2025 RZTO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of RZTO

RZTO (Rizz Network), standing as "The People's Network," represents a Decentralized Physical Infrastructure Network (DePIN) solution for the telecom sector, backed by Rizz Wireless LLC USA. As the Web3 evolution of Rizz Wireless, it embodies the vision that using a phone should be an opportunity to earn, not just an expense. As of December 23, 2025, RZTO has achieved a market capitalization of $10.52 million with a circulating supply of 4.4 billion tokens, currently trading at $0.001052. This innovative asset is playing an increasingly critical role in reshaping the decentralized telecommunications infrastructure landscape.

This article will comprehensively analyze RZTO's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

Rizz Network (RZTO) Market Analysis Report

I. RZTO Price History Review and Current Market Status

RZTO Historical Price Movement Trajectory

- October 2025: RZTO reached its all-time high (ATH) of $0.014999 on October 18, 2025, marking the peak valuation during its trading history.

- December 2025: Price declined significantly from ATH levels, reaching its all-time low (ATL) of $0.0007327 on December 23, 2025, representing a substantial correction of approximately 95.12% from the peak.

RZTO Current Market Conditions

As of December 23, 2025, RZTO is trading at $0.001052, reflecting a 9.46% increase over the past 24 hours. However, the token shows significant downward pressure over longer timeframes, with a 34.78% decline over 7 days and a 45.44% decline over the past 30 days.

The 24-hour trading volume stands at $128,466.77, with a total market capitalization of approximately $4.63 million and a fully diluted valuation (FDV) of $10.52 million. The circulating supply accounts for 44% of the total supply, with 4.4 billion RZTO currently in circulation out of a maximum supply of 10 billion tokens.

The project maintains a market ranking of 1,576 across all cryptocurrencies, with a market dominance of 0.00033%. Currently, RZTO is held by 5,539 addresses and is traded on 2 exchanges.

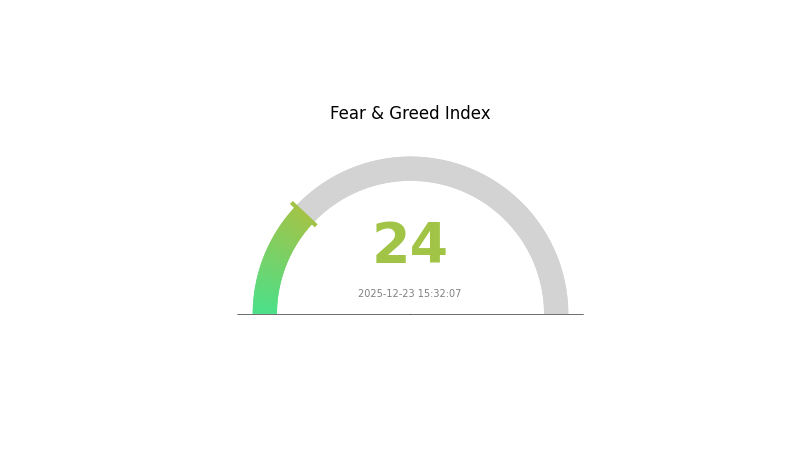

Market sentiment indicates "Extreme Fear" conditions with a VIX of 24, suggesting heightened market volatility and risk aversion among investors.

Check current RZTO market price on Gate.com

RZTO Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 24. This represents a significant market downturn, driven by widespread investor anxiety and risk aversion. During such periods, bearish sentiment dominates, and market participants tend to reduce exposure. However, extreme fear often precedes major market reversals, presenting potential opportunities for long-term investors. Those with strong conviction should carefully monitor market developments on Gate.com and consider selective accumulation strategies while managing risk appropriately.

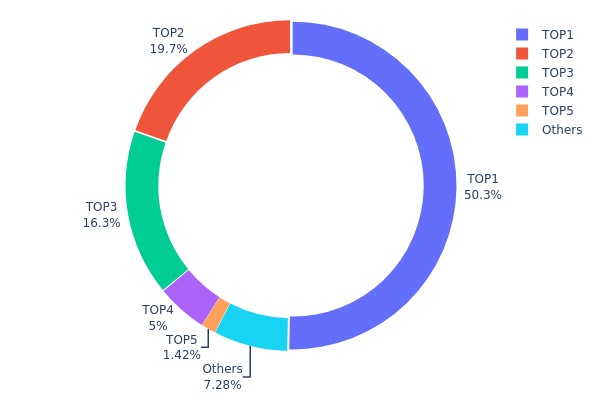

RZTO Holdings Distribution

The address holdings distribution chart illustrates the concentration of RZTO tokens across the blockchain network by tracking the proportion of total supply held by individual addresses. This metric serves as a critical indicator of token decentralization, market structure transparency, and potential vulnerability to large holder manipulation.

