2025 PROPS Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: Market Position and Investment Value of PROPS

Propbase (PROPS) serves as a tokenized real estate investment platform in Southeast Asia, enabling fractional ownership of high-quality real estate assets starting from as little as $100. Since its launch in November 2023, PROPS has established itself as a unique utility token within the property investment ecosystem. As of December 2025, PROPS maintains a market capitalization of approximately $3.71 million, with a circulating supply of around 456.65 million tokens, and is currently priced at $0.008114. This innovative asset is playing an increasingly critical role in democratizing real estate investment opportunities across the Southeast Asian region.

This article will provide a comprehensive analysis of PROPS' price trends through 2025-2030, examining historical patterns, market dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in this emerging tokenized real estate platform.

Propbase (PROPS) Market Analysis Report

I. PROPS Price History Review and Market Status

PROPS Historical Price Evolution

- April 2024: PROPS reached its all-time high of $0.1873 on April 30, 2024, representing the peak valuation during the token's trading history.

- November 2025: PROPS declined to its all-time low of $0.008092 on November 22, 2025, marking a significant depreciation from historical highs.

- Year-to-Date Performance: PROPS has experienced a substantial decline of 91.22% over the past year, reflecting challenging market conditions for the asset.

PROPS Current Market Status

As of December 24, 2025, PROPS is trading at $0.008114, representing a modest decline of 1.86% over the past 24 hours. The token has experienced marginal downward pressure across multiple timeframes: declining 0.64% in the last hour, 4.21% over the past seven days, and 3.17% over the past thirty days.

The token's trading volume in the last 24 hours stands at $69,046.36, with a circulating supply of 456,651,279.63 PROPS tokens out of a total supply of 1,200,000,000. The current market capitalization is approximately $3.71 million, with a fully diluted valuation of $9.74 million. PROPS maintains a circulating supply ratio of 38.05% and holds a market dominance of 0.0003%.

The token is listed on 7 exchanges and has an active holder base of 6,332 addresses. PROPS operates on the Aptos blockchain, with its smart contract deployed at address 0x6dba1728c73363be1bdd4d504844c40fbb893e368ccbeff1d1bd83497dbc756d.

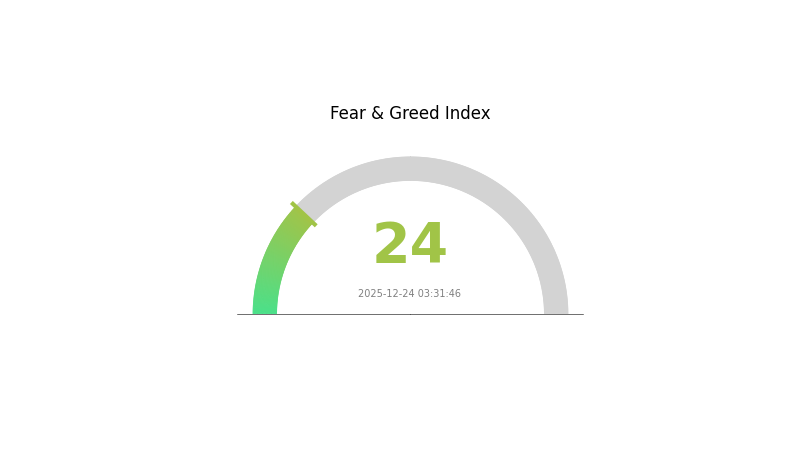

Current market sentiment indicates extreme fear conditions (VIX rating: 24), reflecting broader market uncertainty.

Click to view current PROPS market price

PROPS Market Sentiment Index

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with a Fear and Greed Index reading of 24. This exceptionally low level indicates that investors are showing significant risk aversion and pessimism across the market. During such periods of extreme fear, historically savvy investors often view this as a potential buying opportunity, as assets may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making investment decisions. Market volatility remains high, and cautious positioning is recommended.

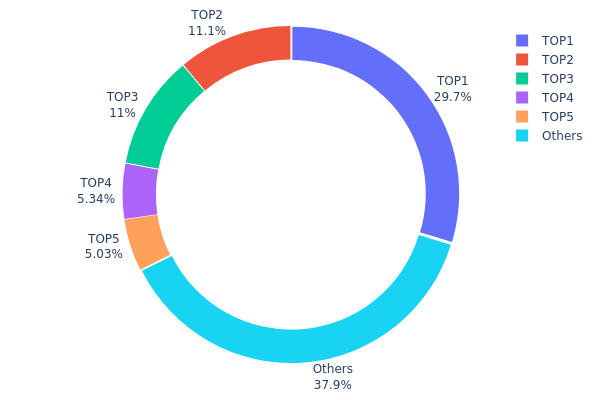

PROPS Holdings Distribution

An address holdings distribution map illustrates the concentration of token ownership across blockchain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the top holders' positions relative to total supply, this metric provides critical insights into wealth concentration, governance vulnerability, and the likelihood of coordinated market movements.

