2025 RENDER Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: RENDER's Market Position and Investment Value

Render Network (RENDER) as a decentralized GPU rendering platform has made significant strides since its inception. As of 2025, RENDER's market capitalization has reached $727,055,631, with a circulating supply of approximately 518,584,616 tokens, and a price hovering around $1.402. This asset, known as the "GPU rendering revolutionizer," is playing an increasingly crucial role in 3D rendering and emerging GPU-intensive applications.

This article will comprehensively analyze RENDER's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. RENDER Price History Review and Current Market Status

RENDER Historical Price Evolution

- 2020: Project launched, price reached an all-time low of $0.036763626053 on June 16

- 2024: RENDER hit its all-time high of $13.596115966188627 on March 18

- 2025: Market downturn, price dropped from the all-time high to the current $1.402

RENDER Current Market Situation

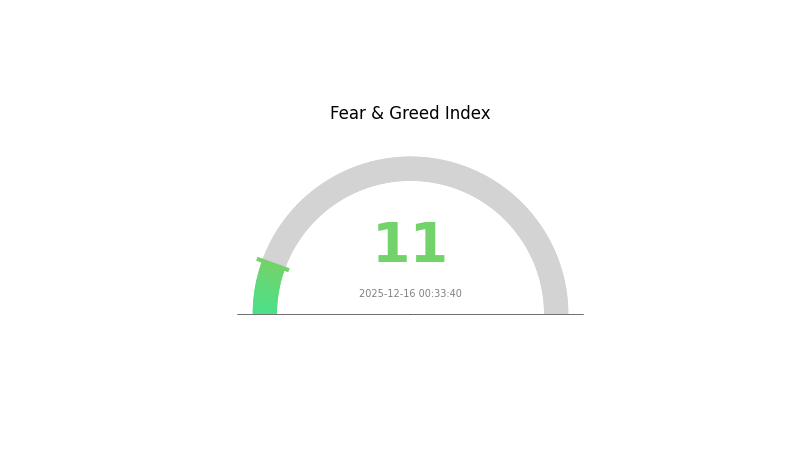

As of December 16, 2025, RENDER is trading at $1.402, with a 24-hour trading volume of $1,296,166.87. The token has experienced a 5.44% decrease in the last 24 hours. RENDER's market cap stands at $727,055,631.86, ranking it 98th in the cryptocurrency market. The circulating supply is 518,584,616.16 RENDER tokens, with a total supply of 532,219,654 RENDER. The token is currently 89.69% down from its all-time high, indicating a significant market correction. The current market sentiment for cryptocurrencies is described as "Extreme Fear" with a VIX index of 11, suggesting a highly cautious investor attitude.

Click to view the current RENDER market price

RENDER Market Sentiment Indicator

2025-12-16 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear as the Fear and Greed Index plummets to 11. This historically low level suggests a potentially oversold market, presenting unique opportunities for contrarian investors. While caution is warranted, seasoned traders often view such extreme fear as a potential bottoming signal. It's crucial to remember that market sentiment can shift rapidly, and thorough research is essential before making any investment decisions. Gate.com offers comprehensive tools and analysis to help navigate these turbulent market conditions.

RENDER Holdings Distribution

The address holdings distribution data for RENDER reveals a significant concentration of tokens among the top holders. The largest address holds 18.80% of the total supply, while the top 5 addresses collectively control 41.31% of RENDER tokens. This level of concentration suggests a relatively centralized distribution pattern.

Such a concentrated holding structure may have implications for market dynamics. The presence of large holders could potentially lead to increased price volatility if they decide to make significant moves in the market. Furthermore, this concentration might raise concerns about the potential for market manipulation or coordinated actions by major token holders.

Despite the concentration at the top, it's noteworthy that 58.69% of RENDER tokens are distributed among other addresses. This indicates a degree of wider distribution and participation in the network, which could contribute to overall ecosystem stability and resilience against single-point vulnerabilities.

Click to view the current RENDER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | AZB72t...m2qAdC | 88576.39K | 18.80% |

| 2 | 9WzDXw...YtAWWM | 51130.25K | 10.85% |

| 3 | CPj5Jg...SXKrvv | 25000.04K | 5.30% |

| 4 | EuPYwH...tVxF58 | 15393.15K | 3.26% |

| 5 | HcTix2...eaAHwS | 14609.07K | 3.10% |

| - | Others | 276296.36K | 58.69% |

II. Key Factors Influencing RENDER's Future Price

Supply Mechanism

- BME Model: This model may drive RENDER towards deflation, with token burning exceeding minting when demand increases, strengthening token value support.

- Current Impact: The potential deflationary effect of the BME model could create upward pressure on RENDER's price as demand grows.