RZTO demonstrates significant concentration risk, with the top three addresses controlling 86.29% of the total token supply. The leading address (DHouSX...Z6dsoA) alone holds 50.33% of all RZTO tokens, substantially exceeding healthy decentralization thresholds. The second and third largest holders account for 19.66% and 16.30% respectively, creating a three-tiered concentration pattern. While the fourth address holds 5.00% and the fifth holds 1.42%, the remaining token distribution among other addresses comprises only 7.29%, indicating pronounced supply concentration rather than broad-based holder participation.

This extreme concentration presents notable implications for market dynamics and structural stability. The substantial holdings concentrated in the top three addresses suggest heightened vulnerability to potential coordinated selling pressure, which could exert significant downward price pressure if any major holder decides to liquidate. Furthermore, the dominance of early-stage or founding addresses in such concentration patterns may indicate restricted supply dynamics, where a limited number of stakeholders effectively control market direction. The skewed distribution raises concerns regarding organic market development and decentralized governance potential, as genuine price discovery and community-driven decision-making become challenging when token voting power or trading influence resides with a small cohort of addresses.

Click to view current RZTO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | DHouSX...Z6dsoA | 5033000.00K | 50.33% |

| 2 | 7qdkQb...jQdGcW | 1966214.19K | 19.66% |

| 3 | Gx9prR...C8JhJ5 | 1630548.99K | 16.30% |

| 4 | FLsa9Q...pqWmC5 | 500000.00K | 5.00% |

| 5 | CuBzsG...5gK7Ms | 142499.00K | 1.42% |

| - | Others | 727734.19K | 7.29% |

II. Core Factors Affecting Future Price of RZTO

Supply Mechanism

-

Use Case Expansion Model: As the number of use cases for RZTO increases, the supply dynamics shift significantly. Even with a constant token supply, expanding use cases creates a deflationary effect. For example, if 100 tokens initially serve two use cases, expanding to ten use cases reduces the available tokens per use case substantially, creating scarcity and potential upward price pressure.

-

Current Impact: The expansion of RZTO use cases across multiple scenarios is expected to drive demand for the token, potentially creating supply constraints that could positively influence future price performance.

Market Dynamics and Sentiment

-

Market Demand: Future RZTO prices are primarily influenced by overall market demand, trading volume, and broader market trends.

-

Sentiment Factors: Market emotion and news events play significant roles in price movement. Institutional-level trader requirements and platform developments can generate bullish sentiment in the market.

III. 2025-2030 RZTO Price Forecast

2025 Outlook

- Conservative Forecast: $0.0009 - $0.00107

- Base Case Forecast: $0.00107

- Optimistic Forecast: $0.00135 (requires sustained market recovery and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with progressive sentiment improvement and fundamental development

- Price Range Predictions:

- 2026: $0.00111 - $0.0017

- 2027: $0.00116 - $0.00186

- 2028: $0.00091 - $0.00194

- Key Catalysts: Enhanced ecosystem partnerships, increased institutional interest, platform utility expansion, and favorable regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.0013 - $0.00271 (assuming steady market development and moderate adoption growth)

- Optimistic Case: $0.0016 - $0.00271 (contingent on accelerated ecosystem expansion and strong market sentiment)

- Transformative Case: $0.00241 - $0.00271 (predicated on breakthrough technological implementations and mainstream adoption)

- 2030-12-31: RZTO targeting $0.0021 average valuation (reflecting potential 100% cumulative growth from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00135 | 0.00107 | 0.0009 | 1 |

| 2026 | 0.0017 | 0.00121 | 0.00111 | 14 |

| 2027 | 0.00186 | 0.00145 | 0.00116 | 38 |

| 2028 | 0.00194 | 0.00166 | 0.00091 | 57 |

| 2029 | 0.00241 | 0.0018 | 0.0016 | 71 |

| 2030 | 0.00271 | 0.0021 | 0.0013 | 100 |

Rizz Network (RZTO) Investment Analysis Report

IV. RZTO Professional Investment Strategy and Risk Management

RZTO Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Believers in decentralized telecom infrastructure, long-term Web3 adopters, and investors with high risk tolerance.

