2025 QANX Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Upcoming Year

Introduction: Market Position and Investment Value of QANX

QANplatform (QANX) stands as the first hybrid blockchain platform featuring quantum resistance, positioning itself at the forefront of next-generation blockchain infrastructure. Since its inception in 2021, QANX has established itself as a pioneering solution addressing quantum computing threats to blockchain security. As of 2025, QANX maintains a market capitalization of approximately $28.51 million, with a circulating supply of 1.7 billion tokens trading at around $0.01677 per token. This quantum-resistant asset is increasingly playing a critical role in enabling developers to build secure smart contracts, DApps, DeFi solutions, tokens, NFTs, and metaverse applications on its blockchain platform.

This article will conduct a comprehensive analysis of QANX's price trajectory through 2025-2030, integrating historical performance patterns, market supply dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

QANX Market Analysis Report

I. QANX Price History Review and Current Market Status

QANX Historical Price Trajectory

-

2021: Project launch and early market phase. QANX reached its all-time high of $0.203412 on November 28, 2021, marking the peak of initial investor enthusiasm for the quantum-resistant blockchain platform.

-

2023: Market correction phase. QANX hit its all-time low of $0.00011724 on January 13, 2023, reflecting significant market pullback and adjustment following the previous bull cycle.

-

2025: Continued consolidation. From the ICO launch price of $0.048563, QANX has declined by approximately 65.47%, demonstrating substantial long-term depreciation against the initial offering valuation.

QANX Current Market Stance

As of December 19, 2025, QANX is trading at $0.01677, representing a -3.05% decline over the past 24 hours. The token has experienced notable weakness across multiple timeframes, with a -10.91% drop over 7 days and a -26.20% decline over the past month. The one-year performance shows a -75.03% decrease, underscoring prolonged bearish pressure.

Key Market Metrics:

- 24-hour Price Range: $0.01637 - $0.01763

- Market Capitalization: $28,509,000.0 (at current circulating supply)

- Fully Diluted Valuation: $35,209,453.50

- 24-hour Trading Volume: $38,544.19

- Circulating Supply: 1,700,000,000 QANX (51.00% of total supply)

- Total Supply: 2,099,550,000 QANX

- Maximum Supply: 3,333,333,000 QANX

- Market Ranking: #715

- Circulating Market Share: 0.0011%

- Active Holders: 7,266

The token is listed on 3 exchanges and maintains presence on Ethereum (ETH) and Binance Smart Chain (BSC) networks. Current market sentiment reflects extreme fear conditions in the broader cryptocurrency market.

View current QANX market price on Gate.com

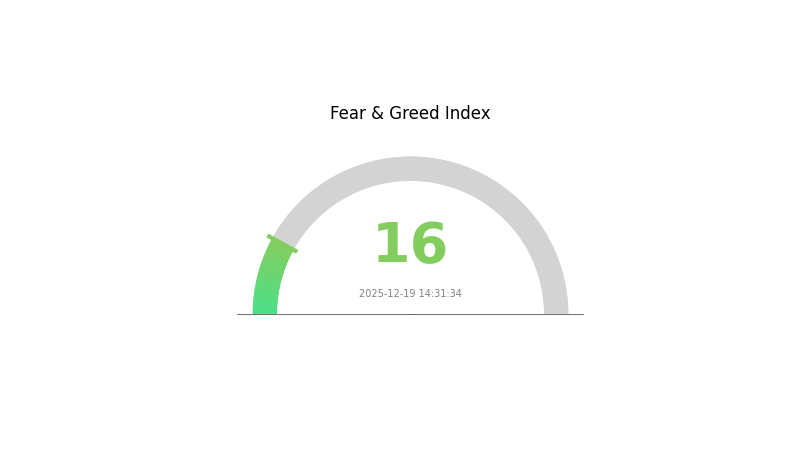

QANX Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 16. This indicates a significant level of market pessimism and risk aversion among investors. When the index reaches such low levels, it often signals potential capitulation selling and excessive pessimism. However, extreme fear can also present contrarian buying opportunities for investors with strong conviction and long-term perspectives. Market participants should exercise caution while remaining alert to potential reversal signals as sentiment typically rebounds from such extreme conditions.

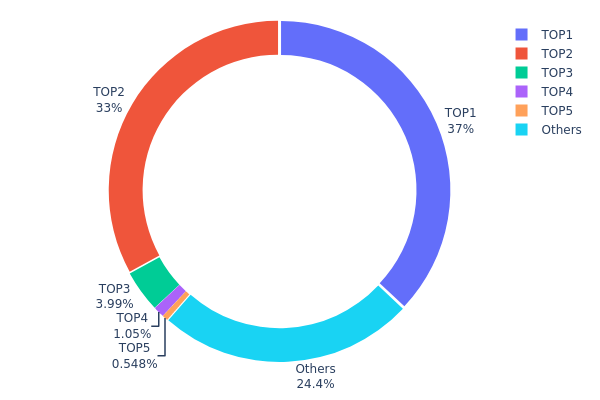

QANX Holdings Distribution

The address holdings distribution map illustrates the concentration of QANX tokens across different wallet addresses on the blockchain. This metric provides critical insights into token liquidity, market structure stability, and the potential for price volatility driven by large holder movements. By analyzing how tokens are distributed among top holders and retail participants, we can assess the decentralization level and vulnerability to coordinated selling or market manipulation.

