2025 STOS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: STOS Market Position and Investment Value

Stratos (STOS), as a next-generation decentralized data infrastructure for the blockchain industry and Web 3.0, has made significant strides since its inception in 2021. As of 2025, Stratos has achieved a market capitalization of $2,494,989.952, with a circulating supply of approximately 69,036,800 tokens, and a price hovering around $0.03614. This asset, dubbed the "Web 3.0 Data Solution," is playing an increasingly crucial role in decentralized storage and content acceleration.

This article will comprehensively analyze Stratos' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. STOS Price History Review and Current Market Status

STOS Historical Price Evolution

- 2021: Initial launch, price reached all-time high of $5.18 on November 26

- 2022-2024: Gradual decline during bear market

- 2025: Price hit all-time low of $0.03594088 on September 20

STOS Current Market Situation

As of October 15, 2025, STOS is trading at $0.03614, down 24.02% in the last 24 hours. The token has experienced significant losses over various timeframes, with a 12.73% decrease in the past week, 25.99% decline over the last month, and a substantial 90.7% drop in the past year. The current price represents a 99.3% decrease from its all-time high, indicating a prolonged bearish trend. With a market cap of $2,494,989 and a fully diluted valuation of $3,614,000, STOS currently ranks 2213th in the cryptocurrency market. The circulating supply stands at 69,036,800 STOS, which is 69.04% of the total supply of 100,000,000 tokens.

Click to view the current STOS market price

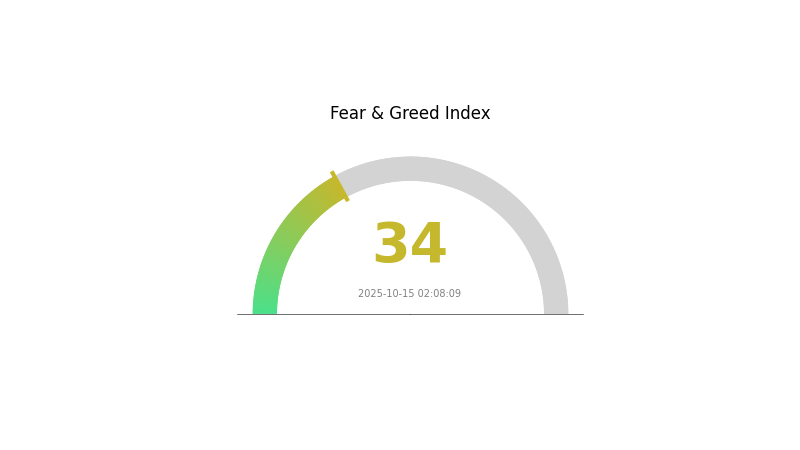

STOS Market Sentiment Indicator

2025-10-15 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, as indicated by the Fear and Greed Index reading of 34. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. Remember, market sentiment can change rapidly, and what seems like a period of fear today could potentially present opportunities for those who are well-informed and prepared.

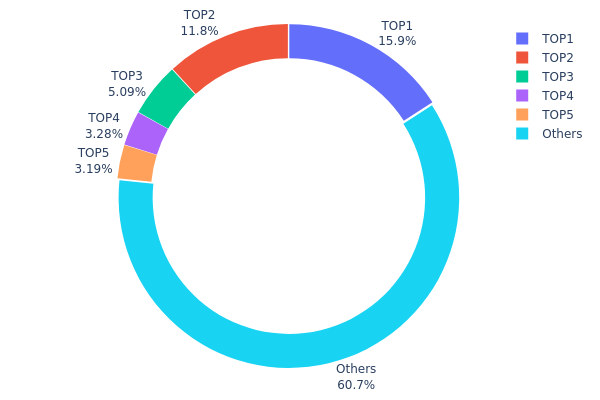

STOS Holdings Distribution

The address holdings distribution chart for STOS reveals a moderately concentrated market structure. The top 5 addresses collectively hold 39.23% of the total supply, with the largest holder possessing 15.88%. This level of concentration indicates a significant influence from major stakeholders but falls short of extreme centralization.

The distribution pattern suggests a balance between large holders and a diverse base of smaller investors. While the top addresses have substantial holdings, the fact that 60.77% is distributed among "Others" points to a reasonably wide participation. This structure may contribute to market stability by preventing excessive control by a single entity, though it still allows for potential price impact from large holder actions.

Overall, the STOS token distribution reflects a moderate level of decentralization. The presence of multiple significant holders, coupled with a broad base of smaller investors, indicates a relatively healthy on-chain structure. However, market participants should remain aware that actions by the top holders could still influence short-term price dynamics.

