2025 VOXEL Price Prediction: Expert Analysis and Market Forecast for the Next 12 Months

Introduction: Market Position and Investment Value of VOXEL

Voxies (VOXEL) stands as the native utility token of a blockchain-based 3D tactical RPG game, representing a unique convergence of gaming and decentralized finance. Since its inception in December 2021, VOXEL has established itself as a functional asset within an innovative gaming ecosystem. As of December 2025, VOXEL maintains a market capitalization of approximately $2.91 million, with a circulating supply of 243.26 million tokens and a price point around $0.01195. This asset, designed to serve as an in-game currency and governance mechanism, is playing an increasingly significant role in the play-to-earn gaming sector.

This article will provide a comprehensive analysis of VOXEL's price trajectory and market dynamics through 2025 and beyond, integrating historical price patterns, market supply and demand factors, ecosystem development, and broader macroeconomic conditions. By examining these multifaceted elements, we aim to deliver professional price forecasts and actionable investment strategies for both experienced and prospective investors seeking exposure to blockchain gaming assets.

I. VOXEL Price History Review and Current Market Status

VOXEL Historical Price Evolution Trajectory

- December 2021: VOXEL reached its all-time high (ATH) of $4.70 on December 16, 2021, following the initial launch period of the Voxies ecosystem.

- 2022-2024: Extended bear market period saw significant price depreciation as the broader crypto market faced headwinds and gaming token valuations contracted substantially.

- December 2025: VOXEL touched its all-time low (ATL) of $0.01118857 on December 24, 2025, representing a decline of approximately 93.42% from ATH.

VOXEL Current Market Status

As of December 25, 2025, VOXEL is trading at $0.01195, reflecting a modest positive momentum with a 24-hour price increase of 5.64%. The token has experienced mixed short-term performance, with a 1-hour gain of 1.53%, while longer-term metrics show continued pressure: a 7-day decline of 18.57% and a 30-day drop of 60.31%.

The market capitalization stands at approximately $2.91 million with a fully diluted valuation of $3.59 million, indicating a market cap to FDV ratio of 81.09%. The circulating supply comprises 243.26 million VOXEL tokens out of a total supply of 300 million, representing a circulation ratio of 81.09%. Daily trading volume is recorded at $101,610.56, with the token being tradable on 9 exchanges. The 24-hour price range fluctuated between $0.01111 and $0.01219.

With 106,371 token holders and a market dominance of just 0.00011%, VOXEL maintains a relatively niche market position within the broader cryptocurrency ecosystem. Current market sentiment, as indicated by the VIX reading, reflects "Extreme Fear" conditions in the broader market.

Click to view current VOXEL market price

Market Sentiment Index

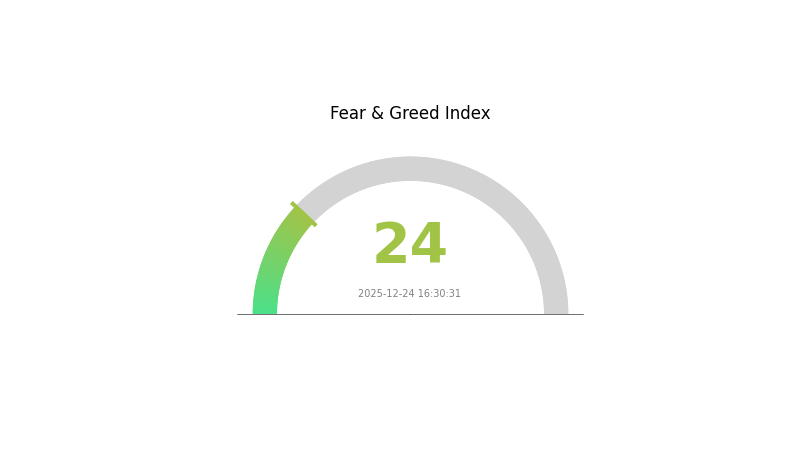

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index at 24. This represents a significant downturn in market sentiment, indicating that investors are highly pessimistic about near-term price movements. During such periods of extreme fear, opportunities may emerge for contrarian investors to accumulate assets at lower valuations. However, caution is advised as market volatility typically remains elevated. Monitor key support levels closely and consider your risk tolerance before making investment decisions. Stay informed through Gate.com's real-time market data and analysis tools to navigate this uncertain period effectively.