The PROPS token currently exhibits moderate concentration characteristics. The top five addresses collectively control approximately 62.09% of the circulating supply, with the leading address commanding 29.69%. While this concentration level is noteworthy, it remains within manageable parameters for a token at this stage of development. The distribution reveals a tiered structure: the top holder possesses a significant position, followed by two addresses with comparable holdings around 11% each, and subsequent addresses showing diminishing stakes. The remaining 37.91% distributed across other addresses indicates a relatively diverse base, suggesting that PROPS has achieved partial decentralization beyond its core holders.

The current address distribution landscape presents mixed implications for market dynamics. The dominant position of the top holder introduces potential volatility vectors, as substantial liquidations or transfers could trigger significant price movements. However, the absence of extreme concentration—wherein a single entity controls over 50% of supply—mitigates acute manipulation risks. The presence of multiple institutional-scale holders (addresses 2-5) suggests institutional participation rather than whale dominance. The relatively healthy tail of distributed holdings provides a stabilizing counterweight, reducing the probability of coordinated single-actor market movements. This structure reflects a market transitioning toward maturity, characterized by neither excessive decentralization nor problematic concentration, positioning PROPS within an acceptable risk profile for continued ecosystem development.

Click to view current PROPS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x785d...e41b41 | 354154.18K | 29.69% |

| 2 | 0x3e16...a47e01 | 131871.09K | 11.06% |

| 3 | 0xe8ca...49b9ea | 130789.94K | 10.97% |

| 4 | 0x430f...ed2426 | 63650.00K | 5.34% |

| 5 | 0x82d8...07059a | 60000.00K | 5.03% |

| - | Others | 452239.54K | 37.91% |

II. Core Factors Influencing PROPS' Future Price

Supply Mechanism

-

Token Economics and Supply Dynamics: PROPS price movements are primarily driven by supply dynamics and market demand patterns. Supply changes and market sentiment serve as key factors influencing the token's valuation trajectory.

-

Historical Patterns: Analysts and traders typically monitor supply dynamics alongside adoption trends to assess future price expectations based on tokenomics and historical performance data.

-

Current Impact: Supply dynamics remain critical considerations for investors evaluating PROPS' medium to long-term price direction within the broader cryptocurrency market context.

Technology Development and Ecosystem Building

-

Prop AMM Protocol: The Prop AMM represents a core innovation reshaping Solana's liquidity landscape. According to Gate.com research, the competitive advantage of Prop AMM lies in the breadth of trading pairs offered and the effectiveness of the team's proprietary strategies and algorithmic curve optimization, with minimizing spreads being a critical factor.

-

Ecosystem Applications: PROPS operates within the Solana ecosystem, where the protocol's infrastructure supports decentralized market making and liquidity provision mechanisms that enhance trading efficiency and user accessibility.

III. 2025-2030 PROPS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00542 - $0.00809

- Base Case Forecast: $0.00809

- Optimistic Forecast: $0.01003 (contingent on positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery and accumulation phase with incremental gains

- Price Range Predictions:

- 2026: $0.00707 - $0.01223 (11% upside potential)

- 2027: $0.00586 - $0.01363 (31% cumulative increase)

- 2028: $0.00643 - $0.01384 (49% cumulative increase)

- Key Catalysts: Enhanced platform utility, ecosystem expansion, institutional interest, and broader market recovery cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01169 - $0.01740 (60% cumulative increase by 2029, assuming stable market conditions and moderate adoption growth)

- Optimistic Scenario: $0.01299 - $0.02234 (87% cumulative increase by 2030, assuming accelerated platform development and market expansion)

- Transformational Scenario: $0.02234+ (extreme bullish conditions with breakthrough technological achievements and mainstream adoption surge)

Note: All price forecasts are indicative projections based on current market data. Investors should conduct thorough due diligence and consider risk factors before making investment decisions. Price discovery and trading of PROPS tokens can be accessed through Gate.com and other regulated platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01003 | 0.00809 | 0.00542 | 0 |

| 2026 | 0.01223 | 0.00906 | 0.00707 | 11 |

| 2027 | 0.01363 | 0.01065 | 0.00586 | 31 |

| 2028 | 0.01384 | 0.01214 | 0.00643 | 49 |

| 2029 | 0.0174 | 0.01299 | 0.01169 | 60 |

| 2030 | 0.02234 | 0.0152 | 0.00897 | 87 |

PROPS Investment Strategy and Risk Management Report

IV. PROPS Professional Investment Strategy and Risk Management

PROPS Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Real estate enthusiasts and passive income seekers interested in tokenized real estate exposure

- Operational Recommendations:

- Accumulate PROPS tokens during market downturns to build positions at lower valuations

- Participate in Propbase platform activities to generate rental yield on fractional real estate holdings

- Hold PROPS as a utility token for accessing new property listings and reducing transaction fees on the platform

(2) Active Trading Strategy

-

Market Analysis Approach:

- Monitor 24-hour and weekly price movements: PROPS shows -1.86% (24H) and -4.21% (7D) volatility patterns

- Track volume trends relative to historical highs ($0.1873) and recent lows ($0.008092)

