2025 QKA Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of QKA

Qkacoin (QKA) is a meme coin themed around quokkas, the small marsupials native to Western Australia. As of December 22, 2025, QKA has established itself as an emerging digital asset with a market capitalization of approximately $8.24 million and a circulating supply of 31,668,129 tokens, maintaining a price point around $0.2603. Trading on platforms like Gate.com, QKA represents a unique entry into the meme coin ecosystem with its distinctive wildlife-inspired branding.

This article will provide a comprehensive analysis of QKA's price trajectory and market trends as of December 2025, incorporating historical price patterns, market dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasting and practical investment guidance for market participants.

QKA Price History Review and Current Market Status

QKA Historical Price Trajectory

QKA reached its all-time high (ATH) of $2.50 on July 29, 2025, marking the peak of market enthusiasm for this quokka-themed meme coin. The token subsequently experienced significant downward pressure, declining substantially over the following months. By December 16, 2025, QKA touched its all-time low (ATL) of $0.15587, representing a dramatic 93.77% decline from its peak valuation.

QKA Current Market Status

As of December 22, 2025, QKA is trading at $0.2603, with a 24-hour trading volume of $12,067.56. The token demonstrates a modest 24-hour price increase of 4.25%, recovering slightly from recent lows. However, the broader trend remains bearish, with QKA down 74.49% over the past 7 days and 68.41% over the past 30 days. On a yearly basis, the token has depreciated 51.81% from its initial launch price.

The fully diluted market capitalization stands at $8.24 million, with a circulating supply of 31,668,129 QKA tokens. The maximum supply is fixed at the same amount, indicating that all tokens are currently in circulation. Market dominance remains minimal at 0.00025%, reflecting QKA's position as a smaller-cap token within the broader cryptocurrency ecosystem.

With only 77 token holders currently recorded, QKA maintains a concentrated holder base. The token operates on the Solana (SOL) blockchain network and is available for trading on Gate.com.

View current QKA market price on Gate.com

QKA Market Sentiment Index

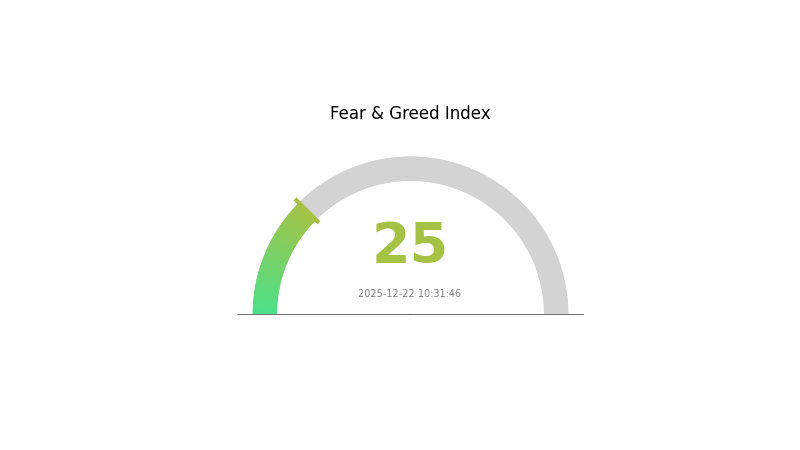

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 25. This exceptionally low level indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, market volatility typically increases as participants reassess risk exposure. Extreme fear often presents contrarian trading opportunities for experienced investors, as panic-driven selling may create attractive entry points. However, caution is advised, as further market deterioration cannot be ruled out. Monitor key support levels and manage position sizes accordingly. Stay informed on market developments through Gate.com's comprehensive market data tools.