-

Operation Recommendations:

- Accumulate RZTO during market downturns when prices are significantly below historical averages, leveraging the current -34.78% 7-day decline as a potential entry opportunity.

- Dollar-cost averaging (DCA) strategy by investing fixed amounts at regular intervals to reduce the impact of price volatility, particularly relevant given the -50.44% annual decline.

- Hold through development cycles as the DePIN telecom sector matures, with focus on project milestones and network expansion announcements.

-

Storage Solution:

- Utilize Gate Web3 Wallet for secure, non-custodial storage of RZTO tokens on the Solana blockchain, enabling direct control of private keys while maintaining easy access for staking or trading opportunities.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor trend reversals and momentum shifts, particularly useful for identifying exits during the current downtrend.

- Relative Strength Index (RSI): Assess overbought (>70) and oversold (<30) conditions; current market conditions may present oversold opportunities.

- Volume Profile Analysis: Confirm breakouts with significant volume increases to distinguish genuine trend reversals from false signals.

-

Swing Trading Key Points:

- Identify support levels near the all-time low of $0.0007327 (reached December 23, 2025) and resistance near the all-time high of $0.014999 (October 18, 2025).

- Monitor 24-hour trading volume of $128,466.77; increased volume above this threshold may signal strengthening momentum.

- Execute position sizing based on risk tolerance, with stop-losses placed 10-15% below entry points to manage downside exposure.

RZTO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-5% of portfolio allocation to RZTO, treating it as a high-risk, speculative position within a diversified portfolio.

- Aggressive Investors: 8-15% of portfolio allocation, actively managing positions through technical indicators and market sentiment shifts.

- Professional Investors: 10-20% allocation with active hedging strategies, leveraging DePIN sector exposure for diversification benefits.

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance RZTO holdings with established cryptocurrencies and traditional assets to reduce single-asset concentration risk, particularly given the current -50.44% annual drawdown.

- Position Sizing with Stop-Losses: Implement predetermined exit strategies, setting stop-losses 10-15% below purchase prices to limit maximum losses and preserve capital during market downturns.

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet provides non-custodial storage with full private key control, supporting Solana blockchain assets like RZTO while enabling seamless trading integration.

- Hardware Wallet Alternative: For large holdings, consider using hardware wallets for enhanced security; transfer RZTO to trusted hardware solutions for long-term storage, then reconnect periodically for trading or staking.

- Security Considerations:

- Never share private keys or seed phrases with anyone; store them in secure, offline locations.

- Verify contract addresses before transactions; RZTO's official Solana contract is 2qpqweHfSKUvZFGQL3D7aadD5i5dDN8kz9xdZGraGAxC.

- Enable two-factor authentication on all exchange and wallet accounts.

- Use hardware wallets for holdings exceeding personal risk thresholds.

V. RZTO Potential Risks and Challenges

RZTO Market Risk

- High Volatility and Drawdown Exposure: RZTO exhibits extreme price volatility with a -50.44% decline over the past year and -34.78% in the past 7 days, indicating rapid value fluctuations that can result in significant losses for retail investors.

- Limited Trading Volume: With 24-hour volume of only $128,466.77 across 2 exchanges, low liquidity may cause slippage during large trades and difficulty exiting positions during market stress.

- Market Capitalization Concentration: A fully diluted valuation of $10.52 million with only 44% of tokens in circulation creates the risk of significant price pressure if circulating supply expands or major holders liquidate positions.

RZTO Regulatory Risk

- Telecom Sector Regulatory Uncertainty: As a DePIN project operating in the highly regulated telecom industry, changes in telecommunications regulations or spectrum licensing requirements could impact project viability.

- Cryptocurrency Regulatory Evolution: Increasing government scrutiny of cryptocurrency projects, particularly those claiming utility in regulated sectors, may introduce compliance challenges or operational restrictions.

- Jurisdictional Compliance: Projects backed by U.S.-based entities face potential regulatory actions if telecommunications authorities determine the project violates existing licensing or infrastructure rules.

