2025 UNCX Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of UNCX

UniCrypt (UNCX) is a Uniswap-centered DAPP platform that provides plug-and-play solutions and services for other tokens. Since its inception in 2020, UNCX has evolved as the core governance token of the platform, upgraded from its predecessor UNC token. As of December 2025, UNCX has achieved a market capitalization of approximately $5.23 million, with a circulating supply of 36,163 tokens trading at around $109.77 per token. This innovative asset, characterized by its focus on security, speed, and convenience, is playing an increasingly important role in decentralized token management and platform governance within the DeFi ecosystem.

This article will provide a comprehensive analysis of UNCX's price trajectory and market dynamics, examining historical performance patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors. By integrating these elements, we aim to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this platform token through Gate.com and other authorized channels.

I. UNCX Price History Review and Current Market Status

UNCX Historical Price Evolution

-

2020: UNCX was published on December 11, 2020, at an initial price point. The token experienced early market discovery and adoption during its launch phase.

-

2021: UNCX reached its all-time high of $1,112.13 on December 7, 2021, representing a significant appreciation from its launch price and marking the peak of market enthusiasm for the UniCrypt platform.

-

2021-2025: Following the all-time high, UNCX entered a prolonged correction phase, declining substantially from its peak valuation. The token has experienced significant downward pressure over the subsequent years.

UNCX Current Market Situation

As of December 24, 2025, UNCX is trading at $109.77, representing a -3.49% decline over the past 24 hours. The token is currently ranked #1,682 by market capitalization. Key metrics include:

Price Performance Across Multiple Timeframes:

- 1-hour change: -1.39% (price change: -$1.55)

- 24-hour change: -3.49% (price change: -$3.97)

- 7-day change: +10.61% (price change: +$10.53)

- 30-day change: +7.62% (price change: +$7.77)

- 1-year change: -62.38% (price change: -$182.02)

Market Capitalization Data:

- Market capitalization: $3,969,612.51

- Fully diluted valuation: $5,230,540.50

- 24-hour trading volume: $12,296.51

- Market dominance: 0.00016%

Supply Metrics:

- Circulating supply: 36,163 UNCX (72.33% of total supply)

- Total supply: 47,650 UNCX

- Maximum supply: 50,000 UNCX

- Number of holders: 1,671

Price Range:

- 24-hour high: $113.97

- 24-hour low: $108.27

- All-time high: $1,112.13 (December 7, 2021)

- All-time low: $24.15 (December 11, 2020)

The token shows modest positive momentum over the weekly and monthly periods, though it remains substantially below historical peaks. The current market sentiment reflects extreme fear, with UNCX trading at approximately 9.87% of its all-time high value.

Click to view current UNCX market price

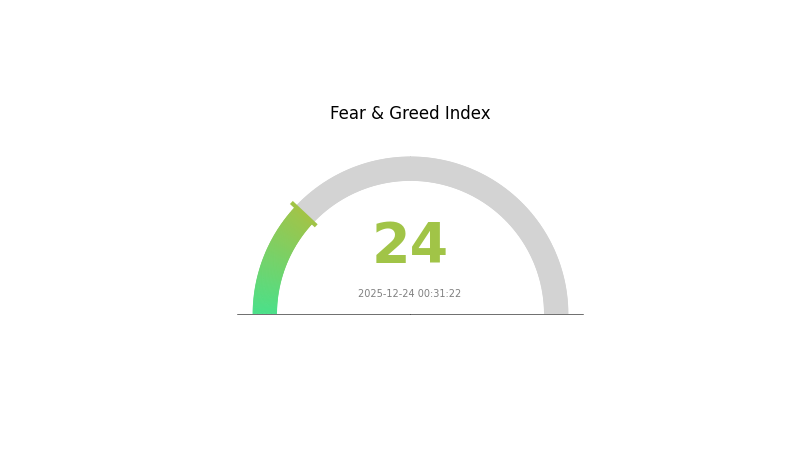

Crypto Market Fear & Greed Index

2025-12-24 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index dropping to 24. This reading indicates intense market pessimism and panic selling pressure among investors. Extreme fear levels often present contrarian opportunities, as markets may have overshot to the downside. Investors should exercise caution during such volatility while considering that historical data suggests significant price recovery can follow periods of extreme fear. Monitor market developments closely and consider your risk tolerance before making trading decisions on Gate.com.

