2025 SYND Price Prediction: Expert Analysis and Market Forecast for Syndicate Token

Introduction: SYND's Market Position and Investment Value

Syndicate (SYND) is a breakthrough innovation in smart rollups and smart sequencers that transform rollups into smart contracts—bringing programmability to the network level and reducing costs by 100x. Since its launch on December 14, 2025, SYND has emerged as a notable player in the application-network layer infrastructure space. As of December 19, 2025, SYND has achieved a market capitalization of $60.19 million with a circulating supply of approximately 478.7 million tokens, trading at $0.06019 per token. This innovative asset is playing an increasingly critical role in unlocking the next wave of innovation at the application-network layer.

This article will provide a comprehensive analysis of SYND's price performance and trends, combining historical patterns, market supply-demand dynamics, and ecosystem development to deliver professional price forecasts and practical investment strategies for investors looking to understand SYND's market trajectory and investment opportunities.

I. SYND Price History Review and Current Market Status

SYND Historical Price Evolution

Based on available data, SYND reached its all-time high (ATH) of $1.2835 on September 23, 2025, followed by a significant correction phase. The token subsequently declined to its all-time low (ATL) of $0.05597 on December 18, 2025, representing a major pullback from peak valuations within the same year.

SYND Current Market Situation

As of December 19, 2025, SYND is trading at $0.06019 with a 24-hour trading volume of $21,837.77. The token exhibits mixed short-term momentum, showing a modest 24-hour gain of 2.02% while demonstrating significant longer-term weakness with a 7-day decline of -30.09% and a 30-day loss of -50.97%.

The current market capitalization stands at approximately $28.81 million, with a fully diluted valuation (FDV) of $60.19 million. The circulating supply comprises 478.7 million tokens out of a total supply of 1 billion SYND, representing a circulation ratio of 59.12%. The token maintains a market dominance of 0.0018% and is ranked #708 in the broader cryptocurrency market.

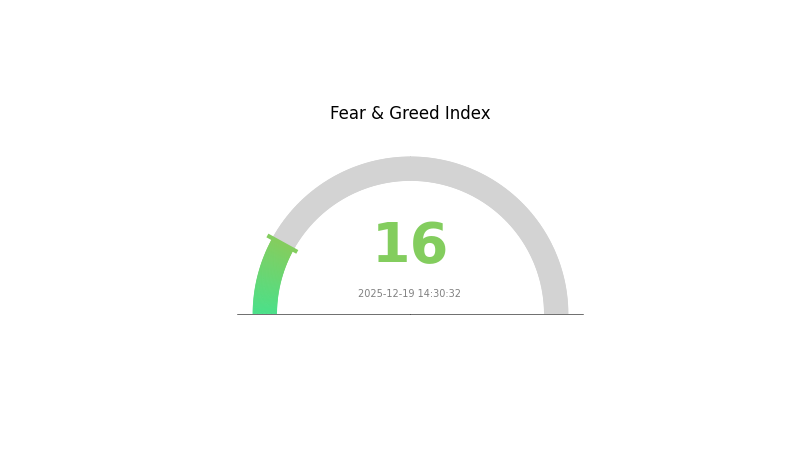

SYND operates on the Ethereum blockchain as an ERC-20 token and currently trades across 16 exchanges. The token holder base consists of 971 addresses. Market sentiment indicators reflect extreme fear conditions (VIX reading of 16), suggesting heightened risk aversion in the broader market environment.

Click to view current SYND market price

SYND Market Sentiment Index

2025-12-19 Fear & Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear & Greed Index dropping to 16. This indicates investors are highly anxious about market conditions, potentially driven by negative news or significant price volatility. During such periods of extreme fear, experienced traders often view it as a contrarian opportunity, as markets tend to recover from panic lows. However, caution remains essential when making investment decisions. Monitor market developments closely and consider your risk tolerance before taking action on the Gate.com platform.

