2025 POLIS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: POLIS Market Position and Investment Value

Star Atlas DAO (POLIS) serves as the governance token for Star Atlas, a next-generation gaming metaverse that combines blockchain, real-time imaging, multiplayer gaming, and decentralized finance technologies. Since its launch in 2021, POLIS has emerged as a key asset within the Solana ecosystem. As of December 2025, POLIS maintains a market capitalization of approximately $8.66 million with a circulating supply of around 317.74 million tokens, currently trading at $0.02724. This metaverse gaming asset is playing an increasingly important role in driving player engagement and governance within the Star Atlas virtual universe.

This article provides a comprehensive analysis of POLIS price trends from 2025 to 2030, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for participants in the digital asset market.

I. POLIS Price History Review and Market Status

POLIS Historical Price Evolution

POLIS reached its all-time high (ATH) of $18.55 on September 4, 2021, during the peak of the gaming and metaverse sector enthusiasm. Since then, the token has experienced a significant long-term decline, with a year-to-date loss of -86.26%, reflecting the broader market correction in the Web3 gaming sector. The token recently touched its all-time low (ATL) of $0.02610135 on December 19, 2025, indicating the prolonged downward pressure on the asset.

POLIS Current Market Status

As of December 22, 2025, POLIS is trading at $0.02724, with a market capitalization of $8,655,122.17 and a fully diluted valuation of $9,806,400. The token has a circulating supply of 317,735,762.35 POLIS out of a total supply of 360,000,000, representing a circulation ratio of 88.26%.

In the short-term price movements, POLIS shows downward pressure across multiple timeframes:

- 1-hour change: -0.26%

- 24-hour change: -2.78%

- 7-day change: -19.95%

- 30-day change: -24.38%

The 24-hour trading volume stands at $13,627.11, with the price fluctuating between $0.02689 (24-hour low) and $0.02802 (24-hour high). The token maintains a market dominance of 0.00030%, indicating its relatively small position in the broader cryptocurrency market. POLIS is held by approximately 52,643 token holders and is available for trading on 4 exchanges.

Click to view current POLIS market price

POLIS Market Sentiment Indicator

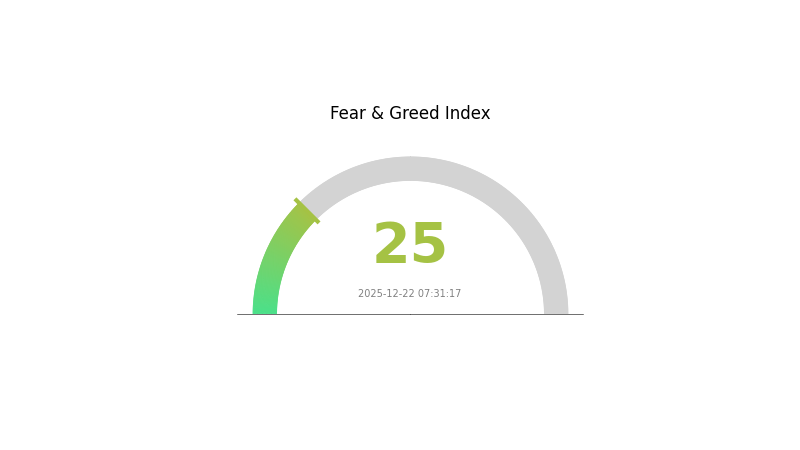

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The market is experiencing extreme fear, with the Fear and Greed Index at 25. This reading indicates severe investor panic and widespread risk aversion across the crypto market. During such periods, volatility tends to intensify, and selling pressure dominates. However, extreme fear often creates contrarian opportunities for long-term investors. Consider this a potential entry point if your investment thesis remains unchanged. Monitor key support levels closely and implement proper risk management strategies. On Gate.com, you can track real-time market sentiment and make informed trading decisions based on comprehensive market data and analysis tools.