Click to view the current STOS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...e08a90 | 4583.43K | 15.88% |

| 2 | 0x7088...fcef8a | 3410.36K | 11.81% |

| 3 | 0x9642...2f5d4e | 1470.02K | 5.09% |

| 4 | 0x858d...c334c5 | 945.29K | 3.27% |

| 5 | 0x96f9...c9eff5 | 920.00K | 3.18% |

| - | Others | 17530.74K | 60.77% |

II. Key Factors Affecting Future STOS Prices

Institutional and Large Holder Dynamics

- Government Policies: Regulatory changes and market acceptance are critical factors influencing STOS prices. Countries are strengthening regulations due to issues like fraud and price volatility arising from the decentralized and anonymous nature of cryptocurrencies.

Macroeconomic Environment

- Inflation Hedging Properties: During periods of drastic price fluctuations in crypto assets, stablecoins can serve as a value storage point. When crypto assets are expected to fall significantly, they can be converted to stablecoins for value preservation, benefiting future price rebounds.

Technical Development and Ecosystem Building

-

Mainnet Launch: Stratos (STOS) launched its mainnet on September 28, which could potentially impact its price and adoption.

-

Ecosystem Applications: The development of the Stratos ecosystem and related DApps could influence STOS prices. The growth of the ecosystem and increased usage of the network may positively affect the token's value.

III. STOS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02275 - $0.03000

- Neutral prediction: $0.03000 - $0.03611

- Optimistic prediction: $0.03611 - $0.03828 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.03593 - $0.05133

- 2028: $0.03435 - $0.06163

- Key catalysts: Technological advancements, expanding use cases, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.05434 - $0.06684 (assuming steady growth and adoption)

- Optimistic scenario: $0.06684 - $0.07934 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $0.07934 - $0.10000 (with breakthrough innovations and mainstream acceptance)

- 2030-12-31: STOS $0.07419 (potential year-end valuation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03828 | 0.03611 | 0.02275 | 0 |

| 2026 | 0.04835 | 0.03719 | 0.03459 | 2 |

| 2027 | 0.05133 | 0.04277 | 0.03593 | 18 |

| 2028 | 0.06163 | 0.04705 | 0.03435 | 30 |

| 2029 | 0.07934 | 0.05434 | 0.04076 | 50 |

| 2030 | 0.07419 | 0.06684 | 0.04746 | 85 |

IV. STOS Professional Investment Strategies and Risk Management

STOS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors and blockchain technology enthusiasts

- Operation suggestions:

- Accumulate STOS during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for trend confirmation

- Use stop-loss orders to manage downside risk

STOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Dollar-Cost Averaging: Regular small purchases to mitigate price volatility

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Stratos wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for STOS

STOS Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: Potential difficulties in executing large trades

- Market sentiment: Susceptible to overall crypto market trends

STOS Regulatory Risks

- Uncertain regulations: Potential for unfavorable regulatory changes

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance requirements: Possible increased KYC/AML regulations

STOS Technical Risks

- Smart contract vulnerabilities: Potential for exploitation or bugs

- Network scalability: Challenges in handling increased transaction volume

- Competitive landscape: Emerging technologies may outpace Stratos

VI. Conclusion and Action Recommendations

STOS Investment Value Assessment

Stratos offers a promising decentralized data infrastructure solution with potential long-term value. However, short-term price volatility and market risks remain significant concerns.

STOS Investment Recommendations

✅ Newcomers: Start with small, regular investments to understand the market

✅ Experienced investors: Consider a balanced approach with defined entry and exit points

✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

STOS Trading Participation Methods

- Spot trading: Buy and sell STOS on Gate.com's spot market

- Staking: Participate in staking programs if offered by Stratos

- DeFi integration: Explore decentralized finance options as they become available

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Stratos a good investment?

Based on current market analysis, Stratos may not be a good investment. Forecasts suggest weak performance in the near future. However, always do your own research before investing.

Does Stacks Crypto have a future?

Yes, Stacks (STX) shows promise for the future. Analysts predict a price increase to $0.1254 by 2033, indicating potential growth. Despite price fluctuations, the overall outlook remains positive, supported by the project's innovative approach.

What will Solana be worth in 2030?

Based on current trends, Solana could potentially reach $500 or higher by 2030. Its low fees and high-speed network may drive increased adoption and value growth over the next few years.

Can cosmos reach $100?

While possible, it's unlikely in the near term. Projections suggest a more realistic target of $20-$30 for Cosmos in the current market cycle.

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

XRP Price Analysis 2025: Market Trends and Investment Outlook

Toncoin Price Prediction for 2025: Will TON Reach New Heights?

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

8 Best NFT Wallets

What Is an IDO? Demystifying Initial DEX Offerings

Best Graphics Card for Mining: Leading GPUs from Recent Years

What Is Tokenomics: A Basic Guide

Free Money for App Registration: Crypto Bonus Guide