SYND Token Holding Distribution

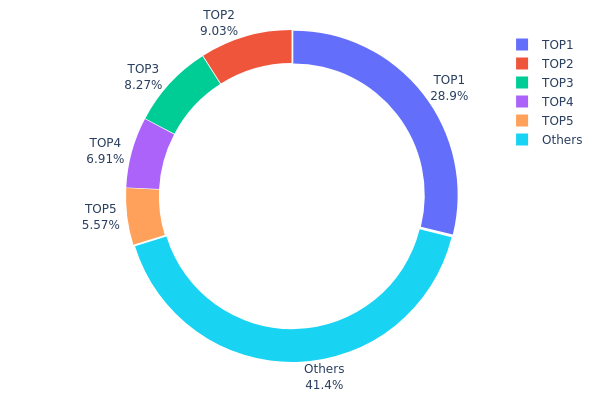

The address holding distribution chart illustrates the concentration of SYND tokens across on-chain addresses, revealing the decentralization level and potential market structure risks of the token. By analyzing the percentage of total supply held by the top addresses and comparing it against distributed holdings, this metric provides critical insight into whether token distribution aligns with healthy decentralization principles or exhibits concentration risks that could affect market stability.

Current analysis of SYND's holding distribution reveals moderate concentration concerns. The top address commands 28.87% of total supply, representing a significant single-point-of-interest in the token ecosystem. The cumulative holding of the top five addresses accounts for 58.63% of circulating tokens, indicating that capital control remains concentrated among a limited number of stakeholders. While this concentration level does not immediately suggest extreme centralization comparable to some early-stage projects, it does warrant attention regarding potential market influence and liquidity dynamics.

The distribution pattern reflects a mixed market structure where institutional or large-scale holders maintain substantial influence over token supply. With 41.37% of holdings dispersed among other addresses, there exists a reasonable degree of retail or smaller holder participation; however, the dominance of top-five holders suggests that price discovery and market movements could be disproportionately influenced by the trading decisions of these major stakeholders. This concentration structure creates potential volatility vectors and necessitates monitoring for coordinated selling or accumulation activities that could impact price stability.

Click to view current SYND Token Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8806...0529d8 | 267080.52K | 28.87% |

| 2 | 0x6311...7ab046 | 83500.00K | 9.02% |

| 3 | 0xde60...f54f14 | 76500.00K | 8.27% |

| 4 | 0x83d2...a199ec | 63928.50K | 6.91% |

| 5 | 0x6a1b...94dd30 | 51499.99K | 5.56% |

| - | Others | 382490.99K | 41.37% |

II. Core Factors Affecting SYND Future Price

Scarcity and Token Supply

-

SYND Scarcity: Token scarcity is a key factor influencing SYND's investment value and long-term price trajectory. Limited supply mechanisms create conditions for potential price appreciation.

-

Current Impact: As an emerging cryptocurrency project with limited information available, supply dynamics and token unlock schedules represent important considerations for price volatility and market sentiment.

Institutional and Major Holder Dynamics

- Institutional Investment Trends: Institutional investor movements significantly influence SYND's investment value and market direction.

Macroeconomic Environment

-

Market Sentiment: Future SYND price movements are substantially affected by overall market sentiment and investor confidence in the cryptocurrency sector.

-

Regulatory Environment: Regulatory developments and policy changes across different jurisdictions represent critical factors that can impact SYND's price trajectory.

Technology Development and Ecosystem Building

- Overall Cryptocurrency Market Impact: SYND's price is influenced by broader cryptocurrency market conditions, technological advancements within the sector, and ecosystem maturity.

Important Disclaimer: Any cryptocurrency price prediction carries significant uncertainty and is influenced by multiple factors including market sentiment, technological development, regulatory environment, and overall cryptocurrency market conditions. This analysis is based on available information and should not be considered as investment advice. Investors should conduct independent assessments and exercise caution given the high volatility and information asymmetry associated with emerging cryptocurrency projects.

