2025 SWELL Price Prediction: Expert Analysis and Market Forecast for Lido's Liquid Staking Token

Introduction: Market Position and Investment Value of SWELL

Swell Network (SWELL) is a non-custodial staking protocol dedicated to delivering the world's best liquid staking and restaking experience while simplifying access to DeFi and securing the future of Ethereum and restaking services. Since its launch in November 2024, the project has established itself as a significant player in the liquid staking ecosystem. As of December 23, 2025, SWELL has achieved a market capitalization of approximately $6.5 million USD with a circulating supply of around 3.98 billion tokens, trading at $0.001633 per token. This innovative protocol is playing an increasingly critical role in the decentralized finance landscape by enabling users to participate in staking activities while maintaining liquidity.

This article will provide a comprehensive analysis of SWELL's price trends and market dynamics, examining historical performance patterns, market supply and demand factors, ecosystem developments, and macroeconomic conditions. By synthesizing these elements, we aim to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to the liquid staking sector through 2030.

Swell Network (SWELL) Market Analysis Report

I. SWELL Price History Review and Current Market Status

SWELL Historical Price Movement Trajectory

-

2024: Swell Network token launched with an initial price of $0.05. The token reached its all-time high (ATH) of $0.19992 on September 29, 2024, marking a strong early market performance.

-

Late 2024 to Present: Following the ATH, SWELL has experienced significant downward pressure. The token declined substantially from its peak, reflecting broader market dynamics and project-specific developments.

-

December 2025: SWELL reached its all-time low (ATL) of $0.001497 on December 18, 2025, representing a decline of approximately 94.69% from its initial launch price over the one-year period.

SWELL Current Market Position

As of December 23, 2025, SWELL is trading at $0.001633, with a 24-hour trading volume of approximately $55,530.77. The token shows a marginal positive movement of +0.06% in the past 24 hours, with an intraday range between $0.001589 (24h low) and $0.001679 (24h high).

The current market capitalization stands at approximately $6.51 million, with a fully diluted valuation (FDV) of $16.33 million. The circulating supply comprises 3.98 billion SWELL tokens out of a total supply of 10 billion tokens, representing a circulation ratio of 39.84%. The token maintains a market dominance of 0.0005%, ranked at position 1,392 across all cryptocurrency assets.

Over the medium to long-term periods, SWELL has experienced substantial losses: 7-day decline of -10.72%, 30-day decline of -40.79%, and a 1-year decline of -94.69%. The token currently has 41,772 token holders and is actively traded on Gate.com.

Market sentiment remains bearish, with the Crypto Fear and Greed Index indicating "Extreme Fear" (VIX level of 25) as of December 22, 2025.

Click to view current SWELL market price

SWELL Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates heightened market anxiety and pessimism among investors. During such periods, risk assets typically face selling pressure, and market volatility tends to increase significantly. However, extreme fear often presents contrarian opportunities for experienced traders. Those with strong conviction and adequate risk management may consider dollar-cost averaging into positions. It's crucial to monitor market developments closely, maintain strict risk controls, and avoid panic-driven decisions. Market sentiment can shift rapidly, so stay informed and prepared for potential rebounds when fear levels normalize.

SWELL Holdings Distribution

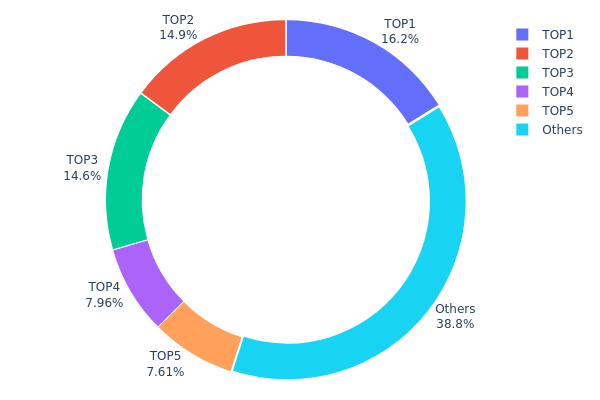

The address holdings distribution map illustrates the concentration of SWELL tokens across blockchain addresses, providing critical insights into the decentralization status and potential market risks. By analyzing the top holders and their respective allocation percentages, we can assess the degree of token concentration and its implications for market stability and governance dynamics.

