2025 SKYAI Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: SKYAI's Market Position and Investment Value

SkyAI (SKYAI) is an all-in-one AI ecosystem powered by MCP (Model Context Protocol), designed to seamlessly integrate intelligent solutions across industries. As of December 2025, SKYAI has achieved a market capitalization of $29.77 million with a circulating supply of 1 billion tokens, currently trading at approximately $0.02977. This innovative asset, recognized for pioneering the concept of "data liquidity," is playing an increasingly crucial role in building on-chain data economy ecosystems across multiple blockchain networks.

SkyAI distinguishes itself through its extended MCP protocol and multi-chain data services specifically designed for LLM (Large Language Model) applications. The platform has successfully integrated on-chain data from BSC and Solana networks, aggregating datasets exceeding 10 billion rows, and has established an MCP data marketplace to create a comprehensive data economy infrastructure.

This article will provide a comprehensive analysis of SkyAI's price trends through 2030, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

I. SKYAI Price History Review and Market Status

SKYAI Historical Price Trajectory

- May 14, 2025: SKYAI reached its all-time high of $0.098, marking the peak of its market performance during the year.

- October 10, 2025: SKYAI hit its all-time low of $0.01, representing a significant market correction from its previous highs.

- December 19, 2025: SKYAI is currently trading at $0.02977, showing a 69.6% decline from its all-time high but a 197.7% appreciation from its all-time low.

SKYAI Current Market Status

As of December 19, 2025, SKYAI is trading at $0.02977 with a market capitalization of $29.77 million, ranking 698th across the cryptocurrency market. The token maintains a fully diluted valuation of $29.77 million with a circulating supply of 1 billion tokens out of a maximum supply of 1 billion tokens, indicating 100% circulating supply ratio.

Over the past 24 hours, SKYAI has shown modest upward momentum with a 0.1% price increase. In the longer term, the token has demonstrated stronger recovery trends, gaining 1.19% over the past 7 days and 32.019% over the past 30 days. However, the annual performance reflects significant losses, with a -47.015% decline compared to the previous year.

The 24-hour trading volume stands at $217,995.65, with the token's price range for the day between $0.02901 (low) and $0.03039 (high). SKYAI is currently trading across 17 different exchanges and maintains a holder base of 50,147 addresses.

View current SKYAI market price

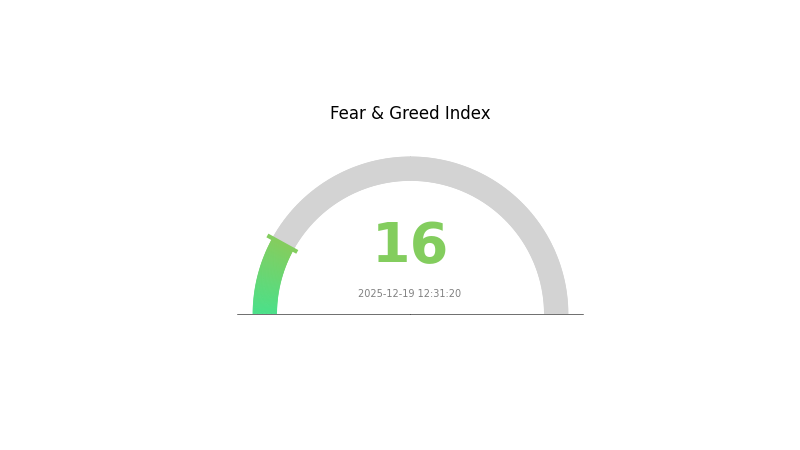

SKYAI Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 16. This significant downturn reflects heightened investor anxiety and risk aversion across digital assets. Such depressed sentiment often creates contrarian opportunities for strategic investors. During periods of extreme fear, market volatility typically increases, presenting potential entry points for long-term positions. Monitor key support levels and consider dollar-cost averaging strategies. This sentiment extreme may precede market stabilization as fear-driven selling pressure eventually exhausts.