III. SYND Price Forecast for 2025-2030

2025 Outlook

- Conservative Prediction: $0.03731–$0.05875

- Neutral Prediction: $0.06018 (Average)

- Optimistic Prediction: $0.07944 (Peak volatility scenario)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual accumulation and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.03839–$0.09494 (15% upside potential)

- 2027: $0.04778–$0.10297 (36% cumulative growth)

- 2028: $0.04726–$0.10657 (53% cumulative growth)

- Key Catalysts: Ecosystem development progress, increased adoption metrics, positive regulatory developments, and institutional market interest

2029-2030 Long-term Outlook

- Base Case Scenario: $0.09265–$0.14744 (65% cumulative appreciation from 2025 levels, assuming steady market conditions and moderate adoption expansion)

- Optimistic Scenario: $0.10377–$0.18283 (105% cumulative growth by 2030, contingent on accelerated ecosystem adoption and favorable macroeconomic conditions)

- Transformational Scenario: $0.18283+ (Sustained bull market with breakthrough partnerships, mainstream integration, and significant network expansion)

- 2030-12-31: SYND reaches potential peak of $0.18283 (Projected long-term resistance level assuming sustained positive market sentiment)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07944 | 0.06018 | 0.03731 | 0 |

| 2026 | 0.09494 | 0.06981 | 0.03839 | 15 |

| 2027 | 0.10297 | 0.08237 | 0.04778 | 36 |

| 2028 | 0.10657 | 0.09267 | 0.04726 | 53 |

| 2029 | 0.14744 | 0.09962 | 0.09265 | 65 |

| 2030 | 0.18283 | 0.12353 | 0.10377 | 105 |

Syndicate (SYND) Professional Investment Strategy and Risk Management Report

I. Project Overview

Basic Information

Syndicate (SYND) is an innovative blockchain project introducing breakthrough Smart Rollups technology with Smart Sequencers. The project transforms rollups and their sequencers into smart contracts, bringing programmability to the network level, reducing costs by 100x, and unlocking the next wave of innovation at the application-network layer.

Current Market Data (As of December 19, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.06019 |

| Market Capitalization | $28,812,953.00 |

| Fully Diluted Valuation | $60,190,000.00 |

| 24H Trading Volume | $21,837.77 |

| Circulating Supply | 478,700,000 SYND |

| Total Supply | 1,000,000,000 SYND |

| Market Dominance | 0.0018% |

| All-Time High | $1.2835 (September 23, 2025) |

| All-Time Low | $0.05597 (December 18, 2025) |

| Token Standard | ERC-20 (Ethereum) |

| Market Ranking | #708 |

| Active Holders | 971 |

Price Performance Analysis

| Time Period | Change % | Price Change |

|---|---|---|

| 1 Hour | +0.37% | +$0.000222 |

| 24 Hours | +2.02% | +$0.001192 |

| 7 Days | -30.09% | -$0.025906 |

| 30 Days | -50.97% | -$0.062572 |

II. Technical & Fundamental Analysis

Project Innovation

Syndicate introduces a breakthrough approach to blockchain scalability through Smart Rollups and Smart Sequencers, which offer:

- Programmable Network Layer: Transforms sequencers into smart contracts, enabling programmability at the network level

- Significant Cost Reduction: Achieves approximately 100x cost reduction compared to traditional rollup architectures

- Enhanced Innovation Capability: Opens new possibilities for application-network layer development

Token Economics

- Distribution Status: Circulating supply represents 59.12% of total supply

- Fully Diluted Market Cap: $60,190,000.00

- Token Utility: ERC-20 standard on Ethereum blockchain

- Supply Structure: Fixed maximum supply of 1 billion tokens

Market Position

With a market rank of #708 and market dominance of 0.0018%, SYND remains a relatively small-cap cryptocurrency. The project maintains presence on 16 cryptocurrency exchanges, demonstrating growing market accessibility.