Current data reveals a moderately concentrated distribution pattern. The top five addresses collectively control 61.22% of total SWELL holdings, with the leading address commanding 16.19% and the second-largest holder accounting for 14.89%. While the remaining 38.78% is dispersed among other addresses, the cumulative concentration of the top five positions indicates a level of token centralization that warrants attention. The relatively balanced distribution among the top three holders—ranging from 14.57% to 16.19%—suggests that no single entity holds overwhelming dominance, though the threshold for significant influence remains notably low.

This distribution structure presents both opportunities and challenges for SWELL's market ecosystem. The moderate concentration level could facilitate coordinated governance decisions and protocol upgrades, yet simultaneously introduces potential volatility risks if large holders execute synchronized transactions. The substantial stake held by institutional or founding entities, as reflected in these top positions, may contribute to price stability through long-term holding incentives, though it also creates asymmetric information dynamics that could influence market movements. The dispersed nature of minority holdings demonstrates broader community participation, though the 61.22% concentration among top five addresses suggests that market sentiment remains partially dependent on the actions of a limited number of stakeholders.

Click to view current SWELL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4b9c...6a2bef | 1619253.11K | 16.19% |

| 2 | 0x2019...a6dc1a | 1490000.00K | 14.89% |

| 3 | 0x7815...c36a6d | 1457735.93K | 14.57% |

| 4 | 0x0934...9d85b7 | 796367.19K | 7.96% |

| 5 | 0x9ae3...df875e | 761184.59K | 7.61% |

| - | Others | 3875459.19K | 38.78% |

II. Core Factors Affecting SWELL's Future Price

Market Dynamics and DeFi Sector Growth

-

DeFi Track Momentum: The DeFi sector represents a key growth driver for SWELL. As a liquid staking protocol, SWELL is positioned to benefit from increased adoption of decentralized finance applications and growing demand for ETH staking solutions.

-

Market Sentiment Impact: Cryptocurrency market volatility significantly influences SWELL's price trajectory. Market sentiment and macroeconomic factors directly affect both ETH and rswETH (Swell's liquid staking token) valuations, which in turn impact user staking yields and token performance.

-

Low FDV and Market Awareness: SWELL maintains a relatively low Fully Diluted Valuation (FDV) and has not yet attracted widespread market attention. This presents potential upside opportunities as the project gains greater visibility and adoption.

Risk Factors

-

Liquidity Concerns: Liquidity challenges represent a notable risk to SWELL's price stability. Insufficient trading volumes could impact market efficiency and investor accessibility.

-

Regulatory and Compliance Risks: As a DeFi project, SWELL faces potential regulatory uncertainties. DeFi protocols operate in an evolving regulatory environment that could introduce compliance challenges.

-

Market and Price Volatility: The cryptocurrency market's inherent volatility, combined with macroeconomic factors, creates price fluctuations for both ETH and rswETH. These price movements can affect the attractiveness of staking yields and overall token demand.

III. 2025-2030 SWELL Price Forecast

2025 Outlook

- Conservative Forecast: $0.00127-$0.00163

- Neutral Forecast: $0.00163

- Optimistic Forecast: $0.00243 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental adoption and infrastructure maturation within the liquid staking derivatives ecosystem.

- Price Range Forecast:

- 2026: $0.00112-$0.00278 (24% projected increase)

- 2027: $0.00152-$0.00274 (47% projected increase)

- 2028: $0.00224-$0.00384 (57% projected increase)

- Key Catalysts: Expansion of staking partnerships, increased DeFi protocol integrations, growing institutional participation in liquid staking solutions, and broader market cycle recovery.

