2025 PHA Price Prediction: Expert Analysis and Future Outlook for Phala Network Token

Introduction: Market Position and Investment Value of PHA

Phala Network (PHA), positioned as a Web3.0 privacy protection infrastructure built on Substrate and leveraging TEE blockchain architecture for confidential smart contracts, has established itself as a pivotal privacy computing solution for the Polkadot ecosystem since its inception in 2020. As of 2025, PHA has achieved a market capitalization of approximately $28.80 million with a circulating supply of around 819.05 million tokens, currently trading at $0.03516. This decentralized trusted computing infrastructure, recognized as a "privacy computing backbone," is increasingly playing a critical role in enabling confidential execution and trustless computing services across Polkadot's DeFi applications, data services, and broader Web3 ecosystem.

This article will provide a comprehensive analysis of PHA's price trajectory from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development prospects, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for stakeholders.

Phala Network (PHA) Market Analysis Report

I. PHA Price History Review and Current Market Status

PHA Historical Price Evolution

-

May 2021: Phala Network reached its all-time high (ATH) of $1.39, marking the peak of the project's early growth phase following its launch in September 2020 at $0.01.

-

2021-2024: The token experienced a prolonged bear market period, with significant downward pressure as the broader cryptocurrency market cycle shifted and competitive pressures within the privacy computation infrastructure sector intensified.

-

December 2025: PHA declined to new historical lows, reaching $0.0323338, reflecting sustained bearish sentiment and challenging market conditions for the privacy computing niche.

PHA Current Market Status

As of December 19, 2025, PHA is trading at $0.03516, representing a modest recovery of 0.99% over the past hour. However, the token exhibits significant weakness across multiple timeframes: declining 0.77% in the 24-hour period, down 18.72% over 7 days, falling 31.72% in the past 30 days, and plunging 74.96% year-over-year.

The 24-hour trading volume stands at $83,726.67, while the circulating market capitalization is approximately $28.80 million based on a circulating supply of 819.05 million PHA tokens out of a total supply of 1 billion. The fully diluted market capitalization reaches $35.16 million, with the project ranking 713 in the overall cryptocurrency market by capitalization. Current market dominance stands at 0.0010%.

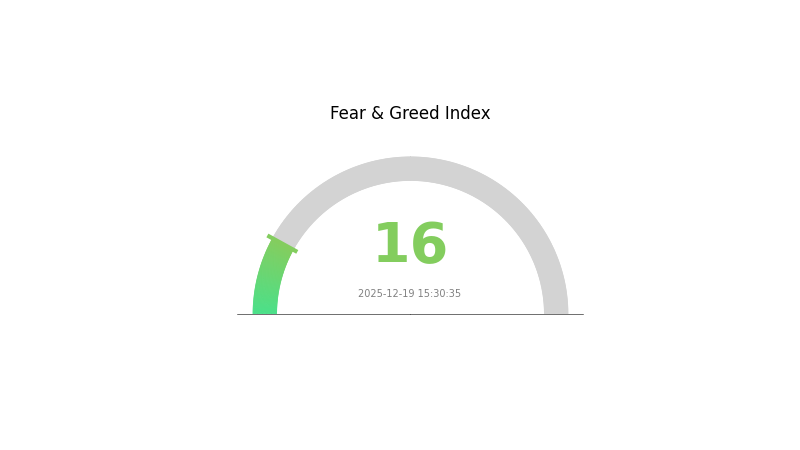

Phala Network maintains a holder base of 25,638 addresses and is listed on 29 different cryptocurrency exchanges, including Gate.com. The market sentiment indicator registers "Extreme Fear" (VIX: 16), reflecting pessimistic investor positioning in the broader digital asset market.

Click to view current PHA market price

PHA Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 16. This indicates significant market pessimism and heightened investor anxiety. During such periods, risk-averse investors typically reduce exposure, while contrarian traders may view the extreme fear as a potential buying opportunity. Market volatility is likely to remain elevated, and investors should exercise caution with position sizing while monitoring key support levels for potential trend reversals.