- Analyze market sentiment indicators and exchange listings across seven trading platforms

-

Trading Considerations:

- PROPS trades on Gate.com and multiple other exchanges with daily volume of approximately 69,046 USD

- Consider entry points near the all-time low of $0.008092 (November 22, 2025) for recovery potential

- Monitor the token's utility demand on the Propbase platform as a key driver of value

PROPS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Active Investors: 2-5% portfolio allocation

- Experienced Crypto Traders: 5-10% portfolio allocation

(2) Risk Mitigation Strategies

- Diversification: Balance PROPS holdings with other blockchain assets to reduce concentration risk

- Position Sizing: Start with small amounts to evaluate the platform's real estate investment ecosystem before scaling exposure

(3) Secure Storage Approach

- Exchange Trading: Use Gate.com's trading platform for active trading with built-in security measures

- Non-Custodial Storage: Transfer PROPS to secure wallets for long-term holdings on the Aptos blockchain

- Security Considerations: Enable two-factor authentication on all exchange accounts, use hardware security practices, and never share private keys or seed phrases

V. PROPS Potential Risks and Challenges

PROPS Market Risks

- High Volatility: PROPS has experienced a -91.22% decline over the past year, indicating significant price volatility and market uncertainty

- Limited Liquidity: With only $69,046 in 24-hour trading volume and a market cap of $3.7 million, liquidity may be constrained for large transactions

- Low Market Adoption: Ranking #1,722 by market capitalization with only 6,332 token holders suggests limited user base and adoption barriers

PROPS Regulatory Risks

- Real Estate Tokenization Uncertainty: Regulatory frameworks for tokenized real estate remain unclear in many Southeast Asian jurisdictions, creating compliance uncertainty

- Regional Jurisdiction Challenges: Operating across multiple Southeast Asian markets with varying regulatory requirements presents ongoing compliance complexity

- Potential Regulatory Changes: Future regulations on digital asset trading and real estate fractional ownership could impact the platform's operations and token utility

PROPS Technology Risks

- Blockchain Dependency: PROPS operates on the Aptos blockchain; any network vulnerabilities or failures could impact token functionality

- Smart Contract Risk: The platform's reliance on smart contracts for property transactions and token settlement carries execution and security risks

- Platform Scalability: As transaction volume grows, the platform must maintain security and efficiency standards

VI. Conclusions and Action Recommendations

PROPS Investment Value Assessment

Propbase represents a nascent opportunity in the tokenized real estate sector within Southeast Asia, offering fractional ownership access to real estate assets starting at $100. However, the token faces significant headwinds including extreme year-to-year price decline (-91.22%), minimal trading volume, and a small holder base. While the utility proposition of PROPS as a settlement token for real estate transactions has merit, the project remains in early stages with uncertain adoption. The token's current valuation near all-time lows may present speculative opportunities for risk-tolerant investors, but substantial execution risks remain.

PROPS Investment Recommendations

✅ Beginners: Consider allocating only 1-2% of portfolio to PROPS as a speculative position; prioritize understanding the Propbase platform's real estate model before investing; start with minimal amounts on Gate.com to test the ecosystem

✅ Experienced Investors: Evaluate the platform's transaction volume and rental yield metrics as key fundamental indicators; consider PROPS as a long-term bet on Southeast Asian real estate tokenization; monitor platform adoption metrics before scaling positions

✅ Institutional Investors: Conduct thorough due diligence on Propbase's regulatory compliance across Southeast Asian markets; assess the platform's ability to scale to meaningful transaction volumes; consider the token's utility mechanisms and platform stickiness before institutional deployment

PROPS Trading Participation Methods

- Exchange Trading: Access PROPS on Gate.com for spot trading, margin opportunities, and regular market participation

- Platform Participation: Hold PROPS to access new property listings on Propbase and benefit from transaction fee reductions

- Yield Generation: Participate in the Propbase platform to earn rental yields on fractional real estate holdings while maintaining PROPS exposure

Cryptocurrency investment carries extreme risk and is highly speculative. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult with professional financial advisors before investing. Never invest more than you can afford to lose completely.

FAQ

Does propy crypto have a future?

Yes, Propy has a promising future. Its blockchain-based real estate solutions and strong utility focus position it well for growth. With increasing adoption of blockchain technology in real estate, Propy is well-positioned for long-term success.

What factors influence PROPS token price?

PROPS token price is influenced by market sentiment, trading volume, technological developments, adoption rates, ecosystem growth, and overall cryptocurrency market conditions.

When is the best time to buy PROPS cryptocurrency?

The best time to buy PROPS is after Bitcoin stabilizes following a rally, which typically triggers altseason. Monitor market trends and trading volume for optimal entry points during upward momentum.

How does PROPS compare to other similar crypto projects?

PROPS distinguishes itself through superior community engagement, innovative tokenomics, and robust ecosystem development. With strong TVL metrics and consistent protocol upgrades, PROPS outperforms comparable projects in scalability and user adoption within the decentralized finance sector.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?

Top Platforms for Learning and Earning in Cryptocurrency