2025 SHPING Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of SHPING

Shping (SHPING) is a pioneering shopping companion platform that integrates consumer marketing, brand protection, product authentication, and global product database into a unified ecosystem, rewarding consumers for their participation and contributions. Since its inception in 2018, Shping has established itself as a leading shopping rewards application, particularly gaining significant traction in Australia with over 300,000 users and partnerships with major global brands including Pepsi, Doritos, Asahi, Mountain Dew, Twinings, Schweppes, Heinz, and Gatorade. As of December 2025, SHPING's market capitalization stands at approximately $23.81 million, with a circulating supply of 2.29 billion tokens and a current price of $0.002381. This innovative "shopping reward token" is playing an increasingly pivotal role in revolutionizing the direct relationship between brands and consumers, enabling businesses to reward consumer participation while creating a safer and more intelligent shopping environment.

This article will provide a comprehensive analysis of Shping's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging retail-focused blockchain utility token.

SHPING Market Analysis Report

I. SHPING Price History Review and Market Status

SHPING Historical Price Evolution Trajectory

- 2020: Project inception, historical low price of $0.000000029996 recorded on May 7, 2020

- 2022: Peak market performance, reaching all-time high of $0.102288 on January 20, 2022

- 2022-2025: Significant decline phase, price dropped from historical peak to current levels, representing a 73.87% decrease over the one-year period

SHPING Current Market Situation

As of December 23, 2025, SHPING is trading at $0.002381, with a market capitalization of $5.44 million and a fully diluted valuation of $23.81 million. The token maintains a global market ranking of 1479, with a market dominance of 0.00075%.

Recent Price Performance:

- 1-Hour Change: +0.0057% ($0.000000135709)

- 24-Hour Change: -1.8% ($-0.000043643585)

- 7-Day Change: -8.19% ($-0.000212399412)

- 30-Day Change: -16.45% ($-0.000468790545)

- 1-Year Change: -73.87% ($-0.006731131649)

The 24-hour trading range is between $0.002321 and $0.002448, with a 24-hour trading volume of approximately 99,076.87 SHPING tokens. Current circulating supply stands at 2,286,791,464 tokens out of a maximum supply of 10 billion tokens, representing a circulation ratio of 22.87%.

The token is held by 9,521 unique wallet addresses and is actively listed on 2 exchanges. SHPING operates on the Ethereum blockchain with the contract address 0x7C84e62859D0715eb77d1b1C4154Ecd6aBB21BEC.

Click to view current SHPING market price

SHPING Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at 24, indicating significant investor pessimism. This sentiment typically reflects widespread market concerns, price volatility, and reduced trading confidence. During such periods, risk-averse investors often adopt defensive strategies, while opportunistic traders may view extreme fear as a potential buying opportunity. Monitor key support levels and market indicators closely to understand the underlying factors driving this sentiment shift on Gate.com.

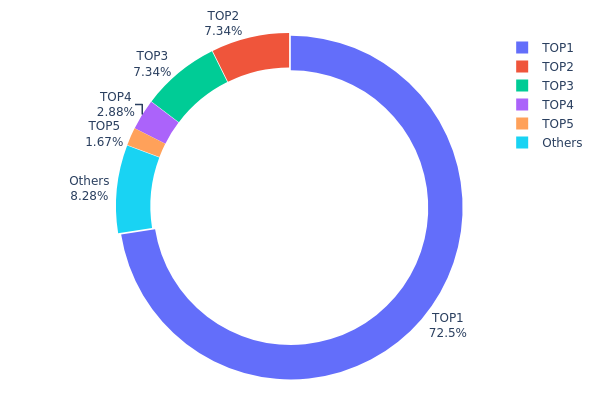

SHPING Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing market structure, liquidity dynamics, and potential concentration risks. By analyzing the distribution of SHPING tokens among top holders and the broader address base, we can evaluate the degree of decentralization and identify potential vulnerabilities to market manipulation or significant price volatility.

SHPING exhibits pronounced concentration characteristics, with the top holder commanding 72.48% of total supply, representing an exceptionally high level of centralization. The second and third largest addresses hold nearly identical positions at 7.33% each, collectively accounting for an additional 14.66% of circulating tokens. Together, the top five addresses control approximately 91.68% of the token supply, leaving only 8.32% distributed among all other holders. This extreme concentration suggests significant concentration risk, as a coordinated action or unexpected movement by the largest holder could substantially impact market dynamics and price stability.

