2025 PORT Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of PORT

Port Finance Token (PORT) is a lending protocol designed to launch a comprehensive range of fixed income investment products including variable interest rate loans, fixed interest rate loans, and interest rate swaps. Since its inception in 2021, PORT has established itself as a significant player in the decentralized finance ecosystem. As of January 2026, PORT maintains a market capitalization of approximately $64,475.64, with a circulating supply of around 35,621,899 tokens at a price point of $0.00181.

This article will provide a comprehensive analysis of PORT's price trajectory throughout 2026, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this fixed income lending protocol.

Port Finance Token (PORT) Market Analysis Report

I. PORT Price History Review and Current Market Status

PORT Historical Price Evolution Trajectory

-

September 2021: Port Finance token launched and reached its all-time high (ATH) of $15.21, marking the peak of initial market enthusiasm during the DeFi lending protocol boom.

-

2021-2024: Following the initial peak, PORT experienced a significant downtrend as market conditions shifted, with the token declining substantially from its ATH across the broader crypto market correction cycle.

-

December 2025 - January 2026: PORT reached its all-time low (ATL) of $0.00125872 on December 6, 2025, reflecting prolonged bearish sentiment and reduced market activity around the lending protocol token.

PORT Current Market Position

As of January 5, 2026, PORT is trading at $0.00181, representing a modest recovery from its recent low point. The token demonstrates the following characteristics:

Price Performance:

- 1-hour change: -0.27%

- 24-hour change: -7.03%

- 7-day change: -16.71%

- 30-day change: +9.56%

- 1-year change: -52.23%

Market Metrics:

- Market capitalization: $64,475.64

- Fully diluted valuation (FDV): $181,000.00

- 24-hour trading volume: $12,230.29

- Circulating supply: 35,621,899.10 PORT (35.62% of total supply)

- Total supply: 100,000,000 PORT

- Current holders: 13,458

- Market dominance: 0.0000054%

The token continues to trade at a significant discount to its launch price of $0.40, reflecting the challenging market environment for DeFi lending protocols. The 24-hour price range shows trading between $0.001768 and $0.001952, indicating relatively contained volatility in the near term.

Click to view current PORT market price

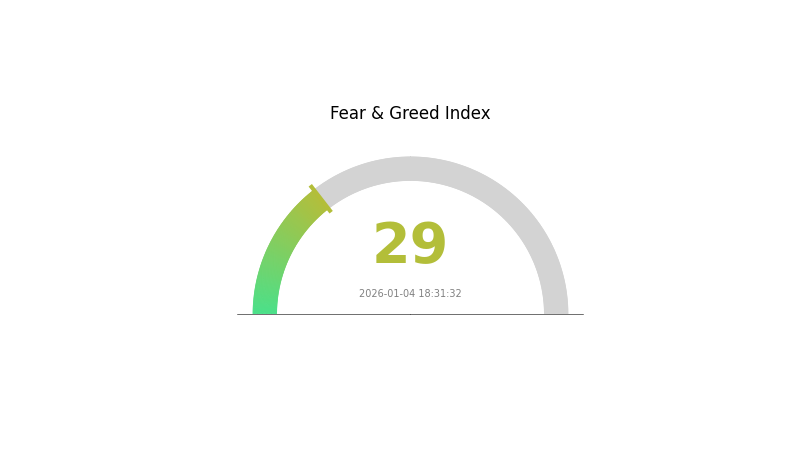

PORT Market Sentiment Index

2026-01-04 Fear and Greed Index: 29 (Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing significant fear sentiment with the index at 29. This reading indicates heightened investor anxiety and risk aversion across the market. During such periods, market participants tend to adopt more conservative positions, potentially creating both challenges and opportunities. Seasoned traders often view extreme fear as a potential buying opportunity, while risk-averse investors may choose to reduce exposure. Monitoring this indicator on Gate.com helps traders make informed decisions about market timing and portfolio allocation strategies.

