2025 TRIBE Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: TRIBE's Market Position and Investment Value

TRIBE (TRIBE) serves as the governance token of Fei Protocol, a decentralized framework built on Ethereum that enables the creation of scalable and fair stablecoins. Since its launch in April 2021, TRIBE has established itself as a key component of the Ethereum ecosystem's stablecoin infrastructure. As of December 2025, TRIBE's market capitalization has reached $631.8 million, with a circulating supply of approximately 38.14 million tokens, currently trading at $0.6318. This governance-focused asset plays an increasingly crucial role in protocol decision-making and ecosystem development.

This article will provide a comprehensive analysis of TRIBE's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem evolution, and macroeconomic conditions to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to decentralized finance governance tokens.

TRIBE Market Analysis Report

I. TRIBE Price History Review and Current Market Status

TRIBE Historical Price Trajectory

Based on available data, TRIBE has experienced significant price volatility since its launch:

- April 4, 2021: All-time high (ATH) reached at $2.45, marking the peak of initial market enthusiasm for the Fei Protocol governance token.

- August 19, 2022: All-time low (ATL) recorded at $0.14412, reflecting the broader market downturn during this period.

- Current Period (2025): The token has demonstrated recovery momentum, with the price appreciating 26.95% over the past year.

TRIBE Current Market Status

As of December 20, 2025, TRIBE is trading at $0.6318, reflecting a 24-hour gain of 2.44%. The token has demonstrated positive momentum over medium-term horizons, with a 7-day increase of 11.51% and a 30-day gain of 8.26%, indicating renewed market interest.

Key Market Metrics:

- 24-hour trading range: $0.60 - $0.64

- Market capitalization: $24,097,165.94

- Fully diluted valuation: $631,800,000.00

- 24-hour trading volume: $11,592.32

- Circulating supply: 38,140,496.90 TRIBE (3.81% of total supply)

- Total supply: 1,000,000,000 TRIBE

- Market rank: #789

The token maintains a market dominance of 0.019%, with 13,415 active token holders. Current market sentiment indicates extreme fear conditions (VIX: 20), suggesting potential contrarian opportunities amid broader market uncertainty.

Click to view current TRIBE market price

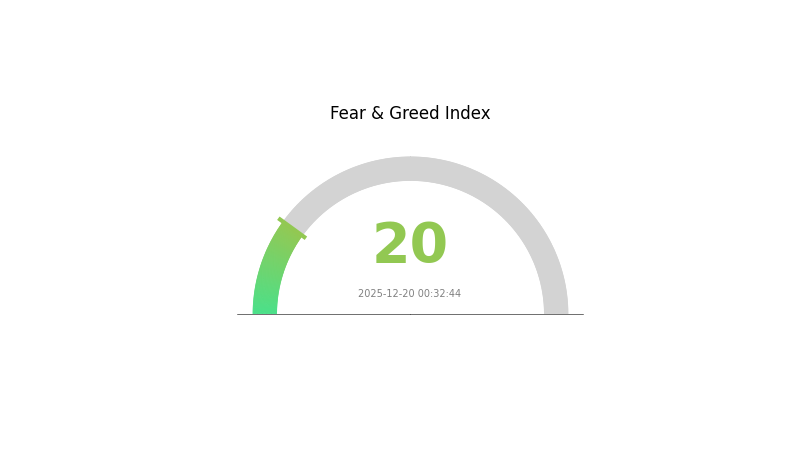

TRIBE Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 20. This indicates heightened market anxiety and significant selling pressure. During such periods, investors typically exhibit risk-averse behavior, leading to reduced trading activity and potential price volatility. Market participants should exercise caution and conduct thorough due diligence before making investment decisions. While extreme fear can present opportunities for contrarian investors, it also signals increased market uncertainty and potential downside risks that warrant careful consideration.

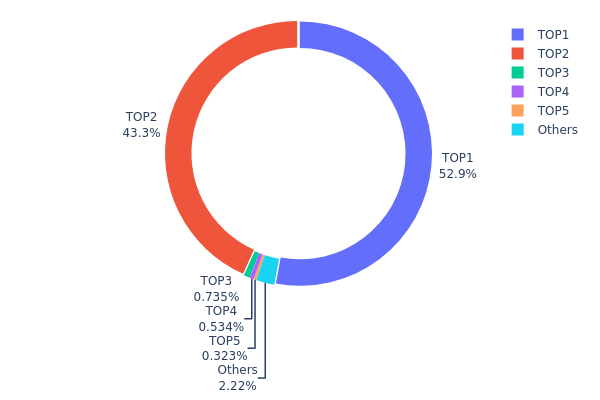

TRIBE Holdings Distribution

The address holdings distribution chart illustrates the concentration of TRIBE tokens across the blockchain, revealing the extent to which token ownership is centralized among major holders. This metric is critical for assessing the decentralization level of the network and identifying potential risks associated with concentration of voting power or market influence.

The current TRIBE distribution exhibits pronounced concentration characteristics, with the top two addresses commanding 96.18% of the total supply. The leading address holds 52.89% of all tokens, while the second-largest holder maintains 43.29%, collectively representing a duopoly-like structure that raises significant concerns regarding network decentralization. This extreme concentration substantially deviates from the optimal distribution pattern expected in a well-distributed tokenomic model, where power should be dispersed across multiple stakeholders to ensure resilience and prevent unilateral decision-making.

The remaining addresses demonstrate minimal market influence, with the third through fifth largest holders accounting for only 1.58% combined, and all other addresses collectively representing merely 2.24% of the circulating supply. This hierarchical distribution creates considerable systemic risks, as the top two holders possess sufficient tokens to materially influence governance decisions, price movements, and market sentiment. The concentration pattern suggests that TRIBE's on-chain structure remains in a nascent stage of decentralization, with token distribution heavily skewed toward early stakeholders. Such structural characteristics warrant careful monitoring, as they may constrain long-term sustainability of the protocol's governance model and expose the ecosystem to concentrated liquidation pressure or coordinated market actions.

For current TRIBE holdings distribution data, please visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8d5e...35d7b9 | 528937.89K | 52.89% |

| 2 | 0x4d96...08b4d5 | 432921.62K | 43.29% |

| 3 | 0xc09b...6909f7 | 7347.59K | 0.73% |

| 4 | 0x7bda...439aa3 | 5335.18K | 0.53% |

| 5 | 0x38af...4f1e5f | 3226.37K | 0.32% |

| - | Others | 22231.35K | 2.24% |

II. Core Factors Influencing TRIBE's Future Price Trend

Macro Economic Environment

-

Market Demand and Sentiment: The future price trend of TRIBE is influenced by market demand, technological advancements, and overall market sentiment. The cryptocurrency market's performance is closely tied to broader economic conditions and investor risk appetite.

-

Price Projections: Based on current analysis, TRIBE's projected price in 2030 is estimated to reach ¥4.72 based on a +5% annual growth rate. Investment returns are expected to accumulate to 27.63% by the end of 2030.

III. 2025-2030 TRIBE Price Forecast

2025 Outlook

- Conservative Forecast: $0.50 - $0.64

- Neutral Forecast: $0.64 - $0.84

- Optimistic Forecast: $0.84 (requires sustained ecosystem growth and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation as the protocol matures and adoption expands within the DeFi ecosystem.

- Price Range Forecast:

- 2026: $0.54 - $1.04 (16% potential upside)

- 2027: $0.67 - $1.07 (40% potential upside)

- 2028: $0.90 - $1.17 (54% potential upside)

- Key Catalysts: Protocol upgrades and feature releases, increased institutional participation, expansion of governance mechanisms, and integration partnerships with major platforms on Gate.com and other trading venues.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.86 - $1.20 (assuming steady ecosystem development and moderate market growth)

- Optimistic Scenario: $0.73 - $1.56 (assuming breakthrough in adoption metrics and strong market recovery by 2030)

- Transformational Scenario: $1.56+ (contingent on TRIBE becoming a leading governance token with significant institutional backing and mainstream recognition)

- 2030-12-20: TRIBE projected at $1.13 average valuation (representing substantial 77% cumulative appreciation from current baseline levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.83604 | 0.6382 | 0.50418 | 1 |

| 2026 | 1.03934 | 0.73712 | 0.5381 | 16 |

| 2027 | 1.06588 | 0.88823 | 0.66617 | 40 |

| 2028 | 1.17246 | 0.97705 | 0.89889 | 54 |

| 2029 | 1.20373 | 1.07476 | 0.85981 | 70 |

| 2030 | 1.56077 | 1.13924 | 0.72912 | 80 |

TRIBE Professional Investment Strategy and Risk Management Report

IV. TRIBE Professional Investment Strategy and Risk Management

TRIBE Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Protocol governance supporters and decentralized stablecoin believers with long-term conviction

- Operation Recommendations:

- Accumulate TRIBE during market corrections, targeting positions that align with your risk tolerance and portfolio allocation

- Hold through governance participation opportunities to benefit from protocol development and decision-making power

- Monitor Fei Protocol ecosystem developments and governance proposals for informed position management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Identify key levels at historical price points (ATH: $2.45, ATL: $0.14412, current support around $0.60) for entry and exit signals

- Volume Analysis: Track 24-hour volume trends ($11,592.32 average) alongside price movements to confirm breakout validity

- Wave Trading Key Points:

- Capitalize on recent positive momentum (24H: +2.44%, 7D: +11.51%) while monitoring for reversal signals

- Watch for pullbacks to previous support levels during uptrends for lower-risk entry opportunities

TRIBE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Active Investors: 2-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing: Implement dollar-cost averaging over multiple entry points to reduce timing risk and smooth acquisition costs

- Profit Taking: Set predetermined profit targets at key resistance levels to lock in gains during bull runs

(3) Secure Storage Solution

- Custody Approach: For significant holdings, consider institutional-grade custody solutions that support Ethereum-based tokens

- Self-Custody: Maintain private key security through industry-standard practices and backup procedures

- Security Considerations: TRIBE operates on Ethereum (Contract: 0xc7283b66Eb1EB5FB86327f08e1B5816b0720212B), so ensure your storage solution fully supports ERC-20 tokens and maintain secure backup of recovery phrases

V. TRIBE Potential Risks and Challenges

TRIBE Market Risk

- Liquidity Risk: With 24-hour volume of $11,592.32 and market cap of $631.8 million, large position movements may experience significant slippage

- Volatility Exposure: Historical price range of $0.14412 to $2.45 demonstrates extreme volatility that can result in rapid capital loss

- Market Sentiment Dependency: Low market dominance (0.019%) indicates vulnerability to broader crypto market sentiment shifts

TRIBE Regulatory Risk

- Stablecoin Regulation Uncertainty: As a governance token for a stablecoin protocol, TRIBE faces evolving regulatory frameworks globally that could impact Fei Protocol's operations

- Protocol Compliance Requirements: Future regulatory requirements for decentralized stablecoin protocols may necessitate protocol modifications affecting TRIBE's utility

- Jurisdiction-Specific Restrictions: Certain jurisdictions may restrict access to Fei Protocol or TRIBE trading, creating geographic limitations

TRIBE Technical Risk

- Smart Contract Vulnerability: Any undiscovered bugs or vulnerabilities in Fei Protocol's smart contracts could result in token loss or protocol failure

- Ethereum Network Dependency: TRIBE's functionality relies entirely on Ethereum network stability and security

- Governance Execution Risk: Governance token value depends on community engagement and effective decision-making; poor governance outcomes could diminish protocol viability

VI. Conclusion and Action Recommendations

TRIBE Investment Value Assessment

TRIBE represents a governance token for Fei Protocol's decentralized stablecoin infrastructure on Ethereum. With current pricing at $0.6318 and recent 1-year performance of +26.95%, TRIBE demonstrates recovery potential from historical lows. However, the token's value is intrinsically tied to Fei Protocol's adoption and success. The low market dominance (0.019%) and moderate trading volume suggest limited institutional participation, presenting both opportunity for early adopters and concentration risk. Investors should recognize that TRIBE is a protocol governance asset rather than a direct cash flow generator, requiring conviction in the protocol's long-term vision.

TRIBE Investment Recommendations

✅ Beginners: Start with small allocations (1-2% of crypto portfolio) through Gate.com's straightforward interface, prioritizing protocol research and governance understanding before expanding positions

✅ Experienced Investors: Deploy dollar-cost averaging strategies across market cycles, actively monitor governance proposals, and adjust positions based on protocol metrics and competitive stablecoin landscape developments

✅ Institutional Investors: Conduct comprehensive due diligence on Fei Protocol's technical architecture, governance structure, and competitive positioning; consider protocol-focused allocations as part of diversified cryptocurrency exposure

TRIBE Trading Participation Methods

- Direct Purchase: Trade TRIBE on Gate.com spot market using ETH or stablecoin pairs

- Limit Orders: Set predetermined buy/sell prices on Gate.com to execute trades automatically at optimal levels

- Wallet Integration: Transfer TRIBE to Ethereum-compatible wallets for governance participation in Fei Protocol proposals

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation, and should consult with professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TRIBE token and what is its use case?

TRIBE is a governance token on Ethereum that empowers holders to vote on protocol decisions and shape the ecosystem's future development through decentralized governance mechanisms.

What is the TRIBE price prediction for 2025?

TRIBE price is predicted to range from $0.00001356 to $0.4755 in 2025, based on comprehensive market analysis and trend evaluation.

What factors could affect TRIBE price in the future?

TRIBE price will be influenced by supply and demand dynamics, protocol updates, hard forks, and block reward halvings. Market sentiment, trading volume, and broader crypto market trends also play significant roles in price movements.

How has TRIBE performed compared to other DeFi tokens?

TRIBE performs comparably to governance tokens like COMP, focusing on voting rights without cash flow allocation. Its market performance has remained moderate within the DeFi sector.

What is the current market cap and circulation supply of TRIBE?

The current market cap of TRIBE is $0.00 with a circulating supply of 0.00 tokens. For the most up-to-date market data, please check real-time price tracking platforms.

2025 RESOLV Price Prediction: Analyzing Market Trends and Future Valuation Potential

ENA vs CRO: A Comparative Analysis of Two Leading Genomic Data Repositories

What Is the Current Market Overview for ENA in 2025?

Is GHO (GHO) a good investment?: Analyzing the potential and risks of Aave's new stablecoin

Is FeiUSD (FEI) a good investment?: Analyzing the potential and risks of this stablecoin in the volatile crypto market

2025 RSR Price Prediction: Navigating the Future of Reserve Rights Token in a Volatile Crypto Market

Is Gunz (GUN) a good investment?: A Comprehensive Analysis of Price Performance, Market Potential, and Risk Factors

Is Bitlayer (BTR) a good investment?: A Comprehensive Analysis of Performance, Technology, and Market Potential

Exploring Secure Web3 Wallet Solutions

Exploring Jambo: Features and Benefits of a Leading Crypto Platform

Ultimate Guide to Web3 Gaming in the Pixelverse