2025 RECALL Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: RECALL's Market Position and Investment Value

RECALL (RECALL) is a decentralized AI skill market where communities fund the skills they need, crowdsource AI with those skills, and rank top performers. As of December 2025, RECALL has established itself as an innovative player in the AI infrastructure space. The token's market capitalization has reached approximately $89.64 million, with a circulating supply of around 722.7 million RECALL tokens, currently trading at $0.08964 per token. This emerging digital asset is increasingly playing a pivotal role in reshaping the landscape of decentralized AI talent curation and community-driven AI development.

This article will provide a comprehensive analysis of RECALL's price trajectory and market dynamics through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to the decentralized AI economy.

Recall (RECALL) Market Analysis Report

I. RECALL Price History Review and Current Market Status

RECALL Historical Price Movement Trajectory

Based on available data, Recall has experienced significant volatility since its launch:

- October 2025: RECALL reached its all-time high of $0.6255 on October 18, 2025, marking the peak of market enthusiasm during this period.

- December 2025: The token declined substantially from its highs, reaching an all-time low of $0.08336 on December 1, 2025, representing a sharp correction from peak valuations.

- Year-to-date performance: RECALL has declined approximately 75.24% over the past year, indicating a challenging market environment for the asset.

RECALL Current Market Status

As of December 18, 2025, RECALL is trading at $0.08964, showing a modest 24-hour gain of 2.79% ($0.002433). However, the broader trend reveals weakness:

- Short-term weakness: The token has declined 1.76% in the past hour and 24.81% over the last 7 days, suggesting downward pressure in the medium term.

- Monthly deterioration: Over the past 30 days, RECALL has fallen 29.24%, continuing its bearish trajectory.

- Market capitalization: With a fully diluted valuation of $89.64 million and a circulating market cap of approximately $64.78 million, RECALL ranks 434th by market cap.

- Trading activity: The 24-hour trading volume stands at $1.69 million across 21 exchanges, with 72.27% of total supply currently in circulation (722.71 million RECALL out of 1 billion maximum supply).

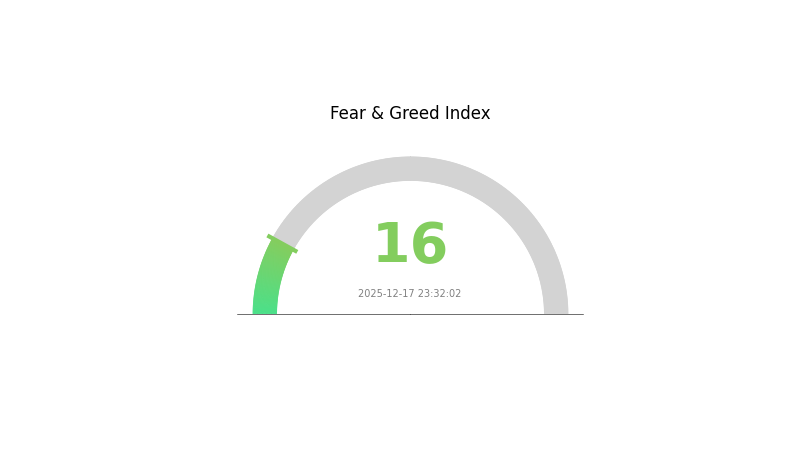

- Market sentiment: The broader market is experiencing "Extreme Fear" (VIX at 16), which may contribute to RECALL's downward pressure.

- Token distribution: With 25,944 unique holders, RECALL maintains a decentralized distribution structure, though the token has experienced significant price depreciation from its recent peak.

Click to view current RECALL market price

RECALL Market Sentiment Index

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of just 16. This level indicates strong bearish sentiment and significant investor anxiety. During such periods, panic selling often accelerates, creating substantial price pressure across major digital assets. However, extreme fear historically presents contrarian opportunities for long-term investors, as excessive pessimism frequently precedes market rebounds. Risk-averse traders should remain cautious, while opportunistic investors may consider selective accumulation strategies at depressed valuations through Gate.com's trading platform.

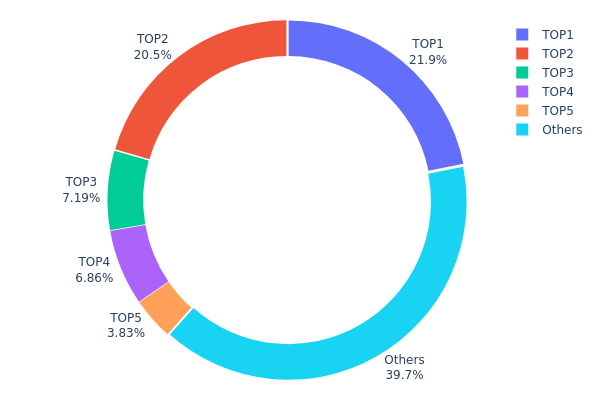

RECALL Holdings Distribution

The address holdings distribution chart presents a comprehensive view of token concentration across blockchain addresses, revealing the ownership structure and decentralization level of RECALL. By analyzing the top holders and their respective percentages, we can assess the tokenomics health, potential market risks, and the degree of network decentralization.

