2025 RWA Price Prediction: Expert Analysis and Market Outlook for Real-World Asset Tokenization

Introduction: Market Position and Investment Value of RWA

Allo (RWA) is building the world's first exchange for tokenized stocks, democratizing access to 24/7 trading with low fees and instant settlement. Since its launch, Allo has achieved significant milestones in the Real World Assets (RWA) space, including tokenizing $2.2 billion in RWAs, staking $50 million in Bitcoin (BTC), and establishing a $100 million lending facility. As of December 23, 2025, RWA maintains a market capitalization of $29.12 million with a circulating supply of 1.8 billion tokens, trading at approximately $0.002912 per token.

This innovative platform is playing an increasingly critical role in bridging traditional finance and blockchain technology through tokenized equity markets and real-world asset representation.

This article provides a comprehensive analysis of RWA's price trajectory through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for participants in the evolving RWA market.

I. RWA Price History Review and Current Market Status

RWA Historical Price Evolution

RWA token reached its all-time high (ATH) of $0.01829 on May 24, 2025, marking the peak of the token's price discovery phase. Following this peak, the token experienced a significant correction, declining substantially over subsequent months as market conditions evolved.

The token subsequently reached its all-time low (ATL) of $0.002718 on December 18, 2025, representing an approximately 85.15% decline from its historical peak. This sharp pullback reflects the volatile nature of emerging tokenized asset platforms and broader market sentiment shifts.

RWA Current Market Status

As of December 23, 2025, RWA is trading at $0.002912, positioned just slightly above its recent all-time low. The token demonstrates modest short-term recovery with a 24-hour price increase of 3.07%, climbing from the lower price levels observed in recent days.

Over the 7-day period, RWA has declined 0.31%, while the 30-day performance shows a more pronounced pullback of -16.82%, indicating ongoing bearish pressure over the intermediate timeframe. The 1-hour movement reflects slight weakness at -0.21%.

The token maintains a 24-hour trading volume of $61,237.49, with price range from $0.002811 (low) to $0.003002 (high) during the period. The current market capitalization stands at approximately $5.24 million against a fully diluted valuation of $29.12 million, with 1.8 billion tokens in circulation out of a maximum supply of 10 billion tokens (18% circulation ratio).

RWA ranks 1,500th by market capitalization with a market dominance of 0.00091%, indicating its position as a micro-cap asset within the broader cryptocurrency ecosystem. The token maintains 17,600 holders across the BEP-20 network on BSC (Binance Smart Chain).

Click to view current RWA market price

RWA Market Sentiment Index

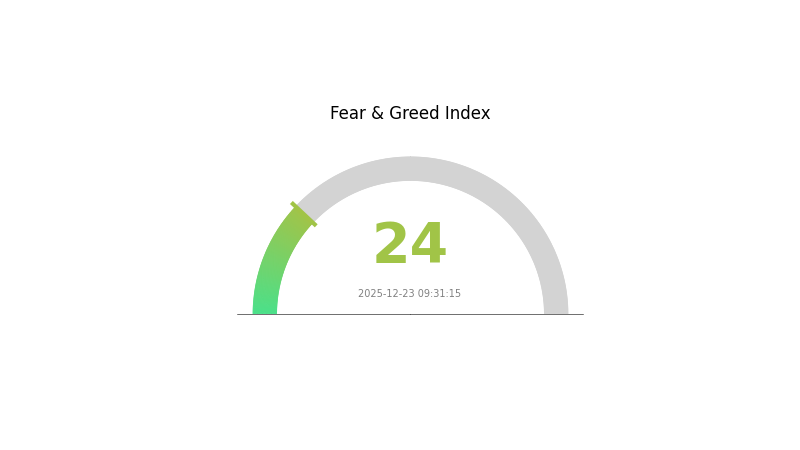

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The RWA market is currently experiencing extreme fear sentiment. With the index at 24, investors are showing significant pessimism and risk aversion. This level typically indicates panic selling and depressed valuations across real-world asset tokens. Market participants should exercise caution and consider their risk tolerance. Extreme fear conditions often present contrarian opportunities for long-term investors with strong conviction. However, careful analysis and position sizing remain essential during such volatile periods. Monitor market developments closely before making investment decisions.