QANX exhibits pronounced concentration characteristics, with the top two addresses commanding 70.01% of total token supply. The dead wallet address (0x0000...00dead) holds 37.01%, representing tokens likely burned or permanently removed from circulation, which effectively reduces the active supply. The second-largest address (0x3e9d...33a32a) controls 33.00%, indicating a significant single entity with substantial influence over token availability and price discovery. Beyond these dominant positions, concentration remains considerable: the third-largest holder maintains 3.99%, while the remaining top five addresses collectively account for approximately 5.58%. The distribution of 24.41% among other addresses suggests moderate retail participation, though this segment remains fragmented and subordinate to whale-level holdings.

This distribution structure presents tangible risks to market maturity and price stability. The heavy concentration in top addresses creates potential liquidity bottlenecks and exposes the token to significant price pressure should major holders execute large transactions. The substantial dead wallet allocation, while reducing active supply, does not mitigate concentration risks among operational addresses. The token's overall decentralization score remains limited, with governance and price discovery mechanisms vulnerable to the coordinated actions of a small number of stakeholders, suggesting that QANX's on-chain structure currently lacks the distributed resilience typical of mature digital assets.

Click to view current QANX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 1233783.00K | 37.01% |

| 2 | 0x3e9d...33a32a | 1100000.00K | 33.00% |

| 3 | 0xaaa9...cc3aaa | 133071.26K | 3.99% |

| 4 | 0xc882...84f071 | 35023.84K | 1.05% |

| 5 | 0xd7f3...904cd8 | 18275.10K | 0.54% |

| - | Others | 813179.80K | 24.41% |

II. Core Factors Affecting QANX's Future Price

Macroeconomic Environment

-

Macroeconomic Trends Impact: QANplatform's exchange rate is influenced by macroeconomic trends and conditions, which play a significant role in determining price fluctuations.

-

Policy Regulatory Effects: Policy regulation and monitoring constitute key factors affecting future price movements. Changes in regulatory frameworks across different jurisdictions can substantially impact investor sentiment and market demand.

-

Market Sentiment: Investor sentiment plays a critical role in price dynamics. Market emotions and collective investor perceptions significantly influence QANX's price trajectory.

Technology Development and Ecosystem Building

- Technological Innovation: Continuous technological innovation serves as an important driver for QANX's long-term price appreciation. Advancements and improvements in the QANplatform ecosystem contribute to sustained market interest and adoption.

Three, 2025-2030 QANX Price Forecast

2025 Outlook

- Conservative Forecast: $0.01512 - $0.0168

- Neutral Forecast: $0.0168

- Optimistic Forecast: $0.02117 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation phase with increasing institutional interest and protocol maturation

- Price Range Predictions:

- 2026: $0.01006 - $0.02145 (12% upside potential)

- 2027: $0.01152 - $0.02851 (20% upside potential)

- 2028: $0.02144 - $0.03143 (44% upside potential)

- Key Catalysts: Protocol upgrades, expanding developer ecosystem, increased utility adoption, strategic partnerships, and mainstream market recognition

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01534 - $0.03766 (65% appreciation by 2029, assuming steady adoption and market stability)

- Optimistic Scenario: $0.02144 - $0.04097 (94% appreciation by 2030, contingent on breakthrough technological innovations and significant market expansion)

- Transformation Scenario: Above $0.04097 (contingent on revolutionary use cases, regulatory clarity, and mass market adoption across Web3 infrastructure)

- 2030-12-19: QANX demonstrates sustained price appreciation trajectory with projected average trading value at $0.03278, reflecting matured market positioning

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02117 | 0.0168 | 0.01512 | 0 |

| 2026 | 0.02145 | 0.01898 | 0.01006 | 12 |

| 2027 | 0.02851 | 0.02022 | 0.01152 | 20 |

| 2028 | 0.03143 | 0.02436 | 0.02144 | 44 |

| 2029 | 0.03766 | 0.0279 | 0.01534 | 65 |

| 2030 | 0.04097 | 0.03278 | 0.01868 | 94 |

QANplatform (QANX) Investment Analysis Report

IV. QANX Professional Investment Strategy and Risk Management

QANX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with strong conviction in quantum-resistant blockchain technology and long-term development potential

- Operational Recommendations:

- Accumulate QANX during market downturns, particularly when price significantly declines from historical highs

- Hold tokens through multiple market cycles to benefit from potential adoption of quantum-resistant infrastructure

- Dollar-cost averaging approach to minimize entry point risk given current 75.03% year-over-year decline

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price points at $0.01637 (24H low) and $0.01763 (24H high) for entry and exit signals

- Volume Analysis: Track 24H trading volume of $38,544 to identify momentum shifts and liquidity conditions

