2025 PUMPBTC Price Prediction: Expert Analysis of Market Trends and Potential Gains in the Coming Year

Introduction: PUMPBTC's Market Position and Investment Value

PumpBTC (PUMPBTC) is an AI-driven staking and liquidity operating system built for Modular Chains, designed to enable Bitcoin holders to maximize their returns by seamlessly integrating with the DeFi ecosystem. As of December 23, 2025, PumpBTC has achieved a market capitalization of $25,950,000, with a circulating supply of 285,000,000 tokens trading at approximately $0.02595 per token. This innovative platform, which provides a highly secure, scalable, and transparent way for Bitcoin holders to participate in decentralized finance while retaining control over their assets, is establishing itself as an important bridge between traditional Bitcoin holders and the broader DeFi landscape.

This article will provide a comprehensive analysis of PUMPBTC's price dynamics and market trends, examining historical performance patterns, supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for market participants.

I. PUMPBTC Price History Review and Current Market Status

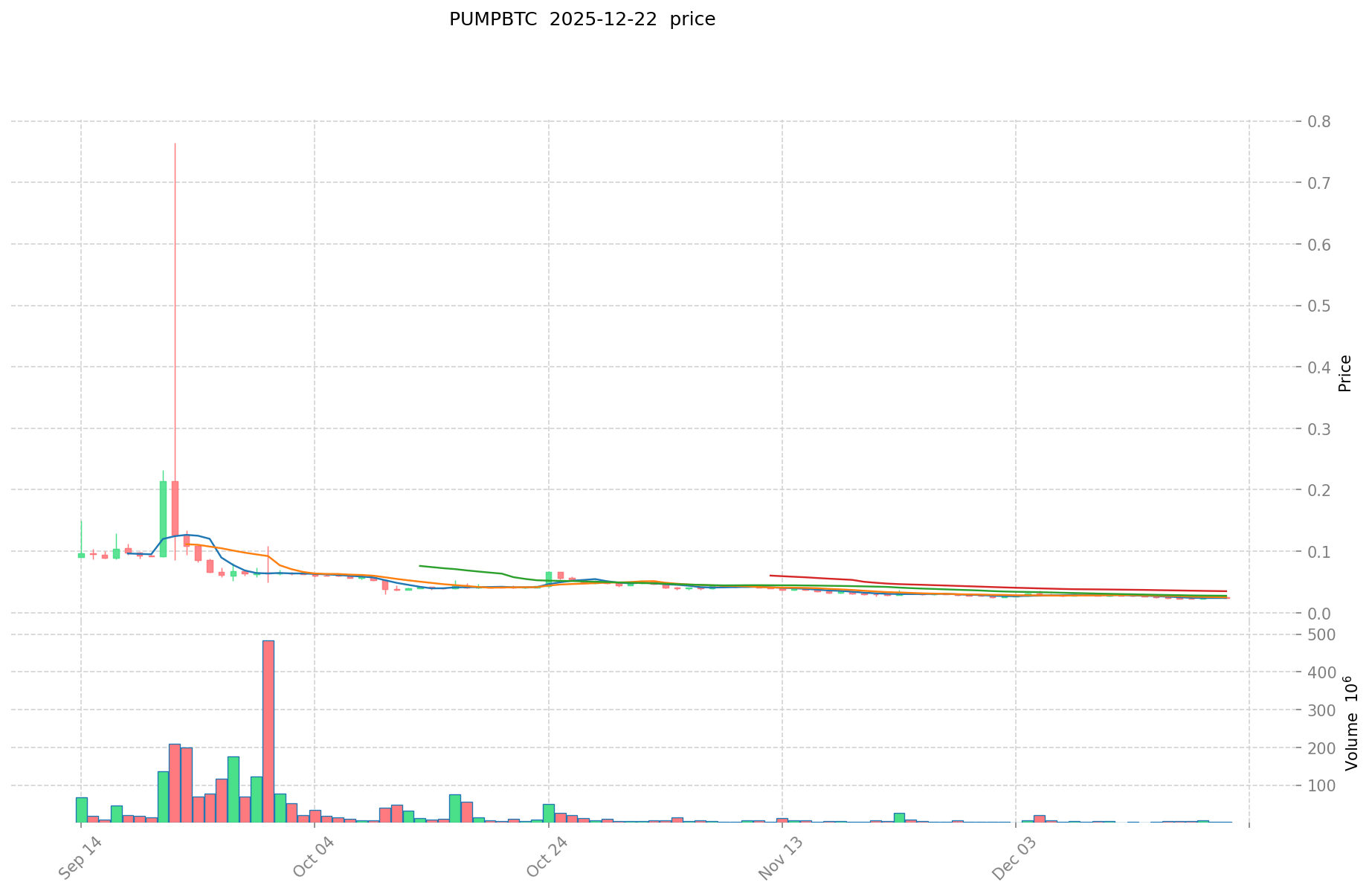

PUMPBTC Historical Price Evolution

- September 2025: Project launched, reaching its all-time high (ATH) of $0.76464 on September 22, 2025

- December 2025: Significant price decline, with the asset reaching its all-time low (ATL) of $0.02217 on December 18, 2025

PUMPBTC Current Market Situation

As of December 23, 2025, PUMPBTC is trading at $0.02595, reflecting a 24-hour price increase of 6.84% with a trading volume of $40,073.61. The token has demonstrated intraday volatility, trading between a 24-hour high of $0.02685 and a low of $0.02405.