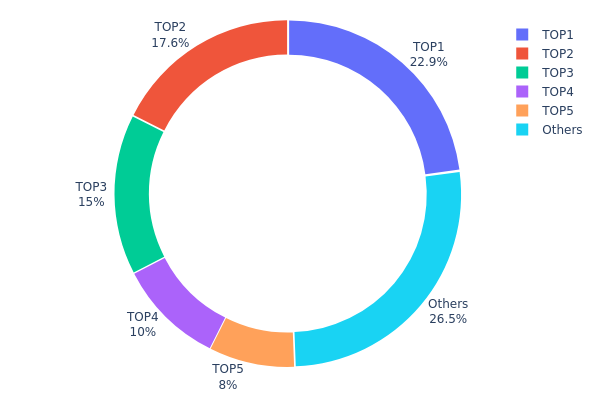

RWA Holdings Distribution

The address holdings distribution map provides a critical snapshot of how RWA tokens are concentrated across the network's major stakeholders. This metric reveals the degree of token centralization by tracking the percentage of total supply held by top addresses, which directly impacts market liquidity, governance dynamics, and systemic risk assessment. Understanding this distribution is essential for evaluating the token's decentralization status and potential vulnerability to coordinated selling or price manipulation.

Current analysis of the RWA holdings distribution indicates moderate concentration concerns. The top five addresses collectively control 73.49% of the total supply, with the largest holder commanding 22.89% and the second-largest controlling 17.60%. While no single address maintains a controlling majority exceeding 25%, the combined influence of the top two addresses at 40.49% suggests potential coordination risks. The remaining 26.51% distributed among other addresses provides some resilience against extreme concentration, yet the imbalanced top-tier distribution warrants monitoring. This concentration pattern is typical for emerging RWA projects where early investors and protocol allocations remain significant stakeholders.

The current address distribution structure presents measurable implications for market dynamics. With the top five holders commanding nearly three-quarters of supply, significant price volatility could emerge from concentrated liquidations or strategic positioning by these major stakeholders. The relatively thin distribution beyond the top five holders may constrain organic price discovery and increase susceptibility to supply-side shocks. However, the 26.51% allocation to smaller addresses suggests an active secondary market presence, which could provide counterbalancing liquidity. From a decentralization perspective, RWA exhibits characteristics typical of mid-stage blockchain assets, with room for improved distribution through targeted community initiatives and unlock schedules to enhance long-term network stability.

Click to view current RWA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7106...a0311a | 2290000.00K | 22.89% |

| 2 | 0x1351...53b950 | 1760000.00K | 17.60% |

| 3 | 0xc056...2719e3 | 1500000.00K | 15.00% |

| 4 | 0xfdc9...30353f | 1000000.00K | 10.00% |

| 5 | 0x69e7...f5e5f4 | 800000.00K | 8.00% |

| - | Others | 2650000.00K | 26.51% |

II. Core Factors Influencing RWA Future Price

Monetary Policy Impact

-

Central Bank Interest Rates and Inflation Policy: Central bank interest rates and inflation policies directly affect RWA prices. RWA assets demonstrate certain inflation-hedging characteristics, receiving increased attention during inflationary periods as investors seek alternative value stores.

-

Market Performance During Economic Uncertainty: International tensions and economic uncertainty drive investors toward RWA as a hedge, potentially supporting price appreciation during periods of geopolitical instability.

Anti-Inflation Characteristics

-

Real Asset Support: Unlike purely digital assets, RWA tokens are backed by real-world assets such as U.S. Treasury bonds, private credit, commodities, and real estate. This tangible backing provides inherent value support and reduces reliance on market sentiment alone.

