2025 TKO Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: TKO's Market Position and Investment Value

Tokocrypto (TKO) serves as the native functional token of Indonesia's fastest-growing digital asset exchange by transaction volume and user registration. Since its inception in 2018, TKO has established itself as a key utility token enabling access to the Indonesian cryptocurrency market and emerging investment opportunities. As of December 2025, TKO boasts a market capitalization of $39.72 million with a circulating supply of 75 million tokens, currently trading at approximately $0.0794 per token. This utility token, recognized for its multi-functional ecosystem integration, is playing an increasingly vital role in facilitating platform benefits, decentralized finance participation, and Indonesia's emerging NFT landscape.

This article will provide a comprehensive analysis of TKO's price trajectory through 2030, integrating historical price patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for digital asset investors.

TKO (Tokocrypto) Market Analysis Report

I. TKO Price History Review and Current Market Status

TKO Historical Price Evolution

- May 2021: TKO reached its all-time high of $4.91, marking the peak of the token's market valuation during the initial bull cycle.

- December 2025: TKO declined to an all-time low of $0.077135 on December 19, 2025, representing a significant 98.43% depreciation from its historical peak.

TKO Current Market Situation

As of December 23, 2025, TKO is trading at $0.07944 with a 24-hour trading volume of $12,129.87. The token exhibits considerable recent weakness, declining 1.04% over the past 24 hours, 6.92% over the past week, and 22.62% over the past month. Over the annual period, TKO has experienced a severe downturn of 81.73%.

The token maintains a circulating supply of 75,000,000 TKO tokens out of a maximum supply of 500,000,000 tokens (15% circulation ratio). The current fully diluted market capitalization stands at approximately $39.72 million, with the actual market capitalization at $5.958 million. TKO maintains a market ranking of 1,440 with a dominance of 0.0012%. The token is held by 58,853 unique holders and is listed on 15 different exchanges.

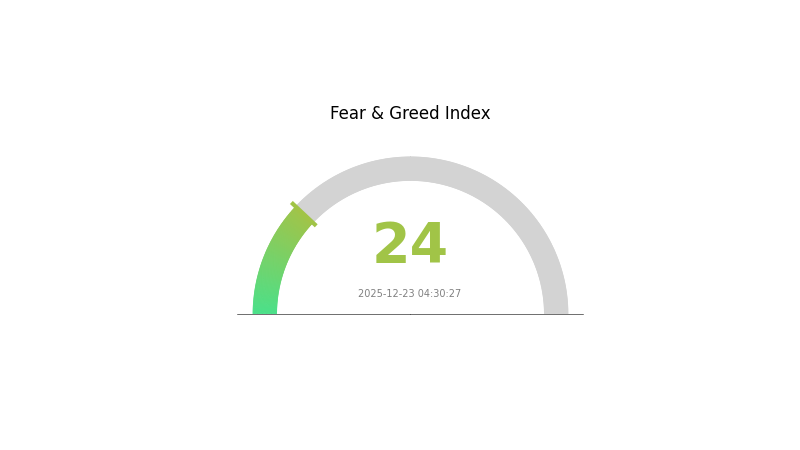

In the current market environment, the Volatility Index (VIX) stands at 24, indicating "Extreme Fear" sentiment among investors.

Click to view current TKO market price

II. Project Overview

Project Background

Tokocrypto was founded in 2018 and has established itself as the fastest-growing digital asset exchange in Indonesia by transaction volume and user registration. The platform is positioned as a gateway for Indonesian users to access cryptocurrency markets and investment opportunities.

Platform Functionality

The Tokocrypto platform enables users to:

- Access the digital currency market

- Gain investment exposure to opportunities within the Indonesian market

- Leverage the growth trajectory of digital currency users from Indonesia

- Participate in decentralized product offerings

- Generate cross-chain yields across multiple assets

- Utilize the TKO NFT Market, Indonesia's first digital collectibles and creative assets marketplace supported by TKO

TKO Token Utility

TKO is the native functional token of Tokocrypto with the following use cases:

Platform Benefits: TKO token holders receive trading fee discounts, airdrop allocations, merchandise redemption rights, and user adoption incentive programs.

CeFi Programs: TKO tokens can be deployed in deposit and savings programs, including TKO Deposit, TKO Savings, and TKO Cashback initiatives.

Cross-Platform DeFi Opportunities: Planned use cases include deploying TKO tokens on third-party DeFi platforms through mining pools, lending protocols, and other yield-generation mechanisms.

NFT Market Integration: TKO token serves as the core medium of the TKO NFT Arcade and functions as the primary payment channel between creators and users. Tokocrypto aims to develop Indonesia's NFT landscape through this marketplace targeting emerging collectors.

III. Token Distribution & Economics

- Circulating Supply: 75,000,000 TKO

- Total Supply: 500,000,000 TKO

- Maximum Supply: 500,000,000 TKO

- Circulation Ratio: 15%

- Token Launch Date: May 3, 2021

- Initial Launch Price: $0.1

- Current Fully Diluted Valuation: $39,720,000

IV. Network Information

Blockchain Network: Binance Smart Chain (BSC)

Contract Address: 0x9f589e3eabe42ebc94a44727b3f3531c0c877809

Blockchain Explorer: BSC Scan

V. Official Resources

- Official Website: https://www.tokocrypto.com/

- Twitter: https://twitter.com/TokoCrypto

- Facebook: https://www.facebook.com/TCDXOfficial

- GitHub: https://github.com/Tokocrypto/

TKO Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of 24. This indicates significant market pessimism and heightened selling pressure across digital assets. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors. Market participants should exercise caution and avoid panic selling. Consider dollar-cost averaging strategies and monitoring support levels. This period of extreme fear typically precedes potential market rebounds, making it crucial to stay informed through reliable platforms like Gate.com for real-time market data and sentiment analysis.

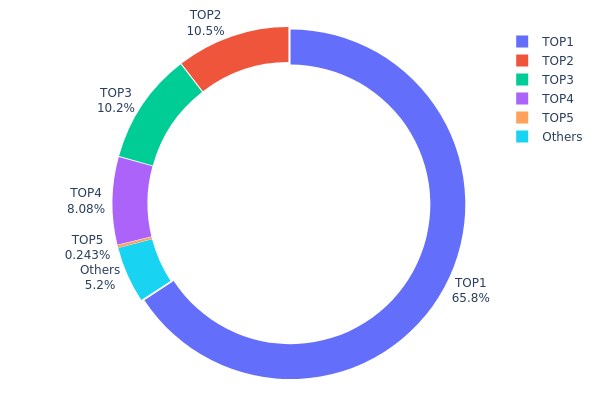

TKO Holdings Distribution

Address holdings distribution refers to the allocation of tokens across different wallet addresses on the blockchain, serving as a key metric to assess the concentration risk and decentralization level of a token. By analyzing the top holders and their proportional stakes, investors can evaluate market structure stability, potential manipulation risks, and the overall health of the token ecosystem.

The TKO token exhibits a highly concentrated distribution pattern. The top holder (0x9733...6a07c3) commands 65.75% of the total supply, representing an exceptionally dominant position. Combined with the second and third largest holders at 10.47% and 10.24% respectively, the top three addresses collectively control approximately 86.46% of all TKO tokens. The fourth largest holder maintains an 8.07% stake, further concentrating voting and economic power. This extreme concentration suggests significant centralization risk within the token structure, where a small number of entities possess disproportionate influence over the network's governance and market dynamics.

Such pronounced concentration raises concerns regarding market manipulation potential and price volatility. The top holder alone possesses sufficient capital to substantially influence TKO's market movements through large-scale transactions. The remaining addresses, including the distributed "Others" category at 5.23%, hold minimal collective influence, indicating an asymmetric power distribution. While the presence of multiple large holders provides some degree of stakeholder diversity, the overall landscape remains heavily concentrated among a limited number of addresses. This distribution pattern reflects a relatively immature decentralization status and suggests that TKO's on-chain structure may be vulnerable to coordinated actions by major token holders, potentially impacting long-term market stability and investor confidence.

Click to view current TKO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9733...6a07c3 | 325673.13K | 65.75% |

| 2 | 0x4fdf...04271e | 51879.72K | 10.47% |

| 3 | 0x5a52...70efcb | 50749.96K | 10.24% |

| 4 | 0xf977...41acec | 40000.00K | 8.07% |

| 5 | 0x4982...6e89cb | 1205.52K | 0.24% |

| - | Others | 25760.31K | 5.23% |

II. Core Factors Influencing TKO's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: U.S. inflation has unexpectedly slowed to its lowest level since early 2021, with November CPI year-over-year growth at 2.7% and core CPI at 2.6%, both below market expectations. If inflation continues to track below expectations over the coming months, this could support a more favorable interest rate reduction environment, with potential for multiple rate cuts in 2026. However, some economists question data reliability, suggesting continued monitoring of subsequent inflation reports is necessary to confirm a clear downtrend.

-

Global Economic Dynamics: Broader cryptocurrency market trends and global economic factors, including trading volume patterns and international market sentiment, continue to influence TKO price movements. Technical analysis indicators such as 50-day, 100-day, and 200-day moving averages are monitored by traders to gauge potential price direction in the coming days and weeks, with breakouts above these moving averages potentially signaling bullish trends.

Three、2025-2030 TKO Price Forecast

2025 Outlook

- Conservative Forecast: $0.05246 - $0.07948

- Neutral Forecast: $0.07948

- Optimistic Forecast: $0.10173 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with moderate growth trajectory, characterized by price stabilization and increasing adoption catalysts.

- Price Range Predictions:

- 2026: $0.04893 - $0.13138

- 2027: $0.08214 - $0.13208

- 2028: $0.08872 - $0.13977

- Key Catalysts: Ecosystem expansion, increased institutional participation, technological upgrades, and enhanced market liquidity through platforms like Gate.com.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.08492 - $0.13849 (assuming moderate adoption and stable market conditions)

- Optimistic Scenario: $0.13849 - $0.19648 (contingent on breakthrough developments in network utility and mainstream adoption)

- Transformation Scenario: $0.19648+ (under conditions of significant protocol innovations, major partnerships, and broader cryptocurrency market expansion)

- 2030-12-23: TKO $0.19648 (potential peak valuation reflecting cumulative growth over the forecast period)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.10173 | 0.07948 | 0.05246 | 0 |

| 2026 | 0.13138 | 0.09061 | 0.04893 | 14 |

| 2027 | 0.13208 | 0.11099 | 0.08214 | 39 |

| 2028 | 0.13977 | 0.12154 | 0.08872 | 52 |

| 2029 | 0.13849 | 0.13065 | 0.08492 | 64 |

| 2030 | 0.19648 | 0.13457 | 0.0794 | 69 |

Tokocrypto (TKO) Professional Investment Analysis Report

I. Executive Summary

Tokocrypto, founded in 2018, is Indonesia's fastest-growing digital asset exchange by transaction volume and user registration. The TKO token serves as the native functional utility token powering the Tokocrypto ecosystem, enabling users to access digital currency markets, investment opportunities in the Indonesian market, and participate in decentralized finance products. As of December 23, 2025, TKO is trading at $0.07944 with a market capitalization of $5,958,000 and a 24-hour trading volume of $12,129.87.

II. TKO Project Overview

Project Background

Tokocrypto established itself as Indonesia's leading digital asset exchange, capitalizing on the rapid growth of cryptocurrency adoption in Southeast Asia. The platform provides a comprehensive ecosystem for digital asset trading and investment opportunities tailored to the Indonesian market.

TKO Token Utility Functions

1. Platform Benefits

- Transaction fee discounts for TKO token holders

- Airdrop participation rights

- Merchandise redemption opportunities

- User adoption incentive measures

2. CeFi Participation Programs

- TKO deposit programs

- TKO savings plans

- TKO cashback rewards

- Interest-bearing deposit mechanisms

3. Cross-Platform DeFi Integration

- Mining pool participation

- Lending protocol integration

- Third-party DeFi platform compatibility

- Yield generation across multiple assets

4. NFT Marketplace Infrastructure

- Core payment mechanism for TKO NFT Arcade

- Creator-to-user payment channel

- Indonesia's first dedicated digital collectibles and creative assets trading market

- Support for emerging NFT collectors

III. Market Performance Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.07944 |

| Market Capitalization | $5,958,000 |

| Fully Diluted Valuation (FDV) | $39,720,000 |

| 24-Hour Trading Volume | $12,129.87 |

| Circulating Supply | 75,000,000 TKO |

| Total Supply | 500,000,000 TKO |

| Market Rank | 1,440 |

| Market Dominance | 0.0012% |

| Number of Holders | 58,853 |

Price Performance Analysis

Historical Price Range:

- All-Time High: $4.91 (May 3, 2021)

- All-Time Low: $0.077135 (December 19, 2025)

- Current Price Distance from ATH: -83.82%

Recent Price Movements:

- 1-Hour Change: -0.31%

- 24-Hour Change: -1.04%

- 7-Day Change: -6.92%

- 30-Day Change: -22.62%

- 1-Year Change: -81.73%

The token has experienced significant downward pressure over the past year, with substantial volatility and a current trading position near historical lows. The token is listed on 15 cryptocurrency exchanges, providing adequate liquidity for trading activities.

IV. TKO Professional Investment Strategy and Risk Management

TKO Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investor Profile: Institutional investors, committed retail investors interested in Southeast Asian cryptocurrency adoption, and users of the Tokocrypto platform seeking ecosystem participation.

-

Operational Recommendations:

- Accumulate TKO during market downturns to establish core positions

- Participate in CeFi programs (TKO deposit and savings plans) to generate additional yield while holding

- Monitor Indonesia's regulatory environment and digital currency adoption trends as key catalysts for long-term appreciation

- Reinvest platform rewards and cashback incentives into additional TKO positions

-

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure asset custody and direct participation in DeFi opportunities

- Maintain backup security through hardware backup options

- Enable two-factor authentication and IP whitelisting on exchange accounts

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Use for identifying momentum shifts and potential reversal points during high-volatility periods

- Relative Strength Index (RSI): Apply for overbought/oversold identification, particularly useful given TKO's price volatility

- Support and Resistance Levels: Track key price levels established during 2021-2025 trading history

-

Swing Trading Key Points:

- Trade around support levels near $0.077-$0.080 and resistance levels at $0.095-$0.110

- Exercise caution during low-volume periods which may amplify price volatility

- Implement strict stop-loss orders at 8-12% below entry positions

- Consider scaling into positions rather than single large purchases given current volatility

TKO Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 0.5-1% portfolio allocation

- Focus on platform utility benefits and CeFi yields

- Prioritize capital preservation over growth

- Extended holding periods with minimal trading activity

-

Active Investors: 2-5% portfolio allocation

- Balanced approach between utility participation and trading opportunities

- Participation in yield-generating programs

- Regular rebalancing based on market conditions

-

Professional Investors: 5-10% portfolio allocation

- Tactical positioning based on technical and fundamental analysis

- Participation in all ecosystem features including DeFi integration

- Hedging strategies and derivative positions where available

(2) Risk Hedging Strategies

- Portfolio Diversification: Maintain TKO allocation as part of diversified digital asset portfolio, reducing single-asset concentration risk through exposure to other established cryptocurrencies and blockchain projects

- Position Scaling: Implement dollar-cost averaging strategies to reduce timing risk and volatility impact during market fluctuations

(3) Secure Storage Solutions

- Custodial wallet Option: Gate.com Web3 Wallet provides integrated security with exchange convenience, offering direct access to trading and DeFi opportunities while maintaining professional security standards

- Non-Custodial Security: Utilize private key management best practices and secure backup procedures

- Critical Security Considerations:

- Never share private keys or seed phrases with any party

- Verify all transaction addresses before confirmation

- Maintain current software updates and security patches

- Monitor wallet activity regularly for unauthorized transactions

- Store backup recovery phrases in secure, offline locations

V. TKO Potential Risks and Challenges

Market Risks

- High Volatility: TKO exhibits extreme price fluctuations with 81.73% decline over one year, making the token unsuitable for risk-averse investors and subject to significant drawdown periods

- Liquidity Concerns: Trading volume of $12,129.87 represents limited trading depth, potentially causing slippage during large orders and difficulties executing positions at intended prices

- Market Sentiment Deterioration: The token's decline from $4.91 ATH to current prices reflects negative market sentiment toward the project and broader Indonesia-focused cryptocurrency initiatives

Regulatory Risks

- Indonesia Regulatory Environment: Changes in Indonesian cryptocurrency regulations could significantly impact Tokocrypto platform operations and TKO token adoption

- Compliance Requirements: Evolving AML/KYC requirements across exchanges could affect trading accessibility and token utility

- Jurisdictional Restrictions: Potential expansion of restrictions on cryptocurrency trading in specific regions could reduce user base and trading volume

Technical Risks

- Smart Contract Vulnerabilities: DeFi integration across third-party platforms presents potential security risks including smart contract exploits and protocol failures

- NFT Market Adoption: Uncertainty regarding TKO NFT Arcade's commercial viability and user adoption in Indonesia's developing NFT ecosystem

- Cross-Chain Integration Risks: Cross-chain yield generation mechanisms introduce technical complexity and potential bridging failures or liquidity issues

VI. Conclusion and Action Recommendations

TKO Investment Value Assessment

TKO represents a speculative investment opportunity focused on Indonesia's emerging digital asset market. The token provides utility within the Tokocrypto ecosystem through fee discounts, CeFi participation, and NFT marketplace integration. However, the project faces significant headwinds including substantial price depreciation (81.73% annual decline), limited trading volume, and uncertain regulatory clarity in Indonesia. The token's long-term value proposition depends on accelerating adoption of Tokocrypto's platform services and expansion of Indonesia's cryptocurrency user base. Current market conditions suggest pricing near technical support levels, but without clear catalyst for recovery, capital deployment requires elevated risk tolerance.

TKO Investment Recommendations

✅ Beginners: Limit exposure to 0.5% portfolio allocation, prioritize understanding platform mechanics through CeFi participation before active trading, and allocate only capital that can withstand complete loss without financial impact.

✅ Experienced Investors: Consider modest positions (2-5% allocation) concentrated at support levels with strict risk management, utilize platform benefits to enhance returns, and monitor developments in Indonesia's digital asset adoption as potential catalysts.

✅ Institutional Investors: Evaluate TKO as part of emerging market digital asset exposure within broader Southeast Asian cryptocurrency strategies, conduct comprehensive due diligence on Tokocrypto platform financials and regulatory compliance, and structure positions through institutional-grade custody solutions.

TKO Trading Participation Methods

- Gate.com Spot Trading: Access TKO/USDT trading pairs with competitive pricing and deep liquidity through Gate.com's professional trading interface

- Platform CeFi Programs: Participate directly in TKO deposit and savings programs through Tokocrypto's native platform, earning platform-native yields while maintaining token exposure

- DeFi Protocol Integration: Engage with third-party DeFi platforms offering TKO mining pools and lending opportunities for additional yield generation mechanisms

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Professional financial advisory consultation is strongly recommended. Never invest capital that you cannot afford to lose completely.

FAQ

Is TKO stock expected to go up?

Yes, TKO is expected to go up. Analyst consensus forecasts a 3.30% increase with an average target price of $222.31, supported by Strong Buy ratings from multiple analysts.

Is TKO a good investment?

TKO shows strong market potential with growing adoption and utility in the Web3 ecosystem. Analysts maintain positive sentiment on the project, making it an attractive investment opportunity for those bullish on the sector.

What are TKO's future prospects?

TKO demonstrates strong future potential through strategic acquisitions, media rights expansion, and innovative promotional initiatives. Growing market adoption and ecosystem development position TKO for significant long-term value appreciation.

Is TKO a growth stock?

TKO is not classified as a typical growth stock. It carries a moderate growth score, making it better suited for value-oriented investors rather than those seeking high-momentum opportunities.

What factors influence TKO price movements?

TKO price movements are driven by market demand and supply dynamics, trading volume, cryptocurrency market trends, regulatory developments, and technological advancements. Investor sentiment and macroeconomic conditions also significantly impact price fluctuations.

What are the risks associated with investing in TKO?

TKO investment risks include entertainment property value fluctuations, rising operational costs, intense market competition, and economic downturn impacts. Market volatility and regulatory changes may also affect performance.

2025 DEGO Price Prediction: Analyzing Potential Growth and Market Trends for the DeFi Governance Token

2025 DEGO Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

Will Crypto Recover in 2025?

2025 DYDX Price Prediction: Evaluating Growth Potential and Market Factors for the Leading Derivatives Exchange Token

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 1INCH Price Prediction: Will This DeFi Protocol Token Reach New Heights in the Decentralized Exchange Market?

What is SIS: A Comprehensive Guide to Student Information Systems in Modern Education

What is HLN: A Comprehensive Guide to Headline News Network and Its Role in Modern Media

What is MONPRO: A Comprehensive Guide to Understanding Modern Professional Development Platforms

What is XTER: A Comprehensive Guide to Understanding the Revolutionary Cross-Chain Exchange Protocol

What is CHAIN: Understanding the Fundamentals of Blockchain Technology and Its Revolutionary Impact on Modern Systems