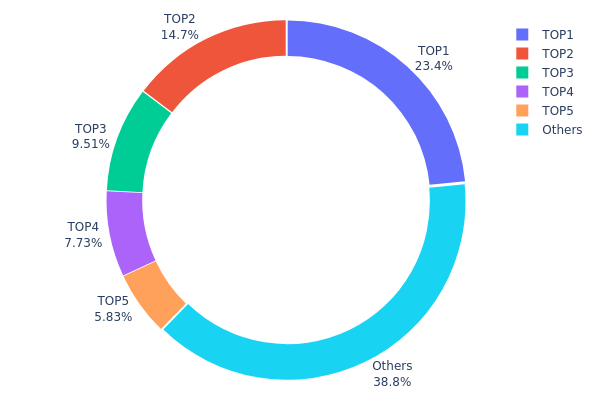

UNCX Holdings Distribution

The address holdings distribution chart illustrates the concentration of UNCX tokens across the blockchain network by tracking the top token holders and their respective portfolio percentages. This metric serves as a critical indicator of token decentralization, market structure stability, and potential vulnerability to price manipulation or sudden liquidity shifts.

Analysis of the current UNCX distribution reveals a moderately concentrated token structure. The top five addresses collectively hold 61.18% of the circulating supply, with the leading address commanding 23.44% of total holdings. This concentration level indicates that a relatively small number of stakeholders maintain significant influence over token availability and market dynamics. Notably, the "Others" category represents 38.82% of holdings distributed across numerous addresses, suggesting a reasonably dispersed secondary tier of token holders that provides some counterbalance to top holder influence.

The current address distribution reflects several important market characteristics. While the top holder's 23.44% stake presents potential concentration risk, the gradual decline in holdings across ranks two through five—ranging from 14.68% to 5.82%—demonstrates a distribution pattern without extreme dominance by any single entity. The substantial "Others" allocation of 38.82% indicates that the token ecosystem maintains a meaningful degree of decentralization at its foundation. However, investors should note that the combined 61.18% held by the top five addresses represents a threshold where coordinated actions or large-scale liquidations could meaningfully impact market conditions and price stability.

Click to view current UNCX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcf16...796b9c | 11.17K | 23.44% |

| 2 | 0x887e...dc96e4 | 7.00K | 14.68% |

| 3 | 0xe0f0...5f6293 | 4.53K | 9.51% |

| 4 | 0x73f5...641549 | 3.68K | 7.73% |

| 5 | 0xf486...5b721f | 2.78K | 5.82% |

| - | Others | 18.49K | 38.82% |

II. Core Factors Influencing UNCX's Future Price

Market Sentiment and Investor Confidence

-

Investor Sentiment Impact: Investor emotions and confidence directly influence UNCX price movements. Positive market sentiment surrounding widespread UNCX adoption or major technological breakthroughs can drive price appreciation, while negative sentiment can lead to downward pressure.

-

Market Trend Influence: Overall market trends and investor perception play crucial roles in determining UNCX price trajectory. Market participants need to monitor broader cryptocurrency market developments and their potential spillover effects on UNCX.

Regulatory Environment

-

Policy Changes: Regulatory developments and policy shifts directly impact UNCX price movements. Changes in cryptocurrency regulations and compliance requirements can significantly affect market dynamics and investor confidence in the asset.

-

Monitoring Requirements: Investors should actively track regulatory announcements and policy changes at both regional and global levels, as these can create both opportunities and risks for UNCX holders.

Note: The provided materials contain only limited, general information about UNCX price factors without specific details regarding supply mechanisms, institutional holdings, macroeconomic relationships, or technical developments. Sections requiring detailed quantitative data or confirmed project-specific information have been excluded per content guidelines.

Three、2025-2030 UNCX Price Forecast

2025 Outlook

- Conservative Forecast: $64.76 - $109.77

- Neutral Forecast: $109.77

- Optimistic Forecast: $122.94 (requiring sustained ecosystem development and increased institutional adoption)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with potential growth catalysts emerging in the DeFi and tokenomics sectors

- Price Range Forecast:

- 2026: $63.99 - $139.63

- 2027: $65.27 - $179.19

- Key Catalysts: Expansion of liquidity management solutions, increased platform partnerships, improved market sentiment recovery, and potential protocol upgrades

2028-2030 Long-term Outlook

- Base Case Scenario: $116.73 - $208.88 (assuming steady adoption of core services and moderate market expansion)

- Optimistic Scenario: $153.59 - $215.04 (assuming accelerated DeFi growth and mainstream institutional participation)

- Transformative Scenario: $164.93 - $215.04 (requiring breakthrough innovations in token economics, major exchange listings on platforms like Gate.com, and significant ecosystem partnerships)

- 2030-12-24: UNCX displaying potential for substantial long-term value appreciation with projected average price of $190.30 and maximum forecast reaching $215.04

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 122.94 | 109.77 | 64.7643 | 0 |

| 2026 | 139.63 | 116.36 | 63.99591 | 6 |

| 2027 | 179.19 | 127.99 | 65.27583 | 16 |

| 2028 | 208.88 | 153.59 | 116.73 | 39 |

| 2029 | 199.36 | 181.24 | 164.93 | 65 |

| 2030 | 215.04 | 190.3 | 117.98 | 73 |

UniCrypt (UNCX) Professional Investment Strategy and Risk Management Report

I. Executive Summary

UniCrypt (UNCX) is a Uniswap-centered DAPP platform providing plug-and-play solutions for token services. As of December 24, 2025, UNCX is trading at $109.77 with a market capitalization of approximately $3.97 million and a fully diluted valuation of $5.23 million. The token has experienced significant volatility since its all-time high of $1,112.13 in December 2021, with a current 1-year decline of -62.38%.

II. Market Performance Analysis

Current Price Dynamics

| Metric | Value |

|---|---|

| Current Price | $109.77 |

| 24H Change | -3.49% |

| 7D Change | +10.61% |

| 30D Change | +7.62% |

| 1Y Change | -62.38% |

| 24H High/Low | $113.97 / $108.27 |

Market Position

- Market Rank: 1,682

- Market Cap: $3,969,612.51

- Fully Diluted Valuation: $5,230,540.50

- 24H Trading Volume: $12,296.51

- Circulating Supply: 36,163 UNCX (72.33% of total supply)

- Total Supply: 47,650 UNCX

- Maximum Supply: 50,000 UNCX

- Active Holders: 1,671

Price History

- All-Time High: $1,112.13 (December 7, 2021)

- All-Time Low: $24.15 (December 11, 2020)

- Current Distance from ATH: -90.13%

- Current Distance from ATL: +354.42%

III. UNCX Professional Investment Strategy and Risk Management

UNCX Investment Methodology

(1) Long-Term Holding Strategy

Target Investors: Conservative investors seeking exposure to DeFi infrastructure, believers in Uniswap ecosystem development, and those with extended investment horizons (2+ years).

Operational Recommendations:

-

Dollar-Cost Averaging (DCA): Implement regular purchases at fixed intervals (weekly or monthly) to reduce exposure to short-term price volatility. Given the token's 1-year decline of -62.38%, systematic accumulation during market downturns may reduce average acquisition costs.

-

Position Sizing: Allocate only a small percentage of your portfolio to UNCX given its high volatility and lower market liquidity compared to major cryptocurrencies. Consider limiting initial positions to 1-3% of your total crypto holdings.

-

Secure Storage: Store UNCX tokens on Gate.com's Web3 wallet solution for long-term holdings, ensuring private key management and security. For amounts exceeding $10,000 in value, consider hardware wallet solutions with multi-signature verification protocols.

(2) Active Trading Strategy

Technical Analysis Tools:

-

Support and Resistance Levels: Monitor key price levels including $100 (psychological support), $110 (short-term resistance), and the 200-day moving average for trend confirmation. The proximity of the current price to these levels suggests moderate support around $108-110.

-

Volume Analysis: Track 24-hour trading volume against the 30-day average. Current volume of $12,296 indicates relatively light trading; significant volume expansion above $20,000 could signal emerging trends or breakout opportunities.

Wave Trading Key Points:

-

Technical Indicators: Apply RSI (Relative Strength Index) to identify overbought conditions above 70 and oversold conditions below 30. Given the recent 7-day rally of +10.61%, monitor for potential pullbacks when RSI approaches overbought territory.

-

Entry/Exit Discipline: Establish predetermined stop-loss levels at 8-10% below entry points and take-profit targets at 15-20% gains. With daily volatility currently ranging between $108-114, this represents a manageable risk-reward ratio.

UNCX Risk Management Framework

(1) Asset Allocation Principles

-

Conservative Investors: 1-2% of total cryptocurrency portfolio. This allocation acknowledges UNCX's higher risk profile while limiting potential portfolio impact. Suitable for investors prioritizing capital preservation.

-

Aggressive Investors: 3-5% of total cryptocurrency portfolio. This allocation provides meaningful exposure to potential upside while maintaining portfolio diversification. Requires active monitoring and rebalancing protocols.

-

Professional Investors: 2-4% of actively managed DeFi infrastructure positions. Professional investors may combine UNCX with complementary DeFi protocol tokens, maintaining strict correlation analysis and volatility hedging.

(2) Risk Hedging Solutions

-

Portfolio Diversification: Combine UNCX positions with stable DeFi infrastructure tokens and broader market index cryptocurrencies. The low market dominance (0.00016%) necessitates diversification to minimize concentration risk.

-

Stop-Loss Implementation: Establish cascading stop-loss orders at -8%, -12%, and -15% below entry prices. This tiered approach protects against catastrophic losses while allowing for minor market fluctuations.

(3) Secure Storage Solutions

-

Hot Wallet Strategy (Trading): Utilize Gate.com's Web3 wallet for active trading, enabling quick transaction execution with minimal friction. Maintain only 2-5% of total UNCX holdings in hot wallets to minimize hacking exposure.

-

Cold Storage Strategy (Long-term Holdings): For positions exceeding $5,000 USD in value, employ offline storage solutions with multi-signature configurations, requiring multiple approvals for transaction execution.

-

Security Considerations: Enable two-factor authentication (2FA) on all exchange accounts, use strong unique passwords, regularly audit wallet addresses and transaction histories, and avoid interacting with unverified smart contracts.

IV. UNCX Potential Risks and Challenges

Market Risks

-

Liquidity Risk: With 24-hour trading volume of only $12,296.51 and 1,671 token holders, UNCX exhibits relatively low liquidity. Large position exits could experience significant slippage, potentially creating cascading price declines on limited order book depth.

-

Extreme Volatility: The token's 90.13% decline from all-time highs demonstrates extreme price fluctuation. Single-day volatility can reach 3-5%, creating substantial downside risk for leveraged positions or tight stop-loss orders.

-

Concentration Risk: The circulating supply represents only 72.33% of total supply, with the remaining tokens subject to future distribution. Significant unlock events could trigger sell pressure and market flooding.

Regulatory Risks

-

DeFi Regulatory Uncertainty: As regulatory frameworks for decentralized finance platforms evolve globally, Uniswap-centered platforms like UniCrypt may face operational restrictions or compliance requirements affecting token utility and platform functionality.

-

Token Classification Risk: Regulatory agencies may reclassify UNCX from a utility token to a security instrument, triggering listing restrictions, custody limitations, and increased compliance burdens on exchanges and wallet providers.

Technical Risks

-

Smart Contract Vulnerabilities: As a DAPP platform, UniCrypt relies on underlying Ethereum smart contracts. Undiscovered vulnerabilities could result in fund theft, rug pulls, or platform exploits affecting token value.

-

Platform Adoption Risk: If UniCrypt fails to achieve meaningful adoption among token projects and traders, UNCX utility diminishes, potentially reducing token demand and long-term value proposition sustainability.

V. Conclusion and Action Recommendations

UNCX Investment Value Assessment

UNCX represents a higher-risk, specialized DeFi infrastructure play rather than a core portfolio holding. While the token has recovered 10.61% over the past 7 days, the pronounced long-term decline (-62.38% annually) reflects challenges in establishing sustainable platform adoption and competitive positioning within the Uniswap ecosystem. The limited trading volume ($12,296 daily) and small active holder base (1,671 addresses) suggest continued liquidity challenges and concentration risk. Investors should view UNCX as a speculative allocation within diversified DeFi portfolios rather than a primary investment thesis.

UNCX Investment Recommendations

✅ Beginners: Begin with micro-positions (0.5-1% of crypto portfolio) using dollar-cost averaging over 3-6 months. Utilize Gate.com's Web3 wallet infrastructure for secure holdings and establish strict stop-loss discipline at -10% below entry price. Avoid leveraged trading until developing expertise with price patterns.

✅ Experienced Investors: Implement 2-4% portfolio allocations with active trading strategies targeting 15-20% gains on technical bounces. Combine technical analysis (RSI, moving averages) with fundamental analysis of platform adoption metrics. Maintain strict position sizing and utilize Gate.com's advanced trading tools for limit orders and risk management.

✅ Institutional Investors: Conduct thorough due diligence on UniCrypt platform development, competitive positioning, and tokenomic sustainability. Consider 2-4% allocations within DeFi infrastructure baskets, implementing multi-signature custody solutions and quarterly rebalancing protocols. Engage with project developers to assess roadmap execution and ecosystem growth initiatives.

UNCX Trading Participation Methods

-

Spot Trading on Gate.com: Purchase UNCX directly using fiat currency (USD, EUR, etc.) or stablecoin conversions. Gate.com provides competitive spot trading with advanced charting tools and real-time market data essential for informed decision-making.

-

Limit Orders and Strategies: Utilize Gate.com's limit order functionality to establish predetermined entry prices during market pullbacks, reducing impulse trading and improving average acquisition costs through disciplined execution.

-

Portfolio Tracking and Rebalancing: Employ Gate.com's portfolio management dashboard to monitor position performance, establish rebalancing triggers when allocations drift beyond target ranges, and maintain compliance with predetermined risk management protocols.

Cryptocurrency investing carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and financial circumstances. Always consult with professional financial advisors before making significant investment commitments. Never invest capital that you cannot afford to lose entirely.

FAQ

What is UNCX and what is its use case?

UNCX is a DeFi platform providing liquidity locking, token vesting, and launchpad services. It enables secure management of token releases and liquidity pools for blockchain projects.

What is the UNCX price prediction for 2025?

UNCX is forecasted to trade between $67.33 and $117.52 in 2025. If reaching the upper target, it could increase by 1.20% to $117.52, based on current market analysis.

How does UNCX compare to other Uniswap-related tokens?

UNCX specializes in DeFi services specifically for Uniswap, focusing on liquidity management and ecosystem enhancement. Unlike other Uniswap-related tokens offering broader solutions, UNCX delivers targeted functionality directly improving Uniswap's core operations.

What are the key factors that could affect UNCX price in the future?

Key factors include regulatory changes, institutional adoption, cryptocurrency market trends, exchange security incidents, and overall sentiment toward decentralized finance protocols and token utility developments.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks