2025 SIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: SIS Market Position and Investment Value

Symbiosis (SIS) operates as a decentralized multi-chain liquidity protocol that enables users to transfer assets seamlessly across multiple blockchains while maintaining full custody of their holdings. Since its inception, the project has established itself as a key player in cross-chain infrastructure by aggregating liquidity across EVM-compatible blockchains and facilitating low-slippage exchanges between chains.

As of December 24, 2025, SIS has achieved a market capitalization of approximately $4.17 million with a circulating supply of approximately 82.14 million tokens, currently trading at $0.05072 per token. This innovative asset is playing an increasingly critical role in enabling seamless multi-chain asset transfers and liquidity aggregation across the decentralized finance ecosystem.

This article will provide a comprehensive analysis of SIS price trends and market dynamics, combining historical performance patterns, market supply and demand fundamentals, and ecosystem development factors to deliver professional price forecasts and actionable investment strategies for the period through 2030.

Symbiosis Finance (SIS) Market Analysis Report

I. SIS Price History Review and Current Market Status

SIS Historical Price Development

Based on available data, Symbiosis Finance (SIS) has experienced significant price volatility since its inception:

- January 2022: SIS reached its all-time high (ATH) of $5.59 on January 17, 2022, marking the peak of early market enthusiasm for the protocol.

- 2022-2024: The token experienced a prolonged bearish period, with continuous price depreciation during the broader cryptocurrency market downturn.

- 2025: SIS hit its all-time low (ATL) of $0.0451631 on April 22, 2025, representing a decline of approximately 92% from its historical peak.

SIS Current Market Situation

As of December 24, 2025, SIS is trading at $0.05072, reflecting:

- 24-hour performance: Down 0.76%, with price range between $0.0502 and $0.05355

- 7-day performance: Up 0.52% over the past week

- 30-day performance: Down 0.65% over the monthly period

- 1-year performance: Down 58.01% over the past year

Market Capitalization Metrics:

- Market cap: $4,165,905.44

- Fully diluted valuation (FDV): $5,046,120.68

- Market cap to FDV ratio: 82.14%

- 24-hour trading volume: $31,015.83

- Token holders: 5,931

- Market ranking: #1648

Supply Information:

- Circulating supply: 82,135,359.63 SIS (82.14% of total)

- Total supply: 99,489,760.94 SIS

- Maximum supply: 100,000,000 SIS

- Market dominance: 0.00015%

The token is currently available on 4 major exchanges, demonstrating moderate liquidity accessibility for traders and investors.

Click to view current SIS market price

SIS Market Sentiment Indicator

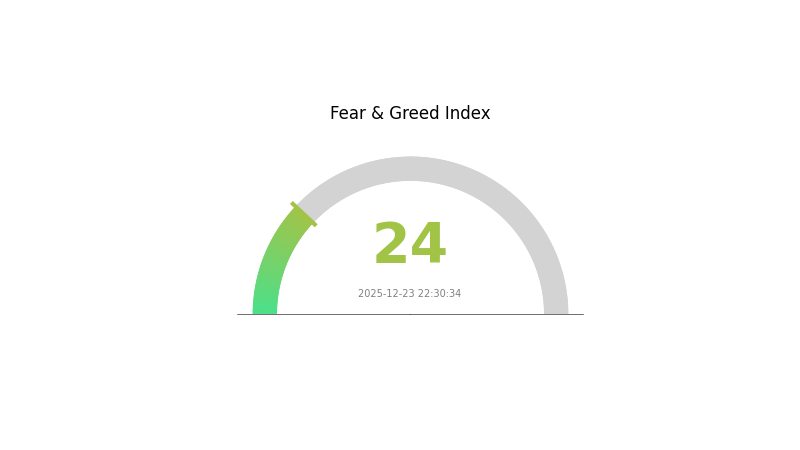

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index dropping to 24. This indicates significant market pessimism and investor anxiety. During such periods, volatility tends to increase as selling pressure mounts. However, extreme fear often presents opportunities for long-term investors seeking favorable entry points. Market participants should exercise caution while remaining vigilant for potential recovery signals. Consider diversifying your portfolio and dollar-cost averaging strategies to navigate this turbulent phase on Gate.com.

