2025 PUNDIX Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: PUNDIX's Market Position and Investment Value

PUNDIX (PUNDIX) serves as a decentralized offline cryptocurrency payment solution designed to enable everyday cryptocurrency transactions. Since its inception in 2021, the project has achieved significant milestones in global expansion, having deployed its XPOS devices to over 25 countries worldwide and issued more than 50,000 cryptocurrency recharge cards. As of December 2025, PUNDIX maintains a market capitalization of $56.28 million with a circulating supply of approximately 258.39 million tokens, trading at around $0.2178 per token. This innovative asset, recognized for its "decentralized offline payment network" approach, is playing an increasingly pivotal role in facilitating mainstream cryptocurrency adoption through physical point-of-sale infrastructure and mobile payment applications.

This article will provide a comprehensive analysis of PUNDIX's price trends and market dynamics, incorporating historical performance patterns, supply-demand dynamics, and ecosystem development. Our analysis aims to equip investors with professional price forecasting insights and practical investment strategies for navigating the cryptocurrency market on Gate.com and other platforms.

PUNDIX Market Analysis Report

I. PUNDIX Price History Review and Current Market Status

PUNDIX Historical Price Evolution

-

March 31, 2021: All-Time High (ATH) reached at $10.07, marking the peak valuation period for the token following its transition from the legacy Pundi X (NPXS) token through a 1000:1 token consolidation smart contract upgrade.

-

2021-2024: Extended bear market phase, with the token experiencing sustained downward pressure as the broader cryptocurrency market cycled through various market conditions.

-

October 11, 2025: All-Time Low (ATL) recorded at $0.212924, representing a significant decline from historical peaks and reflecting extended consolidation and reduced market interest in the asset.

-

December 18, 2025: Current trading price at $0.2178, representing a marginal recovery from the recent ATL but maintaining levels substantially below historical highs.

PUNDIX Current Market Status

As of December 18, 2025, PUNDIX is trading at $0.2178 with a 24-hour trading volume of $15,094.26. The token exhibits recent downward momentum across multiple timeframes:

- Short-term performance: Down 0.09% in the last hour and 2.15% over the past 24 hours

- Medium-term trend: Declined 5.3% over the past 7 days and 16.61% over the past 30 days

- Long-term perspective: Down 56.92% over the past year, indicating substantial erosion of value

The total market capitalization stands at $56,276,588.66, with a fully diluted valuation (FDV) of the same amount. The circulating supply comprises 258,386,541.10 PUNDIX tokens out of a maximum supply of 258,526,640, representing 99.95% circulation ratio. The token maintains a market dominance of 0.0018% and ranks 468th by market capitalization. Current market sentiment indicates extreme fear conditions (VIX: 17).

PUNDIX maintains active presence on the Ethereum blockchain with a contract address of 0x0FD10b9899882a6f2fcb5c371E17e70FdEe00C38, and is supported across 20 exchange platforms with 18,417 token holders.

Check current PUNDIX market price

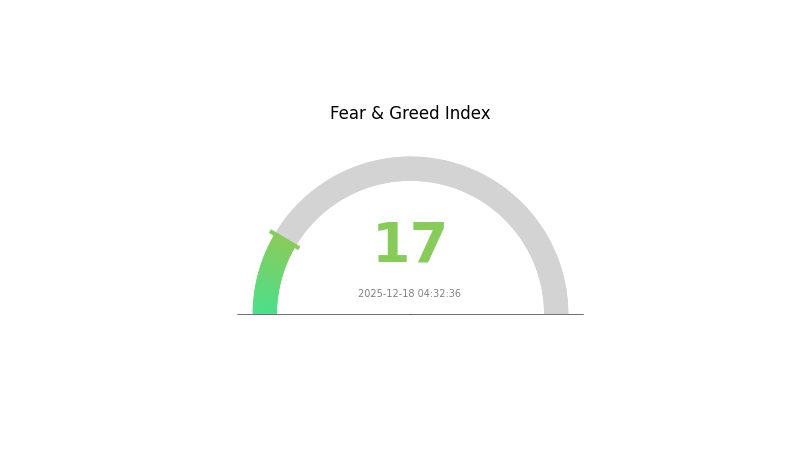

Cryptocurrency Market Sentiment Indicator

12-18-2025 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This indicates strong negative sentiment among investors, with widespread panic selling and risk aversion dominating the market. Such extreme fear conditions historically present opportunities for contrarian investors, as market bottoms often coincide with peak pessimism. However, caution remains essential as further downside risk may exist. Monitor key support levels closely and consider dollar-cost averaging strategies during volatile periods. Always conduct thorough research before making investment decisions on Gate.com.