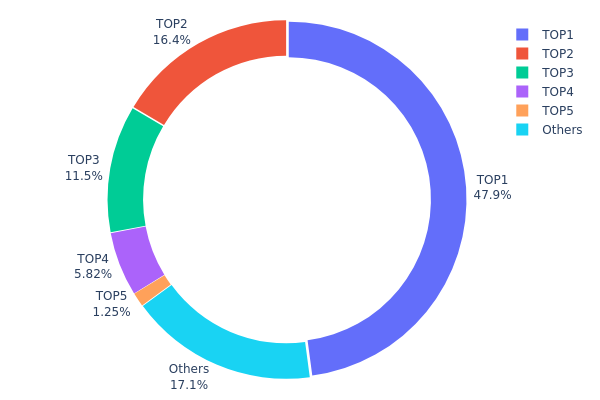

PORT Holdings Distribution

The address holdings distribution represents the concentration of PORT tokens across blockchain addresses, serving as a critical metric for assessing token decentralization and potential market manipulation risks. This distribution snapshot reveals how token supply is allocated among major stakeholders, with the top addresses indicating the presence of significant holders who could potentially influence price dynamics and market structure.

The current PORT holdings data demonstrates pronounced concentration characteristics. The top holder commands 47.88% of total supply, while the second and third largest addresses control 16.44% and 11.53% respectively. Combined, these three addresses account for approximately 75.85% of circulating supply, indicating substantial centralization. The fourth and fifth addresses hold an additional 5.82% and 1.25%, leaving only 17.08% distributed among remaining holders. This distribution pattern suggests a highly tiered structure dominated by institutional or early-stage investors, raising concerns regarding token liquidity constraints and potential price volatility exposure.

The concentration observed in PORT's address distribution carries significant implications for market dynamics and blockchain ecosystem health. With nearly half of all tokens controlled by a single address, the protocol exhibits elevated vulnerability to coordinated selling pressure or strategic market movements by major holders. The steep decline in holdings beyond the top three addresses indicates limited retail participation and reduced token velocity across the broader holder base. This structural configuration may constrain organic price discovery mechanisms while simultaneously elevating the risk of flash crashes or liquidity disruptions during periods of elevated market uncertainty. The relatively modest "Others" category at 17.08% further underscores the limited decentralization profile.

Click to view current PORT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8jJSYe...Z13dn8 | 47876.12K | 47.88% |

| 2 | J97XsF...RihTbr | 16436.19K | 16.44% |

| 3 | u6PJ8D...ynXq2w | 11532.85K | 11.53% |

| 4 | 3uz1tR...Nja8pC | 5821.14K | 5.82% |

| 5 | 5pU7WK...GuXZqc | 1250.00K | 1.25% |

| - | Others | 17056.97K | 17.08% |

II. Core Factors Influencing PORT's Future Price

DeFi Market Trends and Lending Protocol Development

-

Fixed Income Products Expansion: Port Finance is developing a comprehensive suite of fixed income investment products, including floating-rate loans, fixed-rate loans, and interest rate swaps. The large-scale adoption of these fixed income products represents a significant growth catalyst for PORT's valuation.

-

Lending Market Growth: The continued expansion of the decentralized lending market serves as a fundamental driver for PORT's price appreciation. As the DeFi lending ecosystem matures and attracts more capital, Port Finance's protocol adoption is expected to increase proportionally.

-

Market Sentiment and Investor Confidence: Overall cryptocurrency market performance and investor sentiment toward DeFi projects directly influence PORT's price movements. Regulatory clarity and positive developments within the broader digital asset space can significantly boost investor confidence.

Regulatory Environment and Market Dynamics

-

Regulatory Changes: Shifts in cryptocurrency regulations across major jurisdictions can create both opportunities and headwinds for PORT. Clearer regulatory frameworks may accelerate institutional adoption of DeFi protocols, while restrictive policies could dampen growth prospects.

-

Technological Advancements: Improvements in blockchain scalability, security, and user experience within the Port Finance ecosystem can enhance protocol efficiency and attract new users to the platform.

-

Cryptocurrency Market Performance: PORT's price trajectory is closely correlated with broader cryptocurrency market trends. During bull markets, capital inflows into DeFi sectors typically strengthen PORT's upward momentum, while bear markets can create downward pressure.

