralization in the remaining token base. This bifurcated structure demonstrates that while major holders exercise significant influence, a substantial portion of tokens remains distributed among smaller addresses.

From a market structure perspective, this concentration level presents moderate implications for price dynamics and potential volatility. The substantial holdings by top addresses create asymmetric information advantages and could theoretically influence price movements through coordinated actions. Nevertheless, the relatively dispersed nature of the remaining 37.09% in the "Others" category suggests sufficient distributed ownership to prevent extreme centralization scenarios. This balance reflects a market structure characteristic of mid-stage projects with established institutional or team holdings, combined with growing community participation. The current distribution indicates PARTI maintains reasonable decentralization metrics while retaining some concentration risks typical of tokens with significant development team or early investor allocations.

For current PARTI holdings distribution data, please visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbf1e...f2a4d1 | 90000.00K | 19.32% |

| 2 | 0x5a52...70efcb | 79754.75K | 17.12% |

| 3 | 0x3b27...e57830 | 63900.07K | 13.72% |

| 4 | 0xf977...41acec | 41562.75K | 8.92% |

| 5 | 0x68f4...4b0206 | 17844.10K | 3.83% |

| - | Others | 172595.53K | 37.09% |

II. Core Factors Affecting PARTI's Future Price

Supply Mechanism

-

Token Distribution and Circulation: PARTI has a total supply of 1 billion tokens, with 23.3% currently in circulation, representing 233 million tokens. However, an additional 24.39% of the total supply is scheduled to enter circulation by 2026, which will significantly impact future price dynamics.

-

Current Impact: The gradual release of locked tokens through 2026 represents a potential supply pressure that could affect price appreciation in the medium term. Market participants need to monitor the unlock schedule carefully as it represents 243.9 million tokens entering the market.

Market Sentiment and Trading Dynamics

-

Market Supply-Demand Relationship: Direct market supply-demand dynamics serve as primary price drivers for PARTI. Trading volume and user adoption trends play crucial roles in determining price movements.

-

Trading Volume Impact: High transaction volumes coupled with increasing user adoption trends drive significant price fluctuations. The token's performance reflects utility demand, technical momentum, and speculative trading influenced by low circulation relative to total supply.

Technology Development and Ecosystem Building

-

Chain Abstraction Infrastructure: Particle Network functions as a specialized chain abstraction infrastructure layer addressing fragmentation challenges across the blockchain ecosystem. The protocol solves critical pain points including multi-wallet management, cross-chain bridge delays, and fragmented gas token economics across 50+ active mainnets.

-

Universal Accounts Module: The core innovation enables users to maintain unified balances across all chains through a single account, fundamentally improving user experience and cross-chain operability.

-

Universal Liquidity and Universal Gas Modules: These additional components complete the infrastructure for seamless cross-chain asset management and transaction execution, enhancing the ecosystem's utility proposition.

-

Market Performance Context: PARTI's token completed its Binance Wallet IDO on March 25, 2025, at an initial price of $0.04157 USD, achieving a peak gain of 66.65% within 24 hours of listing, with market capitalization reaching approximately $30 million.

III. 2025-2030 PARTI Price Forecast

2025 Outlook

- Conservative Forecast: $0.0637-$0.1063

- Neutral Forecast: $0.1062-$0.1400

- Optimistic Forecast: $0.1400-$0.1583 (requires sustained market momentum and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual upward trajectory, characterized by increasing market maturity and ecosystem development

- Price Range Predictions:

- 2026: $0.0754-$0.1376

- 2027: $0.0796-$0.1727

- 2028: $0.0907-$0.1676

- Key Catalysts: Ecosystem expansion, strategic partnerships, regulatory clarity, increased on-chain activity, and mainstream adoption milestones

2029-2030 Long-term Outlook

- Base Case Scenario: $0.1479-$0.2186 (assumes steady market development and consistent user growth)

- Optimistic Scenario: $0.1683-$0.2186 (assumes accelerated adoption and strong market sentiment)

- Transformative Scenario: $0.1783-$0.1972 (extreme favorable conditions including major technological breakthroughs and widespread institutional investment)

- 2030-12-20: PARTI $0.1972 (approaching historical resistance levels with 79% cumulative growth potential from current baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1583 | 0.10624 | 0.06374 | 0 |

| 2026 | 0.13756 | 0.13227 | 0.07539 | 25 |

| 2027 | 0.17269 | 0.13491 | 0.0796 | 27 |

| 2028 | 0.16764 | 0.1538 | 0.09074 | 45 |

| 2029 | 0.21858 | 0.16072 | 0.14787 | 52 |

| 2030 | 0.19724 | 0.18965 | 0.17827 | 79 |

Particle Network (PARTI) Professional Investment Strategy and Risk Management Report

IV. PARTI Professional Investment Strategy and Risk Management

PARTI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors focused on Web3 infrastructure adoption and those believing in chain abstraction as a fundamental technology layer

- Operation Suggestions:

- Accumulate PARTI during market downturns when sentiment is bearish, taking advantage of the -74.40% one-year decline to establish positions at lower valuations

- Hold through technology development cycles, allowing Universal Accounts infrastructure to mature and gain ecosystem adoption

- Set a multi-year investment horizon (3-5 years minimum) to capture potential upside as chain abstraction becomes industry standard

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the all-time high of $0.44305 (March 25, 2025) as a resistance target and the all-time low of $0.03239 (October 10, 2025) as strong support

- Moving Averages: Track 20-day, 50-day, and 200-day moving averages to identify medium-term trend reversals

- Wave Trading Key Points:

- Enter positions during negative price momentum when the 24-hour volume is elevated, indicating institutional interest

