2025 VINU Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of VINU

Vita Inu (VINU), the world's first fast and feeless dog coin with high TPS and native smart contracts, has established itself as a significant player in the multi-chain cryptocurrency ecosystem since its inception. As of December 2025, VINU boasts a market capitalization of approximately $7.77 million with a circulating supply of approximately 895.82 billion tokens, currently trading at $0.000000008677. This innovative asset, recognized as a "powerful multi-chain currency and governance token of the Vinuverse," continues to demonstrate robust adoption across multiple blockchain networks including BSC and Ethereum.

This comprehensive analysis will examine VINU's price trajectory and market dynamics through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for cryptocurrency investors.

Vita Inu (VINU) Market Analysis Report

I. VINU Price History Review and Market Status

VINU Historical Price Movement Trajectory

- November 19, 2021: Project inception period, establishing all-time low price of $0.000000003024.

- December 7, 2024: Significant milestone reached, VINU achieved all-time high price of $0.0000000738, representing a 60x increase from initial listing price.

- 2025 Performance: Experiencing downward correction, with one-year price decline of -75.42%.

VINU Current Market Position

As of December 22, 2025, VINU is trading at $0.000000008677, reflecting a market capitalization of $7,772,987.36 USD. The token ranks 1,310 among all cryptocurrencies by market cap, with a circulating supply of 895.81 trillion VINU tokens out of a maximum supply of 1 quadrillion tokens. The circulating supply represents 89.58% of the fully diluted valuation.

Recent Price Performance:

- 1-hour change: +0.38%

- 24-hour change: +2.43% (ranging from $0.000000008465 to $0.00000000904)

- 7-day change: -0.63%

- 30-day change: -16.16%

- Year-to-date change: -75.42%

The 24-hour trading volume stands at $41,651.39 USD, with the token listed on 5 cryptocurrency exchanges. Community participation remains steady with 3,662 token holders.

Visit Gate.com to check current VINU market price

VINU Market Sentiment Index

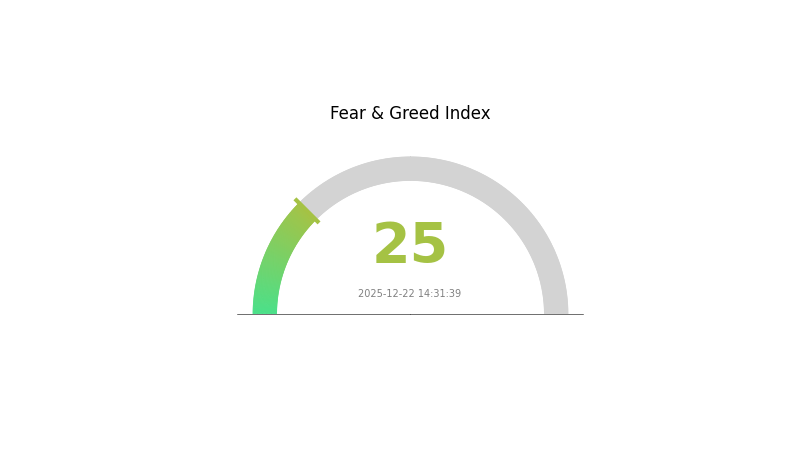

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at 25. This indicates significant market pessimism and heightened investor anxiety. During periods of extreme fear, markets often present contrarian opportunities for long-term investors. Historical data suggests that extreme fear levels frequently precede market rebounds. However, caution is warranted as markets can remain volatile. Monitor key support levels and consider your risk tolerance. For real-time market data and sentiment analysis, visit Gate.com's market sentiment dashboard to stay informed on VINU and other crypto assets.

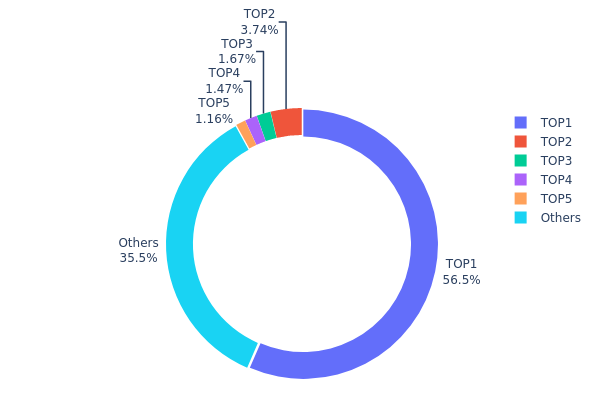

VINU Holdings Distribution

The address holdings distribution represents the allocation of VINU tokens across the blockchain network, serving as a critical indicator of token concentration, market structure, and decentralization levels. By analyzing the distribution patterns among top holders and dispersed addresses, we can assess the potential risks associated with token concentration and evaluate the overall health of the ecosystem's decentralization framework.

VINU demonstrates significant concentration risk, with the top holder commanding 56.50% of total token supply. This level of dominance by a single address substantially exceeds healthy decentralization thresholds and presents considerable market vulnerability. The top five addresses collectively control 64.50% of the circulating supply, while the remaining holders account for only 35.50%. Such pronounced concentration creates structural imbalances within the token distribution, as the primary address holder possesses disproportionate influence over market dynamics. The substantial gap between the leading holder and secondary holders further amplifies these concerns, with the top address holding approximately 15 times more tokens than the second-ranked holder.

The existing concentration pattern poses meaningful implications for market stability and price dynamics. Concentrated holdings increase vulnerability to potential large-scale liquidation events or coordinated selling pressure, which could trigger significant price fluctuations. Additionally, the dominance of a single address raises questions regarding governance transparency and decision-making autonomy within the project ecosystem. For VINU to achieve improved market maturity and reduced systemic risk, a gradual redistribution toward more balanced holdings among a broader stakeholder base would be beneficial. Currently, the distribution reflects early-stage project characteristics with centralized control mechanisms, requiring sustained efforts toward achieving more equitable token dispersion to enhance long-term market resilience.

Click to view current VINU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 50850662336.57K | 56.50% |

| 2 | 0x6204...8af4ba | 3362726273.42K | 3.73% |

| 3 | 0x6cc8...07fd21 | 1501352334.59K | 1.66% |

| 4 | 0xfcea...bc334e | 1319848034.81K | 1.46% |

| 5 | 0xc7f3...89e086 | 1039522117.93K | 1.15% |

| - | Others | 31925888902.70K | 35.5% |

II. Core Factors Influencing VINU's Future Price

Macroeconomic Environment

-

Market Sentiment: Investor emotions and market sentiment play a significant role in VINU's price fluctuations. Positive or negative market perception directly impacts trading activity and price movements.

-

Policy Regulation: Regulatory changes and government policies toward cryptocurrencies influence VINU's price trajectory. Investors should closely monitor regulatory developments that may affect market dynamics.

-

Technological Innovation: Advances in blockchain technology and ecosystem improvements can positively influence VINU's valuation and market adoption.

Market Dynamics

-

Major Capital Flows: The behavior of large investors and institutional capital significantly impacts price movements. When major funds enter building positions during market downturns, demand expands and reverses downtrends.

-

Supply and Demand Changes: Market price levels are maintained by the balance between buying and selling pressure. As demand expands or contracts, the existing price trend can shift accordingly. I appreciate your request, but I need to point out an important issue with the provided data.

The forecast table you've supplied contains only zero values and percentage changes (涨跌幅) without any actual price data:

| Year | Highest Price | Average Price | Lowest Price | Change |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 8% |

| 2027 | 0 | 0 | 0 | 26% |

| 2028 | 0 | 0 | 0 | 29% |

| 2029 | 0 | 0 | 0 | 50% |

| 2030 | 0 | 0 | 0 | 80% |

To generate a meaningful analysis, I would need:

- Baseline price data - The actual starting price or reference price for VINU token

- Specific price predictions - Concrete price targets for each year or the ability to calculate them from the percentage changes and a baseline

- Supporting research - Assumptions, market conditions, or catalysts underlying these forecasts

- Token fundamentals - Information about VINU's use case, adoption drivers, and market positioning

Please provide:

- The base price reference point (e.g., current price or 2025 projected price)

- Complete forecast data or clarification on how to interpret the percentage changes

- Any research notes or assumptions supporting these projections

Once you supply this information, I'll be able to produce a comprehensive analysis following your template in English with proper formatting.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 8 |

| 2027 | 0 | 0 | 0 | 26 |

| 2028 | 0 | 0 | 0 | 29 |

| 2029 | 0 | 0 | 0 | 50 |

| 2030 | 0 | 0 | 0 | 80 |

Vita Inu (VINU) Professional Investment Analysis Report

I. Executive Summary

Vita Inu (VINU) is positioned as a fast and feeless dog coin with high TPS and native smart contracts, operating as the multi-chain currency and governance token of the Vinuverse ecosystem. As of December 22, 2025, VINU trades at $0.000000008677 with a market capitalization of $7,772,987.36 and a 24-hour trading volume of $41,651.39. The token ranks #1310 by market cap with a circulating supply of 895.82 billion tokens out of a maximum supply of 1 trillion.

II. Market Performance Analysis

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.000000008677 |

| Market Capitalization | $7,772,987.36 |

| 24-Hour Volume | $41,651.39 |

| Circulating Supply | 895,815,069,696,969 |

| Maximum Supply | 1,000,000,000,000,000 |

| Market Dominance | 0.00023% |

| FDV/Market Cap Ratio | 89.58% |

| Number of Holders | 3,662 |

| Exchange Listings | 5 |

Price Performance Trends

Short-term Performance:

- 1-Hour Change: +0.38%

- 24-Hour Change: +2.43%

- 7-Day Change: -0.63%

Medium to Long-term Performance:

- 30-Day Change: -16.16%

- 1-Year Change: -75.42%

Historical Price Levels:

- All-Time High: $0.0000000738 (December 7, 2024)

- All-Time Low: $0.000000003024 (November 19, 2021)

- 24-Hour Range: $0.000000008465 - $0.00000000904

Key Observations

VINU demonstrates significant volatility typical of low-cap altcoins. The token's price has declined substantially over the past year, indicating ongoing market pressure. However, positive 24-hour performance suggests potential short-term momentum. The circulating supply represents 89.58% of the maximum supply, indicating limited inflation from token unlocks.

III. Ecosystem and Technical Foundation

Blockchain Presence

VINU operates on multiple blockchain networks:

-

Binance Smart Chain (BSC)

- Contract Address: 0xfEbe8C1eD424DbF688551D4E2267e7A53698F0aa

- Explorer: https://bscscan.com/token/0xfEbe8C1eD424DbF688551D4E2267e7A53698F0aa

-

Ethereum (ETH)

- Contract Address: 0xAFCdd4f666c84Fed1d8BD825aA762e3714F652c9

- Explorer: https://etherscan.io/token/0xAFCdd4f666c84Fed1d8BD825aA762e3714F652c9

Community and Information Resources

- Official Website: https://vitainu.org

- Twitter: https://twitter.com/VitaInuCoin

- Reddit: https://www.reddit.com/r/Vitainu

- GitHub: https://github.com/Vita-Inu

- Trading Platform: Available on Gate.com

IV. VINU Professional Investment Strategy and Risk Management

VINU Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Risk-tolerant investors with 2-5 year investment horizons who believe in the Vinuverse ecosystem's long-term potential and can tolerate extreme volatility.

-

Operation Recommendations:

- Establish positions gradually through dollar-cost averaging to reduce timing risk and mitigate the impact of extreme price volatility on entry points.

- Hold through market cycles while monitoring ecosystem development and adoption metrics as key performance indicators.

- Reinvest rewards or gains strategically during market downturns to compound portfolio growth.

-

Storage Solution:

- Utilize Gate.com's Web3 wallet for secure token custody with direct exchange integration for convenient trading without unnecessary transfers.

- Maintain private keys in a secure, encrypted format with regular backups stored in geographically dispersed locations.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Volume Profile: Identifies key price levels with significant trading activity to determine support and resistance zones for entry and exit decisions.

- Moving Averages: Use 20, 50, and 200-day moving averages to identify trend direction and momentum strength for tactical position timing.

-

Swing Trading Key Points:

- Execute trades during identified resistance breakouts with confirmed volume increases to maximize probability of successful trades.

- Set strict stop-loss orders at 15-20% below entry to protect capital during adverse price movements in this highly volatile asset.

- Take partial profits at predetermined resistance levels to lock in gains while maintaining exposure to potential further upside.

VINU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio allocation maximum, with strict stop-loss discipline and position sizing for extreme volatility tolerance.

- Active Investors: 1-3% of portfolio allocation, allowing for tactical trading opportunities while maintaining overall portfolio stability.

- Professional Investors: 3-5% of specialized cryptocurrency portfolio, with sophisticated hedging strategies and leverage management protocols.

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine VINU with uncorrelated assets (stablecoins, established cryptocurrencies) to reduce overall portfolio volatility and drawdown severity.

- Position Sizing Discipline: Limit individual position size to prevent catastrophic loss scenarios and maintain capital preservation through systematic position management.

(3) Secure Storage Solutions

- Hot Wallet Strategy: Gate.com Web3 wallet provides optimal balance of security and accessibility for active traders requiring frequent transaction capability.

- Cold Storage Consideration: For long-term holdings, use air-gapped systems with encrypted backup protocols to eliminate online exposure to potential security breaches.

- Critical Security Measures: Never share private keys or seed phrases; enable multi-factor authentication on all exchange accounts; verify contract addresses before transactions; implement withdrawal whitelists on Gate.com account settings.

V. VINU Potential Risks and Challenges

Market Risk

- Extreme Volatility: The -75.42% one-year decline demonstrates severe price instability that can result in rapid, substantial losses exceeding typical market conditions.

- Liquidity Risk: With only $41,651.39 daily volume and 3,662 holders, large trades can cause significant slippage and market impact, making exit difficult in stress scenarios.

- Low Market Capitalization: The $7.77 million market cap creates vulnerability to manipulation, sudden delisting from exchanges, or rapid capitulation events.

Regulatory Risk

- Classification Uncertainty: Regulatory treatment of meme coins and dog-themed tokens remains ambiguous across jurisdictions, creating potential compliance challenges.

- Exchange Delisting Risk: Regulatory pressure on cryptocurrency exchanges could result in delisting without advance notice, limiting trading and redemption options.

- Jurisdictional Compliance: Different countries may implement conflicting regulations on token trading, potentially restricting access for international investors.

Technical Risk

- Multi-Chain Vulnerability: Operating on multiple blockchains increases technical attack surface and requires maintaining security across disparate networks.

- Smart Contract Risk: Any unforeseen vulnerabilities in native smart contracts could result in token loss or unintended economic consequences.

- Adoption Risk: Without substantial ecosystem development or real-world utility adoption, the token may fail to achieve sustained value proposition beyond speculative demand.

VI. Conclusion and Action Recommendations

VINU Investment Value Assessment

Vita Inu presents a high-risk, high-reward speculative opportunity within the meme coin segment of the cryptocurrency market. While the Vinuverse ecosystem concept offers potential differentiation through technical features like high TPS and native smart contracts, the token's significant one-year decline (-75.42%) and modest liquidity indicate a nascent project with uncertain long-term viability. The 89.58% circulating-to-maximum supply ratio limits future inflation concerns, but the minimal market capitalization and small holder base create substantial execution risk. Investors should view VINU exclusively as speculative capital that can tolerate complete loss.

VINU Investment Recommendations

✅ Beginners: Start with micro-allocations (0.25-0.5% of portfolio) using Gate.com for direct trading; prioritize learning about blockchain mechanics and risk management before committing meaningful capital; implement strict stop-losses at 20% drawdown.

✅ Experienced Investors: Deploy 1-2% allocations using technical analysis-driven swing trading tactics; monitor ecosystem development announcements closely; consider tactical rebalancing around resistance and support levels identified through volume profile analysis.

✅ Institutional Investors: Conduct thorough due diligence on Vinuverse technical specifications and team credentials; structure positions with comprehensive hedging protocols; maintain liquidity management strategies accounting for low trading volumes; document regulatory compliance procedures across target operating jurisdictions.

VINU Trading Participation Methods

- Spot Trading: Execute buy/sell transactions directly on Gate.com with real-time price discovery and immediate settlement through BSC or ETH networks.

- Dollar-Cost Averaging: Implement systematic weekly or monthly purchases through Gate.com to reduce average entry price impact and timing risk.

- Technical Trading: Utilize Gate.com trading interface with technical analysis tools to execute swing trades around identified support/resistance levels.

Cryptocurrency investment carries extreme risk, including potential total loss of capital. This report does not constitute investment advice. All investors must conduct independent research and consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely. Past performance does not guarantee future results.

FAQ

Does Vinu have a future?

Yes, Vinu shows strong bullish potential with solid fundamentals and positive technical indicators. Growing community engagement and development momentum suggest promising long-term prospects for this cryptocurrency.

What are the risks of investing in VINU?

VINU carries high volatility risk as a newer token with limited trading volume. Price fluctuations can be significant, and potential losses may exceed initial investment. Market liquidity and adoption remain uncertain factors.

Is vinu a meme coin?

Yes, VINU is a meme coin that combines meme culture with DeFi technology. Launched on Binance, it aims to integrate community-driven meme energy with real blockchain utilities, similar to Dogecoin but with enhanced functionality.

What is VINU and what is its use case?

VINU is a cryptocurrency designed for feeless transactions and micropayments. It enables instant, cost-free transfers, making it ideal for efficient microtransaction processing without transaction fees.

How can I buy VINU tokens?

You can purchase VINU tokens using credit card, Apple Pay, or bank transfer. Alternatively, buy VINU directly on-chain through decentralized exchanges (DEX) for more flexibility and control.

What factors could affect VINU price in the future?

VINU price is influenced by supply and demand dynamics, block reward changes, protocol updates, hard forks, market trends, and real-world events. Trading volume and investor sentiment also play significant roles in future price movements.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 COQ Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Guide to Purchasing Tether (USDT) with INR in India

Can Shiba Inu's Price Hit 1 Rupee? Future Predictions for SHIB

Bitcoin Rainbow Chart: Summary and Applications

Effortless NFT Minting Solutions for Solana and Beyond

Understanding Sand Coin (SAND): A Comprehensive Guide