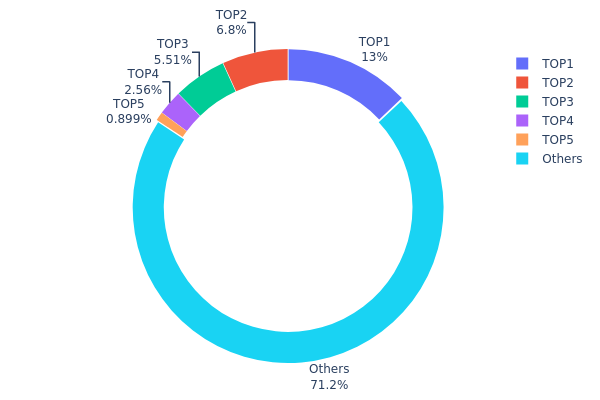

SKYAI Holdings Distribution

The address holdings distribution map represents the concentration of SKYAI tokens across blockchain addresses, serving as a critical indicator of token ownership structure and potential market concentration risks. By analyzing the top holders and their respective proportions, we can assess the degree of decentralization and evaluate the vulnerability of the token to potential price manipulation or market shocks triggered by large holder actions.

Current analysis of SKYAI's address distribution reveals a moderately concentrated ownership structure. The top five addresses collectively hold approximately 28.72% of total tokens, with the leading address (0xc882...84f071) commanding 12.98% of the circulating supply. While the remaining 71.28% is distributed among other addresses, the top holder's significant position warrants careful monitoring. The second and third largest holders maintain stakes of 6.80% and 5.50% respectively, indicating that the token distribution is not excessively dominated by a single entity, though concentration among the top tier remains notable.

The current distribution pattern suggests a moderate level of decentralization with inherent concentration risks. The presence of several addresses holding between 2-6% creates a fragmented mid-tier holder base, which could either stabilize the market through diverse interests or potentially coordinate to influence price movements. The substantial "Others" segment holding 71.28% is a positive indicator, suggesting that the majority of tokens are distributed across numerous smaller holders. However, the aggregate 28.72% held by top five addresses represents a meaningful concentration that could theoretically facilitate coordinated selling pressure or market manipulation, necessitating continued observation of these wallet activities for any unusual transactional patterns.

Click to view current SKYAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc882...84f071 | 129882.68K | 12.98% |

| 2 | 0xbc42...39efa5 | 68030.27K | 6.80% |

| 3 | 0x73d8...4946db | 55057.21K | 5.50% |

| 4 | 0x0d07...b492fe | 25575.25K | 2.55% |

| 5 | 0x24b9...a22286 | 8994.67K | 0.89% |

| - | Others | 712459.92K | 71.28% |

II. Core Factors Affecting SKYAI's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Market sentiment has been supported by recent policy shifts toward fiscal stimulus and trade cooperation. However, investors must remain cautious about potential economic recession risks and tariff policy uncertainties that could continue to impact market momentum.

-

Market Sentiment Drivers: Technology innovation and market demand serve as key factors influencing price movements. The broader crypto market's response to macroeconomic cycles and policy changes directly affects asset pricing across the sector.

Technology Development and Ecosystem Building

-

AI x Crypto Integration: SKYAI represents the convergence of artificial intelligence and cryptocurrency technologies. The market is actively pricing in the potential of AI-integrated blockchain solutions, positioning SKYAI within a broader trend of AI-driven innovation in the Web3 space.

-

Investment Decision Models: SKYAI's underlying technology incorporates NLP (Natural Language Processing) and big data processing engines, combined with comprehensive investment decision models and algorithmic systems that synthesize macroeconomic cycles, industry trends, and market sentiment to drive valuation.