- Take partial profits at resistance levels, particularly as PARTI approaches historical highs

- Exit or reduce positions if price falls below key support levels on high volume, signaling weakness

PARTI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation maximum

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 50-60% of allocated capital in stablecoins to capitalize on sharp price declines and rebalance positions

- Dollar-Cost Averaging: Deploy capital in equal installments over 6-12 months to reduce timing risk and average entry costs

(3) Secure Storage Solutions

- Hardware Wallet Options: Self-custody solutions for long-term holders seeking maximum security and independence from exchange counterparty risk

- Exchange Wallet: Maintain active trading positions on Gate.com for liquidity and execution speed, using Gate.com's secure custody infrastructure for amounts needed for frequent trading

- Security Considerations: Enable two-factor authentication on all accounts; maintain offline backups of recovery phrases; never share private keys; verify smart contract addresses before transactions

V. PARTI Potential Risks and Challenges

PARTI Market Risk

- High Volatility Exposure: PARTI has experienced a 77.27% gain over 30 days alongside a -74.40% annual decline, indicating extreme price swings that can result in significant losses

- Low Market Liquidity: With a 24-hour trading volume of $854,396.27 and market cap of $24.57 million, PARTI has relatively limited liquidity compared to established cryptocurrencies, risking slippage on large trades

- Early-Stage Project Risk: As chain abstraction infrastructure remains nascent, adoption uncertainty creates significant valuation risk if the market does not embrace this technology layer

PARTI Regulatory Risk

- Evolving Classification: Regulatory authorities globally are still determining how Web3 infrastructure tokens should be classified, potentially impacting trading, listing, and holding requirements

- Geographic Restrictions: Certain jurisdictions may restrict trading or holding of PARTI tokens, limiting market access and creating forced liquidation scenarios

- Compliance Uncertainty: Changes in anti-money laundering or know-your-customer requirements could impact exchange listings and trading pairs

PARTI Technology Risk

- Protocol Execution Risk: Universal Accounts technology must successfully execute across multiple blockchain networks; any security vulnerabilities could undermine the entire value proposition

- Competitive Threats: Other chain abstraction solutions or scaling solutions may offer superior technology, network effects, or developer adoption, rendering PARTI's approach obsolete

- Smart Contract Risk: Bugs or exploits in PARTI's smart contracts could result in fund loss or system compromise, particularly as the protocol expands to new chains

VI. Conclusion and Action Recommendations

PARTI Investment Value Assessment

Particle Network represents a high-risk, high-potential-reward investment thesis centered on chain abstraction infrastructure becoming a fundamental layer of Web3. The -74.40% one-year return reflects early-stage technology risk and market uncertainty about adoption timelines. However, the 77.27% 30-day rally suggests potential institutional re-engagement with the thesis. PARTI's market cap of $24.57 million and ranking at #780 indicate an early-stage asset with limited liquidity. Success depends entirely on Universal Accounts achieving meaningful developer adoption, security validation, and ecosystem lock-in. For investors with high risk tolerance and extended investment horizons, PARTI offers exposure to an emerging infrastructure layer; for conservative investors, significant caution is warranted.

PARTI Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of portfolio) through dollar-cost averaging over 6-12 months on Gate.com; focus on understanding chain abstraction technology before scaling exposure

✅ Experienced Investors: Consider 2-5% tactical allocations following technical breakouts above $0.15 resistance; use tight stop-losses at 10% below entry points; take profits at $0.25-$0.30 targets

✅ Institutional Investors: Conduct full technical and business due diligence on Universal Accounts protocol before allocation; consider position sizing based on long-term infrastructure thesis; engage directly with Particle Network team on roadmap and adoption metrics

PARTI Trading Participation Methods

- Gate.com Direct Trading: Access PARTI spot trading pairs with competitive fees and real-time execution; ideal for active traders and rebalancing

- Long-term Storage: Utilize Gate.com's secure wallet infrastructure for extended holding periods, eliminating self-custody complexity

- Portfolio Rebalancing: Execute tactical position adjustments on Gate.com using limit orders to manage exposure to changing risk dynamics

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate decisions based on personal risk tolerance and circumstances. Consult with professional financial advisors before making investment decisions. Never invest funds you cannot afford to lose.

FAQ

Will parti coin go up?

Yes, PARTI is expected to experience steady growth. According to market analysis, the coin's value is projected to increase from current levels to approximately $8.50 by 2030, reflecting strong long-term potential and increasing adoption in the Particle Network ecosystem.

What factors influence PARTI token price predictions?

Institutional adoption, ETF demand, and macroeconomic trends significantly influence PARTI token price predictions. Market sentiment, trading volume, and overall crypto market conditions also play crucial roles in price movements.

What is the historical price performance of PARTI coin?

PARTI coin has shown steady movement recently. It traded at $0.1000 on December 11, 2025, and $0.1011 on December 12, 2025. The coin reached $0.1084 on December 10, 2025, demonstrating moderate price fluctuations within a tight range.

What are the risks involved in PARTI price prediction and investment?

PARTI investment carries high market volatility risk with prices fluctuating significantly. Market conditions, liquidity changes, and trading volume shifts can cause substantial losses. Always conduct thorough research before investing.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

What Are the Major Smart Contract Vulnerabilities and Security Risks in Crypto Exchanges Like SHIB?

What is Dogecoin (DOGE) fundamentals: whitepaper logic, use cases, and technical innovation explained

How Does Dogecoin (DOGE) Price Volatility Compare to Bitcoin with 70-80% Correlation?

What are the regulatory risks and compliance requirements for cryptocurrency exchanges in 2025?

Beginner's Guide to Setting Up Your First Digital Wallet