The circulating supply stands at 285 million tokens out of a total supply of 1 billion PUMPBTC, representing a circulation ratio of 21.28%. The fully diluted valuation (FDV) is positioned at $25,950,000, with a current market capitalization of $7,395,750. The asset currently ranks 1,333 in the broader cryptocurrency market with a market dominance of 0.0008%.

Recent price performance shows mixed signals across different timeframes: the token gained 0.38% in the last hour, advanced 6.1% over the past seven days, but declined 8.79% over the past month and 62.16% year-to-date. The market sentiment remains in extreme fear territory with a VIX reading of 25.

PUMPBTC maintains presence across multiple blockchain networks, with active contract addresses on the Ethereum (ETH) network (0xb7c0007ab75350c582d5eab1862b872b5cf53f0c) and BEP-20/ERC-20 standards. The token is listed on Gate.com with 129 current holders.

Click to view current PUMPBTC market price

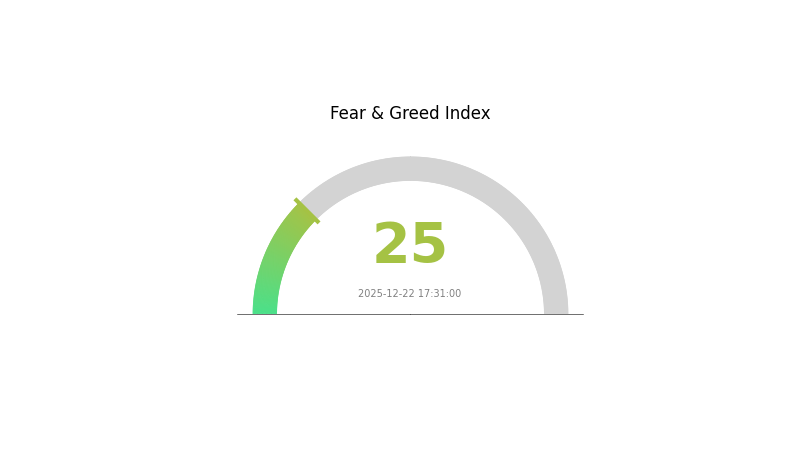

PUMPBTC Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index reaching 25. This indicates significant investor pessimism and heightened market anxiety. During such periods, risk-averse traders typically reduce positions, while contrarian investors may identify potential buying opportunities. Market volatility remains elevated as participants digest uncertain macroeconomic factors. Monitoring sentiment shifts closely is essential for strategic decision-making. Consider your risk tolerance carefully before making any trades on Gate.com.