POLIS Holdings Distribution

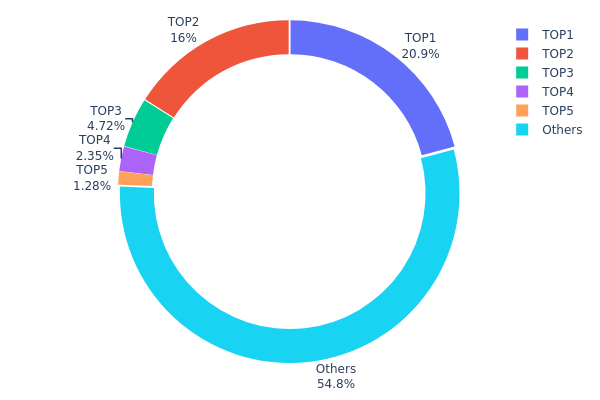

The address holdings distribution map illustrates the concentration of POLIS tokens across different wallet addresses on the blockchain. This metric serves as a critical indicator of token distribution patterns, ownership structure, and potential market risk factors. By analyzing the top holders and their proportional ownership, investors and analysts can assess the degree of centralization, evaluate liquidity dynamics, and understand the potential vulnerability to large-scale token movements.

POLIS exhibits moderate concentration characteristics in its current holdings structure. The top two addresses collectively control approximately 36.88% of the total token supply, with the leading address holding 20.85% and the second-largest address commanding 16.03%. The top five addresses account for 45.21% of all POLIS tokens, while the remaining addresses—categorized as "Others"—represent 54.79% of the supply. This distribution suggests that while significant token concentration exists among major holders, a substantial portion of POLIS remains distributed across a broader base of addresses, indicating a relatively decentralized ownership model compared to highly concentrated tokens in the market.

The current distribution pattern presents both opportunities and considerations for market dynamics. The concentration of over one-third of tokens among the top two addresses could potentially amplify price volatility in response to significant token movements or trading decisions by these major stakeholders. However, the fact that more than half of the token supply is held across a diverse array of smaller addresses mitigates extreme centralization risks and suggests a growing community of distributed participants. This balanced structure reflects a relatively healthy on-chain ecosystem with adequate diversification, reducing the likelihood of coordinated market manipulation while maintaining sufficient liquidity through multiple holder participation.

Click to view current POLIS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5MPLVo...6TfjDu | 75093.46K | 20.85% |

| 2 | 2cg6Sb...KdKvZT | 57718.19K | 16.03% |

| 3 | 3ENn1U...cdAzmP | 17000.00K | 4.72% |

| 4 | u6PJ8D...ynXq2w | 8447.04K | 2.34% |

| 5 | EFE3j1...o4ewqR | 4600.51K | 1.27% |

| - | Others | 197138.34K | 54.79% |

II. Core Factors Affecting POLIS Future Price

Market Conditions and Investor Sentiment

-

Price Volatility: POLIS price is subject to significant fluctuations driven by market conditions and investor sentiment. The cryptocurrency market is inherently unpredictable, and POLIS token value may fluctuate substantially based on trader and investor behavior.

-

Trading Activity: Investor and trader attention to POLIS value is critical for making informed decisions regarding purchases, sales, and holding positions. Market participants should closely monitor price movements and trading volumes to assess market dynamics.

Regulatory Development

-

Regulatory Impact: Regulatory developments play a significant role in shaping POLIS future price trajectory. Changes in cryptocurrency regulations across different jurisdictions can materially impact investor confidence and market adoption.

-

Risk Assessment: Investors must evaluate regulatory risks associated with holding POLIS tokens, as evolving regulatory frameworks may affect token utility and market accessibility.

Technological Progress

-

Technology Advancement: Continued technological progress within the cryptocurrency ecosystem influences POLIS valuation. Improvements in blockchain infrastructure, security protocols, and scalability solutions can enhance the token's utility and market perception.

-

Risk Considerations: Investors should remain aware that crypto asset markets are unpredictable and may result in financial losses. Due diligence and careful risk assessment are essential before making investment decisions.

