2025 RARI Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: RARI's Market Position and Investment Value

Rarible (RARI) serves as the native governance token of the Rarible ecosystem, powering infrastructure for onchain commerce. Since its launch in 2020, RARI has established itself as a key utility token within the NFT marketplace ecosystem. As of December 2025, RARI maintains a market capitalization of approximately $5.04 million, with a circulating supply of around 18.12 million tokens out of a total supply of 25 million. The token is currently trading at $0.2015, reflecting significant market dynamics and volatility.

RARI distinguishes itself as a governance and incentive token that drives long-term ecosystem growth and liquidity deepening. Transaction fees generated on the Rarible NFT marketplace are collected by the RARI Foundation and distributed to users in RARI tokens, creating a direct value-sharing mechanism. Token holders can also stake RARI to delegate voting power and earn yield while participating in governance decisions, aligning individual and ecosystem interests.

This analysis will examine RARI's price trends and market movements through 2025-2030, incorporating historical performance patterns, market supply and demand dynamics, ecosystem development trajectories, and macroeconomic factors. The evaluation aims to provide investors with professional price forecasts and actionable investment strategies grounded in comprehensive market research.

I. RARI Price History Review and Market Status

RARI Historical Price Evolution

RARI reached its all-time high of $46.7 on March 30, 2021, marking the peak of market enthusiasm during the NFT boom period. Since then, the token has experienced a prolonged decline, reflecting the broader market correction in the digital asset space. The token reached its all-time low of $0.191384 on December 19, 2025, representing a devastating 99.59% decline from its peak value.

RARI Current Market Situation

As of December 24, 2025, RARI is trading at $0.2015, positioned at #1,736 in the overall cryptocurrency market rankings. The token displays significant downward pressure across multiple timeframes:

- 1-hour performance: Down 0.69%

- 24-hour performance: Down 4.77%

- 7-day performance: Down 27.029%

- 30-day performance: Down 51.16%

- Year-to-date performance: Down 92.25%

The 24-hour trading range spans from $0.1949 to $0.2543, with a daily trading volume of approximately $142,294. The market capitalization stands at $3,651,559.28, while the fully diluted valuation reaches $5,037,500.00. With a circulating supply of 18,121,882.26 RARI tokens out of a total supply of 25,000,000, the circulation ratio is 72.49%.

The token maintains a market dominance of 0.00015%, reflecting its minimal influence on the overall cryptocurrency market. Current market sentiment indicates extreme fear, with a volatility index reading of 24.

Click to view current RARI market price

RARI Market Sentiment Indicator

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 24. This indicates heightened market anxiety and significant sell-off pressure among investors. During such periods of extreme fear, risk-averse traders typically reduce positions, while contrarian investors may view this as a potential accumulation opportunity. Market volatility remains elevated, and investors should exercise caution while considering long-term investment strategies. Monitor key support levels closely and ensure proper risk management throughout this uncertain market phase.

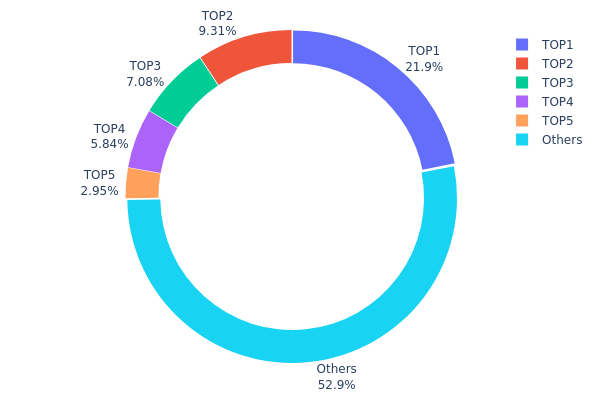

RARI Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across the blockchain network by tracking the proportion of total supply held by individual addresses. This metric serves as a critical indicator of token decentralization, market structure stability, and potential vulnerability to large-scale liquidation events or coordinated market movements.