-

Yield Generation: RWA products generate real yields often exceeding traditional fixed-income markets. As DeFi protocols like Aave and Spark integrate these assets, users can compound returns through staking or leveraged strategies, amplifying their attractiveness during low-rate environments.

Geopolitical Factors

- Global Economic Uncertainty: International geopolitical tensions and economic instability push investors toward seeking stable value stores, increasing demand for RWA-backed assets as a more secure alternative to purely speculative cryptocurrencies.

Regulatory Environment

-

Global Regulatory Framework Evolution: The regulatory landscape significantly impacts RWA prices. The U.S. Securities and Exchange Commission (SEC) has begun actively engaging with market participants including BlackRock, Fidelity, and Nasdaq on RWA tokenization frameworks. Clear regulatory pathways enhance institutional adoption and support price stability.

-

Regional Compliance Standards: Hong Kong's Securities and Futures Commission (SFC) requires projects to ensure genuine asset custody, clear ownership, and limit trading to professional investors. Such clear frameworks reduce regulatory risk premiums and support market development.

Market Structure and Liquidity

-

Fragmentation Impact: Market fragmentation across multiple blockchains creates persistent price disparities. Economically equivalent tokenized assets trade at 1-3% price differentials across different networks. This fragmentation, coupled with 2-5% capital transfer losses between chains, creates friction that suppresses overall market efficiency and price discovery mechanisms.

-

Investor Confidence: Market maturity and investor confidence directly influence RWA token valuations. Institutional adoption by financial giants like BlackRock (BUIDL fund managing $2.39 billion) and Franklin Templeton (BENJI fund at $776 million AUM) signals legitimacy and attracts broader capital flows, supporting price appreciation.

Technology Development and Ecosystem

-

Cross-Chain Interoperability Solutions: Development of mature cross-chain protocols and Layer 2 interoperability solutions represents a critical technical advancement. These innovations address the fragmentation challenge by enabling seamless asset and liquidity transfer between chains, potentially unlocking substantial growth by reducing transaction friction currently costing the market $600 million to $1.3 billion annually.

-

Institutional Infrastructure Development: Expansion of institutional-grade infrastructure, including on-chain government securities, compliant stablecoins, and standardized custody solutions, enhances market accessibility for traditional finance participants. Projects like Ondo Finance establishing the Global Markets Alliance with Solana Foundation, BitGo, and Jupiter demonstrate ecosystem maturation supporting broader adoption.

-

DeFi Protocol Integration: Deep integration of RWA assets into DeFi borrowing protocols, yield aggregators, and collateral systems expands use cases and economic incentives for holding RWA tokens. This expanding ecosystem functionality supports sustained demand and price stability.

Three、2025-2030 RWA Price Forecast

2025 Outlook

- Conservative Forecast: $0.00202 - $0.00293

- Neutral Forecast: $0.00293

- Optimistic Forecast: $0.00415 (requires sustained market interest and adoption momentum)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with increasing institutional participation in RWA tokenization

- Price Range Forecast:

- 2026: $0.00198 - $0.00488 (21% upside potential)

- 2027: $0.00282 - $0.00543 (44% upside potential)

- 2028: $0.00318 - $0.00632 (65% upside potential)

- Key Catalysts: Expansion of real-world asset tokenization platforms, regulatory clarity in major markets, increased enterprise adoption of blockchain-based asset management, and integration with traditional financial infrastructure

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00507 - $0.00646 (assumes moderate adoption and steady ecosystem growth)

- Optimistic Scenario: $0.00788 (assumes accelerated institutional adoption and mainstream RWA market penetration)

- Transformation Scenario: $0.01000+ (assumes breakthrough regulatory frameworks, mass enterprise adoption, and RWA becoming core infrastructure for global asset management)