QKA Holdings Distribution

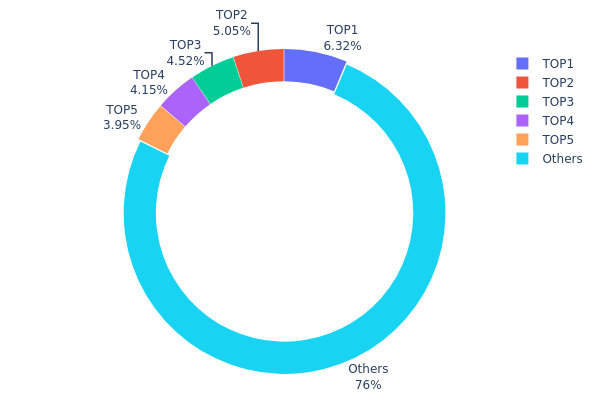

The address holdings distribution represents the concentration of QKA tokens across blockchain addresses, providing critical insights into token ownership structure and potential market dynamics. By analyzing the top holders and their respective allocations, researchers can assess decentralization levels, identify potential concentration risks, and evaluate the token's vulnerability to coordinated market movements.

Current analysis reveals that QKA maintains a relatively balanced distribution structure. The top five addresses collectively hold approximately 23.96% of total circulating tokens, with the largest holder controlling 6.31% of the supply. This concentration level falls within moderate parameters compared to industry standards. Notably, the "Others" category accounts for 76.04% of holdings, distributed across the remaining address base, indicating substantial decentralization of token ownership and reducing the likelihood of coordinated price manipulation by a small group of stakeholders.

The distribution pattern suggests stable on-chain governance and reduced systemic risk from large holder liquidations. With no single address controlling an excessive proportion of the token supply, QKA demonstrates reasonable resilience against sudden market shocks triggered by whale activity. The fragmented holder base across numerous addresses contributes to improved market structure integrity, promoting more organic price discovery mechanisms and reducing the potential for artificial volatility. This decentralized holding architecture reflects a healthier token ecosystem, where market movements are more likely driven by genuine market sentiment rather than concentrated whale activities.

Click to view current QKA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | DRA3dV...rx6Zry | 2000.00K | 6.31% |

| 2 | 9Ukic7...negRSi | 1600.00K | 5.05% |

| 3 | GhZDsp...2P4ENL | 1430.00K | 4.51% |

| 4 | AGXpE4...qEzpEf | 1315.59K | 4.15% |

| 5 | 6WFYLZ...83ym2q | 1250.04K | 3.94% |

| - | Others | 24072.49K | 76.04% |

Core Factors Influencing QKA's Future Price

Macroeconomic Environment

-

Market Demand and Investment Trends: QKA's future price is significantly influenced by overall market demand and global investment trends in the cryptocurrency sector. As market sentiment shifts, investor appetite for digital assets like QKA can experience considerable fluctuations.

-

Regulatory Changes: Regulatory developments at both national and international levels play a crucial role in determining QKA's price trajectory. Changes in cryptocurrency policy and compliance frameworks can have material impacts on market valuation.

-

Global Economic Trends: Broader macroeconomic conditions, including inflation patterns, currency valuations, and geopolitical developments, continue to influence cryptocurrency markets and QKA's performance.

Market Dynamics

-

Supply and Demand Relationship: The fundamental supply-demand dynamics remain a key driver of QKA's price movements. Market liquidity, trading volumes, and the availability of QKA across exchanges like Gate.com affect price discovery and volatility.

-

Technology and Innovation: Advancements in blockchain technology and improvements to the underlying infrastructure supporting QKA can enhance its utility and long-term value proposition, though such developments remain subject to market conditions and adoption rates.

Note: QKA's future price trajectory depends on a multifaceted combination of factors including market sentiment, regulatory environment, macroeconomic conditions, and technological developments. Investors should conduct comprehensive due diligence before making investment decisions.

III. 2025-2030 QKA Price Forecast

2025 Outlook

- Conservative Forecast: $0.1978-$0.2603

- Neutral Forecast: $0.2603

- Optimistic Forecast: $0.2994 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with increasing institutional interest and ecosystem expansion.