Three、2025-2030 Year POLIS Price Prediction

2025 Outlook

- Conservative Prediction: $0.01848 - $0.02717

- Neutral Prediction: $0.02717

- Optimistic Prediction: $0.03777 (requires sustained market momentum and ecosystem expansion)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Recovery and gradual appreciation phase with increasing institutional interest and project development milestones

- Price Range Prediction:

- 2026: $0.01916 - $0.03994 (expected 19% upside potential)

- 2027: $0.0315 - $0.04344 (expected 32% upside potential)

- Key Catalysts: Protocol upgrades, strategic partnerships, increased adoption metrics, and improved market sentiment toward blockchain gaming and entertainment sectors

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03038 - $0.06716 (sustained ecosystem development and moderate mainstream adoption)

- Optimistic Scenario: $0.05535 - $0.05901 (strong community growth, successful product launches, and expanded use cases by 2028-2029)

- Transformative Scenario: $0.06716 (exceptional conditions including major institutional backing, significant platform penetration, and broad blockchain market recovery by 2030)

Note: These price predictions are based on historical data analysis and market modeling. Actual prices may vary significantly based on regulatory changes, market cycles, and technological developments. Investors should conduct thorough due diligence before making investment decisions on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03777 | 0.02717 | 0.01848 | 0 |

| 2026 | 0.03994 | 0.03247 | 0.01916 | 19 |

| 2027 | 0.04344 | 0.0362 | 0.0315 | 32 |

| 2028 | 0.05535 | 0.03982 | 0.02031 | 46 |

| 2029 | 0.05901 | 0.04759 | 0.03236 | 74 |

| 2030 | 0.06716 | 0.0533 | 0.03038 | 95 |

Star Atlas DAO (POLIS) Professional Investment Report

IV. POLIS Investment Strategy and Risk Management

POLIS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Metaverse and Web3 gaming enthusiasts with high risk tolerance and long-term investment horizons

- Operational Recommendations:

- Accumulate during market downturns, particularly when POLIS trades below $0.05, capitalizing on the 88.26% market cap to fully diluted valuation ratio

- Hold through development milestones and ecosystem expansions on the Solana blockchain

- Store POLIS securely in cold storage solutions with regular portfolio reviews quarterly

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points at $0.02724 (current price) and resistance at $0.02802 (24-hour high)

- Volume Analysis: Observe the 24-hour trading volume of 13,627 POLIS to identify breakout opportunities and trend confirmation

- Wave Trading Key Points:

- Capitalize on the -2.78% daily decline and -19.95% weekly decline as potential accumulation phases

- Set stop-loss orders at 5-10% below entry points given the volatile nature of gaming tokens

POLIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional Investors: 5-15% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance POLIS holdings with established blockchain assets and stablecoins to mitigate concentration risk

- Dollar-Cost Averaging: Execute regular, fixed-amount purchases over extended periods to reduce the impact of price volatility

(3) Secure Storage Solutions

- Hot Wallet Options: Gate Web3 Wallet for frequent trading and active participation in Star Atlas ecosystem activities

- Cold Storage Method: Transfer POLIS to cold storage after accumulation phases to eliminate exchange counterparty risks

- Security Precautions: Enable two-factor authentication on all exchange accounts, use hardware security keys, maintain backup recovery phrases in secure offline locations, and never share private keys or seed phrases

V. POLIS Potential Risks and Challenges

POLIS Market Risk

- Price Volatility: POLIS has experienced severe depreciation of -86.26% over the past year, from historical highs of $18.55 to current levels near $0.027, indicating extreme price instability

- Liquidity Risk: With 24-hour trading volume of only 13,627 and market capitalization of $9.8 million, large trades may face significant slippage and execution challenges

- Market Sentiment Risk: The token currently ranks 1,250 globally with minimal market dominance (0.00030%), suggesting limited investor confidence and potential for rapid price movements

POLIS Regulatory Risk

- Jurisdiction Uncertainty: As a gaming and metaverse token operating on Solana blockchain, POLIS faces potential regulatory scrutiny from governments classifying blockchain gaming as gambling or securities

- Compliance Changes: Evolving cryptocurrency regulations across major markets could restrict institutional participation or trading accessibility

- Gaming Regulation: Metaverse gaming platforms may face additional compliance requirements regarding in-game asset tokenization and player protection