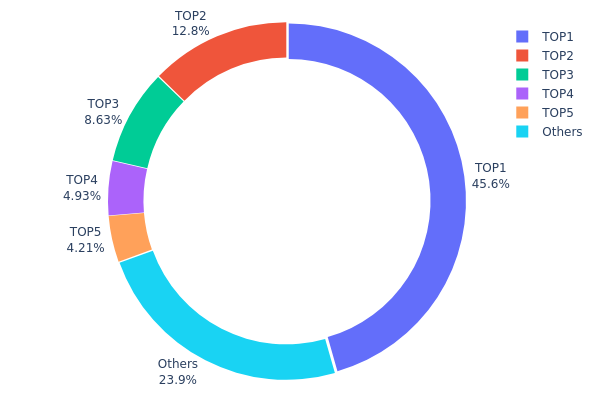

PUNDIX Holdings Distribution

The holdings distribution map illustrates how PUNDIX tokens are allocated across different addresses on the blockchain, serving as a critical indicator of token concentration and decentralization levels. By analyzing the top holders and their respective ownership percentages, we can assess the degree of centralization risk and the potential for market manipulation or coordinated price movements within the ecosystem.

PUNDIX exhibits significant concentration characteristics, with the top five addresses collectively controlling approximately 76.05% of the total token supply. The leading address alone commands 45.56% of all circulating tokens, substantially exceeding typical decentralization thresholds recommended for healthy token distribution. The second-largest holder maintains 12.75%, followed by progressively smaller positions at 8.62%, 4.92%, and 4.20% respectively. In contrast, the remaining addresses aggregate only 23.95% of holdings, indicating a highly skewed distribution pattern where decision-making power is concentrated among a limited number of entities.

This pronounced concentration poses meaningful considerations for market structure and governance dynamics. The dominant holder's substantial stake creates potential liquidity fragmentation and suggests possible influence over price discovery mechanisms. Such distribution patterns typically emerge from strategic allocations to founding teams, early investors, or treasury reserves, which may indicate that PUNDIX is still in a phase where institutional control or project stewardship remains a significant factor. The concentration underscores the importance of monitoring large holder behavior, as coordinated movements or substantial liquidations could generate material volatility. The current distribution reflects a relatively early-stage tokenomics structure with room for further decentralization as the token circulates more broadly through ecosystem adoption and community participation.

Click to view current PUNDIX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2bc8...2a2960 | 117745.77K | 45.56% |

| 2 | 0xf977...41acec | 32963.60K | 12.75% |

| 3 | 0x6f1d...d80a27 | 22296.63K | 8.62% |

| 4 | 0x5a52...70efcb | 12733.82K | 4.92% |

| 5 | 0xd11b...14fd51 | 10870.49K | 4.20% |

| - | Others | 61776.23K | 23.95% |

II. Core Factors Influencing PUNDIX Future Price

Community Activities and Market Sentiment

-

Community-Driven Events: Historical data shows that community-driven events enhance visibility and promote partnership development, directly impacting cryptocurrency prices. PUNDIX has hosted over 20 Web3 events since 2024 through its OffChain Tokyo initiative, expanding its network presence to 75 cities across 30 countries.

-

Investor Confidence: Market sentiment and investor confidence have a direct impact on PUNDIX price movements. When market conditions shift, investors should adjust their strategies accordingly based on market dynamics.

Technology Innovation and Ecosystem Development

- Ecosystem Expansion: The project's ongoing technology innovation and strategic partnerships are key drivers for future price performance. PUNDIX's expanding global presence and Web3 event hosting demonstrate active ecosystem development that supports long-term value creation.

Three、2025-2030 Year PUNDIX Price Forecast

2025 Outlook

- Conservative Forecast: $0.1243 - $0.1800

- Neutral Forecast: $0.1800 - $0.2181

- Optimistic Forecast: $0.2181 - $0.2356 (requires sustained market recovery and increased institutional adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with consolidation patterns, transitioning toward potential recovery momentum as market sentiment stabilizes.

- Price Range Forecast:

- 2026: $0.2041 - $0.3244

- 2027: $0.1819 - $0.3721

- 2028: $0.2234 - $0.3335

- Key Catalysts: Ecosystem development initiatives, increased DeFi integration, improved market liquidity on major exchanges including Gate.com, and potential regulatory clarity in key markets.

2029-2030 Long-term Outlook

- Base Case: $0.1676 - $0.4437 (assumes moderate adoption growth and stable macroeconomic conditions through 2029)

- Optimistic Case: $0.3476 - $0.4789 (assumes accelerated enterprise partnerships and widespread cross-chain interoperability by 2030)

- Transformational Case: Above $0.4789 (extreme favorable conditions including mainstream payment adoption, significant venture capital inflows, and breakthrough technology implementations)

- 2030-12-18: PUNDIX projected at $0.3862 (median forecast with 77% aggregate upside potential from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.23555 | 0.2181 | 0.12432 | 0 |

| 2026 | 0.32436 | 0.22682 | 0.20414 | 4 |

| 2027 | 0.37205 | 0.27559 | 0.18189 | 26 |

| 2028 | 0.33353 | 0.32382 | 0.22344 | 48 |

| 2029 | 0.44371 | 0.32868 | 0.16763 | 50 |

| 2030 | 0.47888 | 0.3862 | 0.34758 | 77 |

PUNDIX Professional Investment Strategy and Risk Management Report

IV. PUNDIX Professional Investment Strategy and Risk Management

PUNDIX Investment Methodology

(1) Long-term Holding Strategy

-

Suitable For: Investors with 1-3 year investment horizons seeking exposure to payment infrastructure and cryptocurrency adoption, particularly those believing in Pundi X's offline payment ecosystem expansion.

-

Operation Recommendations:

- Accumulate PUNDIX during market downturns, especially when price falls below historical support levels. With current price at $0.2178 and all-time low at $0.212924 (October 2025), consider dollar-cost averaging for consistent entry points.

- Hold through volatility cycles while monitoring the development of Pundi X's XPOS deployment across 25+ countries and XWallet user growth beyond 100,000 registered users.

- Set realistic price targets based on fundamental milestones: XPOS expansion, merchant adoption rates, and transaction volume growth.

-

Storage Solutions:

- Use Gate.com Web3 Wallet for active trading access and ecosystem participation rewards.

- For long-term security, consider cold storage solutions with proper backup of private keys and seed phrases.

- Maintain secure documentation of wallet addresses and recovery procedures in an encrypted, offline location.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support/Resistance Levels: Monitor the all-time high of $10.07 (March 2021) and recent low of $0.212924 (October 2025). Current price action near historical lows suggests potential support formation; resistance would emerge near $0.25-0.30 range.

- Volume Analysis: Track 24-hour trading volume of $15,094.26 USD. Increased volume during price movements can confirm trend strength or signal reversal patterns.

- Price Momentum Indicators: Use 24H change (-2.15%), 7-day change (-5.3%), and 1-year decline (-56.92%) to assess market sentiment and potential oversold conditions.

-

Wave Trading Key Points:

- Entry signals: Price bounces from $0.212924-$0.215 support zone with volume confirmation.

- Exit targets: Set incremental profit-taking at $0.25, $0.30, and $0.40 resistance levels.

- Risk management: Use trailing stop-losses at 8-12% below entry point to protect against sudden downside moves.

- Time frames: Focus on 4-hour to daily charts for clearer trend identification given current market conditions.

PUNDIX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation. Prioritize capital preservation; use gate.com spot trading only with funds you can afford to lose completely.