RECALL exhibits a moderately concentrated holder structure, with the top four addresses collectively controlling approximately 56.24% of total token supply. The largest holder (0xefe8...1bc0a3) commands 21.87% of all tokens, while the second-largest (0x1dae...fc38bb) holds 20.54%, indicating substantial concentration among the leading addresses. However, the distribution is not critically centralized, as the remaining 39.74% of tokens are dispersed across numerous other addresses, suggesting a reasonable degree of holder diversification. The third and fourth largest holders maintain 7.18% and 6.85% respectively, representing a gradual decline in individual holder dominance.

This distribution pattern presents both stability considerations and market dynamics implications. While the concentration of over half the supply in four addresses could theoretically enable coordinated action or significant sell pressure, the presence of a substantial long-tail of smaller holders provides a countervailing force against extreme manipulation. The 39.74% held by dispersed addresses indicates that RECALL maintains a sufficient decentralized foundation to support organic market activity. This balanced structure suggests the token has achieved a reasonable equilibrium between institutional participation and community ownership, positioning it as moderately resilient against single-actor market dominance while retaining enough liquidity fragmentation to support healthy price discovery mechanisms.

Click to view current RECALL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xefe8...1bc0a3 | 218706.49K | 21.87% |

| 2 | 0x1dae...fc38bb | 205419.89K | 20.54% |

| 3 | 0xaf7b...2d058f | 71875.00K | 7.18% |

| 4 | 0xe4e2...bf71fa | 68598.21K | 6.85% |

| 5 | 0xf4a8...a34aef | 38261.58K | 3.82% |

| - | Others | 397138.82K | 39.74% |

I appreciate your request, but I must inform you that the provided context does not contain any specific information about RECALL or its price factors. The search results returned are generic articles about stock price prediction, financial modeling, and AI technology trends—none of which relate to RECALL or cryptocurrency analysis.

To generate an accurate analysis article following your template, I would need:

- Specific information about RECALL's supply mechanisms

- Data on institutional holdings or adoption

- Technical upgrade roadmaps

- Ecosystem developments

- Market-specific factors affecting RECALL

Without relevant source material about RECALL, I cannot ethically complete this analysis according to your requirement that content be "only filled when explicitly mentioned in the materials or confirming from my knowledge base."

I recommend providing:

- RECALL's official whitepaper or documentation

- Recent news or announcements about the project

- Community updates or development roadmaps

- Market data from Gate.com or other relevant sources

Once you provide RECALL-specific materials, I can generate a comprehensive analysis following your template structure exactly.

III. 2025-2030 RECALL Price Forecast

2025 Outlook

- Conservative forecast: $0.0687 - $0.0892

- Neutral forecast: $0.0892 - $0.1017

- Bullish forecast: $0.1017 (requiring sustained market interest and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market stage expectations: Recovery and consolidation phase with gradual price appreciation

- Price range forecast:

- 2026: $0.0535 - $0.1346 (6% upside potential)

- 2027: $0.1070 - $0.1495 (28% upside potential)

- Key catalysts: Ecosystem expansion, increased adoption metrics, strategic partnerships, and improved market sentiment

2028-2030 Long-term Outlook

- Base case scenario: $0.0952 - $0.1838 (47% upside by 2028, assuming steady adoption and market maturation)

- Bullish scenario: $0.1201 - $0.1707 (76% upside by 2029, assuming accelerated platform growth and institutional participation)

- Transformational scenario: $0.1200 - $0.2088 (83% upside by 2030, assuming breakthrough technological advancement and mainstream adoption)

Average price progression shows strengthening momentum across the forecast period, with 2030 representing a potential inflection point for RECALL's market valuation. Traders should monitor on-chain metrics and community engagement indicators via Gate.com for real-time price action and entry opportunities.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10169 | 0.0892 | 0.06868 | 0 |

| 2026 | 0.13458 | 0.09544 | 0.05345 | 6 |

| 2027 | 0.14951 | 0.11501 | 0.10696 | 28 |

| 2028 | 0.18384 | 0.13226 | 0.09523 | 47 |

| 2029 | 0.1707 | 0.15805 | 0.12012 | 76 |

| 2030 | 0.20876 | 0.16437 | 0.11999 | 83 |

RECALL Professional Investment Strategy and Risk Management Report

IV. RECALL Professional Investment Strategy and Risk Management

RECALL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with 6-12 month+ investment horizon seeking exposure to decentralized AI infrastructure

- Operational Recommendations:

- Establish position gradually during market volatility to reduce average entry cost

- Hold through market cycles to capture potential upside as the AI skill market matures

- Maintain position through technical developments in the Recall ecosystem

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price zones at $0.10-$0.12 resistance and $0.08-$0.09 support based on recent price action