- Price Range Forecast:

- 2026: $0.2183-$0.4002 (7% upside potential)

- 2027: $0.2652-$0.4420 (30% cumulative gains)

- 2028: $0.3402-$0.4496 (50% cumulative gains)

- Key Catalysts: Protocol upgrades, strategic partnerships, market adoption rate acceleration, and macroeconomic sentiment improvements affecting risk assets.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.3867-$0.4959 (61% cumulative gains by 2029, assuming stable ecosystem growth and moderate market expansion)

- Optimistic Scenario: $0.4398-$0.4720 (sustained momentum through mainstream adoption and increased utility integration)

- Transformation Scenario: $0.4398-$0.4963 (achieved under conditions of breakthrough technological innovation, major institutional adoption waves, and favorable regulatory frameworks enabling mass market participation)

- 2025-12-22: QKA trading at historical consolidation levels with preparation for multi-year growth trajectory through 2030

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.29935 | 0.2603 | 0.19783 | 0 |

| 2026 | 0.40015 | 0.27982 | 0.21826 | 7 |

| 2027 | 0.44198 | 0.33998 | 0.26519 | 30 |

| 2028 | 0.44963 | 0.39098 | 0.34015 | 50 |

| 2029 | 0.49596 | 0.42031 | 0.38668 | 61 |

| 2030 | 0.47188 | 0.45813 | 0.43981 | 76 |

QKA Investment Strategy and Risk Management Report

IV. Professional Investment Strategy and Risk Management for QKA

QKA Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors with long-term investment horizons and belief in meme coin community development

- Operation Recommendations:

- Accumulate QKA during market downturns when sentiment is extremely bearish, given the current 74.49% decline over 7 days

- Hold positions through market cycles without reacting to short-term volatility

- Participate in community activities to support ecosystem growth

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the recent low of $0.15587 (ATL on December 16, 2025) as potential support and the all-time high of $2.5 (ATL on July 29, 2025) as resistance

- Price Action: Analyze the 24-hour positive momentum of 4.25% against the broader 7-day downtrend to identify entry and exit points

- Wave Trading Key Points:

- Enter positions during extreme pessimism when price approaches historical lows

- Take profits strategically when price rebounds toward previous resistance levels

QKA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio

- Active Investors: 3-5% of portfolio

- Professional Investors: 5-10% of portfolio (with strict stop-losses at predetermined levels)

(2) Risk Hedging Approaches

- Portfolio Diversification: Allocate QKA holdings within a broader diversified cryptocurrency portfolio to mitigate concentration risk

- Position Sizing: Implement strict position limits to ensure no single meme coin exceeds acceptable loss thresholds

(3) Secure Storage Solutions

- Self-Custody Options: Store QKA tokens on the Solana blockchain using secure wallet management practices

- Exchange Storage: Maintain trading portions on Gate.com for accessibility and trading convenience

- Security Considerations: Protect private keys rigorously, use hardware-level security practices, and enable multi-signature authentication where available

V. Potential Risks and Challenges for QKA

Market Risks

- Extreme Volatility: QKA has experienced a 74.49% decline over 7 days and 68.41% decline over 30 days, indicating severe price swings that can result in significant losses

- Low Trading Volume: With only $12,067.56 in 24-hour volume, the token exhibits poor liquidity, making large positions difficult to exit without substantial price impact

- Concentration Risk: With only 77 holders, QKA demonstrates extreme concentration, creating vulnerability to whale manipulation and sudden price movements

Regulatory Risks

- Meme Coin Classification: Regulatory authorities in various jurisdictions may implement stricter oversight of meme coins, potentially affecting QKA's trading status

- Compliance Uncertainty: The evolving regulatory landscape for tokens on Solana blockchain may impose restrictions on trading, listing, or distribution

- Jurisdictional Restrictions: Different countries may prohibit or restrict access to meme coins, limiting the addressable market and investor base