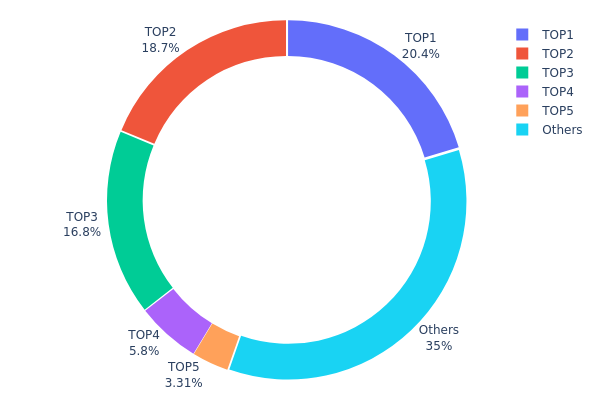

PHA Holding Distribution

The address holding distribution represents the concentration of PHA tokens across blockchain addresses, providing critical insights into the token's decentralization status and market structure. This metric tracks the top addresses by holding quantity and their respective percentages of total supply, offering a comprehensive view of wealth distribution within the ecosystem.

The current PHA holding distribution reveals a moderate level of concentration among major holders. The top three addresses collectively control approximately 55.87% of the token supply, with the leading address holding 20.35%, the second holding 18.73%, and the third controlling 16.79% respectively. While this concentration is notable, the distribution does not indicate extreme centralization, as the remaining supply is dispersed across numerous addresses, with "others" accounting for 35.04% of total holdings. The fourth and fifth largest holders maintain more modest positions at 5.79% and 3.30%, creating a relatively gradual decline in holding sizes.

This distribution pattern presents moderate implications for market dynamics. The significant concentration among top-five holders suggests potential for coordinated token movements that could influence price volatility, particularly during periods of market stress or strategic rebalancing. However, the substantial portion held by dispersed addresses provides a stabilizing counterweight, reducing the likelihood of singular-actor manipulation. The current structure indicates PHA maintains a balanced ecosystem state—concentrated enough to suggest institutional or strategic participant involvement, yet distributed sufficiently to maintain a degree of market resilience and decentralization.

View the current PHA holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 203520.68K | 20.35% |

| 2 | 0x21d6...3a0ec0 | 187334.49K | 18.73% |

| 3 | 0x4a39...f3ebef | 167980.63K | 16.79% |

| 4 | 0x35e0...65b103 | 57960.41K | 5.79% |

| 5 | 0x073f...113ad7 | 33089.27K | 3.30% |

| - | Others | 350114.52K | 35.04% |

II. Core Factors Affecting PHA's Future Price

Macroeconomic Environment

-

Global "Ban Plastic" Policies: Regulatory policies worldwide are deepening restrictions on non-degradable single-use plastics. China's "ban plastic" policy specifically targets non-degradable disposable plastic products, driving rapid growth in the biodegradable materials industry. The market scale reached 29.9 billion yuan in 2024 and is projected to exceed 48 billion yuan in 2025.

-

Environmental Awareness and Market Demand: Increasing public environmental consciousness is boosting demand for biodegradable plastics. Global biodegradable plastic capacity reached 2.47 million tons in 2024 and is expected to increase to 5.73 million tons by 2029, with PHA showing the fastest growth rate, potentially reaching close to 1 million tons of capacity.

-

Global Economic Recovery: As the global economy continues to recover, the digital currency market and investment in sustainable materials are gradually warming up. This creates more investment opportunities for emerging projects focused on solving environmental problems.

Technology Development and Ecosystem Building

-

Production Technology Advancement: PHA production technology has achieved major breakthroughs in key areas. China's first 10,000-ton-class production line has been completed, marking a transition from early industrialization to scaled production. Technological iteration by leading enterprises like Jin Fa Technology and Haizheng Biomaterials has significantly reduced production costs.