The current distribution pattern reflects a highly centralized market structure that deviates significantly from ideal decentralization standards. While such concentration may indicate strong stakeholder commitment or institutional backing, it simultaneously elevates the risk of sudden supply shocks and price manipulation. The minimal participation of smaller holders (8.32% of supply) suggests limited organic distribution and retail ownership, which may constrain genuine market depth and resilience. Investors should monitor whether this concentration persists or gradually disperses over time, as sustained extreme centralization typically correlates with heightened volatility and reduced market maturity.

Click to view current SHPING holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x52a6...535a03 | 7248909.77K | 72.48% |

| 2 | 0xbb10...d57472 | 733902.81K | 7.33% |

| 3 | 0x3243...846132 | 733884.01K | 7.33% |

| 4 | 0xe901...1f4b3a | 287961.04K | 2.87% |

| 5 | 0x70a9...211616 | 167460.36K | 1.67% |

| - | Others | 827882.01K | 8.32% |

II. Core Factors Affecting SHPING's Future Price

Supply Mechanism

-

Token Burn Mechanism: SHPING employs a token burning mechanism to gradually reduce total supply volume, enhancing scarcity as supply decreases over time.

-

Historical Patterns: Token destruction mechanisms have historically demonstrated the ability to increase asset scarcity, which theoretically supports price appreciation by reducing the circulating supply available in the market.

-

Current Impact: The ongoing implementation of the burn mechanism is expected to continue reducing supply pressure on SHPING, potentially creating upward price dynamics as the circulating supply contracts.

Macro-Economic Environment

-

Monetary Policy Impact: Global central banks are reassessing their monetary stances, with the U.S. Federal Reserve resuming rate cuts. Expectations for interest rate reductions in 2026 create a favorable liquidity environment that typically supports cryptocurrency valuations.

-

Geopolitical Factors: International geopolitical tensions and shifts in global economic order contribute to increased demand for alternative assets, including cryptocurrencies, as investors seek diversification away from traditional currency exposure.

III. 2025-2030 SHPING Price Forecast

2025 Outlook

- Conservative Forecast: $0.00198-$0.00239

- Base Case Forecast: $0.00239

- Bullish Forecast: $0.00329 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Potential recovery and growth phase with moderate upward trajectory as the asset gains broader market recognition and adoption.

- Price Range Forecast:

- 2026: $0.00190-$0.00403

- 2027: $0.00265-$0.00488

- Key Catalysts: Increased institutional interest, improved market liquidity on platforms such as Gate.com, expansion of use cases, and overall cryptocurrency market sentiment improvement.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.00333-$0.00549 (assumes steady adoption growth and favorable regulatory environment)

- Bullish Scenario: $0.00462-$0.00743 (assumes accelerated mainstream adoption and strengthened fundamentals)

- Transformational Scenario: $0.00743+ (assumes breakthrough technological innovation, mass institutional adoption, and emergence as a key digital asset in its category)

- 2030-12-31: SHPING at $0.00502 average (sustained growth phase with 110% cumulative appreciation from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00329 | 0.00239 | 0.00198 | 0 |

| 2026 | 0.00403 | 0.00284 | 0.0019 | 19 |

| 2027 | 0.00488 | 0.00344 | 0.00265 | 44 |

| 2028 | 0.00549 | 0.00416 | 0.00333 | 74 |

| 2029 | 0.00521 | 0.00482 | 0.00343 | 102 |

| 2030 | 0.00743 | 0.00502 | 0.00462 | 110 |

Shping (SHPING) Professional Investment Strategy and Risk Management Report

IV. SHPING Professional Investment Strategy and Risk Management

SHPING Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors with belief in Shping's ecosystem development, brand loyalty program adoption, and long-term consumer engagement trends

- Operational Recommendations:

- Accumulate SHPING tokens during market downturns when price volatility increases opportunities for better entry points

- Monitor brand adoption metrics and user growth on the Shping platform as leading indicators of token demand

- Maintain a diversified portfolio with SHPING representing only a portion of total crypto holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages (MA): Use 20-day and 50-day MAs to identify trend reversals and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions for potential entry and exit signals

- Wave Trading Key Points:

- Trade within established support levels given the token's 73.87% decline over one year

- Set strict stop-loss orders at 5-8% below entry points to protect against sudden market reversals

- Scale into positions incrementally rather than deploying capital in single transactions

SHPING Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Active Investors: 2-5% of total crypto portfolio allocation

- Professional Investors: 5-10% of total crypto portfolio allocation, with hedging strategies in place

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Invest fixed amounts at regular intervals to reduce timing risk and average out price volatility

- Portfolio Diversification: Balance SHPING holdings with established cryptocurrencies and traditional assets to mitigate concentration risk