Technical Risks

- Blockchain Dependency: QKA's functionality depends entirely on the Solana network's stability and security; any critical issues on Solana could impact token utility

- Smart Contract Vulnerabilities: While not detailed in available information, any underlying smart contracts could contain exploitable vulnerabilities

- Network Congestion: High transaction volumes on Solana may result in delays or failed transactions affecting QKA trading ability

VI. Conclusions and Action Recommendations

QKA Investment Value Assessment

QKA is a meme coin themed around quokkas, native to Western Australia's coastal regions. The token operates on the Solana blockchain with a fixed supply of 31,668,129 tokens, currently valued at approximately $0.2603 per token with a market capitalization of $8.24 million. While QKA demonstrates community support and a unique thematic identity, it faces significant challenges including extreme volatility (74.49% weekly decline), very low trading volume ($12,067.56 daily), and extreme holder concentration (77 holders). The token's risk profile is exceptionally high, and investment decisions should be based on high-risk tolerance and community participation motivations rather than fundamental value analysis.

QKA Investment Recommendations

✅ Beginners: Start with minimal allocations (under 1% of crypto portfolio) only if you understand meme coin dynamics and can afford complete loss of investment ✅ Experienced Investors: Consider QKA only as a high-risk, speculative position with strict stop-loss orders; never exceed 5% of your cryptocurrency portfolio ✅ Institutional Investors: Due to extreme volatility and limited liquidity, QKA is generally unsuitable for institutional portfolios; if considered, apply rigorous risk controls and position sizing constraints

QKA Trading Participation Methods

- Direct Purchase on Gate.com: Access QKA trading pairs directly through Gate.com's spot trading platform for immediate acquisition

- Solana Network Trading: Interact with QKA tokens through Solana-based exchanges and decentralized platforms for alternative trading routes

- Community Participation: Engage with the QKA community through official channels (website: https://qkacoin.org/, Twitter: https://x.com/qkacoin) to stay informed about project developments

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make careful decisions based on their individual risk tolerance and should consult with professional financial advisors. Never invest amounts you cannot afford to lose completely.

FAQ

How high can Quant (QKA) go in 2025?

Quant (QKA) is projected to reach approximately $215 by the end of 2025, based on current market trends and technical analysis. This forecast reflects anticipated adoption growth and broader market momentum in the Web3 ecosystem.

What factors influence QKA price predictions?

QKA price predictions are influenced by macro-economic conditions, energy prices, and international carbon emission prices. These key factors drive market trends and determine future pricing movements.

What is Quant (QKA) and what is its use case?

Quant (QKA) is a cryptocurrency utilizing quantitative finance principles and mathematical models for algorithmic trading strategies. Its use case enables data-driven investment decisions, identifies profitable trading patterns, and optimizes risk management through advanced analytics.

What are the risks and challenges for QKA price growth?

QKA price growth faces market volatility risks, regulatory uncertainties, and operational challenges. Short selling exposure creates unlimited upside risk potential. Liquidity fluctuations and market sentiment shifts also impact price stability and growth trajectory.

2025 SLERF Price Prediction: Analyzing Market Trends and Future Growth Potential in the Expanding Digital Asset Ecosystem

2025 AURASOL Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHILLGUY Price Prediction: Will This Viral Meme Coin Reach New Highs or Face a Market Correction?

2025 NOBODY Price Prediction: Will the Token Reach New Highs Amid Market Volatility?

2025 FWOG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 QKA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

XRP Price Forecast for 2025-2026: Is It a Good Time to Invest?

Quant Price Forecast 2023-2031: Is QNT a Smart Long-Term Investment?

What is QUACK: A Comprehensive Guide to Understanding This Emerging Technology and Its Applications in Modern Computing

What is VINU: A Comprehensive Guide to Virtual Integrated Network Utilities

What is SHDW: A Comprehensive Guide to Shadow's Revolutionary Blockchain Infrastructure