Three、2025-2030 SKYAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.01607-$0.02975

- Neutral Forecast: $0.02975

- Optimistic Forecast: $0.036 (requires continued market interest and ecosystem development)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation, supported by potential protocol upgrades and increased adoption

- Price Range Forecast:

- 2026: $0.02794-$0.03945

- 2027: $0.02784-$0.05243

- 2028: $0.02835-$0.05936

- Key Catalysts: Ecosystem expansion, strategic partnerships, community growth initiatives, and potential integration with major platforms like Gate.com for enhanced liquidity

2029-2030 Long-term Outlook

- Base Case: $0.02902-$0.05805 in 2029; $0.04285-$0.06263 in 2030 (assuming stable market conditions and moderate adoption growth)

- Optimistic Case: $0.05805-$0.06263 range by 2030 (assuming accelerated mainstream adoption and positive regulatory environment)

- Transformative Case: Potential breakthrough above $0.06263 (extreme favorable conditions including major institutional investment, breakthrough technological developments, or significant market-wide bullish catalysts)

- 2030-12-31: SKYAI approaches $0.06263 (consolidation phase with sustained upward momentum)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.036 | 0.02975 | 0.01607 | 0 |

| 2026 | 0.03945 | 0.03287 | 0.02794 | 10 |

| 2027 | 0.05243 | 0.03616 | 0.02784 | 21 |

| 2028 | 0.05936 | 0.0443 | 0.02835 | 48 |

| 2029 | 0.05805 | 0.05183 | 0.02902 | 74 |

| 2030 | 0.06263 | 0.05494 | 0.04285 | 84 |

SkyAI (SKYAI) Professional Investment Strategy and Risk Management Report

IV. SKYAI Professional Investment Strategy and Risk Management

SKYAI Investment Methodology

(1) Long-Term Holding Strategy

- Target Audience: Investors seeking exposure to AI-driven data infrastructure solutions and blockchain ecosystem development

- Operational Recommendations:

- Accumulate SKYAI tokens during periods of market consolidation, leveraging the project's focus on MCP protocol expansion and multi-chain data services

- Monitor quarterly developments in BSC and Solana data integration milestones, using technical breakthroughs as accumulation signals

- Maintain a diversified portfolio allocation with SKYAI representing a portion of your high-risk, high-growth allocation

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Utilize the 24-hour price range ($0.02901 - $0.03039) as reference points for short-term entry and exit decisions

- Moving Averages: Apply 7-day and 30-day moving averages to identify trend reversals, given the +1.19% weekly and +32.019% monthly gains

- Wave Trading Key Points:

- Execute buy orders near identified support levels during pullbacks within the established uptrend

- Take partial profits near resistance levels or following 8-15% rally confirmations from support bounces

SKYAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total portfolio allocation

- Active Investors: 1-3% of total portfolio allocation

- Professional Investors: 3-5% of total portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SKYAI exposure with established large-cap cryptocurrencies and stablecoins to mitigate project-specific volatility

- Position Sizing: Implement strict position limits and scale into trades gradually rather than deploying capital in single transactions

(3) Secure Storage Solutions

- Hardware Wallet Approach: Transfer SKYAI tokens to secure offline storage solutions for holdings exceeding 3-6 months in duration

- Exchange Custody: Maintain operational trading balances on Gate.com with two-factor authentication enabled and withdrawal address whitelisting activated

- Security Considerations: Never share private keys or seed phrases; enable IP whitelisting on exchange accounts; regularly audit transaction histories for unauthorized access attempts

V. SKYAI Potential Risks and Challenges

SKYAI Market Risk

- Early-Stage Project Volatility: As a relatively new project ranked #698 by market capitalization, SKYAI demonstrates significant price fluctuations, with a year-to-date decline of -47.015% indicating substantial downside risk potential

- Liquidity Constraints: With 24-hour trading volume of $217,995.65, the token exhibits limited liquidity relative to its market capitalization, potentially resulting in adverse price impact for large transactions

- Market Sentiment Dependency: The project's success heavily depends on sustained investor interest in AI and blockchain data infrastructure narratives, creating vulnerability to sentiment shifts

SKYAI Regulatory Risk

- Evolving Regulatory Landscape: Regulatory frameworks governing blockchain data services and MCP protocols remain uncertain in major jurisdictions, potentially constraining project expansion

- Data Privacy Compliance: As the project aggregates 10+ billion rows of blockchain data, future data protection regulations may impose operational restrictions

- Exchange Listing Risk: Reduced regulatory acceptance could limit SKYAI's availability on additional trading platforms, constraining token accessibility