Institutional and Major Holder Dynamics

- Institutional Adoption: Increasing institutional investment and mainstream adoption are key factors influencing RENDER's market value.

Macroeconomic Environment

- Inflation Hedging Properties: RENDER's performance in inflationary environments may affect its attractiveness as a potential hedge.

- Geopolitical Factors: International situations and broader cryptocurrency market trends can impact RENDER's price.

Technological Development and Ecosystem Building

- Solana Upgrade: Solana's high throughput and low-cost features help Render process million-level rendering tasks, potentially increasing network efficiency and attractiveness.

- Ecosystem Applications: The growth of AI and GPU resource demand directly impacts the value of RENDER tokens, reflecting the expanding use cases within its ecosystem.

III. RENDER Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.72956 - $1.403

- Neutral prediction: $1.403 - $1.69062

- Optimistic prediction: $1.69062 - $1.97823 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market phase expectation: Growth phase with potential volatility

- Price range forecast:

- 2027: $1.50414 - $2.34793

- 2028: $1.19194 - $2.71846

- Key catalysts: Technological advancements, broader market trends, and increased utility of RENDER token

2029-2030 Long-term Outlook

- Base scenario: $2.40479 - $2.68134 (assuming steady growth and adoption)

- Optimistic scenario: $2.95789 - $3.96838 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $3.96838+ (assuming major breakthroughs in rendering technology and widespread integration)

- 2030-12-31: RENDER $2.68134 (91% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.97823 | 1.403 | 0.72956 | 0 |

| 2026 | 1.97802 | 1.69062 | 1.50465 | 20 |

| 2027 | 2.34793 | 1.83432 | 1.50414 | 30 |

| 2028 | 2.71846 | 2.09112 | 1.19194 | 49 |

| 2029 | 2.95789 | 2.40479 | 1.25049 | 71 |

| 2030 | 3.96838 | 2.68134 | 2.44002 | 91 |

IV. RENDER Professional Investment Strategies and Risk Management

RENDER Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized GPU rendering technology

- Operation suggestions:

- Accumulate RENDER tokens during market dips

- Stay informed about Render Network's technological advancements and partnerships

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set stop-loss orders to manage risk

RENDER Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Dollar-Cost Averaging: Regular small purchases to mitigate price volatility

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. RENDER Potential Risks and Challenges

RENDER Market Risks

- High volatility: RENDER price can experience significant fluctuations

- Competition: Other blockchain-based rendering solutions may emerge

- Market sentiment: Crypto market cycles can impact RENDER's price regardless of project fundamentals

RENDER Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting crypto assets

- Token classification: Risk of RENDER being classified as a security in some jurisdictions

- Cross-border restrictions: Possible limitations on token transfers or trading in certain countries

RENDER Technical Risks

- Network security: Potential vulnerabilities in the Solana blockchain or Render Network

- Scalability challenges: Ensuring the network can handle increased rendering demands

- Technological obsolescence: Risk of more advanced rendering solutions emerging

VI. Conclusion and Action Recommendations

RENDER Investment Value Assessment

RENDER presents a unique value proposition in the decentralized GPU rendering space. Long-term potential exists due to the growing demand for GPU computing, but short-term volatility and regulatory uncertainties pose significant risks.

RENDER Investment Recommendations

✅ Beginners: Consider small, regular investments to learn about the project and market dynamics ✅ Experienced investors: Implement a balanced approach with both long-term holding and active trading strategies ✅ Institutional investors: Conduct thorough due diligence and consider RENDER as part of a diversified crypto portfolio

RENDER Trading Participation Methods

- Spot trading: Buy and sell RENDER tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options involving RENDER tokens

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will RENDER reach $100?

While possible, reaching $100 would require significant market growth and adoption of RENDER's technology. It's an ambitious target but not impossible in the long term.

How high will RENDER go in 2025?

RENDER is expected to reach between $3.62 and $4.10 in 2025, with an average price of $3.84. This forecast is based on growing demand for GPU rendering in 3D animation and AI.

Does RENDER crypto have a future?

Yes, RENDER has a promising future. It powers decentralized GPU rendering, which is crucial for AI advancements. Its technology is gaining traction, suggesting strong potential for growth.

Can RENDER reach $50?

Yes, RENDER could potentially reach $50 given strong network growth and positive market trends. As of 2025, this price target remains feasible for RENDER.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

DRK: Understanding the Controversial Cryptocurrency and Its Market Impact

Infrared Finance LSD: How IR Token Works in DeFi Yield Farming and Liquid Staking

How to Invest in Tokenized US Stocks on Solana With Ondo Finance ETFs

Theoriq (THQ): AI-Driven DeFi Infrastructure for Web3

Bitwise 2026 Crypto Market Forecast: Breaking the Four-Year Cycle