RZTO Technology Risk

- DePIN Implementation Challenges: Execution risks in building decentralized physical infrastructure networks include achieving sufficient hardware adoption, network reliability, and economic sustainability.

- Solana Blockchain Dependency: RZTO operates solely on the Solana blockchain; technical failures, network congestion, or ecosystem-wide issues could impact token accessibility and functionality.

- Competition in DePIN Telecom Space: Emerging competitors and established telecom companies developing blockchain solutions may capture market share, reducing RZTO's competitive advantage.

VI. Conclusion and Action Recommendations

RZTO Investment Value Assessment

Rizz Network (RZTO) presents a speculative opportunity within the emerging DePIN telecom sector, offering a unique Web3 evolution of traditional wireless services. However, the current market conditions—marked by a -50.44% annual decline, extremely low trading volume, and small market capitalization—reflect significant execution and market adoption risks. The project's long-term value depends on successfully building a functioning decentralized telecom network and achieving meaningful user adoption. Current price levels near all-time lows may present opportunities for risk-tolerant investors, but only as part of a highly diversified portfolio with strict risk management protocols. The extreme volatility and limited liquidity require professional-grade trading discipline and position sizing.

RZTO Investment Recommendations

✅ Beginners: Start with micro-positions (0.1-0.5% of portfolio) through Gate.com's simple trading interface. Use only capital you can afford to lose entirely, set automated stop-losses at -15%, and focus on learning the DePIN sector fundamentals before increasing exposure.

✅ Experienced Investors: Implement dollar-cost averaging strategies during significant drawdowns, use technical analysis for swing trading opportunities, and maintain positions within 5-10% of total portfolio allocation. Monitor network development milestones and community sentiment on official channels.

✅ Institutional Investors: Conduct deep due diligence on the project's technical roadmap, team credentials, and telecom partnership development. Consider positions within 10-20% allocation frameworks while maintaining active hedging strategies and exit protocols based on quantitative metrics.

RZTO Trading Participation Methods

- Direct Exchange Trading: Purchase RZTO on Gate.com using fiat gateways (USD, EUR) or crypto deposits, taking advantage of integrated trading tools and market data.

- Decentralized Swap Integration: Utilize Solana-based decentralized protocols to acquire RZTO directly from smart contracts, enabling decentralized access with full custody control.

- Gate.com Advanced Features: Leverage Gate.com's margin trading, futures markets, and alert systems for sophisticated trading strategies, though only for experienced traders comfortable with leverage risks.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

What is RZTO and what is its current price?

RZTO is a cryptocurrency token currently trading at $0.0017013 USD, up 2.61% in the past 24 hours. It represents a digital asset within the blockchain ecosystem.

What is the price prediction for RZTO in 2025?

Based on market analysis, RZTO is projected to reach approximately $0.002174 by December 2025. This forecast reflects current market trends and technical indicators for the token's performance.

What factors could influence RZTO's price in the future?

RZTO's price may be influenced by block reward halvings, hard forks, protocol updates, market demand, trading volume, and broader cryptocurrency market trends. Developer activity and community adoption also impact long-term price movements.

Is RZTO a good investment and what are the risks?

RZTO offers potential growth in the decentralized mobile network sector. However, crypto investments carry inherent volatility risks and market uncertainty. Token prices may fluctuate significantly. Always conduct thorough research and consider your risk tolerance before investing.

How does RZTO compare to other similar tokens?

RZTO stands out with strong fundamentals and innovative features compared to similar tokens. It offers better transaction efficiency, lower fees, and growing ecosystem adoption. RZTO's technical advantages position it competitively in the market.

Is Rizz Network (RZTO) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

What is ROAM: A Comprehensive Guide to Revolutionizing Your Note-Taking and Knowledge Management

What is HONEY: The Complete Guide to Nature's Golden Nectar and Its Remarkable Health Benefits

2025 HAT Price Prediction: Will the Decentralized Storage Token Reach New Heights?

What is SHDW: A Comprehensive Guide to Shadow's Revolutionary Blockchain Infrastructure

What is SAROS: Understanding the Ancient Eclipse Cycle and Its Modern Applications

2025 DATA Price Prediction: Expert Analysis and Future Market Outlook for Cryptocurrency Investors

2025 TET Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Understanding Crypto Cards: Functionality and Applications

2025 XDB Price Prediction: Expert Analysis and Market Outlook for the Year Ahead

2025 CLORE Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year