RARI's current holding distribution exhibits moderate concentration characteristics. The top holder commands 21.90% of total supply, while the top five addresses collectively control 47.06% of circulating tokens. This level of concentration suggests a moderately centralized token structure, though not at critically alarming levels. The remaining 52.94% distributed among other addresses indicates a reasonably fragmented holder base, which provides some resilience against sudden price shocks. However, the substantial holdings of the top four addresses—ranging from 5.84% to 21.90%—represents meaningful concentration risk that warrants monitoring.

The current distribution pattern carries notable implications for market dynamics. Large holders in this concentration range possess sufficient capital to materially influence short-term price action through position adjustments or strategic accumulation. While the fragmented tail of smaller holders (represented by the 52.94% "Others" category) provides underlying liquidity depth, any coordinated movement or forced liquidation by top-tier holders could trigger cascading volatility. The distribution suggests RARI maintains a balanced structure between institutional or large investor participation and retail participation, indicating a market in development rather than one with excessive centralization or complete decentralization.

Click to view current RARI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0bcb...f80ccf | 5475.19K | 21.90% |

| 2 | 0xa9d1...1d3e43 | 2326.69K | 9.30% |

| 3 | 0xb625...76ef78 | 1768.88K | 7.07% |

| 4 | 0x6c0f...168a12 | 1461.11K | 5.84% |

| 5 | 0x3369...1202f7 | 738.10K | 2.95% |

| - | Others | 13230.02K | 52.94% |

II. Core Factors Affecting RARI's Future Price

Supply Mechanism

-

Token Supply Structure: RARI has a maximum supply of 25,000,000 tokens, with a current circulating supply of 19,488,928 RARI tokens. This fixed supply cap creates a defined tokenomics framework that prevents unlimited inflation and establishes scarcity parameters for the asset.

-

Current Impact: The approximately 78% circulation rate of RARI indicates a significant portion of tokens are already in circulation. The remaining 5.5 million tokens in reserve may gradually enter the market, potentially affecting price dynamics as supply continues to approach its maximum limit.

Governance and Community Participation

-

Governance Structure: RARI operates through RARI DAO, a decentralized autonomous organization managed by the community and dedicated to the development and sustainability of the Rarible Protocol and RARI Chain. Token holders can participate in governance by locking RARI tokens, which grants them voting rights in the RARI DAO and enables them to propose suggestions regarding protocol updates, innovations, and financial decisions.

-

Treasury Management: The RARI Foundation manages the RARI DAO treasury through tokenomics, providing funding for projects that support the Rarible Protocol and RARI Chain development, community initiatives, and ecosystem activities. Strategic treasury allocation is overseen by RARI DAO to ensure effective resource distribution and support for long-term ecosystem growth and innovation.

Technical Development and Ecosystem Building

-

NFT Use Case Development: The primary objective of RARI DAO and the foundation is to develop NFT use cases by creating a robust, creator-centric, fully decentralized ecosystem. This positioning ties RARI's value proposition directly to the expansion and adoption of NFT applications within the Rarible ecosystem.

-

Rarible Protocol Evolution: The Rarible Protocol serves as the technical foundation supporting the ecosystem. The development roadmap for RARI Chain and protocol improvements directly influences the utility and adoption potential of RARI tokens, affecting long-term price drivers through increased ecosystem activity and user engagement.

III. 2025-2030 RARI Price Forecast

2025 Outlook

- Conservative Forecast: $0.1947 - $0.2028

- Neutral Forecast: $0.2028

- Optimistic Forecast: $0.2636 (requires sustained ecosystem adoption)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing institutional interest and protocol expansion

- Price Range Predictions:

- 2026: $0.2216 - $0.3172 (15% upside potential)

- 2027: $0.2669 - $0.3137 (36% upside potential)

- Key Catalysts: Enhanced platform utility, increased trading volume on Gate.com and other major venues, community governance activation, and strategic partnerships