III. SYND Professional Investment Strategy and Risk Management

SYND Investment Methodology

(1) Long-Term Hold Strategy

Suitable For: Institutional investors, long-term believers in Layer 2 scaling solutions, and risk-tolerant portfolio diversifiers

Operational Recommendations:

- Position Building Phase: Accumulate SYND gradually during periods of market weakness, particularly when the token retreats from recent highs, to establish a cost-averaged entry position

- Holding Period: Maintain positions for 12-24 months to capitalize on potential maturation of Smart Rollups technology and increased adoption

- Secure Storage Solution: Store SYND tokens on Gate Web3 Wallet for enhanced security and easy accessibility for staking or governance participation opportunities that may emerge

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor critical levels at $0.05597 (all-time low) as strong support and $0.15-$0.20 zones as initial resistance targets

- Volatility Indicators: Utilize MACD and RSI oscillators to identify overbought/oversold conditions, given SYND's recent -50.97% monthly decline indicating potential oversold positioning

Wave Trading Key Points:

- Downtrend Reversal Signals: Watch for bullish divergences at the all-time low support level, which could indicate accumulation phase completion

- Breakout Opportunities: Position for potential rallies if SYND breaks above the $0.10-$0.12 resistance zone, targeting previous higher prices as profit-taking levels

SYND Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1.0% of total portfolio allocation

- Active Investors: 1.0-3.0% of total portfolio allocation

- Professional/Institutional Investors: 2.0-5.0% of total portfolio allocation (with additional due diligence on protocol development milestones)

(2) Risk Hedging Strategies

- Dollar-Cost Averaging (DCA): Implement systematic purchases over 3-6 months to reduce the impact of price volatility and lower average entry costs

- Profit-Taking Protocol: Establish predetermined exit targets at 50% and 100% gains to lock in profits during bull runs, reducing exposure to potential reversal

(3) Secure Storage Solution

- Hot Wallet Recommendation: Utilize Gate Web3 Wallet for active traders maintaining regular SYND trading positions, offering convenient access and integrated exchange functionality

- Cold Storage Approach: For long-term holders not requiring frequent access, consider hardware storage solutions or offline wallet management

- Security Best Practices: Enable multi-factor authentication, never share private keys, verify contract addresses before transactions, and maintain backups of wallet recovery phrases in secure locations

IV. SYND Potential Risks and Challenges

Market Risk

- High Volatility: SYND exhibits extreme price volatility, with a -50.97% decline over 30 days and -30.09% weekly decline, indicating substantial downside risk potential

- Limited Liquidity: Daily trading volume of only $21,837.77 relative to market cap suggests limited liquidity, potentially causing significant price slippage for large transactions

- Concentration Risk: With only 971 active holders, token distribution is heavily concentrated, creating potential for large holder liquidations to dramatically impact price

Regulatory Risk

- Evolving Classification: Layer 2 scaling solutions and their governance tokens face uncertain regulatory classification across different jurisdictions

- Smart Contract Regulatory Scrutiny: As Smart Sequencers introduce novel smart contract capabilities at the network level, regulators may subject the protocol to enhanced review

- Compliance Timeline Uncertainty: Changes in cryptocurrency regulations could require protocol modifications or token redenomination

Technical Risk

- Unproven Technology: Smart Rollups with Smart Sequencers represent novel architecture not yet fully tested at scale in production environments

- Smart Contract Vulnerabilities: New technological approaches introduce unknown security risks and potential contract vulnerabilities that could lead to fund loss

- Protocol Adoption Uncertainty: Achieving claimed 100x cost reduction requires significant developer adoption and ecosystem integration, which remains speculative

V. Conclusion and Action Recommendations

SYND Investment Value Assessment

Syndicate presents an intriguing investment thesis centered on breakthrough Layer 2 scaling innovation. However, the token remains highly speculative with limited market maturity, extreme price volatility, and unproven technology at scale. The project's innovative Smart Rollups concept has genuine potential to address blockchain scalability challenges, but significant technical and market execution risks exist. Recent -50% monthly decline suggests either market capitulation presenting entry opportunity or continued downtrend pressure reflecting genuine fundamental concerns.

