2025 UOS Price Prediction: Analyzing Growth Potential and Market Dynamics in the Evolving Blockchain Ecosystem

Introduction: UOS's Market Position and Investment Value

Ultra (UOS), as a blockchain platform designed to revolutionize the $140 billion gaming industry, has been making significant strides since its inception in 2019. By 2025, Ultra's market capitalization has reached $15,025,566, with a circulating supply of approximately 472,205,109 tokens, and a price hovering around $0.03182. This asset, often referred to as the "game industry disruptor," is playing an increasingly crucial role in reshaping game distribution and virtual goods trading.

This article will provide a comprehensive analysis of Ultra's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. UOS Price History Review and Current Market Status

UOS Historical Price Evolution

- 2019: UOS launched at $0.05, price fluctuated around this level

- 2021: Reached all-time high of $2.49 on November 25, marking significant growth

- 2022-2024: Market downturn, price declined to lower levels

UOS Current Market Situation

As of October 7, 2025, UOS is trading at $0.03182. The token has seen a 1.69% increase in the last 24 hours, with a trading volume of $20,936.07. UOS currently ranks #1238 in market capitalization, with a total market cap of $31,820,000. The circulating supply is 472,205,109.5661 UOS, which represents 47.22% of the total supply of 1 billion tokens.

Over the past week, UOS has shown a slight uptrend with a 1.67% increase. However, looking at longer timeframes, the token has experienced significant declines, with a 13.48% drop over the past 30 days and a substantial 62.71% decrease over the past year.

The current price is significantly below its all-time high of $2.49, recorded on November 25, 2021, but remains above its all-time low of $0.02137354, set on September 2, 2019.

Click to view the current UOS market price

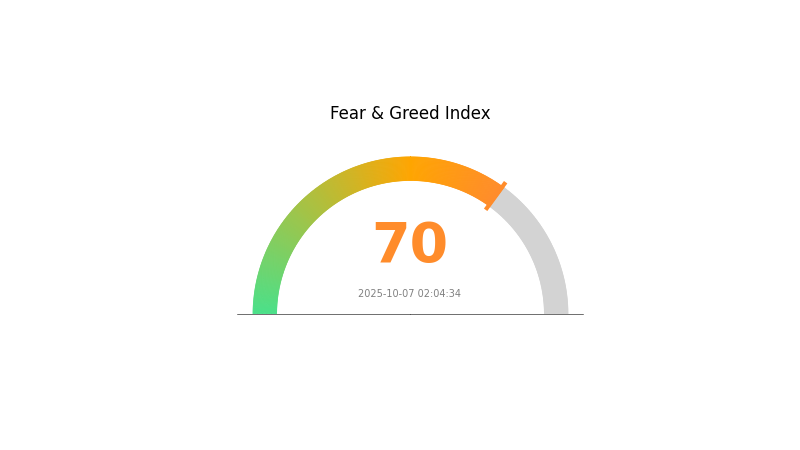

UOS Market Sentiment Indicator

2025-10-07 Fear and Greed Index: 70 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 70. This suggests investors are becoming increasingly optimistic, potentially leading to overbought conditions. While high sentiment can drive prices up in the short term, it's crucial to remain cautious. Experienced traders often view extreme greed as a signal to consider taking profits or reducing exposure. As always, it's essential to conduct thorough research and manage risk carefully in this volatile market environment.

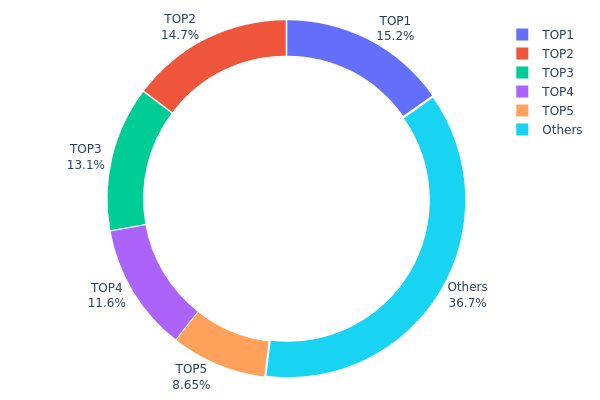

UOS Holdings Distribution

The address holdings distribution data for UOS reveals a significant concentration of tokens among a few top addresses. The top 5 addresses collectively hold 63.28% of the total UOS supply, with the largest single address controlling 15.23%. This level of concentration indicates a relatively centralized token distribution, which could have implications for market dynamics and price stability.

Such a concentrated distribution raises concerns about potential market manipulation and volatility. Large holders, often referred to as "whales," have the capacity to significantly influence token prices through substantial buy or sell orders. This concentration also suggests that the UOS ecosystem may be less decentralized than ideal, as a small number of entities hold considerable sway over the token's circulation and potentially its governance.

However, it's worth noting that 36.72% of the tokens are distributed among other addresses, which provides some level of diversification. This distribution pattern highlights the importance of monitoring large address movements and emphasizes the need for increased token dispersion to enhance market resilience and reduce manipulation risks in the UOS ecosystem.

Click to view the current UOS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa353...e1ecf1 | 152348.13K | 15.23% |

| 2 | 0x7b5d...2cf8b1 | 147300.00K | 14.73% |

| 3 | 0xd13c...ab5c8c | 131301.19K | 13.13% |

| 4 | 0xca5f...fbbc26 | 115506.31K | 11.55% |

| 5 | 0xc9e8...5e87ca | 86465.00K | 8.64% |

| - | Others | 367079.37K | 36.72% |

II. Key Factors Affecting UOS Future Price

Supply Mechanism

- Halving Events: Bitcoin's periodic halving events reduce new supply, potentially impacting UOS price.

- Historical Patterns: Past halvings have led to price increases due to supply shock.

- Current Impact: The next halving is expected to reduce inflation and potentially drive up prices.

Institutional and Whale Dynamics

- Institutional Holdings: Central banks have increased gold purchases, which may influence UOS as a digital gold alternative.

- Corporate Adoption: Some companies are holding UOS as part of their treasury reserves.

- National Policies: Certain countries are exploring UOS for international settlements and reserves.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve interest rate decisions affect UOS price as an alternative investment.

- Inflation Hedging Properties: UOS is increasingly viewed as a hedge against inflation, similar to gold.

- Geopolitical Factors: Global tensions and economic uncertainties drive demand for UOS as a safe-haven asset.

Technical Development and Ecosystem Growth

- Network Upgrades: Ongoing improvements to scalability and functionality enhance UOS utility.

- DeFi Integration: Expanding decentralized finance applications on UOS network increases adoption.

- Ecosystem Applications: Growing number of dApps and projects built on UOS blockchain drives demand.

III. UOS Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.01907 - $0.02500

- Neutral forecast: $0.02500 - $0.03500

- Optimistic forecast: $0.03500 - $0.04417 (requires strong market recovery and increased UOS adoption)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.02566 - $0.04429

- 2028: $0.03085 - $0.04456

- Key catalysts: Ecosystem expansion, technological improvements, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $0.03000 - $0.04500 (assuming steady growth and adoption)

- Optimistic scenario: $0.04500 - $0.05234 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.05234 - $0.06000 (assuming breakthrough use cases and mainstream integration)

- 2030-12-31: UOS $0.04436 (projected average price for 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04417 | 0.03178 | 0.01907 | 0 |

| 2026 | 0.04481 | 0.03798 | 0.02127 | 19 |

| 2027 | 0.04429 | 0.0414 | 0.02566 | 30 |

| 2028 | 0.04456 | 0.04284 | 0.03085 | 35 |

| 2029 | 0.04501 | 0.0437 | 0.02928 | 37 |

| 2030 | 0.05234 | 0.04436 | 0.03149 | 39 |

IV. Professional Investment Strategies and Risk Management for UOS

UOS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate UOS during market dips

- Set price targets and review periodically

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

UOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for UOS

UOS Market Risks

- High volatility: Significant price fluctuations are common

- Limited adoption: Depends on the success of the Ultra platform

- Competition: Faces strong competition in the gaming industry

UOS Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations are evolving globally

- Potential restrictions: Some countries may limit or ban cryptocurrency usage

- Compliance issues: Changes in regulations may affect Ultra's operations

UOS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues as the platform grows

- Technological obsolescence: Rapid advancements in blockchain technology

VI. Conclusion and Action Recommendations

UOS Investment Value Assessment

UOS presents a unique proposition in the gaming industry, but faces significant competition and regulatory uncertainties. Long-term potential exists if Ultra succeeds, but short-term volatility and risks are high.

UOS Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging with strict risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider as part of a diversified crypto portfolio

UOS Trading Participation Methods

- Spot trading: Buy and sell UOS on Gate.com

- Staking: Participate in staking programs if available

- DeFi: Explore decentralized finance options involving UOS tokens

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

Can Uniswap hit $100?

Based on current predictions, Uniswap is unlikely to reach $100. The highest projected price is around $49 by 2049, according to market trends and forecasts.

Which crypto boom in 2025 prediction?

Bitcoin, Ethereum, Solana, XRP, and Binance Coin are predicted to experience significant growth in 2025, with substantial price increases expected for these major cryptocurrencies and altcoins.

What will Uniswap be worth in 2025?

Uniswap (UNI) is projected to trade between $7.99 and $17.03 in 2025, with an average price of $12.54, based on current market trends.

What is Nvidia's price prediction for 2025?

Nvidia's stock price is predicted to reach $1,000 per share by 2025, driven by strong growth in AI and data center demand.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Free Money for App Registration: Crypto Exchange Welcome Bonuses

Crypto Exchanges Without KYC: Top Platforms for Anonymous Trading

Solana ETF Launch High Performance Chain Enters Mainstream Investment

Uniswap Protocol Fees Activation Governance Proposal Reshapes DeFi Incentives

Best Platforms for Learn and Earn Programs in the Cryptocurrency Space