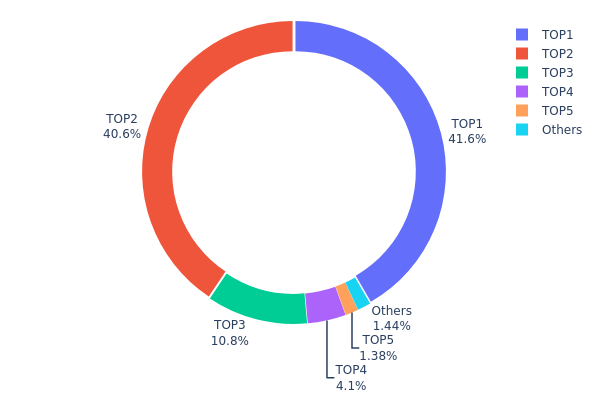

PUMPBTC Holdings Distribution

The address holdings distribution chart illustrates how PUMPBTC tokens are allocated across different wallet addresses on the blockchain. This metric serves as a critical indicator of token concentration, market structure health, and potential risks related to centralization. By analyzing the distribution pattern, we can assess the degree of decentralization and identify potential vulnerabilities to market manipulation or sudden liquidity events.

PUMPBTC demonstrates a notably concentrated holder structure, with significant centralization risks evident in the current distribution. The top two addresses collectively control 82.24% of all circulating tokens, with the largest holder (0xa5a7...10e6ce) commanding 41.64% and the second-largest (0x12e0...bdbcde) holding 40.60% respectively. This extreme concentration in the hands of just two entities represents a substantial departure from an ideally distributed token ecosystem. The third-largest holder accounts for only 10.82%, highlighting a steep drop-off in holdings beyond the top two positions. The remaining addresses collectively represent less than 7% of total supply, indicating a highly skewed distribution pattern.

This concentrated holder structure presents considerable implications for market dynamics and stability. The dominance of two primary stakeholders creates material risks for price volatility, as coordinated or unilateral selling by either entity could trigger substantial downward pressure on the token price. The current distribution pattern also raises concerns regarding governance and decision-making processes, as such concentration of tokens typically translates to disproportionate voting power in decentralized governance mechanisms. From a decentralization perspective, PUMPBTC currently exhibits a relatively low degree of token distribution, which contradicts the fundamental principles of decentralized finance and may impede long-term ecosystem development and community participation.

Click to view current PUMPBTC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa5a7...10e6ce | 200000.00K | 41.64% |

| 2 | 0x12e0...bdbcde | 195000.00K | 40.60% |

| 3 | 0x1091...e3e2e9 | 52000.45K | 10.82% |

| 4 | 0xf42a...36f173 | 19697.72K | 4.10% |

| 5 | 0x0d07...b492fe | 6638.43K | 1.38% |

| - | Others | 6936.49K | 1.46% |

II. Core Factors Affecting PUMPBTC's Future Price

Supply Mechanism

- 1:1 Peg Mechanism: PUMPBTC maintains a 1:1 peg with Bitcoin, meaning Bitcoin price fluctuations directly impact PUMPBTC's value proportionally.

- Current Market Impact: PUMPBTC's total locked value (TVL) has exceeded USD 200 million, indicating substantial market adoption within the Bitcoin restaking ecosystem.

Institutional and Major Holder Dynamics

- Institutional Positioning: Leading projects in the restaking field, such as Solv, hold over 24,000 BTC in reserves, equivalent to approximately USD 1.6 billion in liquidity. Lombard has accumulated nearly 10,000 BTC deposits, demonstrating significant institutional participation in Bitcoin-backed asset protocols.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's rate-cutting measures have driven positive market sentiment, with the market sentiment index recovering to 87% and cryptocurrency total market cap showing strong correlation with traditional equities (0.65 correlation with S&P 500 in 2024).

- Market Competition: The BTC restaking sector currently exhibits over-construction on the supply side, while demand-side market size remains uncertain. PUMPBTC faces emerging competition from other Bitcoin bridge protocols, which may impact market share and adoption rates.

- Regulatory Environment: The regulatory environment for cross-chain assets remains uncertain and may affect operational flexibility, potentially influencing PUMPBTC's future development and market positioning.