(3) Secure Storage Solutions

- Hot wallet Strategy: Use Gate.com Web3 Wallet for frequent trading and active management of SHPING tokens

- Cold Storage Approach: Transfer long-term holdings to secure offline storage solutions after initial accumulation

- Security Precautions: Enable two-factor authentication, use hardware-based transaction confirmation, never share private keys, and regularly audit wallet security settings

V. SHPING Potential Risks and Challenges

SHPING Market Risk

- Extreme Price Volatility: The token has experienced a 73.87% decline over one year and an 8.19% decline over the past seven days, indicating high price instability and potential for further downward pressure

- Limited Liquidity: Daily trading volume of approximately $99,076 represents relatively thin liquidity compared to major cryptocurrencies, resulting in wider bid-ask spreads and potential slippage on larger trades

- Market Capitalization Concentration: With a market cap of only $23.81 million and circulating value of $5.44 million, SHPING remains a micro-cap token vulnerable to large investor exits

SHPING Regulatory Risk

- Uncertain Classification Status: Regulatory frameworks for shopping reward tokens and consumer loyalty programs remain ambiguous in many jurisdictions, creating potential legal challenges

- Brand Compliance Exposure: Regulatory changes affecting promotional campaigns or consumer reward programs could impact major brand partners' willingness to utilize SHPING tokens

- Cross-Border Compliance: Operating globally while maintaining compliance across different regulatory environments in Australia, the United States, and other markets presents ongoing legal complexity

SHPING Technology Risk

- Smart Contract Vulnerabilities: Ethereum-based smart contracts governing token distribution and brand reward mechanisms could contain undiscovered security flaws

- Platform Integration Challenges: Technical failures in integrating SHPING tokens with retail point-of-sale systems could disrupt brand partnerships and consumer adoption

- Scalability Limitations: As user adoption grows, the Ethereum network's transaction costs and confirmation times could create friction in the consumer reward experience

VI. Conclusion and Action Recommendations

SHPING Investment Value Assessment

Shping presents an innovative approach to direct brand-to-consumer engagement through tokenized reward mechanisms, with demonstrated adoption from major global brands including Pepsi, Doritos, Asahi, and Mountain Dew. The platform's established user base exceeding 300,000 in Australia and over $110 million in distributed token rewards indicates viable market traction. However, the token's 73.87% one-year decline, limited liquidity, and micro-cap market position create substantial downside risks. The long-term value proposition depends critically on scaling brand partnerships globally, increasing daily active users, and maintaining regulatory approval across multiple jurisdictions.

SHPING Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) through dollar-cost averaging over several months to understand platform dynamics before increasing exposure ✅ Experienced Investors: Employ technical analysis for tactical trading around support/resistance levels while maintaining strict risk management protocols and diversification requirements ✅ Institutional Investors: Conduct extensive due diligence on brand partnership sustainability and regulatory compliance frameworks before considering significant allocations

SHPING Trading Participation Methods

- Gate.com Spot Trading: Execute buy and sell orders directly on Gate.com's spot market for SHPING/USDT pairs with real-time price discovery

- Gate.com Web3 Wallet Integration: Seamlessly transfer SHPING tokens between the platform and personal Web3 wallets while maintaining custody control

- Platform Rewards Program: Earn SHPING tokens directly through the Shping app's consumer engagement activities and brand interaction campaigns

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is shping crypto?

Shping crypto is the blockchain token powering the Shping economy, providing rewards to Shping app users. It incentivizes participation within the Shping ecosystem through a token-based reward mechanism.

What is the all time high for the shping coin?

The all-time high for SHPING coin is $0.098838. This represents the peak price the token has reached in its trading history.

Can Shping Coins reach $1?

It is highly unlikely. Shping would need approximately 41,900% price appreciation to reach $1, which contradicts current market trends and fundamental factors. Reaching $1 remains improbable.

How Will TOAD's Fundamental Analysis Impact Its Price in 2025?

Trump Coin 2025: Investment Guide and Price Analysis

What trends do the price performance and volume analysis of HOT show?

What Does “Liquidated” Actually Mean?

MACD & RSI: Essential Indicators for Predicting Quq's Price Trends in 2025

What Does 'Stonks' Mean ?

Understanding Actively Validated Services (AVS) Systems

Understanding the Difference Between Mark Price and Latest Price in Crypto Futures

Exploring Elon Musk's Business Ownership in American Companies

Understanding Cryptocurrency Bags: Effective Management Tips

What is SCA: A Comprehensive Guide to Strong Customer Authentication in Digital Payment Security