- 2030-12-31: RWA token reaches $0.00788 (represents 91% cumulative growth from 2025 baseline, reflecting matured market positioning)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00415 | 0.00293 | 0.00202 | 0 |

| 2026 | 0.00488 | 0.00354 | 0.00198 | 21 |

| 2027 | 0.00543 | 0.00421 | 0.00282 | 44 |

| 2028 | 0.00632 | 0.00482 | 0.00318 | 65 |

| 2029 | 0.00646 | 0.00557 | 0.00507 | 91 |

| 2030 | 0.00788 | 0.00602 | 0.00313 | 106 |

Allo (RWA) Investment Strategy and Risk Management Report

IV. RWA Professional Investment Strategy and Risk Management

RWA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Institutional investors, wealth management funds, and long-term retail investors seeking exposure to the tokenized assets market

- Operation Recommendations:

- Accumulate positions during market downturns when RWA trades below $0.003, leveraging the current 30-day decline of -16.82%

- Hold through market cycles to benefit from the growing $2.2B tokenized RWA ecosystem and the platform's 24/7 trading infrastructure

- Establish dollar-cost averaging (DCA) purchases over 6-12 months to reduce timing risk in this emerging market

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor key price zones at $0.002718 (recent all-time low) and $0.01829 (all-time high), with immediate resistance near $0.003002 (24-hour high)

- Volume Analysis: Track the 24-hour volume of 61,237.49 RWA tokens to identify breakout opportunities and liquidity patterns

- Wave Trading Key Points:

- Enter positions when price bounces from support levels with increasing volume

- Exit or take profits near resistance zones, particularly around $0.003-0.0035 levels based on historical volatility

RWA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-7% of total portfolio allocation

- Professional Investors: 7-15% of total portfolio allocation, with diversification across RWA tokenized assets and BTC collateral exposure

(2) Risk Hedging Solutions

- Position Sizing Hedge: Limit single trade exposure to maximum 2% of portfolio to manage the -16.82% monthly volatility

- Diversification Strategy: Balance RWA holdings with stablecoin reserves to protect against sharp downturns, given the nascent stage of tokenized stock trading platforms

(3) Secure Storage Solution

- Hardware Security Recommendation: Utilize non-custodial BEP-20 compatible wallets for self-custody of RWA tokens on the Binance Smart Chain

- Custody Arrangement: For large institutional positions, consider professional custody solutions that support BEP-20 assets

- Security Considerations: Never share private keys; enable multi-signature authorization for wallets holding significant RWA positions; verify contract address (0x9c8b5ca345247396bdfac0395638ca9045c6586e) before transactions; use official sources from https://allo.xyz/ and https://bscscan.com/

V. RWA Potential Risks and Challenges

RWA Market Risks

- Liquidity Risk: With only 1 exchange listing and relatively low 24-hour volume of approximately $61,237, RWA faces limited liquidity that could result in slippage during large trades

- Price Volatility Risk: The token has experienced -16.82% decline over 30 days and historically swung from $0.002718 to $0.01829, representing extreme volatility unsuitable for risk-averse investors

- Market Adoption Risk: The tokenized stocks platform remains nascent; failure to achieve mainstream adoption could severely impact token utility and valuation

RWA Regulatory Risks

- Securities Compliance Risk: Tokenized stock trading platforms face uncertain regulatory treatment globally; jurisdictions may impose restrictions on the trading or holding of RWA tokens

- Cross-Border Regulatory Risk: Different countries have varying approaches to RWA regulation; changes in major markets could negatively impact platform operations and token value

- AML/KYC Evolution Risk: Regulatory authorities may impose stricter compliance requirements on RWA-denominated transactions, increasing operational costs and reducing platform competitiveness

RWA Technology Risks

- Smart Contract Risk: As a BEP-20 token on Binance Smart Chain, RWA depends on the security of Allo's smart contracts; any vulnerabilities could expose user funds or disrupt platform functionality

- Blockchain Dependency Risk: The platform relies on BSC infrastructure; network congestion, outages, or security breaches could impair 24/7 trading capabilities and settlement mechanisms

- Integration Risk: The ecosystem's $50M in BTC staking and $100M lending facility depend on successful integration with external protocols; failures could cascade through the system

