2025 QNT Price Prediction: Analyzing Potential Growth and Market Trends for Quant Network's Token

Introduction: QNT's Market Position and Investment Value

Quant (QNT), as a technology provider enabling trusted digital interaction, has made significant strides since its inception in 2018. As of 2025, Quant's market capitalization has reached $1.27 billion, with a circulating supply of approximately 14.54 million tokens, and a price hovering around $87.25. This asset, often referred to as the "interoperability solution," is playing an increasingly crucial role in blockchain innovation and enterprise adoption.

This article will comprehensively analyze Quant's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. QNT Price History Review and Current Market Status

QNT Historical Price Evolution

- 2018: Initial launch, price reached a low of $0.215773 on August 23

- 2021: Bull market peak, price hit an all-time high of $427.42 on September 11

- 2022-2023: Crypto winter, price declined from highs but showed resilience

QNT Current Market Situation

As of October 16, 2025, QNT is trading at $87.25, with a market capitalization of $1.27 billion. The token has experienced a 2.51% decrease in the last 24 hours, with a trading volume of $566,506. QNT's price has seen a significant decline of 14.64% over the past week and 12.97% in the last 30 days. However, it still maintains a 30.55% increase compared to one year ago, showcasing its long-term growth potential despite recent market volatility.

The current circulating supply of QNT is 14,544,176 tokens, representing 31.99% of the total maximum supply of 45,467,000. This relatively low circulation ratio suggests potential for future growth as more tokens enter the market. The fully diluted valuation stands at $3.97 billion, indicating substantial room for expansion if the project achieves its long-term goals.

Click to view the current QNT market price

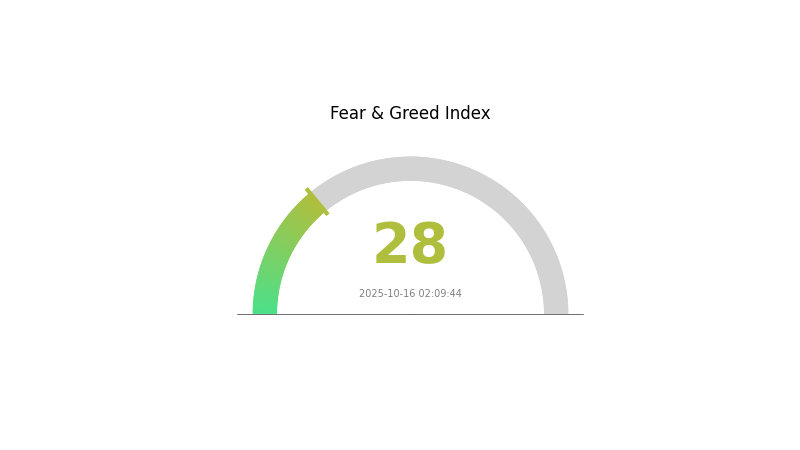

QNT Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index sits at 28, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can present chances for value investments, it's crucial to conduct thorough research and manage risks. Gate.com offers tools and resources to help traders navigate these market conditions. Remember, market sentiment can shift rapidly, so stay informed and adjust your strategy accordingly.

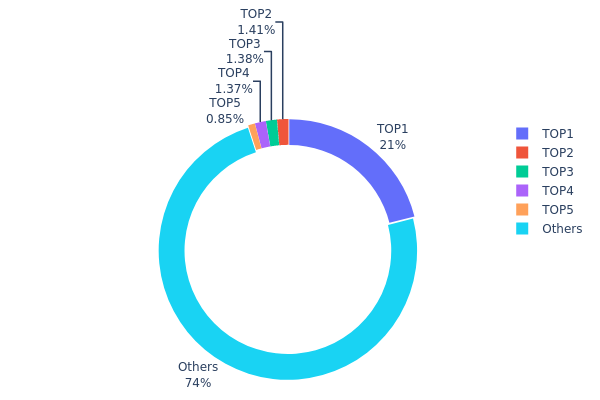

QNT Holdings Distribution

The address holdings distribution data for QNT reveals a moderately concentrated ownership structure. The top address holds a significant 21% of the total supply, with 9,550,600 QNT tokens. This concentration is noteworthy but not necessarily alarming for a cryptocurrency project. The subsequent top addresses hold considerably smaller portions, ranging from 1.40% to 0.85% of the supply.

Importantly, 74.02% of QNT tokens are distributed among numerous other addresses, indicating a relatively wide dispersion of ownership beyond the top holders. This distribution suggests a balance between major stakeholders and a broader community of token holders. While the presence of a dominant address holding over 20% of the supply could potentially influence market dynamics, the overall distribution appears to maintain a degree of decentralization.

The current holdings structure implies a moderate level of market stability, as no single entity apart from the top address has overwhelming control. However, investors should remain aware that significant moves by the largest holder could impact price volatility. Overall, the QNT token distribution reflects a maturing ecosystem with a mix of major players and diverse smaller holders, contributing to a relatively robust on-chain structure.