III. 2025-2030 PUMPBTC Price Forecast

2025 Outlook

- Conservative Forecast: $0.02461 - $0.03341

- Base Case Forecast: $0.0259

- Bullish Forecast: $0.03341 (requires sustained market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with incremental growth trajectory, characterized by increasing institutional interest and ecosystem expansion

- Price Range Forecast:

- 2026: $0.0258 - $0.03944

- 2027: $0.02038 - $0.04595

- 2028: $0.02173 - $0.05071

- Key Catalysts: Protocol upgrades, expanded exchange listings on platforms such as Gate.com, growing community engagement, and favorable macroeconomic conditions supporting risk assets

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03642 - $0.04912 (assumes steady market maturation and mainstream adoption acceleration)

- Bullish Scenario: $0.0473 - $0.06622 (assumes breakthrough partnerships and significant ecosystem development)

- Transformative Scenario: $0.06622+ (assumes widespread institutional adoption, major technological breakthroughs, and favorable regulatory environment)

- 2030-12-31: PUMPBTC shows potential 82% cumulative appreciation from current levels (reflecting positive long-term trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03341 | 0.0259 | 0.02461 | 0 |

| 2026 | 0.03944 | 0.02966 | 0.0258 | 14 |

| 2027 | 0.04595 | 0.03455 | 0.02038 | 33 |

| 2028 | 0.05071 | 0.04025 | 0.02173 | 55 |

| 2029 | 0.04912 | 0.04548 | 0.03639 | 75 |

| 2030 | 0.06622 | 0.0473 | 0.03642 | 82 |

PumpBTC Professional Investment Strategy and Risk Management Report

IV. PumpBTC Professional Investment Strategy and Risk Management

PumpBTC Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Bitcoin holders seeking DeFi exposure, conservative cryptocurrency investors, institutional players looking for yield optimization

- Operational Recommendations:

- Accumulate PUMPBTC during market corrections to build a core position aligned with the project's AI-driven staking and liquidity operations focus

- Participate in staking activities offered through the platform to generate additional returns on Bitcoin holdings

- Monitor quarterly performance metrics and ecosystem integration updates to reassess position sizing

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Identify key price zones at $0.76464 (all-time high) and $0.02217 (all-time low) to guide entry and exit decisions

- Volume Analysis: Track 24-hour trading volume trends against the current average of $40,073.61 to confirm price movement validity

-

Wave Trading Key Points:

- Capitalize on the volatility between recent 24-hour range ($0.02405 to $0.02685) by setting tight stop losses below support levels

- Monitor AI-driven protocol developments that may trigger substantial price movements and liquidity shifts

PumpBTC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of cryptocurrency portfolio allocation

- Active Investors: 5-10% of cryptocurrency portfolio allocation

- Professional Investors: Up to 15% of cryptocurrency portfolio allocation, with active rebalancing quarterly

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Execute regular purchases over extended periods to reduce exposure to short-term price volatility, particularly given the -8.79% 30-day performance decline

- Portfolio Diversification: Maintain PumpBTC as a satellite position rather than a concentrated bet, balancing exposure with established digital assets

(3) Security Storage Solutions

- Hot Wallet for Active Trading: Gate.com Web3 Wallet for frequent transactions and staking participation on modular chains

- Cold Storage for Long-term Holdings: Secure non-custodial wallets for extended holding periods to minimize security risks

- Security Considerations: Enable multi-signature verification, maintain backup recovery phrases in secure offline locations, and verify all contract addresses against official sources before transactions

V. PumpBTC Potential Risks and Challenges

PumpBTC Market Risks

- High Volatility Exposure: The asset has experienced -62.16% performance over the past year and -8.79% over 30 days, indicating substantial price swings that can result in significant portfolio losses

- Limited Liquidity: With only one exchange listing and $40,073.61 in 24-hour volume, the token exhibits thin liquidity that may restrict position entry and exit flexibility

- Market Adoption Uncertainty: As an emerging AI-driven platform focused on Bitcoin DeFi integration, widespread adoption remains unproven with only 129 token holders currently

PumpBTC Regulatory Risks

- Evolving DeFi Regulatory Environment: Regulatory frameworks for decentralized finance continue to develop globally, potentially impacting protocol operations and token value

- Smart Contract Compliance: Changes in blockchain regulations could affect the ERC-20 and BEP-20 implementations and cross-chain functionality

- Jurisdiction-Specific Restrictions: Different countries may impose varying restrictions on staking services and DeFi protocol participation

PumpBTC Technical Risks

- Modular Blockchain Dependency: Protocol functionality depends on the continued development and adoption of modular chain architectures, which remain nascent technology

- Smart Contract Vulnerabilities: Code flaws in the staking and liquidity mechanisms could expose user funds to exploitation or operational failures

- Integration Complexity: Seamless DeFi ecosystem integration depends on maintaining compatibility across multiple blockchain protocols and maintaining operational stability

VI. Conclusion and Action Recommendations

PumpBTC Investment Value Assessment

PumpBTC presents a specialized investment opportunity within the Bitcoin DeFi ecosystem, offering exposure to AI-driven staking and liquidity operations. The platform's focus on providing secure, scalable access to decentralized finance for Bitcoin holders addresses a genuine market need. However, the token exhibits substantial volatility, limited trading liquidity, and unproven protocol adoption, requiring careful position sizing and risk management. The -62.16% year-over-year decline and current market cap of approximately $7.4 million suggest the project remains in early development stages with execution risks.

PumpBTC Investment Recommendations

✅ Beginners: Execute small exploratory positions (1-3% of crypto allocation) via Gate.com using dollar-cost averaging over 2-3 months to reduce timing risk. Focus on understanding the staking mechanics before expanding exposure.

✅ Experienced Investors: Consider 5-10% satellite positions for those with Bitcoin holdings seeking DeFi yield optimization. Conduct thorough due diligence on smart contract audits and participate in governance discussions to monitor project progress.

✅ Institutional Investors: Evaluate positions up to 10-15% allocation only after comprehensive technical audits, team verification, and regulatory compliance assessment. Prioritize interactions with the protocol team to understand development roadmap and risk mitigation strategies.

PumpBTC Trading Participation Methods

- Exchange Trading: Access PUMPBTC on Gate.com for spot trading, setting limit orders to manage slippage in the current low-liquidity environment

- Staking Integration: Participate in platform-native staking mechanisms to generate yield on Bitcoin holdings while maintaining exposure to protocol development

- DeFi Interactions: Engage with modular chain liquidity pools offering PumpBTC pairs for advanced traders seeking additional return mechanisms

Cryptocurrency investments carry extremely high risks. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Can pump coin reach $1?

Pump Coin reaching $1 is unlikely based on current market trends and fundamentals. While the project has potential, significant growth catalysts and increased adoption would be required to achieve this price target in the near term.

What crypto will 1000x prediction?

PUMPBTC has strong potential for significant gains. With growing market interest, increasing trading volume, and unique tokenomics, it could achieve exceptional returns. Early adopters positioning themselves now may see substantial appreciation as adoption accelerates.

Does pump crypto have a future?

Yes. PUMP has strong potential as a decentralized social finance platform on Solana. With over 11 million meme coins launched and $700 million in trading fees generated, it demonstrates solid market traction. Continued user engagement and platform evolution could drive significant growth through 2030.

What is the price of PumpBTC?

The price of PumpBTC is $0.02477 as of December 22, 2025, with a 24-hour trading volume of $9,930,214. The token has shown a 2.12% price increase in the last 24 hours.

What is PUMPBTC: A Comprehensive Guide to the Bitcoin Pump Token and Its Market Impact

Is Bedrock (BR) a good investment? An In-Depth Analysis of Market Potential, Risk Factors, and Expert Predictions for 2024

2025 BANK Price Prediction: Expert Analysis and Market Forecast for the Banking Sector

2025 BB Price Prediction: Expert Analysis and Market Forecast for the Coming Year

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

2025 SOLV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

What Are the Key Compliance and Regulatory Risks in Cryptocurrency Markets in 2025?

Understanding Crypto Payments: A Guide to Using Cryptocurrency for Purchases

What is the current crypto market overview by market cap, trading volume, and liquidity in 2025?

2025 Cryptocurrency Investment: Top Coins for Future Wealth

2025 BLD Price Prediction: Expert Analysis and Market Forecast for Buildel Token's Future Growth