-

Unique Degradation Properties: PHA (Polyhydroxyalkanoate) is currently the only biodegradable material that can rapidly and completely degrade in natural environments (soil, seawater, compost) without requiring special industrial composting conditions. Unlike PLA (Polylactic Acid) which typically requires industrial composting environments, or PBAT which depends on specific microbial conditions, PHA's universal degradation capability positions it as an ideal material for solving white pollution.

-

Biocompatibility and Medical Applications: PHA possesses excellent biocompatibility, offering significant application potential in high-end medical fields including medical implants and drug carriers. This enhances its market value beyond traditional packaging applications.

-

Industry Chain Optimization: The biodegradable materials industry chain is becoming increasingly sophisticated. Upstream suppliers provide bio-based raw materials (corn, straw) and petroleum-based raw materials (adipic acid, butanediol). The midstream focuses on PLA, PHA, and PBS synthesis and modification. Downstream applications span packaging, agriculture, and medical fields, with high-value-added sectors like food packaging, degradable agricultural films, and medical supplies showing notable growth acceleration.

Market Demand and Application Expansion

-

Expected Market Growth: China's PHA market is projected to reach 7.2 billion yuan in 2025, experiencing rapid expansion from its current early industrialization phase. The global PHA market size was 1.559 billion USD in 2023 and is projected to reach 2.306 billion USD by 2029.

-

Diverse Application Scenarios: Beyond traditional single-use packaging, PHA is increasingly being applied in food packaging, agricultural films, and medical consumables. Policy guidance and market demand are jointly driving continued expansion of terminal demand.

3. PHA Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.0186 - $0.03445

- Neutral Forecast: $0.03445

- Bullish Forecast: $0.03721 (requires sustained ecosystem development and increased adoption)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Consolidation and gradual recovery phase with renewed investor interest in privacy-focused protocols

- Price Range Forecast:

- 2026: $0.02293 - $0.04371

- 2027: $0.03062 - $0.04136

- Key Catalysts: Enhancement of privacy features, strategic partnerships, ecosystem expansion, and growing demand for privacy-preserving solutions in decentralized finance

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03935 - $0.0576 (assuming steady protocol development and moderate market growth)

- Bullish Case Scenario: $0.04908 - $0.06358 (with significant institutional adoption and widespread integration into major platforms)

- Transformational Case Scenario: Above $0.06358 (under conditions of breakthrough privacy technology adoption, major regulatory clarity supporting privacy coins, and exponential user growth)

- Price Trajectory: PHA demonstrates cumulative growth of 42% by 2030 (from 2029 to 2030), reflecting strengthening market fundamentals and increasing recognition as a critical privacy infrastructure asset

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03721 | 0.03445 | 0.0186 | -2 |

| 2026 | 0.04371 | 0.03583 | 0.02293 | 1 |

| 2027 | 0.04136 | 0.03977 | 0.03062 | 13 |

| 2028 | 0.0576 | 0.04056 | 0.03935 | 15 |

| 2029 | 0.05105 | 0.04908 | 0.03976 | 39 |

| 2030 | 0.06358 | 0.05006 | 0.03605 | 42 |

Phala Network (PHA) Investment Strategy and Risk Management Report

IV. PHA Professional Investment Strategy and Risk Management

PHA Investment Methodology

(1) Long-term Holding Strategy

Suitable Investors:

- Privacy-conscious users and Web3 enthusiasts interested in confidential computing

- Polkadot ecosystem supporters seeking exposure to privacy infrastructure

- Investors with medium to long-term conviction in decentralized computing

Operational Recommendations:

- Accumulate PHA tokens during market downturns when sentiment is weak, taking advantage of historical lows near $0.0323

- Dollar-cost averaging (DCA) approach to reduce timing risk given the token's volatility

- Participate in Phala DAO governance once you accumulate sufficient PHA holdings to influence protocol decisions

Storage Solutions:

- Use Gate Web3 Wallet for active participation in staking and governance activities

- For maximum security with long-term holdings, employ offline cold storage methods with hardware considerations

- Ensure seed phrase backup stored in physically secure locations

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the $0.032-$0.035 range as the current trading zone, with historical resistance at $1.39 (previous all-time high from May 2021)

- Volume Analysis: Track 24-hour volume trends (current: $83,726.67) to identify potential breakout opportunities and validate price movements

Swing Trading Key Points:

- Current price at $0.03516 represents 97.47% decline from all-time high; monitor for accumulation patterns

- Watch for positive developments in pLibra and Web3 Analytics applications that received Web3 Foundation grants

- Be prepared for volatility given 1-year performance showing -74.96% decline; use tight stop-losses

PHA Risk Management Framework

(1) Asset Allocation Principles

Conservative Investors: 1-2% of total crypto portfolio

- Focus on fundamental belief in privacy computing value proposition

- Avoid leveraged positions given current price volatility

Active Investors: 3-5% of total crypto portfolio

- Can increase position sizing on confirmed technical breakouts

- Consider tactical rebalancing during 20-30% move windows

Professional Investors: 5-10% of total crypto portfolio

- May implement correlation hedging strategies with other Polkadot ecosystem tokens

- Use derivatives cautiously to manage downside risk

(2) Risk Hedging Solutions

Diversification Strategy: Balance PHA holdings with other privacy-focused protocols and broader Polkadot ecosystem tokens to reduce single-project risk

Position Sizing: Maintain strict position limits aligned with risk tolerance; avoid over-concentration in a token trading near historical lows with unproven recovery catalysts

(3) Secure Storage Solutions

Custodial Wallet Solution: Gate Web3 Wallet is recommended for users who want seamless integration with Gate.com trading platform, enabling quick response to market opportunities while maintaining reasonable security standards

Non-Custodial Approach: Self-custody using standard wallet solutions provides maximum security, though users assume full responsibility for key management

Security Precautions:

- Never share private keys or seed phrases with any third party

- Enable two-factor authentication on all exchange accounts

- Verify official channels (https://phala.network/, https://twitter.com/PhalaNetwork) before engaging with the project

- Be cautious of phishing attempts targeting privacy-focused project communities

V. PHA Potential Risks and Challenges

Market Risks

Extreme Volatility: PHA exhibits significant price volatility with 24-hour swings of approximately 0.77% and 7-day declines of -18.72%, reflecting low liquidity and speculative trading patterns typical of lower-ranked altcoins (#713 market cap ranking)

Low Market Capitalization: Total market cap of $35.16 million with circulating market cap of $28.8 million indicates limited liquidity and susceptibility to large order impacts; this increases slippage risk for significant position changes

Historical Performance Deterioration: 74.96% year-over-year decline and current price near all-time lows suggest diminished investor confidence and potential continued downward pressure despite fundamental developments

Regulatory Risks

Privacy Technology Scrutiny: Privacy-focused computing protocols face increasing regulatory attention in multiple jurisdictions as governments seek to prevent misuse of confidential execution environments

Compliance Uncertainty: Regulatory treatment of tokens enabling private transactions and confidential computing remains undefined in many regions, creating potential legal obstacles for ecosystem development

Exchange Listing Pressure: Privacy tokens have faced delisting pressures from major exchanges in certain jurisdictions; this could impact liquidity and accessibility for PHA token trading

Technology Risks

Adoption Barriers: Despite Web3 Foundation grants for pLibra and Web3 Analytics applications, mainstream adoption of privacy computing services remains unproven; technology may not achieve product-market fit

Trusted Execution Environment (TEE) Vulnerabilities: Reliance on Secure Enclave technology embedded in modern processors creates dependency on third-party hardware security; potential discovery of TEE vulnerabilities could undermine the entire value proposition