SIS Holdings Distribution

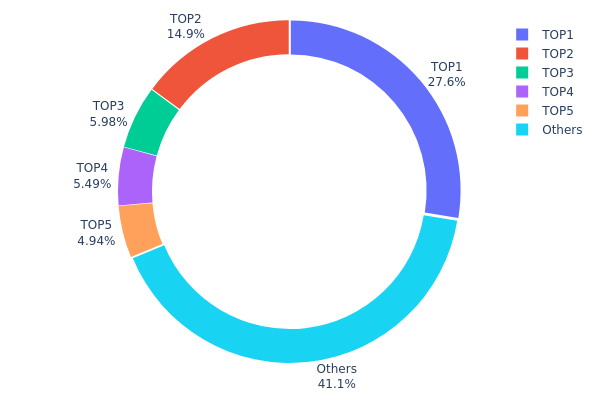

The address holdings distribution map illustrates the concentration of SIS tokens across different wallet addresses on the blockchain. This metric is essential for assessing token decentralization, market structure stability, and potential risks associated with large holder concentration. By analyzing the percentage of total supply held by top addresses, investors and analysts can evaluate whether the token distribution presents healthy market dynamics or exhibits signs of centralization risk.

The current SIS distribution data reveals moderate concentration characteristics. The top holder commands 27.59% of the total supply, while the top five addresses collectively control approximately 58.82% of all tokens in circulation. This concentration level indicates that while a significant portion of the token supply remains distributed among other addresses, accounting for 41.18%, the asset exhibits a noteworthy dependency on major holders. Such a distribution pattern is not uncommon in emerging crypto projects; however, it suggests that price movements and market sentiment could be meaningfully influenced by the actions of these prominent stakeholders.

From a market structure perspective, this concentration level presents both opportunities and considerations. The substantial holdings by top addresses could indicate strong institutional or core team involvement, potentially providing stability and aligned incentives for project development. However, the relatively high concentration of voting power and liquidity control among the top five holders raises questions about decision-making autonomy and the potential for coordinated market movements. The remaining 41.18% distributed among other addresses demonstrates moderate retail participation, which helps mitigate extreme centralization risks but remains below levels typically associated with highly decentralized token networks.

Click to view current SIS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa3a7...d60eec | 27456.09K | 27.59% |

| 2 | 0xf89d...5eaa40 | 14776.68K | 14.85% |

| 3 | 0xb8f2...9e81a8 | 5944.93K | 5.97% |

| 4 | 0xddac...cb0374 | 5460.99K | 5.48% |

| 5 | 0x0d07...b492fe | 4912.08K | 4.93% |

| - | Others | 40939.00K | 41.18% |

II. Core Factors Impacting SIS Future Price

Supply Mechanism

- Token Burn Mechanism: SIS implements a token burn mechanism to gradually reduce total supply.

- Historical Performance: Previous burn initiatives have generally provided positive support for SIS token price.

- Current Impact: Continued token burns are expected to create a deflationary effect, which is favorable for price movement.

Staking Mechanism

- Staking Rewards: SIS tokens can be staked to earn rewards and participate in governance.

- Current Impact: The staking mechanism helps reduce circulating supply and enhance price stability.

Macroeconomic Environment

- Market Sentiment: Market sentiment and investor confidence are critical factors influencing SIS price trajectory. Crypto market panic index fluctuations can significantly impact trading behavior and price volatility.

III. 2025-2030 SIS Price Prediction

2025 Outlook

- Conservative Prediction: $0.0294 - $0.0507

- Neutral Prediction: $0.0507

- Optimistic Prediction: $0.0659 (requires sustained market stability and protocol adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with incremental utility expansion driving organic growth

- Price Range Prediction:

- 2026: $0.0321 - $0.0659 (14% potential upside)

- 2027: $0.0540 - $0.0844 (22% potential upside)

- 2028: $0.0498 - $0.1004 (44% potential upside)

- Key Catalysts: Enhanced ecosystem development, increased institutional interest, improved market liquidity on platforms such as Gate.com, and expanding use cases within the SIS network

2029-2030 Long-term Outlook

- Base Case Scenario: $0.0547 - $0.1267 (71% appreciation by 2029, assuming moderate adoption acceleration)

- Optimistic Scenario: $0.0587 - $0.1175 (110% appreciation by 2030, assuming strong DeFi integration and mainstream recognition)

- Transformation Scenario: $0.1175+ (sustained above $0.10 through 2030, assuming breakthrough technological developments and widespread institutional adoption)

- 2030-12-31: SIS at $0.1067 average (consolidation phase with potential for sustained utility-driven growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0659 | 0.05069 | 0.0294 | 0 |

| 2026 | 0.06587 | 0.05829 | 0.03206 | 14 |

| 2027 | 0.08443 | 0.06208 | 0.05401 | 22 |

| 2028 | 0.10036 | 0.07326 | 0.04982 | 44 |

| 2029 | 0.12674 | 0.08681 | 0.05469 | 71 |

| 2030 | 0.11745 | 0.10678 | 0.05873 | 110 |

Symbiosis (SIS) Professional Investment Strategy and Risk Management Report

IV. SIS Professional Investment Strategy and Risk Management

SIS Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: DeFi protocol enthusiasts, cross-chain infrastructure believers, and patient capital allocators seeking exposure to multi-chain liquidity solutions.

-

Operational Recommendations:

- Accumulate SIS during periods of market weakness, particularly when the token trades significantly below historical averages, leveraging dollar-cost averaging to reduce entry risk.

- Hold positions through market cycles, recognizing that cross-chain infrastructure projects typically require extended periods to achieve mainstream adoption and demonstrate network effects.

- Participate in governance and protocol-level activities to maintain engagement with ecosystem developments and upcoming feature releases.

-

Storage Solution: Utilize Gate.com's Web3 wallet for secure asset management, enabling direct protocol interaction while maintaining self-custody and security standards appropriate for long-term holdings.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Monitoring: Track SIS against key support levels ($0.0451631 - all-time low) and resistance zones ($0.05355 - 24-hour high), identifying reversal patterns and volatility breakpoints.

- Volume Analysis: Monitor 24-hour trading volume trends relative to the current $31,015.83 benchmark, as volume expansion often precedes significant directional moves in lower-liquidity altcoins.

-

Position Management Key Points:

- Establish profit-taking levels at 15-25% gains from entry positions, given the token's historical volatility and current market conditions.

- Implement stop-loss orders at 8-12% below entry points to protect capital during adverse market movements and protocol-specific downside scenarios.

SIS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.5% portfolio allocation - SIS represents a specialized infrastructure play with concentrated risks; minimal exposure appropriate for risk-averse portfolios.

- Aggressive Investors: 2-4% portfolio allocation - sufficient exposure to capture upside potential from cross-chain liquidity adoption while maintaining overall portfolio stability.

- Professional Investors: 3-6% allocation - leveraging sophisticated position sizing tied to protocol development milestones and market adoption metrics.

(2) Risk Hedging Strategies

- Stablecoin Reserves: Maintain 40-50% of intended SIS investment in stablecoins, enabling rapid rebalancing opportunities during significant volatility events or protocol announcements.

- Portfolio Diversification: Combine SIS holdings with exposure to complementary infrastructure tokens and established layer-1 blockchains, reducing concentration risk and improving risk-adjusted returns.

(3) Secure Storage Solutions

- Custodial Solution: Gate.com Web3 wallet provides institutional-grade security features with seamless integration to the Gate.com trading platform, enabling efficient portfolio management and swift execution when rebalancing needs arise.

- Non-Custodial Alternative: For investors preferring enhanced self-custody, maintain private key control through hardware security practices, though recognize reduced accessibility for active trading scenarios.

- Security Considerations:

- Enable multi-factor authentication on all exchange accounts and wallet interfaces.

- Never share private keys or seed phrases, regardless of circumstances.

- Verify all smart contract interactions through official Symbiosis channels before authorizing transactions.

- Maintain regular security audits of connected wallet addresses and transaction history.

V. SIS Potential Risks and Challenges

SIS Market Risk

-

Liquidity Constraints: With only $31,015.83 in 24-hour trading volume across 4 exchange listings, SIS exhibits limited liquidity. This concentration creates susceptibility to slippage during larger trades and potential difficulty executing positions at desired price levels during market stress.

-

Price Volatility: The token demonstrates extreme price swings, trading between $0.0451631 (all-time low) and $5.59 (all-time high). This 123x range indicates severe market sentiment fluctuations and makes valuation stability uncertain.

-

Market Capitalization Sensitivity: With a fully diluted valuation of $5.05 million against circulating value of $4.17 million, SIS remains vulnerable to minor capital flows, lacking the market depth typical of established infrastructure tokens.

SIS Regulatory Risk

-

Protocol Classification Uncertainty: Regulatory authorities continue developing frameworks for decentralized cross-chain protocols. Potential reclassification of Symbiosis as a regulated financial infrastructure provider could impose compliance burdens affecting operations and token utility.

-

Cross-Chain Bridge Scrutiny: Bridges and multi-chain protocols face increasing regulatory examination globally. Enhanced compliance requirements could impede the protocol's ability to seamlessly facilitate cross-chain asset transfers.

-

Token Utility Definitions: Ongoing regulatory evolution around token classification and utility definitions may impact SIS's legal status and trading availability across jurisdictions.

SIS Technology Risk

-

Smart Contract Vulnerability: Cross-chain protocols inherently face heightened security challenges. Any exploits targeting Symbiosis's bridge or liquidity mechanisms could result in significant value destruction and user fund losses.

-

Network Integration Risk: Dependence on multiple blockchain networks means SIS's security profile is linked to the weakest connected chain. Vulnerabilities in connected EVM-compatible chains could propagate to the Symbiosis protocol.

-

Adoption Rate Risk: As a multi-chain liquidity solution, Symbiosis requires sustained user adoption and deep integration with existing DeFi infrastructure. Slower-than-anticipated adoption would limit revenue generation and protocol growth.

VI. Conclusion and Action Recommendations

SIS Investment Value Assessment

Symbiosis Finance presents a technically specialized investment thesis centered on decentralized cross-chain liquidity provision. The protocol addresses a genuine market need for seamless asset transfers across EVM-compatible blockchains while maintaining user custody and avoiding centralized bridge risks.

However, the investment carries substantial constraints: limited market liquidity, significant price volatility, modest market capitalization, and early-stage adoption metrics. The token's 58.01% year-over-year decline reflects broader market skepticism regarding cross-chain infrastructure valuations. Success depends critically on accelerating user adoption, achieving sustainable transaction volume, and maintaining technological leadership in an increasingly competitive cross-chain landscape.

SIS Investment Recommendations

✅ Beginners: Consider minimal exploratory positions (0.5-1% of crypto allocation) through Gate.com, treating SIS as a speculative infrastructure bet rather than core holding. Focus on understanding protocol functionality before expanding exposure.

✅ Experienced Investors: Implement structured accumulation strategies during documented support levels, combining technical analysis with protocol development milestones. Maintain disciplined position sizing (2-4% allocation) and rebalance according to predetermined thresholds.

✅ Institutional Investors: Conduct comprehensive due diligence on Symbiosis governance structure, team credibility, security audit history, and competitive positioning within the cross-chain infrastructure landscape before establishing meaningful allocations.

SIS Trading and Participation Methods

-

Primary Exchange Access: Trade SIS directly through Gate.com, which provides comprehensive spot trading pairs, real-time market data, and integrated portfolio management tools necessary for active SIS trading strategies.

-

Protocol Interaction: Access Symbiosis Finance directly through the official protocol interface at symbiosis.finance to experience cross-chain liquidity services firsthand and participate in governance mechanisms.

-

Information Monitoring: Follow official channels including Twitter (@symbiosis_fi) and GitHub (symbiosis-finance) for protocol updates, security announcements, and development roadmap changes affecting investment decisions.

Cryptocurrency investment involves extreme risk. This report does not constitute investment advice. Investors must make decisions according to their individual risk tolerance and financial situation. Always consult qualified financial advisors before making investment decisions. Never invest more than you can afford to lose completely.

FAQ

Is SIS stock a good buy?

Yes, SIS is rated 'Buy' with strong upside potential of 22.07% toward a 12-month target price of $26.88. The token shows promising fundamentals and market positioning in the web3 ecosystem.

What is the future outlook for SIS shares?

SIS shares show strong growth potential with forecasted earnings growth of 46% annually and revenue growth of 11.1% per annum. EPS is expected to increase by 43.9% yearly, indicating positive momentum ahead.

Does Siacoin have a future?

Yes, Siacoin has significant potential. With growing demand for decentralized storage solutions and strong community support, SC is well-positioned for long-term growth. Technological advancements and increased adoption could drive substantial value appreciation in coming years.

Is TrustWallet (TWT) a good investment?: Analyzing the potential and risks of the native token of a popular crypto wallet

Is THORWallet (TITN) a good investment?: A comprehensive analysis of features, tokenomics, and market potential

2025 WALLET Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Crypto Presale Insights: Exploring Early Investment Opportunities and Strategies

Avalanche (AVAX) 2025 Price Analysis and Market Trends

SEI Staking Analysis: 60-70% Supply Locked and Its Price Impact

What is RARI: A Comprehensive Guide to the Decentralized Art NFT Platform

What is BLD: A Comprehensive Guide to Binaural Beat Lucid Dreaming Techniques

What is HIFI: A Complete Guide to High-Fidelity Audio Systems and Technology

What is ADP: A Comprehensive Guide to Adenosine Diphosphate and Its Role in Cellular Energy

Can Dash Achieve the $1000 Milestone?