2029-2030 Long-term Outlook

- Base Case: $0.00311-$0.00452 by 2029 (96% projected increase from 2025 levels)

- Optimistic Scenario: $0.00232-$0.00549 by 2030 (136% projected increase from 2025 levels, assuming accelerated adoption and market capitalization growth)

- Transformative Scenario: $0.00549+ (assumes breakthrough regulatory clarity, mainstream institutional adoption of liquid staking protocols, and significant expansion of the underlying blockchain ecosystem)

Note: These forecasts are based on historical patterns and market analysis. Actual price movements may vary significantly based on regulatory developments, macroeconomic conditions, competitive dynamics, and broader cryptocurrency market cycles. Users are advised to conduct independent research and consult with financial advisors before making investment decisions on Gate.com or other platforms.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00243 | 0.00163 | 0.00127 | 0 |

| 2026 | 0.00278 | 0.00203 | 0.00112 | 24 |

| 2027 | 0.00274 | 0.00241 | 0.00152 | 47 |

| 2028 | 0.00384 | 0.00258 | 0.00224 | 57 |

| 2029 | 0.00452 | 0.00321 | 0.00311 | 96 |

| 2030 | 0.00549 | 0.00386 | 0.00232 | 136 |

Swell Network (SWELL) Professional Investment Strategy and Risk Management Report

IV. SWELL Professional Investment Strategy and Risk Management

SWELL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts seeking exposure to liquid staking and restaking protocols, investors with a 1-3 year investment horizon

- Operation Recommendations:

- Accumulate SWELL during market downturns when prices are below $0.01, leveraging the -94.69% annual decline for dollar-cost averaging

- Hold positions for extended periods to capture potential recovery towards historical highs ($0.19992 recorded on September 29, 2024)

- Participate in Swell's ecosystem developments and potential protocol upgrades that could drive adoption of liquid staking and restaking services

(2) Active Trading Strategy

-

Price Volatility Observation:

- 24-hour range: $0.001589 to $0.001679, indicating limited intraday volatility

- 7-day decline of -10.72% provides context for swing trading opportunities

- 30-day decrease of -40.79% suggests strong downward pressure requiring careful entry points

-

Wave Trading Key Points:

- Monitor resistance levels around $0.001679 and support at $0.001589

- Track broader market conditions affecting liquid staking token performance

- Watch for protocol announcements or ecosystem developments that could trigger short-term price movements

SWELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio allocation maximum

- Active Investors: 2-5% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation, with appropriate hedging strategies

(2) Risk Hedge Solutions

- Portfolio Diversification: Balance SWELL holdings with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Never allocate more capital than you can afford to lose given SWELL's significant -94.69% annual decline

(3) Secure Storage Solutions

- Self-Custody Approach: Store SWELL tokens directly in personal wallets using Gate.com's Web3 wallet for ERC-20 token management

- Exchange Custody: Maintain a portion on Gate.com for active trading with appropriate account security measures

- Security Considerations: Enable two-factor authentication, use hardware security keys, never share private keys or seed phrases, and regularly verify contract addresses before transactions

V. SWELL Potential Risks and Challenges

SWELL Market Risks

- Severe Price Depreciation: The -94.69% annual decline indicates sustained downward pressure, with current price ($0.001633) representing approximately 99.18% loss from all-time high

- Low Trading Volume: 24-hour volume of $55,530.77 is relatively modest, potentially limiting liquidity for larger transactions and creating execution risk

- Concentrated Token Distribution: With only 41,772 token holders and 39.84% of total supply in circulation, market concentration poses risks from potential large holder exits

SWELL Regulatory Risks

- Evolving DeFi Regulation: Liquid staking and restaking protocols face increasing regulatory scrutiny globally, potentially affecting protocol operations and token utility