- Wave Trading Key Points:

- Identify reversal patterns during high volatility periods to capture short-term gains

- Monitor price trends across multiple timeframes (1H: +0.84%, 24H: -3.05%, 7D: -10.91%) for trend confirmation

QANX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation (with specific risk hedging protocols)

(2) Risk Hedging Solutions

- Diversification Strategy: Combine QANX holdings with established blockchain assets to reduce concentration risk

- Position Sizing: Limit individual trade size to prevent excessive exposure to volatility

(3) Secure Storage Solution

- Hardware wallet Approach: Use reputable hardware wallet solutions for long-term storage of QANX tokens

- Exchange Storage: For active traders, maintain QANX holdings on Gate.com with two-factor authentication enabled

- Security Considerations: Enable withdrawal whitelisting, use strong passwords, never share private keys, and perform regular security audits of account activity

V. QANX Potential Risks and Challenges

QANX Market Risk

- Severe Valuation Decline: QANX has experienced a 75.03% price decline over one year and 26.20% depreciation in the past month, indicating significant market sentiment deterioration

- Low Trading Liquidity: With only $38,544 in 24H trading volume and presence on only 3 exchanges, QANX faces limited market depth for large transactions

- Market Capitalization Pressure: Current market cap of $28.5 million represents only 51% of fully diluted valuation, suggesting significant dilution risk upon future token unlock events

QANX Regulatory Risk

- Emerging Technology Classification: Quantum-resistant blockchain technology remains relatively unregulated, creating uncertainty in future regulatory frameworks

- Jurisdictional Uncertainties: Different regulatory approaches across jurisdictions may impact QANX adoption and utility

- Compliance Evolution: As governments establish clearer cryptocurrency regulations, projects may face unexpected compliance costs or restrictions

QANX Technical Risk

- Unproven Quantum Resistance: The practical effectiveness of PoR (Proof of Randomness) consensus algorithm against quantum computing threats remains untested at scale

- Development Execution Risk: Successful implementation of planned features (EVM compatibility, multilingual smart contracts, DApp ecosystem) depends on development team execution

- Network Adoption: Low holder count of 7,266 addresses indicates minimal network adoption, creating bootstrapping challenges for ecosystem growth

VI. Conclusion and Action Recommendations

QANX Investment Value Assessment

QANplatform represents a speculative investment in emerging quantum-resistant blockchain infrastructure. The project addresses a legitimate long-term concern regarding quantum computing threats to cryptographic security. However, significant challenges exist: the token has experienced substantial value erosion (-75% YoY), maintains minimal market liquidity, and operates with unproven technology at scale. The project's success depends on achieving meaningful developer adoption, successful technical execution, and market recognition of quantum resistance as a critical blockchain feature. Current valuation reflects substantial risk and early-stage uncertainty.

QANX Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) only if you have strong risk tolerance and genuine interest in quantum-resistant technology research. Consider this a high-risk, speculative position.

✅ Experienced Investors: May consider 2-5% allocation as a diversification play within quantum computing/cryptography theme, with clear stop-loss discipline and regular portfolio rebalancing.

✅ Institutional Investors: Conduct thorough technical due diligence on PoR consensus mechanism, evaluate development team credentials, and establish clear milestones before consideration of any allocation.

QANX Trading Participation Methods

- Direct Purchase: Acquire QANX through Gate.com exchange using ETH or BSC networks; ensure wallet security protocols are followed

- Trading Activity: Execute spot trading on Gate.com leveraging price volatility, with strict adherence to risk management principles

- Long-term Staking: Hold tokens in secure wallets pending potential future network incentive mechanisms or exchange staking programs

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Can quant reach $10 000?

While unlikely in the near term, Quant reaching $10,000 is theoretically possible with significant market expansion and adoption growth. This would require substantial increases in trading volume and institutional interest in the ecosystem.

What is qanx crypto?

QANX is the native token of QANplatform, a quantum-resistant Layer 1 blockchain designed for enterprise applications. QANX powers transactions, enables staking rewards, and incentivizes developers building on the platform.

What will QNT be worth in 2030?

Quant (QNT) is projected to reach between $101.21 and $190.35 by 2030, based on current market trends and expert analysis. The actual price may vary depending on market conditions and adoption rates.

EGL1: The Rising Dark Horse with 60% Completed Roadmap

Manyu Whitepaper Deep Dive: Core Logic, Use Cases, and Technical Innovation

JuChain White Paper Analysis: Core Value Proposition and Growth Potential

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

$PI Coin Price Prediction, $1 Incoming ?

Pi to GBP: Price and Prediction

How Do On-Chain Data Analysis Reveal WLFI's True Circulating Supply and Whale Movement Trends?

Mastering the Wyckoff Accumulation Phase in Cryptocurrency Trading

What is TST (Test) Token Price, Market Cap, and 24-Hour Trading Volume Overview?

Exploring UnityMeta (UMT): A Beginner's Guide to Cryptocurrency

Ethereum Upgrade Release and Initial Value Exploration