2028-2030 Long-term Outlook

- Base Case: $0.2267 - $0.4270 (46% growth by 2028, supported by mainstream adoption)

- Optimistic Case: $0.2814 - $0.5158 (79% growth by 2029, assuming accelerated DeFi integration and protocol improvements)

- Transformational Case: $0.4076 - $0.5172 (117% growth by 2030, contingent on breakthrough technological advancement and market-wide bullish sentiment)

Note: These forecasts are based on current market conditions and historical trends. Actual results may vary significantly based on regulatory developments, competitive dynamics, and broader cryptocurrency market movements.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.26364 | 0.2028 | 0.19469 | 0 |

| 2026 | 0.31718 | 0.23322 | 0.22156 | 15 |

| 2027 | 0.31373 | 0.2752 | 0.26694 | 36 |

| 2028 | 0.42697 | 0.29446 | 0.22674 | 46 |

| 2029 | 0.51583 | 0.36072 | 0.28136 | 79 |

| 2030 | 0.51716 | 0.43827 | 0.40759 | 117 |

Rarible (RARI) Professional Investment Strategy and Risk Management Report

IV. RARI Professional Investment Strategy and Risk Management

RARI Investment Methodology

(1) Long-term Holding Strategy

- Target Investor Profile: Community participants, NFT marketplace users, and believers in decentralized commerce infrastructure

- Operational Recommendations:

- Participate in the cross-chain rewards program on Rarible.com to accumulate RARI tokens through ecosystem engagement

- Stake RARI tokens to earn APY while delegating voting power in governance decisions

- Maintain positions through market cycles, focusing on the long-term value creation of the ecosystem

(2) Active Trading Strategy

-

Market Observation Points:

- Monitor 24-hour trading volume trends (current 24H volume: $142,294)

- Track price movements across different timeframes (1H, 24H, 7D, 30D, 1Y)

- Observe support and resistance levels around current price levels

-

Wave Trading Considerations:

- Current price at $0.2015 with 24H decline of -4.77%; assess entry points during consolidation periods

- Historical low price at $0.191384 (ATL on 2025-12-19) provides potential support reference

- Consider trading volume relative to market cap for liquidity assessment

RARI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Moderate Investors: 3-5% of portfolio allocation

- Aggressive Investors: 5-10% of portfolio allocation

(2) Risk Hedging Approaches

- Position Sizing: Only allocate capital you can afford to lose completely, given the volatile nature of governance tokens and NFT market dependency

- Diversification Strategy: Balance RARI holdings with other asset classes to reduce concentrated risk exposure

(3) Secure Storage Solutions

- Hardware Wallet Option: Use professional-grade hardware wallets for long-term storage of significant RARI holdings

- Exchange Custody: For active trading, maintain holdings on Gate.com, which supports RARI trading with proper security protocols

- Security Precautions:

- Enable two-factor authentication (2FA) on all exchange accounts

- Never share private keys or seed phrases

- Regularly update wallet software to patch security vulnerabilities

- Consider multi-signature wallets for large holdings

V. RARI Potential Risks and Challenges

RARI Market Risks

-

Extreme Price Volatility: RARI has declined 92.25% over the past year, demonstrating severe price instability. The token trades at $0.2015 compared to its all-time high of $46.7 (March 30, 2021), indicating substantial downside risk even from current levels.

-

Low Trading Liquidity: With 24-hour volume of only $142,294 and a fully diluted valuation of $5,037,500, RARI faces liquidity challenges that could impact entry and exit execution at desired prices.

-

NFT Market Dependency: RARI's value proposition is intrinsically tied to NFT marketplace trading activity. Any contraction in NFT trading volumes directly impacts the fee-generation mechanism that funds RARI distributions.

RARI Regulatory Risks

-

Governance Token Classification: Regulatory clarity around governance tokens remains uncertain in many jurisdictions. Changes in how regulators classify RARI could affect its trading status and utility.