III. PORT Price Forecast for 2026-2031

2026 Outlook

- Conservative Forecast: $0.00116 - $0.00181

- Base Case Forecast: $0.00181

- Optimistic Forecast: $0.00237 (requires sustained market recovery and increased adoption)

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with consolidation patterns, transitioning toward recovery momentum as institutional interest potentially increases.

- Price Range Forecasts:

- 2027: $0.00132 - $0.00295 (+15% growth trajectory)

- 2028: $0.00181 - $0.0034 (+39% cumulative appreciation)

- 2029: $0.00216 - $0.00334 (+63% cumulative appreciation)

- Key Catalysts: Enhanced ecosystem development, strategic partnerships, improved market liquidity on platforms such as Gate.com, and broader cryptocurrency market sentiment recovery.

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00277 - $0.0041 by 2030 (+74% appreciation, assuming steady adoption and market stabilization)

- Optimistic Scenario: $0.00301 - $0.0054 by 2031 (+100% appreciation, assuming accelerated protocol upgrades and mainstream institutional adoption)

- Transformation Scenario: $0.00541+ (under conditions of significant technological breakthroughs, widespread enterprise integration, and substantial macroeconomic tailwinds)

- 2031-12-31: PORT trading near $0.0054 (representing potential doubling of current valuations under favorable market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00237 | 0.00181 | 0.00116 | 0 |

| 2027 | 0.00295 | 0.00209 | 0.00132 | 15 |

| 2028 | 0.0034 | 0.00252 | 0.00181 | 39 |

| 2029 | 0.00334 | 0.00296 | 0.00216 | 63 |

| 2030 | 0.0041 | 0.00315 | 0.00277 | 74 |

| 2031 | 0.0054 | 0.00363 | 0.00301 | 100 |

PORT Finance Token: Professional Investment Strategy and Risk Management Report

IV. PORT Professional Investment Strategy and Risk Management

PORT Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Conservative investors seeking exposure to Solana-based lending protocols with a multi-year investment horizon

- Operational Recommendations:

- Accumulate PORT during market downturns when the token trades below psychological support levels

- Hold positions through market cycles, recognizing that DeFi lending protocols require time to achieve significant adoption and protocol revenue

- Reinvest any yield or airdrops back into the position to compound gains

(2) Active Trading Strategy

-

Technical Analysis Focus:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.001768 - $0.001952) for intraday breakout opportunities

- Volume Analysis: Track the 24-hour volume of $12,230.29 as a key indicator of market participation and trend validity

-

Swing Trading Key Points:

- Identify mean reversion opportunities following the recent 24-hour decline of -7.03%

- Monitor the 7-day performance (-16.71%) for potential bottoming patterns

- Use the 30-day gain of 9.56% as context for identifying cyclical trading windows

PORT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation maximum, given the token's speculative nature and illiquidity relative to major assets

- Experienced Traders: 3-7% allocation with defined stop-loss orders at 15-20% below entry price

- Professional Investors: 5-10% allocation with hedging strategies and regular rebalancing protocols

(2) Risk Mitigation Approaches

- Position Sizing Strategy: Never exceed 5% of total liquid assets in any single PORT position; scale entries across multiple price levels

- Dollar-Cost Averaging: Implement systematic purchases over 6-12 month periods to reduce timing risk and average entry cost across market conditions

(3) Secure Storage Recommendations

- Hot Wallet Solution: Use Gate.com Web3 wallet for active trading and liquidity management, with withdrawal limits configured for security

- Cold Storage Option: Transfer long-term holdings to Solana-compatible cold storage solutions for enhanced security against exchange-based risks

- Critical Security Practices: Enable multi-signature authorization where available; never share private keys; verify contract addresses before transfers; maintain secure backups of seed phrases in geographically distributed secure locations

V. PORT Potential Risks and Challenges

PORT Market Risk

- Extreme Volatility and Price Collapse: PORT has declined 52.23% over the past year and lost 99.98% from its all-time high of $15.21 (September 2021), indicating severe market rejection and liquidity challenges