POLIS Technology Risk

- Solana Network Dependence: Star Atlas operates exclusively on the Solana blockchain; any critical vulnerabilities or network failures could directly impact POLIS utility and value

- Development Execution Risk: The success of Star Atlas depends on the team's ability to deliver on complex technological promises including real-time imaging, multiplayer functionality, and DeFi integration using Unreal Engine 5

- Smart Contract Vulnerabilities: Potential exploits or bugs in the underlying Solana smart contracts could result in asset loss or network disruptions

VI. Conclusion and Action Recommendations

POLIS Investment Value Assessment

Star Atlas (POLIS) represents a high-risk, speculative investment in the intersection of blockchain gaming and metaverse development. While the project combines innovative technologies including Unreal Engine 5, Solana blockchain infrastructure, and DeFi mechanisms, the token has suffered devastating losses exceeding 86% annually. With a market capitalization of only $9.8 million and minimal market dominance, POLIS demonstrates characteristics of an early-stage, highly volatile asset. The project's long-term value depends critically on successful execution of its ambitious technical roadmap and meaningful user adoption within the Star Atlas gaming ecosystem. Current market conditions suggest POLIS remains primarily a speculative holding rather than an established cryptocurrency investment.

POLIS Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio maximum), use Gate.com for secure trading, maintain positions in established cryptocurrencies as portfolio foundation, and thoroughly research Star Atlas development progress before increasing exposure

✅ Experienced Investors: Consider accumulating during significant price declines below $0.05, utilize technical analysis to identify entry and exit points, implement strict stop-loss strategies at -10% from entry, and monitor ecosystem development milestones for fundamental catalysts

✅ Institutional Investors: Conduct comprehensive due diligence on Star Atlas development team and technology roadmap, evaluate Solana blockchain risks and dependencies, establish positions only after thorough tokenomics and regulatory compliance analysis, and maintain conservative position sizing given market cap constraints

POLIS Trading Participation Methods

- Direct Exchange Trading: Purchase POLIS on Gate.com using multiple trading pairs and payment methods, ensuring compliance with local regulatory requirements

- Spot Trading: Execute immediate buy/sell orders on Gate.com with real-time price execution and transparent fee structures

- Strategic Accumulation: Implement dollar-cost averaging programs through Gate.com to systematically build positions at variable price points while managing volatility risk

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is polis crypto?

Polis (POLIS) is a community-driven cryptocurrency designed for fast transactions and payments. It serves as the primary currency on the Polispay app, a multi-coin wallet platform that enables quick and efficient financial interactions within its ecosystem.

What is the POLIS price prediction for 2025?

The POLIS price prediction for 2025 is expected to range between $0.000524 and $0.00069, based on current market trends and technical analysis.

What factors influence POLIS token price movements?

POLIS token price is influenced by market sentiment, trading volume, supply and demand dynamics, technological developments, and broader cryptocurrency market conditions.

Is POLIS a good investment compared to other altcoins?

POLIS demonstrates solid fundamentals with strong utility and community support. Compared to many altcoins, it offers better long-term value potential due to its governance features and ecosystem growth. However, like all altcoins, POLIS carries market volatility risks. Research your risk tolerance and market conditions before investing.

Is Star Atlas DAO (POLIS) a Good Investment?: Analyzing the Potential and Risks in the Metaverse Gaming Token

What is POLIS: Exploring the Participatory Online Democracy Platform

SHILL vs MANA: Battle of the Metaverse Tokens in the Digital Real Estate Market

What is POLIS: A Comprehensive Guide to Decentralized Governance and Community-Driven Decision Making

2025 APE Price Prediction: Analyzing Market Trends, Ecosystem Growth and Investment Potential in the ApeCoin Ecosystem

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

What is BTR: A Comprehensive Guide to Beyond the Rack and Its Impact on Online Retail

What is CGN: A Comprehensive Guide to Conditional Generation Networks and Their Applications in Modern AI

What is VOOI: A Comprehensive Guide to Voice-Operated Operating Interface Technology

What is PUMPBTC: A Comprehensive Guide to the Bitcoin Pump Token and Its Market Impact

A Comprehensive Guide to Manta Network Token for Web3 Enthusiasts