Polkadot Ecosystem Dependency: As a Polkadot parachain, PHA's success is intrinsically linked to Polkadot's continued development and market adoption; reduced Polkadot ecosystem activity directly impacts PHA demand

VI. Conclusions and Action Recommendations

PHA Investment Value Assessment

Phala Network addresses a critical infrastructure gap in Web3 by providing privacy-preserving computation capabilities for the Polkadot ecosystem. The token's fundamental utility in purchasing trusted computing resources, facilitating data exchange, securing network validators, and enabling governance creates intrinsic value potential. However, the 74.96% year-over-year decline and current market capitalization of $35.16 million suggest the project remains in early adoption phases with unproven commercial traction. The recent all-time low price near $0.0323 reflects significant market skepticism, though this may also represent a potential accumulation opportunity for believers in the privacy computing thesis. Success depends on achieving meaningful adoption of pLibra and Web3 Analytics applications, expanding the Polkadot ecosystem, and navigating regulatory uncertainties around privacy technologies.

PHA Investment Recommendations

✅ Beginners: Start with small exploratory positions (under 1% of crypto portfolio) through Gate.com to understand the privacy computing narrative; use dollar-cost averaging to average into positions during periods of weakness; focus on learning the fundamentals before increasing exposure

✅ Experienced Investors: Implement core-satellite strategy with a core position sized 3-5% for long-term belief in privacy infrastructure, supplemented by tactical trading around technical support ($0.032) and resistance ($0.040) levels; participate in governance to influence protocol direction

✅ Institutional Investors: Conduct thorough due diligence on regulatory compliance for privacy technologies in target markets; consider privacy computing as a thematic exposure trade within broader Polkadot ecosystem allocations; implement position limits reflecting illiquidity and execution risk

PHA Trading Participation Methods

Method 1 - Spot Trading: Trade PHA directly on Gate.com against major trading pairs (if available); utilize limit orders to avoid slippage in the current low-liquidity environment; monitor 24-hour volume ($83,726.67) to assess execution feasibility for position sizes

Method 2 - Staking and Governance: Lock PHA tokens to participate in network security as a Gatekeeper (requires staking collateral) or join Phala DAO for governance participation; earn protocol rewards while maintaining long-term exposure

Method 3 - DeFi Integration: Monitor Polkadot ecosystem DeFi protocols for PHA liquidity pools or yield farming opportunities; consider composability benefits within the broader Polkadot parachain ecosystem

Cryptocurrency investment carries extreme risk and this report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. Always consult with qualified financial advisors before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

Can phala coin reach $1?

Yes, Phala Network has the potential to reach $1. With growing adoption of privacy-preserving technologies and increasing market demand, PHA could achieve this milestone as the project expands its ecosystem and use cases.

Is pha coin a good investment?

Yes, PHA shows strong potential as a medium-long term investment. With solid fundamentals and growing adoption in privacy computing, PHA presents compelling opportunities for investors seeking exposure to decentralized infrastructure.

Why is Phala pumping?

Phala is pumping due to major launches announced by PhalaNetwork for next year. The token has surged approximately 250% in five days, driven by positive market sentiment and upcoming ecosystem developments.

Why is Phala increasing?

Phala is increasing due to expanding market support and growing adoption of its privacy-focused computing solutions. Rising institutional interest and positive ecosystem developments drive demand for the PHA token.

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

LMWR vs AAVE: Understanding the Linguistic Debate Between Language Minority Ways of Reading and African American Vernacular English

Is Vaulta (A) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 DCB Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Decubate (DCB) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Debox (BOX) a Good Investment?: Analyzing Growth Potential and Risks in the Web3 Storage Market

The Ultimate Guide to Algorithmic Trading in Cryptocurrencies and Web3

Understanding the Difference Between Crypto Exchanges and Wallets

Claiming Your Share of the ZK Sync Airdrop: A Guide

Exploring the Benefits and Use Cases of USD Coin Stablecoin

Guide to Launching TRUST with Token-Curated Knowledge Graphs