VI. Conclusion and Action Recommendations

RWA Investment Value Assessment

Allo presents a transformative vision for democratizing stock market access through 24/7 tokenized trading with low fees and instant settlement. The platform's $2.2B in tokenized RWAs and significant $50M BTC collateral demonstrate concrete operational progress. However, investors must weigh this compelling long-term potential against substantial near-term risks: extreme price volatility (-16.82% monthly), minimal exchange liquidity, uncertain regulatory frameworks, and the platform's nascent adoption stage. The current market capitalization of $29.12M relative to the $5.24M in circulating value suggests the market is pricing in significant growth expectations, leaving limited margin of safety for new entrants.

RWA Investment Recommendations

✅ Beginners: Start with a 1-2% portfolio allocation using dollar-cost averaging over 6-12 months; purchase exclusively on Gate.com where the token is listed; store tokens in a secure non-custodial BEP-20 wallet; conduct thorough research on tokenized RWA market trends before increasing exposure

✅ Experienced Investors: Consider 3-7% allocation combining long-term accumulation with tactical profit-taking near $0.003-0.0035 resistance levels; monitor regulatory developments across major jurisdictions; maintain hedge positions in stablecoins to capitalize on volatility; actively track project milestones regarding trading volume and user adoption

✅ Institutional Investors: Evaluate 7-15% allocations with professional custody solutions; conduct comprehensive due diligence on Allo's smart contract security and operational resilience; diversify exposure across the platform's RWA asset classes; establish governance participation through community governance if available

RWA Trading Participation Methods

- Gate.com Spot Trading: Direct purchase of RWA tokens using BTC, ETH, or stablecoins on Gate.com's spot market; recommended for all investor types

- Dollar-Cost Averaging (DCA): Automated recurring purchases at fixed intervals (weekly or monthly) to reduce timing risk and benefit from long-term price appreciation potential

- Platform Native Participation: Engage directly with Allo's ecosystem by using the tokenized stock trading platform itself; this provides firsthand experience with the technology while building RWA holdings

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. All investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult professional financial advisors before investing. Never invest more than you can afford to lose.

FAQ

Is Rwa crypto a good investment?

Yes, RWA crypto is a solid investment choice. It combines blockchain security with real-world asset backing, providing intrinsic value and stability. Unlike purely speculative tokens, RWAs generate actual cash flow from tangible assets like real estate and commodities, making them attractive for long-term wealth building.

What is the RWA token prediction?

The RWA token is predicted to reach approximately $10.81 by 2026, based on current market trends and a 5% price change projection. This prediction reflects anticipated ecosystem growth and market momentum.

What exactly is RWA (Real World Assets) and how does it differ from traditional cryptocurrencies?

RWA represents real-world assets tokenized on blockchain, unlike traditional cryptocurrencies which are purely digital. RWA coins are backed by tangible assets like real estate, commodities, and securities, bridging physical and digital worlds.

What are the main risks and benefits of investing in RWA tokens?

Benefits include high returns, cost reduction, and improved liquidity. Risks involve regulatory uncertainty, smart contract vulnerabilities, and custodial concerns. RWA tokenization bridges traditional assets and blockchain opportunities.

Is Allo (RWA) a good investment?: A Comprehensive Analysis of Real-World Asset Tokenization and Market Potential

Bitcoin Staking Guide 2025: How to Secure High Returns

Best Bitcoin Staking Methods in 2025: Yield Comparison and Security Strategies

On-Chain BTC Staking: A Guide for Bitcoin Investors in 2025

Bitcoin And AUD

2025 BTC on-chain staking: Yield, platform comparison and Risk Management

2025 CATE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 CALCIFY Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 PUBLIC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Is Morpher (MPH) a good investment?: A Comprehensive Analysis of Features, Market Potential, and Risk Factors for 2024

Is Soil (SOIL) a good investment?: A Comprehensive Analysis of Price Potential, Use Cases, and Market Outlook for 2024