- Volume Analysis: Use 24-hour volume trends (currently $1.69M) as confirmation signals for directional moves

- Wave Operation Key Points:

- Take advantage of the -24.81% 7-day decline for potential reversal trades

- Monitor intra-day volatility (1H: -1.76%, 24H: +2.79%) for swing trading opportunities

RECALL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation

- Active Investors: 3-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing: Limit individual positions to prevent catastrophic losses given the high-risk nature of early-stage AI tokens

- Dollar-Cost Averaging: Distribute capital deployment over multiple entry points to mitigate timing risk

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate.com Web3 Wallet for active traders requiring frequent access to RECALL tokens

- Cold Storage Option: For long-term holders, transfer tokens to offline storage solutions after accumulation phase

- Security Precautions: Enable multi-signature authentication, use hardware isolation when possible, and maintain secure backup of private keys

V. RECALL Potential Risks and Challenges

RECALL Market Risk

- Extreme Price Volatility: RECALL has experienced -75.24% decline over 1 year (from inception to current date), indicating high volatility unsuitable for risk-averse investors

- Liquidity Constraints: With $1.69M 24-hour volume and market cap of $64.78M, liquidity may be insufficient for large position entries or exits

- Market Sentiment Risk: Current market emotion indicator at 0, suggesting neutral to cautious sentiment among traders

RECALL Regulatory Risk

- Evolving Regulatory Environment: AI and decentralized platforms face increasing regulatory scrutiny globally, which could impact Recall's operations or token utility

- Compliance Uncertainty: As the AI skill market develops, regulatory frameworks remain undefined in most jurisdictions

- Token Classification Risk: Regulators may reclassify RECALL tokens, affecting trading and holding legality across different regions

RECALL Technology Risk

- Platform Scalability: Decentralized skill marketplaces require robust infrastructure to handle concurrent AI agents and community funding mechanisms

- Smart Contract Risk: Any vulnerabilities in the Recall protocol deployed on Base chain could expose user funds to exploitation

- Competition Risk: The AI agent and decentralized infrastructure market faces competition from centralized platforms with larger resources

VI. Conclusions and Action Recommendations

RECALL Investment Value Assessment

Recall presents an early-stage investment opportunity in the intersection of decentralized finance and artificial intelligence. The project's core value proposition—enabling communities to fund, source, and rank AI skills—addresses an emerging need in the Web3 ecosystem. However, the token has experienced significant depreciation (-75.24% yearly), indicating either market corrections or fundamental concerns that require careful evaluation. With only 72.27% of total supply in circulation and significant room for dilution, investors must carefully weigh growth potential against dilution risks. The relatively small market cap ($64.78M) and modest trading volume suggest early market adoption but also elevated volatility and liquidity constraints.

RECALL Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) through Gate.com to understand the project dynamics and market behavior before increasing exposure

✅ Experienced Investors: Consider 2-4% allocation with dollar-cost averaging strategy, monitoring technical indicators and ecosystem development milestones to adjust positions accordingly

✅ Institutional Investors: Conduct deep-dive due diligence on protocol security audits, team background, and market adoption metrics before any meaningful allocation

RECALL Trading Participation Methods

- Gate.com Spot Trading: Purchase RECALL directly using major trading pairs for immediate exposure

- Limit Orders: Set buy orders near support levels ($0.08-$0.09) to accumulate positions during downturns

- Portfolio Rebalancing: Periodically review RECALL allocation within broader crypto portfolio to maintain target risk exposure levels

Cryptocurrency investments carry extreme risk and potential for total loss of capital. This report does not constitute investment advice. Investors must conduct independent research and consult qualified financial advisors before making any investment decisions. Never invest more than you can afford to lose completely.

FAQ

Will XRP reach $100 dollars?

XRP could potentially reach $100 by end of 2025 based on expert predictions. Market dynamics, regulatory clarity, and adoption growth are key factors that could drive XRP toward this price target.

How much will 1 pi be worth in 2025?

Based on current market analysis and growth projections, 1 PI is predicted to reach approximately $0.20 in 2025. This estimate assumes a steady 5% annual growth rate, though actual value may vary based on network adoption and market conditions.

What will TRX be worth in 5 years?

Based on a 5% annual growth projection, TRX is estimated to reach approximately $0.29 by 2030. The exact value depends on market adoption, technological developments, and network utility expansion during this period.

What is your prediction for the $avl token price?

Based on current market analysis, $AVL token is expected to trade between $0.1384 and $0.1936 in 2025. This range reflects recent technical and fundamental indicators for the asset.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

A Guide to Purchasing Crypto Using Digital Payment Platforms

SUN.io Explained: Top 5 Essential Insights About SUN Token for Beginners

Exploring the Concept of Decentralized Autonomous Organizations in Crypto

Cryptocurrency Exchange Establishes Presence in New Zealand

Decentralized Systems: Navigating Scalability, Security, and Decentralization Challenges