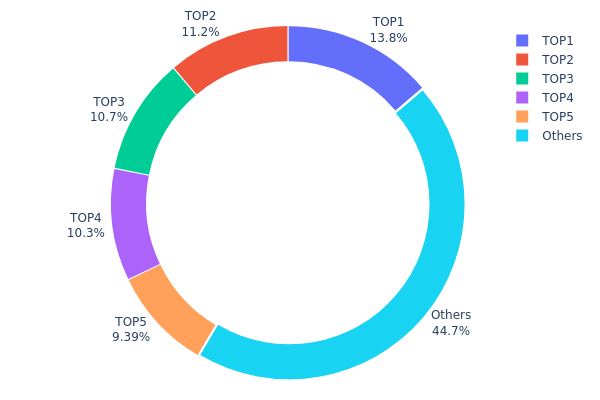

VOXEL Holdings Distribution

The address holdings distribution chart illustrates the concentration of VOXEL tokens across the network's major wallet addresses. By analyzing the top holders and their respective percentages, we can assess the degree of token centralization and evaluate potential risks associated with wealth concentration in the ecosystem.

Current data reveals a moderate concentration pattern within VOXEL's holder base. The top five addresses collectively control approximately 55.25% of the circulating supply, with the largest holder commanding 13.76% of total tokens. While this concentration level is not uncommon in emerging blockchain projects, it does warrant attention. The distribution shows a relatively steep decline in holdings from rank one through five, followed by a more distributed tail represented by the "Others" category, which accounts for 44.75% of tokens held across numerous smaller addresses. This structure suggests that governance and market direction could be influenced by a relatively small number of stakeholders, though the substantial "Others" segment indicates a meaningful degree of decentralization has already been achieved.

The current address distribution reflects a market structure with moderate centralization risks. The top five holders maintain sufficient influence to potentially impact price volatility through coordinated movements, yet the existence of a substantial retail holder base mitigates extreme concentration concerns. This balance presents a typical profile for mid-stage cryptocurrency projects transitioning from early investor dominance toward broader community participation. The on-chain structure demonstrates emerging decentralization while retaining structural stability, suggesting VOXEL maintains reasonable governance resilience without being overly fragmented.

Click to view current VOXEL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4acb...575257 | 41284.00K | 13.76% |

| 2 | 0xe780...b6e245 | 33579.71K | 11.19% |

| 3 | 0xbd27...af0abf | 32021.96K | 10.67% |

| 4 | 0x17c7...d7d0fb | 30773.02K | 10.25% |

| 5 | 0x4d83...10acb9 | 28157.58K | 9.38% |

| - | Others | 134183.72K | 44.75% |

II. Core Factors Affecting VOXEL's Future Price

Supply Mechanism

-

Supply and Demand Dynamics: VOXEL's price movement is primarily driven by supply and demand forces in the market. Token availability and market demand fluctuations directly impact price volatility.

-

Historical Patterns: Supply variations have historically influenced VOXEL's price trajectory, with market sentiment playing a significant role in determining price direction during periods of supply changes.

-

Current Impact: Current supply dynamics are expected to continue exerting pressure on price movements as market participants adjust their positions in response to evolving token availability.

Technical Development and Ecosystem Building

-

Game Development and Updates: Regular software updates and game feature enhancements are critical to VOXEL's ecosystem. Voxies operates as a play-to-earn gaming platform, where continuous development directly impacts player engagement and adoption rates.

-

Player Adoption and User Base: Player participation is essential to Voxies' success due to its play-to-earn model. The expansion of the user base and sustained player engagement serve as key drivers for ecosystem growth and token utility.

Market Sentiment and External Factors

-

Regulatory Environment: Real-world events such as regulatory changes and government policy developments significantly impact VOXEL's price. Changes in cryptocurrency regulations across different jurisdictions can create substantial price volatility.