SYND Investment Recommendations

✅ Beginners: Limited exposure (0.5% of portfolio) through Gate.com, strictly adhering to dollar-cost averaging accumulation over 6+ months to reduce timing risk and familiarize yourself with the technology before increasing allocation.

✅ Experienced Investors: Moderate position (1-3% of portfolio) with active technical analysis and clear profit-taking targets at predetermined levels; maintain careful monitoring of protocol development milestones and competitive Layer 2 landscape developments.

✅ Institutional Investors: Strategic allocation (2-5% of portfolio) contingent on completion of advanced due diligence on development team qualifications, protocol audits, and partnership pipeline; require formal risk management frameworks and potential hedging mechanisms.

SYND Trading Participation Methods

- Spot Trading on Gate.com: Execute buy/sell orders directly on Gate.com's spot market using fiat currency or other cryptocurrencies for immediate SYND acquisition or liquidation

- DCA Purchase Plan: Establish automated recurring purchases on Gate.com to systematically accumulate SYND over time, reducing timing risk through disciplined long-term accumulation

- Technical Entry Strategy: Execute tactical purchases when technical indicators suggest oversold conditions (RSI below 30) at support levels ($0.05597-$0.06000 zone), with predetermined stop-loss discipline

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

SYND是什么?它的主要用途和价值主张是什么?

SYND is a blockchain utility token designed to power decentralized data systems and governance protocols. Its primary use enables users to access, validate, and contribute to distributed networks while earning rewards through participation and staking mechanisms.

What is the price prediction for SYND in 2024? What are the main factors affecting the price?

SYND price in 2024 is projected to be influenced by market sentiment, investor confidence, and technology development. Key factors include adoption rates, market demand, and overall crypto market conditions. Precise predictions require real-time market analysis.

How is SYND's technical foundation and project team? How does this affect its long-term price trend?

SYND's programmable sequencer technology and experienced team establish strong competitive advantages. As ecosystem adoption expands and more application chains integrate, SYND is well-positioned for sustained long-term price appreciation driven by increasing utility and network effects.

What are the main risks of investing in SYND? How should I assess its investment potential?

SYND carries market volatility and project execution risks. Evaluate its potential by analyzing tokenomics, development roadmap, community engagement, and trading volume. Strong fundamentals and active development indicate bullish prospects for long-term growth.

What are the advantages and disadvantages of SYND compared to other similar cryptocurrency projects?

SYND features on-chain order book matching with low slippage and high capital efficiency, delivering near-CEX experience. Its main advantage is direct peer-to-peer matching. The primary disadvantage is dependence on high-throughput blockchain infrastructure for optimal performance.

How is SYND's market liquidity and trading volume? What impact does this have on price stability?

SYND has relatively lower market liquidity and trading volume, resulting in higher price volatility. This limited liquidity increases price fluctuations and trading risk, creating both opportunities and challenges for traders in the market.

2025 APT Price Prediction: Key Factors That Could Drive Aptos Token to New Heights

2025 KAS Price Prediction: Analyzing Key Factors Driving the Future Value of Kaspa

2025 MOVE Price Prediction: Analyzing Growth Factors and Market Trends in the Evolving Cryptocurrency Landscape

2025 SAGA Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Blockchain Ecosystem

Is Kaspa (KAS) a good investment?: Analyzing the potential of this high-throughput blockchain project

FOXY vs APT: Comparing Modern Threat Detection Systems in Enterprise Security Environments

Is aura (AURASOL) a good investment?: A Comprehensive Analysis of Market Performance, Risk Factors, and Future Prospects

Is GameBuild (GAME2) a good investment?: A comprehensive analysis of tokenomics, market potential, and risk factors for 2024

Discover How to Receive Your Optimism Airdrop

Xenea Daily Quiz Answer 20 december 2025

Ethereum 2.0: Staking Rewards and Market Insights