- Compliance Uncertainty: Changes in cryptocurrency classification or staking protocol regulations could impact SWELL's value proposition and market demand

- Jurisdictional Restrictions: Various countries may impose restrictions on staking-related services or limit accessibility to Swell's protocol features

SWELL Technical Risks

- Protocol Security: As a non-custodial staking protocol, smart contract vulnerabilities could result in user fund losses or protocol failures

- Cross-chain Risks: SWELL operates across multiple blockchains (Swell Network and Ethereum), introducing potential compatibility and security considerations

- Market Competition: Emerging liquid staking solutions and alternative restaking protocols may capture market share, impacting SWELL token demand and value

VI. Conclusions and Action Recommendations

SWELL Investment Value Assessment

Swell Network positions itself in the competitive liquid staking and restaking sector with a focus on non-custodial solutions and DeFi accessibility. However, the -94.69% annual price decline, modest trading volume, and early-stage market adoption present significant challenges. The project's long-term value depends on successful protocol adoption, technological differentiation, and favorable regulatory developments in the staking economy. Current valuations may present opportunities for risk-tolerant investors with extended time horizons, but the extreme volatility and downward trend warrant cautious positioning.

SWELL Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of portfolio) only if you have high risk tolerance and can afford complete loss; focus on understanding the liquid staking sector before committing capital

✅ Experienced Investors: Consider 2-5% allocation with proper diversification strategies; actively monitor protocol developments and community sentiment; use technical analysis to time entries during recovery phases

✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security and regulatory compliance; consider strategic positions only if long-term thesis aligns with staking protocol adoption; maintain appropriate hedging mechanisms

SWELL Trading Participation Methods

- Gate.com Spot Trading: Access SWELL/ETH and SWELL/USDT trading pairs with competitive fees and professional trading tools

- ERC-20 Token Management: Hold SWELL on Ethereum network through Gate.com's Web3 wallet for direct participation in protocol interactions

- Swell Network Native Trading: Utilize SWELL chain's native token for ecosystem participation and protocol governance activities

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the future of the Swell coin?

Swell coin is predicted to experience price decline through 2027, with forecasts suggesting it could trade around $0.0015-0.0016 levels. The token's future depends on network adoption and ecosystem development within the liquid staking sector.

How much is swell crypto worth?

Swell crypto is currently worth $0.00583382 per token, with a market cap of $15.47 million as of December 22, 2025. The price reflects Swell's value in the market and may fluctuate based on trading volume and market conditions.

What factors influence Swell token price movements?

SWELL token price is influenced by market demand, cryptocurrency market trends, trading volume, project developments, staking rewards, and ecosystem adoption.

What is Swell crypto and what is its use case?

Swell is an Ethereum Layer 2 chain enabling native ETH restaking for additional rewards. It enhances network security and scalability while allowing users to earn extra income through restaking mechanisms.

What is the price target for Swell in 2025?

Swell Network is expected to trade between $0.030639 and $0.046298 by the end of 2025, based on current market indicators and analysis.

2025 REZ Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

What is REZ: A Comprehensive Guide to Understanding Real Estate Investment Zones and Their Impact on Property Markets

# How Much SOL Are Institutions Currently Holding: 2025 Holdings & Fund Flow Analysis

Is Swell Network (SWELL) a good investment?: A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

What is SWELL: A Comprehensive Guide to Understanding Liquid Staking and Ethereum's Future

Exploring LSDFi: Unlocking the Potential of Liquid Staking in DeFi

AI Predicts the 10 Cryptos Poised for Growth in 2025 | Expert Insights

What is SMTX: A Comprehensive Guide to Surface Mount Technology X and Its Applications in Modern Electronics Manufacturing

What is SOIL: Understanding the Foundation of Earth's Ecosystems and Agricultural Productivity

What is KONET: A Comprehensive Guide to Korea's National Optical Network Infrastructure

Tether Launches New USDT Payment Method for Citizens in the Philippines