-

Securities Regulation: Staking mechanisms that provide APY returns could potentially attract regulatory scrutiny regarding whether RARI functions as an unregistered security in certain jurisdictions.

-

Cross-Chain Compliance: The cross-chain rewards program introduces additional regulatory complexity as RARI operates across multiple blockchain networks with varying regulatory frameworks.

RARI Technical Risks

-

Smart Contract Vulnerabilities: The RARI token contract (0xfca59cd816ab1ead66534d82bc21e7515ce441cf on Ethereum) and associated staking mechanisms could contain exploitable vulnerabilities despite security audits.

-

Chain Dependency: RARI's primary deployment on Ethereum exposes it to network congestion, high gas fees, and potential chain-specific technical failures that could impact accessibility.

-

Ecosystem Adoption Risk: The value of RARI depends on continued adoption and trading activity on the Rarible marketplace. Competitive pressures from other NFT platforms could reduce marketplace relevance and RARI utility.

VI. Conclusions and Action Recommendations

RARI Investment Value Assessment

RARI represents a governance token for a decentralized NFT commerce infrastructure, offering staking rewards and governance participation. However, the token faces significant headwinds: a 92.25% year-over-year decline, extreme volatility with a peak-to-current drawdown exceeding 99%, and direct dependency on NFT market health. The current market capitalization of $3.65 million reflects dramatically reduced valuations from earlier periods. While the staking and cross-chain rewards mechanisms provide utility, they do not offset the structural challenges facing the broader NFT market. RARI is best viewed as a speculative holding with substantial capital risk rather than a core portfolio component.

RARI Investment Recommendations

✅ Beginners: Consider gaining exposure through small, experimental positions (under 1% of portfolio) only after understanding how Rarible's fee-sharing and staking mechanisms work. Focus on learning the ecosystem before committing significant capital.

✅ Experienced Investors: Evaluate RARI as part of a diversified Web3 portfolio, potentially using technical analysis to identify entry points after sustained stabilization. Consider 2-5% portfolio allocation only with clear entry and exit strategies.

✅ Institutional Investors: Conduct comprehensive due diligence on Rarible Foundation governance, NFT market trends, and regulatory developments before considering any positions. Position sizing should reflect the speculative nature and liquidity constraints.

RARI Trading and Participation Methods

- Gate.com Trading: Access RARI trading directly on Gate.com with real-time order execution for both buying and selling positions

- Staking Protocol: Participate in RARI staking on Rarible.com to earn APY while contributing to ecosystem governance

- Rewards Program: Engage with the cross-chain rewards program on Rarible.com for fee distributions while supporting marketplace liquidity

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. Consult qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

Is Rari a good investment?

Rari shows strong growth potential with increasing market adoption and trading volume. Based on current trends, price predictions suggest significant upside potential. However, conduct thorough research before investing, as cryptocurrency markets remain highly volatile and unpredictable.

What is the RARI prediction?

Rarible (RARI) is predicted to trade between $0.1342 and $0.2177 by 2030. If RARI reaches the upper target of $0.2177, it could increase by 2.72%, based on current market trends and technical analysis.

How much is RARI crypto worth?

As of December 24, 2025, RARI is valued at approximately $0.50. RARI is an ERC-20 governance token on Ethereum that controls the Rarible ecosystem and RARI Foundation treasury.

Does Rarible have a future?

Yes, Rarible has strong future potential. As the NFT market evolves, RARI is positioned for growth with increasing user adoption. Price predictions suggest potential reaches around $0.2177 by 2030, driven by platform expansion and NFT ecosystem development.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What Is an Airdrop in Cryptocurrency?

What is GMRT: Understanding the Giant Metrewave Radio Telescope and Its Role in Modern Astronomy

What is DEAI: Decentralized Ethical AI and Its Impact on the Future of Technology

What is LOULOU: A Comprehensive Guide to the Emerging Fashion and Lifestyle Brand

What is RFD: A Comprehensive Guide to Request for Discussion in Software Development