- Aggressive Investors: 5-10% portfolio allocation. Can tolerate 50%+ drawdowns; suitable for active trading and position averaging during downturns.

- Professional Investors: 5-15% allocation as part of diversified cryptocurrency infrastructure holdings, combined with complementary payment and DeFi tokens.

(2) Risk Hedge Solutions

- Diversification Strategy: PUNDIX represents a specialized payment infrastructure play; balance with stablecoin holdings (USDT, USDC) and other established layer-1 blockchain tokens to reduce concentration risk.

- Position Sizing: Implement the 2% rule—never risk more than 2% of total portfolio on a single PUNDIX position. Given -56.92% 1-year decline, maintain smaller position sizes than with established cryptocurrencies.

- Volatility Management: Use stop-loss orders at predetermined levels (8-15% below entry) to limit downside exposure during market corrections.

(3) Secure Storage Solutions

- Hot Wallet (Trading): Gate.com Web3 Wallet for active trading, staking rewards, and frequent transactions. Keep only 10-20% of holdings here for operational needs.

- Cold Storage (Long-term): Hardware wallets or offline paper wallets for primary holdings. PUNDIX operates on Ethereum (contract: 0x0FD10b9899882a6f2fcb5c371E17e70FdEe00C38), so ensure cold storage supports ERC-20 tokens.

- Security Considerations:

- Never share private keys or seed phrases; store recovery phrases in a fireproof safe or secure deposit box.

- Enable multi-signature authentication for wallets holding significant PUNDIX amounts.

- Regularly verify wallet balances through Etherscan (https://etherscan.io/token/0x0FD10b9899882a6f2fcb5c371E17e70FdEe00C38) rather than clicking wallet links.

- Use VPN and secure internet connections when accessing Web3 wallets.

V. PUNDIX Potential Risks and Challenges

PUNDIX Market Risks

-

Severe Price Depreciation: PUNDIX has declined 56.92% over 12 months and 83.16% from all-time high of $10.07. This significant value erosion suggests either fundamental challenges to the business model or severe market sentiment deterioration. The token's market cap of $56.27 million remains relatively modest compared to established payment solutions.

-

Low Trading Liquidity: 24-hour trading volume of $15,094 USD is extremely low, representing only 0.027% of market capitalization. This illiquidity creates potential slippage risks for position entries/exits and increases price manipulation vulnerability.

-

Market Dominance Insignificance: At 0.0018% market dominance, PUNDIX commands minimal ecosystem influence. The token ranks #468 by market cap, indicating limited institutional adoption and investor interest compared to major payment infrastructure projects.

PUNDIX Regulatory Risks

-

Payment Compliance Uncertainty: XPOS devices and offline payment networks operate in regulatory gray zones across 25+ countries. Changes in local payment regulations, AML/KYC requirements, or cryptocurrency restrictions could impede deployment and utility expansion.

-

Token Classification Risk: Regulatory bodies may reclassify PUNDIX from utility token to security token, subjecting it to stricter regulations, registration requirements, and trading restrictions on major platforms.

-

Geographic Expansion Constraints: Different jurisdictions have varying cryptocurrency merchant acceptance rules. Regulatory tightening in key markets could limit Pundi X's ability to expand XPOS distribution and reduce PUNDIX utility.

PUNDIX Technology Risks

-

Blockchain Dependency: As an ERC-20 token on Ethereum, PUNDIX inherits Ethereum's technical risks including network congestion, smart contract vulnerabilities, and upgrade complications. Ethereum network issues directly impact PUNDIX transaction feasibility.

-

Offline Synchronization Challenges: The core value proposition (offline cryptocurrency transactions via XPOS) requires complex blockchain reconciliation processes. Technical failures could undermine user trust and transaction security.

-

Competitive Displacement: Emerging payment solutions, central bank digital currencies (CBDCs), and improved merchant payment systems could render Pundi X's offline payment approach obsolete or unnecessary.