- Minimal Liquidity and Market Depth: Daily trading volume of only $12,230 suggests extremely thin order books, making larger trades subject to significant slippage and price impact

- Low Market Capitalization: With a fully diluted valuation of only $181,000, PORT ranks #5426 globally and holds just 0.0000054% market dominance, indicating minimal ecosystem adoption

PORT Regulatory Risk

- Regulatory Uncertainty for DeFi Protocols: Lending protocols and fixed income products face evolving regulatory scrutiny in multiple jurisdictions regarding securities classification

- Compliance Challenges on Solana: As DeFi regulation tightens, PORT may face operational restrictions or compliance costs that impact token value and protocol viability

PORT Technical Risk

- Smart Contract and Protocol Risk: As a lending protocol, PORT is exposed to smart contract vulnerabilities, liquidation cascades, and systemic DeFi risks

- Solana Network Dependency: Protocol performance is entirely dependent on Solana's network stability, scalability, and continued development; network outages or congestion directly impact PORT utility

VI. Conclusion and Action Recommendations

PORT Investment Value Assessment

Port Finance operates in the DeFi lending space but faces significant headwinds evidenced by its 99.98% decline from peak valuations and minimal current market adoption. The token's extremely low market capitalization, negligible trading volume, and weak price trends suggest limited institutional interest and shallow liquidity. While the protocol's technical infrastructure for fixed income products on Solana holds theoretical merit, current market evidence indicates the project has failed to gain meaningful traction. Investment in PORT should be considered highly speculative and appropriate only for experienced cryptocurrency traders comfortable with potential total loss of invested capital.

PORT Investment Recommendations

✅ Beginners: Avoid PORT entirely. Focus on establishing foundational knowledge with major cryptocurrencies before considering illiquid, low-capitalization tokens.

✅ Experienced Traders: Consider PORT only as a micro-cap speculation position (1-2% maximum) with strict stop-loss discipline and prepared for total loss scenarios.

✅ Institutional Investors: PORT does not meet institutional investment criteria due to insufficient liquidity, market capitalization, and ecosystem adoption metrics.

PORT Trading Participation Methods

- Gate.com Spot Trading: Direct purchase of PORT tokens with transparent pricing and standard trading pairs available on Gate.com

- Dollar-Cost Averaging Programs: Systematic purchasing over extended periods to mitigate entry price risk

- Portfolio Monitoring: Regular assessment of PORT's market position, trading volume trends, and protocol development milestones to inform position adjustments

Cryptocurrency investment carries extreme risk. This report is not investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Professional financial consultation is strongly recommended. Never invest funds you cannot afford to lose completely.

FAQ

What is PORT token? What are its uses and application scenarios?

PORT is a DeFi governance token used on Port Finance platform for lending, borrowing, and liquidity provision. Users can stake PORT tokens to earn yields or collateralize them for loans within the decentralized finance ecosystem.

What is PORT's historical price performance? What is the price change over the past year?

PORT has demonstrated strong momentum over the past year, with significant gains reflecting growing market adoption. Historical price data shows notable volatility typical of emerging crypto assets, with year-to-date performance reflecting broader market trends and project development milestones.

What are the main factors affecting PORT price?

PORT price is influenced by market demand, DeFi sector performance, project development progress, trading volume, liquidity conditions, and regulatory changes. Adoption of fixed-income products and borrowing protocol expansion also drive price movements.

How to predict PORT prices? What are the analysis methods and tools?

To predict PORT prices, use technical analysis examining price trends and trading volume patterns, fundamental analysis evaluating project economics and adoption metrics, and on-chain analytics monitoring transaction activity and holder behavior. Combine chart analysis tools, market data platforms, and sentiment indicators for comprehensive price forecasting.

What is PORT's future outlook? What are the price predictions for 2024-2025?

PORT is expected to grow with crypto market recovery in 2024-2025. Specific price movements depend on market dynamics and economic factors. Precise forecasting remains challenging; monitor market trends closely for better insights.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

SafeMoon Latest Updates and Price Analysis: What’s Happening with SafeMoon?

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential