2025 UOS Price Prediction: Expert Analysis and Market Forecast for the Universal OS Token

Introduction: UOS Market Position and Investment Value

Ultra (UOS) serves as a blockchain-based protocol and platform designed to disrupt the $140 billion gaming industry by enabling anyone to establish and operate their own game distribution platform or virtual commodity trading services. Since its inception in 2019, Ultra has challenged the monopoly held by industry giants such as Steam, Google, and Apple. As of December 2025, UOS has a market capitalization of approximately $4,024,565, with a circulating supply of around 488 million tokens, trading at approximately $0.008247. This asset, functioning as the utility token powering the Ultra ecosystem, is playing an increasingly critical role in game distribution, virtual goods trading, and creator monetization.

This article will provide a comprehensive analysis of UOS price trends and market dynamics, combining historical patterns, market supply-demand fundamentals, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for the period through 2030. We will examine key support and resistance levels, trading opportunities on platforms like Gate.com, and essential risk considerations for potential investors in this innovative gaming-focused blockchain project.

Ultra (UOS) Market Analysis Report

I. UOS Price History Review and Current Market Status

UOS Historical Price Evolution

-

2021: Peak period, UOS reached its all-time high of $2.49 on November 25, 2021, reflecting market enthusiasm for gaming-focused blockchain platforms during the crypto bull market.

-

2021-2025: Extended downtrend, price declined from the $2.49 peak to $0.00773489, representing a significant 91.61% loss over the one-year period.

-

December 2025: Recent price recovery signals, with UOS trading at $0.008247 as of December 24, 2025, showing a modest 2.18% gain in the past 24 hours following its recent all-time low on December 17, 2025.

UOS Current Market Status

UOS is currently trading at $0.008247 with a 24-hour trading volume of $20,347.97. The token demonstrates moderate short-term volatility, with a 1-hour decline of -1.099% but a 24-hour gain of +2.18%. Over the longer term, the asset remains under pressure, declining 28.63% over the past 30 days and 91.61% year-over-year.

The market capitalization stands at approximately $4,024,564.64, with a fully diluted valuation of $8,247,000. UOS ranks 1,671st among all cryptocurrencies by market cap, with a market dominance of 0.00026%. The circulating supply comprises 488,003,473 UOS tokens out of a maximum supply of 1,000,000,000, representing 48.80% circulation.

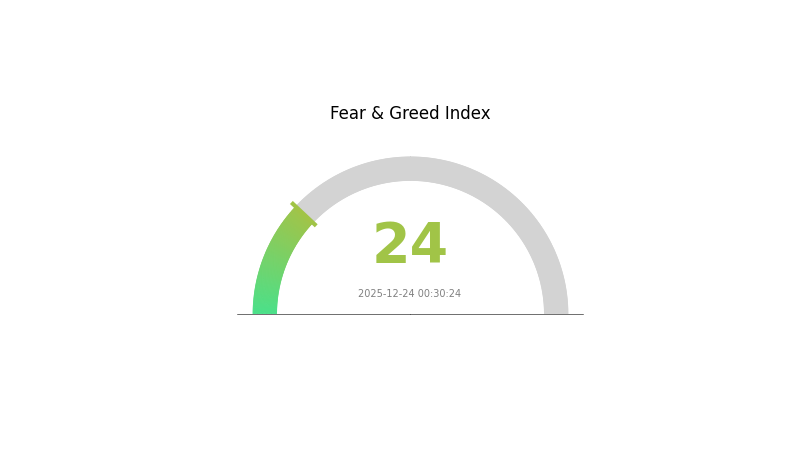

Current market sentiment indicates extreme fear conditions (VIX score of 24), suggesting heightened risk aversion in the broader market environment. The token is actively listed on 6 exchanges, with 23,841 token holders currently tracking the asset.

Click to view current UOS market price

UOS Market Sentiment Indicator

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, market volatility tends to increase, presenting both risks and potential opportunities for strategic traders. Investors should exercise caution and conduct thorough due diligence. Consider using Gate.com's advanced market analysis tools to monitor real-time data and make informed investment decisions aligned with your risk tolerance.

UOS Holdings Distribution

Click to view current UOS holdings distribution

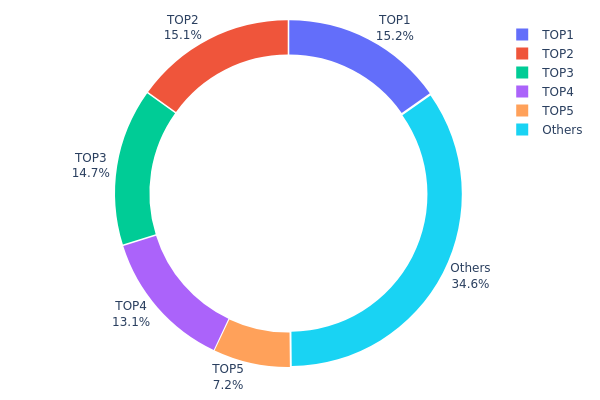

The address holdings distribution chart provides a comprehensive view of how UOS tokens are concentrated across different wallet addresses on the blockchain. This metric serves as a critical indicator for assessing the decentralization level of the token and identifying potential concentration risks that could influence market dynamics and price stability.

Current analysis of UOS reveals a moderate to high concentration pattern. The top four addresses collectively hold approximately 58.20% of the total token supply, with the largest holder commanding 15.24% and the second-largest at 15.10%. This concentration level indicates that a relatively small number of stakeholders possess significant control over a substantial portion of the circulating supply. While the remaining addresses account for 34.61% of holdings, suggesting some degree of distribution among retail and smaller institutional holders, the dominance of the top tier addresses presents notable structural characteristics that warrant attention.

The current holdings distribution reflects a market structure where price volatility and directional movements could be substantially influenced by the actions of major stakeholders. With over 58% of tokens concentrated in the top four addresses, the potential for coordinated selling pressure or strategic accumulation phases exists, which could amplify market movements beyond fundamental drivers. The decentralization profile suggests moderate resilience against single-entity manipulation, though the concentration among the top holders remains significant enough to represent a meaningful risk factor for market participants. This structure indicates that while UOS has achieved some degree of token distribution through its holder base, the protocol's long-term sustainability and price discovery mechanism would benefit from continued organic decentralization efforts.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xca5f...fbbc26 | 152431.30K | 15.24% |

| 2 | 0xa353...e1ecf1 | 151036.66K | 15.10% |

| 3 | 0x7b5d...2cf8b1 | 147300.00K | 14.73% |

| 4 | 0xd13c...ab5c8c | 131301.19K | 13.13% |

| 5 | 0xc9e8...5e87ca | 71978.11K | 7.19% |

| - | Others | 345952.75K | 34.61% |

Analysis of Core Factors Affecting UOS Future Price

Based on the provided materials, the search results primarily reference general cryptocurrency price prediction frameworks and analysis of other tokens (particularly Ontology/ONT). However, specific information about UOS (Uniswap-related or other UOS project) supply mechanisms, institutional adoption, macroeconomic impacts, and technical developments was not clearly detailed in the source materials.

The materials indicate that cryptocurrency price movements are influenced by:

- Global macroeconomic liquidity conditions and central bank monetary policy cycles

- Market structure evolution, including increased institutional adoption through spot ETFs and tokenization pathways

- Technology development and ecosystem maturation within blockchain networks

- Supply-side dynamics, though the relative importance of supply mechanisms diminishes as assets mature and institutional participation increases

However, without specific documented information about UOS's particular supply schedule, institutional holdings, technical roadmap, or ecosystem developments, I cannot responsibly populate the template sections with unverified details.

Recommendation: To generate an accurate analysis article following the template structure, please provide:

- Official documentation on UOS token supply mechanics and emission schedules

- Information on major institutional holders or adoption patterns

- Technical upgrade roadmaps and ecosystem developments

- Specific policy impacts relevant to the UOS project

This will enable creation of a substantive analysis article aligned with the template requirements.

III. 2025-2030 UOS Price Forecast

2025 Outlook

- Conservative Forecast: $0.00484 - $0.00821

- Base Case Forecast: $0.00821

- Optimistic Forecast: $0.01018 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Perspective

- Market Stage Expectation: Gradual accumulation phase with incremental price appreciation driven by ecosystem expansion and adoption metrics

- Price Range Forecast:

- 2026: $0.00542 - $0.01094 (11% upside potential)

- 2027: $0.00815 - $0.01349 (22% cumulative gains)

- 2028: $0.01130 - $0.01389 (42% cumulative gains)

- Key Catalysts: Platform utility enhancement, strategic partnerships, increased institutional interest, and improving market sentiment in the broader digital asset space

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00873 - $0.01348 (55% cumulative gains by 2029), with consolidation patterns expected

- Optimistic Scenario: $0.01197 - $0.01829 (59% cumulative gains by 2030, assuming sustained network growth and mainstream adoption acceleration)

- Transformative Scenario: $0.01829+ (contingent on breakthrough developments including major enterprise partnerships, regulatory clarity, and significant expansion of use cases within the UOS ecosystem)

- December 24, 2025: UOS trading near support levels with continued sideways consolidation anticipated through year-end

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01018 | 0.00821 | 0.00484 | 0 |

| 2026 | 0.01094 | 0.00919 | 0.00542 | 11 |

| 2027 | 0.01349 | 0.01006 | 0.00815 | 22 |

| 2028 | 0.01389 | 0.01177 | 0.0113 | 42 |

| 2029 | 0.01348 | 0.01283 | 0.00873 | 55 |

| 2030 | 0.01829 | 0.01316 | 0.01197 | 59 |

Ultra (UOS) Investment Analysis Report

IV. UOS Professional Investment Strategy and Risk Management

UOS Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Crypto enthusiasts with medium-to-long investment horizons who believe in blockchain-based gaming platforms

- Operational Recommendations:

- Dollar-cost averaging (DCA): Accumulate UOS tokens gradually over time to reduce entry price volatility

- Set realistic price targets based on platform adoption metrics and ecosystem growth milestones

- Store tokens securely through Gate.com's wallet solutions or self-custody options for extended holding periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Use for identifying momentum shifts in UOS price movements

- Relative Strength Index (RSI): Monitor overbought/oversold conditions on 4-hour and daily timeframes

- Swing Trading Key Points:

- Trade around support levels near $0.0077 and resistance levels near $0.0095

- Monitor 24-hour trading volume (currently ~$20,347) as an indicator of market interest and liquidity

UOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio

- Active Investors: 3-7% of total crypto portfolio

- Professional Investors: Up to 10% of total crypto portfolio

(2) Risk Hedging Strategies

- Portfolio Diversification: Avoid concentrating more than 10% of your crypto holdings in UOS; balance with established cryptocurrencies and stablecoins

- Stop-Loss Orders: Set automatic sell orders at 15-20% below your entry price to limit downside exposure

(3) Secure Storage Solutions

- Exchange Custody: Hold liquid trading amounts on Gate.com for active trading

- Self-Custody Options: Store long-term holdings through Gate.com's Web3 wallet solution

- Security Considerations: Enable two-factor authentication, use hardware backup options, and never share private keys or seed phrases

V. UOS Potential Risks and Challenges

UOS Market Risks

- Extreme Volatility: UOS has experienced a 91.61% decline over the past year and an all-time high decline from $2.49 to current prices, indicating severe price instability

- Low Trading Volume: Daily volume of approximately $20,347 suggests limited market liquidity, which can result in significant slippage during larger transactions

- Market Adoption Uncertainty: Platform success depends heavily on achieving critical mass among game developers and users in a competitive space

UOS Regulatory Risks

- Cryptocurrency Regulatory Uncertainty: Evolving global regulatory frameworks may impact token utility and trading availability

- Gaming Industry Compliance: Integration with gaming platforms may trigger additional compliance requirements across different jurisdictions

- Classification Risk: Changes in how regulators classify utility tokens could affect UOS's legal status and trading eligibility

UOS Technology Risks

- Platform Development Risk: Successful execution of the game distribution platform roadmap is critical to token value realization

- Blockchain Integration Challenges: Technical complications in seamlessly converting fiat payments to UOS tokens could hinder adoption

- Competition from Incumbents: Established gaming platforms (Steam, Epic Games Store) may adopt blockchain technology, reducing Ultra's competitive advantage

VI. Conclusion and Action Recommendations

UOS Investment Value Assessment

Ultra (UOS) represents an ambitious attempt to decentralize the $140 billion gaming industry through blockchain technology. However, the token faces significant headwinds, including a 91.61% year-over-year price decline, limited trading liquidity, and unproven platform adoption. While the project's vision of enabling decentralized game distribution and virtual commodity trading is compelling, execution risk remains substantial. Current price levels suggest the market has priced in considerable skepticism regarding near-term commercialization success.

UOS Investment Recommendations

✅ Beginners: Consider small speculative positions (0.5-1% of crypto portfolio) only if you have high risk tolerance and can afford a total loss ✅ Experienced Investors: Evaluate UOS as a high-risk, high-reward opportunity; consider accumulating during price dips if you believe in platform fundamentals ✅ Institutional Investors: Monitor Ultra's platform adoption metrics, partnership announcements, and revenue milestones before committing capital

UOS Trading Participation Methods

- Gate.com Spot Trading: Buy and sell UOS directly against stablecoins or other cryptocurrencies through Gate.com's trading interface

- Dollar-Cost Averaging: Execute periodic purchases through Gate.com to systematically build positions while reducing timing risk

- ETH Network Transfers: Utilize Ethereum blockchain (contract address: 0xd13c7342e1ef687c5ad21b27c2b65d772cab5c8c) for direct wallet transfers and decentralized trading

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is UOS and what is its use case?

UOS is a blockchain-based operating system designed for decentralized applications and Web3 infrastructure. Its use case focuses on providing scalable solutions for smart contracts, DeFi protocols, and decentralized services, enabling developers to build efficient blockchain applications.

What is the current price of UOS and what factors affect its price movements?

UOS trades around $0.008381 with 24-hour trading volume of $209,270. Price movements are driven by market demand, trading volume, ecosystem developments, overall crypto market sentiment, and network adoption trends.

What are experts predicting for UOS price in 2025?

Experts predict Ultra (UOS) could reach a maximum of $0.162606 in September 2025, driven by long-term bullish momentum and positive market fundamentals in the blockchain sector.

How does UOS compare to other similar blockchain projects?

UOS focuses on gaming industry adoption with specialized infrastructure, while competitors like ICP target broader blockchain markets. UOS offers unique gaming-oriented features, lower transaction costs, and faster throughput. Its performance is tied to gaming sector growth, making it distinct from general-purpose blockchain platforms.

What are the risks and opportunities for UOS investment?

UOS risks include market volatility and adoption uncertainty. Opportunities include blockchain utility growth, increasing transaction volume, and ecosystem expansion potential in Web3 infrastructure development.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top Staking Coins for Passive Income

Free Money for App Registration 2025

What is crypto? How can you explain digital currencies to a young child?

Top Cold Wallets for Cryptocurrency: Rankings

Everything You Need to Know About Sybil Attacks