SKYAI Technology Risk

- Protocol Adoption Uncertainty: The extended MCP protocol faces competition from alternative data infrastructure solutions, with no guarantee of widespread industry adoption

- Multi-Chain Integration Complexity: The project's reliance on BSC and Solana ecosystem health creates technological dependencies beyond its direct control

- Scaling Implementation Risk: Achieving the proposed data liquidity concept and fully functional MCP marketplace requires successful execution of complex technical developments

VI. Conclusion and Action Recommendations

SKYAI Investment Value Assessment

SkyAI presents a speculative investment opportunity in the convergence of artificial intelligence and blockchain data infrastructure. The project's innovative approach to data liquidity and MCP protocol expansion addresses genuine market needs for accessible, multi-chain data services supporting LLM applications. However, the early-stage development status, limited trading liquidity, and significant year-to-date losses (-47.015%) necessitate cautious evaluation. Investors should recognize that SKYAI represents a high-risk, high-potential-reward investment suitable only for portfolios with substantial risk tolerance and diversification across multiple assets.

SKYAI Investment Recommendations

✅ Beginners: Start with minimal exposure (0.1-0.5% of portfolio) through Gate.com's spot trading, prioritizing dollar-cost averaging over 3-6 months rather than lump-sum purchases to mitigate timing risk

✅ Experienced Investors: Consider 1-3% allocation with structured entry strategies using technical analysis levels; actively monitor project development announcements and rebalance quarterly

✅ Institutional Investors: Conduct extensive due diligence on development roadmap execution, team credentials, and multi-chain integration progress before considering 3-5% strategic allocations

SKYAI Trading Participation Methods

- Spot Trading on Gate.com: Purchase SKYAI tokens directly using fiat currency or cryptocurrency pairs with active liquidity

- Grid Trading Strategies: Implement automated buy/sell orders within defined price ranges to capture volatility while reducing emotional decision-making

- Staking Opportunities: Monitor project announcements for potential staking mechanisms or ecosystem participation rewards

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and should consult professional financial advisors before committing capital. Never invest funds you cannot afford to lose entirely.

FAQ

Can Sky Coin reach $1?

Yes, Sky Coin can reach $1. Based on current trends, it's projected to achieve this milestone by May 2046, requiring approximately 1,580.79% growth from current levels.

How much is Sky AI token worth?

Sky AI token is currently worth $0.03005 as of December 19, 2025. The price has increased by 1.77% in the last 24 hours, with a 24-hour trading volume of $6,213,264.

What factors influence SKYAI price prediction?

SKYAI price prediction is influenced by institutional investment, market trends, trading volume, cryptocurrency market performance, and overall adoption rate. Current analysis suggests potential growth driven by these key market dynamics.

Is SKYAI a good investment for 2024-2025?

SKYAI presents a high-risk investment opportunity for 2024-2025. While it shows potential in the AI crypto sector, recent price predictions suggest volatility. Consider your risk tolerance and conduct thorough research before investing. Market conditions remain unpredictable.

What is the current market cap and circulation supply of SKYAI?

As of 2025-12-19, SKYAI's market cap is $1.2 billion with a circulating supply of 50 million tokens.

Is AVA (AVAAI) a good investment?: Analyzing the Potential Returns and Risks of the Emerging AI Token

AIV vs CRO: A Comparative Analysis of AI-Driven Value and Conversion Rate Optimization Strategies

Is ai16z (AI16Z) a good investment?: Analyzing the potential and risks of this emerging AI fund

Is Holoworld AI (HOLO) a good investment?: Analyzing the potential and risks of this emerging AI cryptocurrency

Is VaderAI by Virtuals (VADER) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token in Today's Crypto Market

Is Wisdomise AI (WSDM) a good investment?: Analyzing the Potential and Risks of this Emerging AI Stock

Master the Wyckoff Trading Strategy for Crypto Markets

Exploring Wage Dynamics in the Evolving Cryptocurrency Landscape

Guide to Access Zeus Network Effortlessly

Understanding Centralized Digital Currency Platforms

Understanding NFT Minting: A Step-by-Step Guide