Click to view the current QNT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4a22...254675 | 9550.60K | 21.00% |

| 2 | 0xf977...41acec | 640.00K | 1.40% |

| 3 | 0x48e9...04a170 | 625.78K | 1.37% |

| 4 | 0x8266...22d78b | 622.81K | 1.36% |

| 5 | 0x7e8b...8e594c | 386.67K | 0.85% |

| - | Others | 33641.15K | 74.02% |

II. Key Factors Affecting QNT's Future Price

Institutional and Whale Dynamics

- Whale Activity: The surge in whale activity brings more possibilities to Quant's price trends. If these large investors continue to accumulate, it could potentially drive the price upwards.

Macroeconomic Environment

- Inflation Hedging Properties: As a digital asset, QNT may be viewed as a potential hedge against inflation, similar to other cryptocurrencies.

- Geopolitical Factors: International situations and geopolitical events can influence the overall cryptocurrency market, including QNT.

Technological Development and Ecosystem Building

- Interoperability Solutions: QNT focuses on enterprise-level blockchain interoperability. The increasing demand for Real World Assets (RWA) and cross-chain solutions could positively impact QNT's value.

- Ecosystem Applications: The growth of DApps and ecosystem projects utilizing Quant's technology could drive adoption and potentially increase QNT's value.

III. QNT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $51.05 - $88.01

- Neutral prediction: $88.01 - $98.57

- Optimistic prediction: $98.57 - $109.13 (requires favorable market conditions and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $72.15 - $160.87

- 2028: $83.75 - $207.97

- Key catalysts: Technological advancements, expanded use cases, and broader market recovery

2029-2030 Long-term Outlook

- Base scenario: $173.77 - $192.89 (assuming steady growth and adoption)

- Optimistic scenario: $212.00 - $254.61 (assuming rapid ecosystem expansion and market penetration)

- Transformative scenario: $254.61+ (extreme favorable conditions such as major institutional adoption and regulatory clarity)

- 2030-12-31: QNT $254.61 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 109.13 | 88.01 | 51.0458 | 0 |

| 2026 | 138 | 98.5712 | 92.65693 | 12 |

| 2027 | 160.87 | 118.29 | 72.15412 | 35 |

| 2028 | 207.97 | 139.58 | 83.74609 | 59 |

| 2029 | 212 | 173.77 | 121.64 | 99 |

| 2030 | 254.61 | 192.89 | 175.53 | 121 |

IV. QNT Professional Investment Strategies and Risk Management

QNT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in blockchain interoperability

- Operation suggestions:

- Accumulate QNT during market dips

- Set price targets for partial profit-taking

- Store QNT in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Watch for breakouts above key resistance levels

- Set stop-loss orders to manage downside risk

QNT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple blockchain projects

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, regular security audits

V. Potential Risks and Challenges for QNT

QNT Market Risks

- Volatility: Cryptocurrency market's inherent price fluctuations

- Competition: Emerging interoperability solutions may challenge Quant's market position

- Adoption: Slow enterprise adoption of blockchain technology could impact growth

QNT Regulatory Risks

- Global regulations: Varying cryptocurrency regulations across jurisdictions

- Securities classification: Potential for QNT to be classified as a security in some countries

- Compliance costs: Increased regulatory requirements may impact operational costs

QNT Technical Risks

- Network security: Potential vulnerabilities in the Overledger system

- Scalability: Challenges in handling increased network load as adoption grows

- Interoperability issues: Unforeseen complications in connecting diverse blockchain networks

VI. Conclusion and Action Recommendations

QNT Investment Value Assessment

Quant (QNT) presents a compelling long-term value proposition in the blockchain interoperability sector. However, short-term volatility and regulatory uncertainties pose significant risks.

QNT Investment Recommendations

✅ Beginners: Start with small, regular investments to build a position over time ✅ Experienced investors: Consider a core holding with active management around market cycles ✅ Institutional investors: Evaluate QNT as part of a diversified blockchain technology portfolio

QNT Trading Participation Methods

- Spot trading: Direct purchase and holding of QNT tokens

- Staking: Participate in any available staking programs for passive income

- DeFi integration: Explore DeFi platforms that support QNT for additional yield opportunities

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can QNT reach $1000?

Yes, QNT has the potential to reach $1000. Based on current projections, it may even surpass this level and reach $10,000 by 2035, though this long-term prediction is speculative.

What will QNT be worth in 2030?

Based on current trends, QNT is projected to be worth approximately $540 by 2030. This forecast assumes continued growth in the cryptocurrency market.

Does QNT crypto have a future?

Yes, QNT has a promising future. Its blockchain-agnostic design, scarcity, and advanced features position it for significant growth in the evolving crypto landscape.

How high can quant go in 2025?

Based on market analysis, Quant (QNT) could reach between $80.92 and $121.39 in 2025, showing potential for significant growth.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Survey Note: Detailed Analysis of the Best AI in 2025

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Kaspa’s Journey: From BlockDAG Innovation to Market Buzz

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

Popular GameFi Games in 2025

Top 5 Crypto Credit Cards for Maximizing Rewards

When is the optimal time to sell following the Bitcoin halving?

Best Cryptocurrency Exchanges in the Evolving Market

What is SCF: A Comprehensive Guide to Supply Chain Finance and Its Impact on Modern Business

What is XCX: A Comprehensive Guide to Understanding the Emerging Technology and Its Applications