-

Market Sentiment and Macroeconomic Factors: VOXEL's price is subject to market sentiment fluctuations and broader macroeconomic conditions affecting the cryptocurrency market. Investor sentiment, market dynamics, and overall crypto market volatility directly influence price movements.

-

Security and Exchange-Related Events: Cryptocurrency exchange security incidents and hacking events can negatively affect VOXEL's price performance. Such events create market uncertainty and may trigger broader portfolio adjustments among investors.

Three, 2025-2030 VOXEL Price Forecast

2025 Outlook

- Conservative Forecast: $0.0103 - $0.01198

- Neutral Forecast: $0.01198

- Optimistic Forecast: $0.01653 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Recovery and consolidation phase with gradual institutional adoption and increasing project utility

- Price Range Forecast:

- 2026: $0.01269 - $0.02039

- 2027: $0.01299 - $0.02044

- Key Catalysts: Enhanced platform functionality, strategic partnerships, increased user engagement, and growing decentralized metaverse adoption

2028-2030 Long-term Outlook

- Base Case: $0.01114 - $0.02058 (2028) progressing to $0.02169 - $0.03489 (2030), assuming steady ecosystem expansion and moderate market growth

- Optimistic Scenario: $0.02742 (2029) with potential reach toward $0.03489 (2030), contingent on accelerated mainstream adoption and successful protocol upgrades

- Transformative Scenario: $0.03489+ (2030) under conditions of breakthrough technological innovations, massive user growth, and favorable macroeconomic environment

- December 25, 2025: VOXEL trading at stable levels with 0% YTD change, establishing foundation for future growth trajectory

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01653 | 0.01198 | 0.0103 | 0 |

| 2026 | 0.02039 | 0.01426 | 0.01269 | 19 |

| 2027 | 0.02044 | 0.01732 | 0.01299 | 44 |

| 2028 | 0.02058 | 0.01888 | 0.01114 | 57 |

| 2029 | 0.02742 | 0.01973 | 0.01677 | 65 |

| 2030 | 0.03489 | 0.02358 | 0.02169 | 97 |

Voxies (VOXEL) Investment Analysis Report

IV. VOXEL Professional Investment Strategy and Risk Management

VOXEL Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Game economy enthusiasts, blockchain gaming believers, and community-driven project supporters

- Operation Recommendations:

- Accumulate VOXEL during market weakness, particularly when price declines significantly from all-time highs

- Participate actively in game ecosystem activities (PvP matches, in-game marketplace transactions) to generate organic yield

- Hold Voxie NFTs as complementary assets to benefit from character generation mechanics and in-game utility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor support and resistance levels around the 24-hour high ($0.01219) and low ($0.01111) range

- Volume Indicators: Track the 24-hour trading volume of $101,610.56 to identify accumulation or distribution patterns

- Wave Trading Key Points:

- Consider entry opportunities when price tests the 52-week low ($0.01118857) with strong volume confirmation

- Set profit targets at previous resistance levels, considering the token's extreme volatility (-93.42% over one year)

VOXEL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of portfolio

- Active Investors: 2-5% of portfolio

- Professional Investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Diversification Strategy: Balance VOXEL holdings with stablecoin reserves to manage extreme price volatility

- Position Sizing: Implement strict stop-loss orders at predetermined levels to limit downside exposure

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and in-game transactions

- Cold Storage Strategy: For long-term holdings, consider offline storage methods to eliminate exchange counterparty risk

- Security Considerations: Enable two-factor authentication on all exchange accounts, never share private keys, and regularly verify contract addresses before transactions

V. VOXEL Potential Risks and Challenges

VOXEL Market Risk

- Extreme Volatility: VOXEL has experienced a 93.42% decline over one year and an 18.57% drop over seven days, indicating severe price instability

- Low Liquidity: With 24-hour trading volume of only $101,610.56 against a market cap of $2.91 million, the token exhibits thin order books vulnerable to slippage

- Market Position: Ranked #1,890 by market capitalization with minimal market dominance (0.00011%), reflecting limited adoption and investor confidence

VOXEL Regulatory Risk

- Gaming Regulatory Uncertainty: Different jurisdictions maintain varying regulations toward blockchain-based gaming and NFT-backed play-to-earn mechanics

- NFT Classification: Regulatory status of in-game NFTs remains unclear in several major markets, potentially affecting asset ownership and trading rights

- Compliance Evolution: Future regulatory frameworks could restrict token utility or impose restrictions on in-game transactions

VOXEL Technical Risk

- Smart Contract Vulnerability: The Polygon-based token infrastructure requires continuous security auditing to prevent exploitation

- Blockchain Dependency: The game's functionality depends on Polygon network stability and transaction costs, which could impact gameplay economics

- Update Implementation: Game balance changes or protocol modifications could unexpectedly affect token value and utility

VI. Conclusions and Action Recommendations

VOXEL Investment Value Assessment

VOXEL represents a speculative investment opportunity within the blockchain gaming sector. The project offers genuine gaming mechanics combining exploration and tactical combat with play-to-earn economics. However, the token's 93.42% one-year decline, minimal market liquidity, and low trading volume indicate significant market skepticism. The fully diluted valuation of $3.585 million reflects limited capital allocation, and the circulating supply represents 81.09% of total supply, suggesting moderate inflation pressure. Potential upside depends heavily on successful game adoption and ecosystem development, while downside risks remain substantial given current market conditions.

VOXEL Investment Recommendations

✅ Beginners: Start with minimal exposure (0.5-1% portfolio allocation) through Gate.com spot trading, participating initially in free-to-play game mechanics before committing capital. Prioritize learning the Voxies ecosystem and understanding game economics before substantial investment.

✅ Experienced Investors: Consider tactical accumulation during extreme weakness with predetermined entry points, maintain stop-loss discipline at 15-20% below entry, and allocate profits back into core gaming utility through in-game activities and marketplace participation.

✅ Institutional Investors: Conduct comprehensive due diligence on development roadmap and team execution, evaluate competitive positioning against established gaming ecosystems, and structure positions to align with long-term blockchain gaming adoption trends rather than short-term price movements.

VOXEL Trading Participation Methods

- Spot Trading on Gate.com: Direct VOXEL purchase and sale for active traders and market participants

- In-Game Ecosystem Participation: Earn VOXEL rewards through PvP competitions, item upgrades, and marketplace activities

- NFT Character Holdings: Acquire Voxie NFTs to access exclusive game mechanics and character generation features

Cryptocurrency investments carry extreme risk. This analysis does not constitute investment advice. Investors must make decisions according to personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Why is the VOXEL coin falling?

VOXEL is experiencing a market correction following a 200% surge. After reaching its peak, the token has declined over 50%, currently trading at $0.06 due to normal profit-taking and market consolidation cycles.

What is the max supply of VOXEL coin?

The max supply of VOXEL coin is 300,000,000 tokens. Currently, the circulating supply stands at 254,486,480.74 VOXEL coins.

What is the price of VOXEL?

VOXEL is currently priced at $0.0115. The price has shown a 0.4% increase over the last 24 hours, reflecting steady market activity and growing investor interest in this digital asset.

What is VOXEL coin and what is its use case?

VOXEL is the utility token for Voxie Tactics RPG game, enabling in-game purchases, character upgrades, and rewards. Players earn VOXEL tokens through gameplay activities like exploration and battles, supporting a play-to-earn model with decentralized asset ownership.

What are the price predictions for VOXEL in 2025?

VOXEL is predicted to reach approximately $0.07862 in 2025, with potential highs around $0.085. This forecast is based on consistent growth trends in the GameFi sector.

What factors influence VOXEL price movements?

VOXEL price is influenced by market sentiment, trading volume, technological developments, and user adoption trends. These factors drive real-time price changes across the crypto market.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

What are MERL compliance and regulatory risks in 2026?

Top 4 Coins with the Best Mining Profitability

How does Merlin Chain (MERL) community drive ecosystem growth with 70% activity rate on Twitter, Telegram, and Reddit?

What is the COINX price volatility analysis: historical trends, support resistance levels, and correlation with BTC in 2026?

Top Platforms for Learning and Earning in Cryptocurrency