VI. Conclusion and Action Recommendations

PUNDIX Investment Value Assessment

PUNDIX presents a high-risk, speculative opportunity in the niche cryptocurrency payment infrastructure sector. While the core mission—enabling widespread cryptocurrency adoption through accessible offline payment solutions—remains strategically sound, current market valuations suggest significant skepticism. The token has lost 83% from peak valuations, trades with minimal liquidity, and shows declining investor interest (ranked #468 globally).

The project demonstrates operational progress with XPOS deployment in 25+ countries and 100,000+ XWallet users, providing a business foundation. However, the risk-reward profile remains unfavorable for most investors given the substantial price decline, regulatory uncertainties, and competitive pressures in the payment infrastructure space.

PUNDIX Investment Recommendations

✅ Beginners: Avoid PUNDIX as a primary cryptocurrency holding. If interested in payment infrastructure, start with $50-100 educational positions on Gate.com to understand market dynamics. Never allocate more than 1% of portfolio to this token.

✅ Experienced Investors: Consider PUNDIX only as a speculative position (2-5% of crypto portfolio) if you have conviction in Pundi X's offline payment ecosystem expansion. Implement strict stop-losses at 15% below entry points. Use dollar-cost averaging over 3-6 months rather than lump-sum purchases.

✅ Institutional Investors: Conduct thorough due diligence on regulatory compliance across Pundi X's operating jurisdictions before considering allocation. If proceeding, limit exposure to 1-3% of fund cryptocurrency allocation with defined exit criteria tied to business milestones (XPOS deployment targets, XWallet user growth, merchant adoption rates).

PUNDIX Trading Participation Methods

-

Spot Trading on Gate.com: Buy and hold PUNDIX directly. Create account, complete KYC verification, fund account with stablecoin, and trade PUNDIX/USDT or PUNDIX/USDC pairs. Suitable for long-term holders and position averaging strategies.

-

Gate.com Web3 Wallet Management: Transfer purchased PUNDIX to Gate.com Web3 Wallet for enhanced security and potential staking/rewards participation. Provides direct blockchain interaction and self-custody benefits.

-

Dollar-Cost Averaging Program: Execute recurring small purchases (e.g., $25-50 weekly) on Gate.com to reduce entry price volatility and psychological pressure of market timing. Particularly relevant given current price near historical lows.

Cryptocurrency investment carries extreme risks. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial situation. Strongly recommend consulting professional financial advisors. Never invest money you cannot afford to lose completely. PUNDIX's speculative nature and market position make it suitable only for experienced investors with high risk tolerance.

FAQ

Is pundix crypto a good investment?

PUNDIX shows strong potential with growing adoption in payment solutions and blockchain integration. Its innovative technology and expanding use cases make it an attractive opportunity for investors believing in Web3's future growth and mainstream adoption.

Will pi coin reach $100?

Pi reaching $100 is unlikely. It would require a market cap of $670.8 billion, significantly exceeding current valuations. While long-term growth is possible, such price levels depend on massive adoption and market expansion beyond current trajectories.

How much will 1 pi be worth in 2025?

In 2025, 1 PI is expected to be worth between $0.30 and $0.70. This prediction is based on future market trends and network utility development. Exact value may vary depending on market conditions.

Is pi coin going to be worth anything?

Pi Coin's future value depends on exchange listings and market adoption. Currently, it lacks established blockchain infrastructure. Potential exists if the network gains mainstream acceptance and achieves exchange integration.

How to Buy Crypto: A Step-by-Step Guide with Gate.com

MACD & RSI: Essential Indicators for Predicting Quq's Price Trends in 2025

Divergence in Trading: What It Means and How to Spot It

why is crypto crashing and will it recover ?

What Does "Stonks" Mean? The Meme That Took Over Trading

Why is CryptoJack so hopeful about Gate.com and GT TOKEN in this bull run?

A Comprehensive Guide to Buying Super Trump Coin (STRUMP)

Guide to Bridging Assets to Arbitrum

Beginner's Guide to Earning Passive Income through Liquidity Mining in DeFi

Discover a Solana Meme Coin Offering Unique Gaming Experiences and NFT Potential

Top 10 Promising Cryptocurrencies to Consider for 2024 Investments