2025 VVSPrice Prediction: Market Analysis and Future Outlook for Crypto Investors

Introduction: VVS's Market Position and Investment Value

VVS Finance (VVS), as the first and largest decentralized exchange using automatic market makers (AMM) on the Cronos blockchain, has made significant strides since its inception. As of 2025, VVS Finance has a market capitalization of $194,515,891, with a circulating supply of approximately 46,668,879,859,403 tokens, and a price hovering around $0.000004168. This asset, often referred to as the "Simplest DeFi Platform," is playing an increasingly crucial role in decentralized finance and token swapping.

This article will provide a comprehensive analysis of VVS Finance's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. VVS Price History Review and Current Market Status

VVS Historical Price Evolution Trajectory

- 2021: VVS Finance launched, price reached all-time high of $0.00033093 on November 15

- 2025: Price hit all-time low of $0.00000168 on February 28

- 2025: Market recovery, price increased by 67.19% over the past year

VVS Current Market Situation

As of September 24, 2025, VVS is trading at $0.000004168. The token has experienced significant volatility over the past 24 hours, with a high of $0.000004492 and a low of $0.000004101. The 24-hour trading volume stands at $36,749.21.

VVS has shown mixed performance across different timeframes. While it has declined by 2.45% in the last hour and 11.68% over the past week, it has gained 19.67% in the last 30 days and 67.19% over the past year. This suggests a generally positive trend in the medium to long term, despite short-term fluctuations.

The token's market capitalization is currently $194,515,891, ranking it 302nd in the cryptocurrency market. VVS has a circulating supply of 46,668,879,859,403 tokens, representing 46.67% of its maximum supply of 100 trillion tokens.

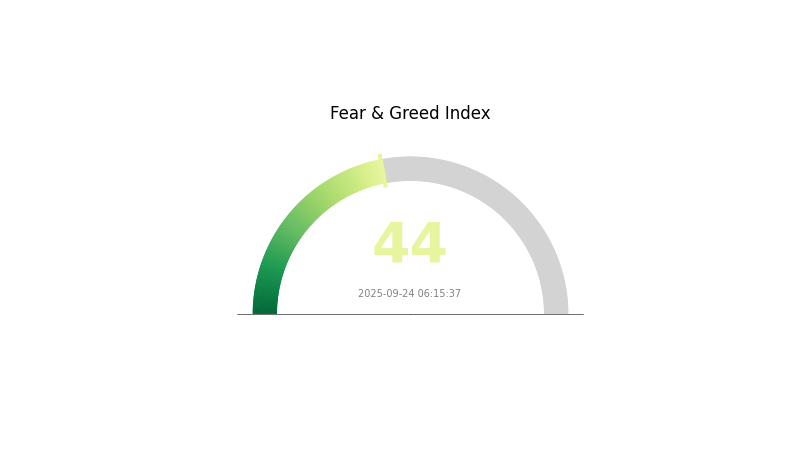

The overall cryptocurrency market sentiment is currently in the "Fear" zone, with a VIX index of 44. This cautious market environment may be influencing VVS's price movements.

Click to view the current VVS market price

VVS Market Sentiment Indicator

2025-09-24 Fear and Greed Index: 44 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 44, indicating a state of fear. This suggests investors are hesitant and risk-averse, potentially creating buying opportunities for contrarian traders. However, it's crucial to conduct thorough research and manage risks wisely. As market conditions can shift rapidly, staying informed and adapting strategies accordingly is key. Remember, extreme fear can be a sign of a potential market bottom, but always invest responsibly.

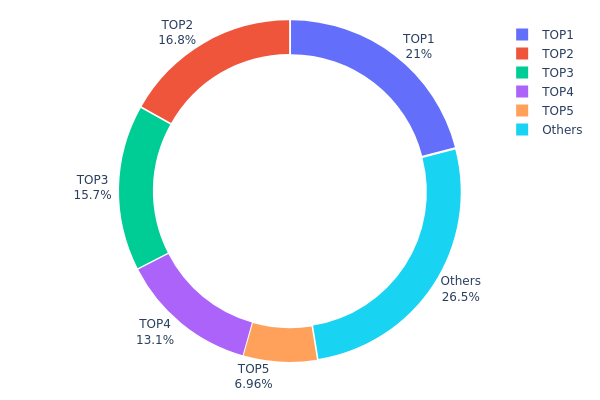

VVS Holdings Distribution

The address holdings distribution data for VVS reveals a highly concentrated ownership structure. The top 5 addresses collectively hold 73.5% of the total supply, with the largest address controlling 20.96% of all tokens. This level of concentration raises concerns about the project's decentralization and potential market manipulation risks.

Such a concentrated distribution could lead to increased price volatility and susceptibility to large-scale sell-offs. The top holders have significant influence over the token's market dynamics, potentially affecting liquidity and price stability. This situation may deter some investors due to perceived centralization risks and the potential for price manipulation by large holders.

However, it's worth noting that 26.5% of tokens are distributed among other addresses, indicating some level of wider distribution. This broader ownership base could provide a degree of resilience against extreme market movements initiated by top holders. Nonetheless, the current distribution structure suggests that VVS's on-chain stability and decentralization aspects require careful monitoring by market participants.

Click to view the current VVS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0253...25c1ea | 20397544490.08K | 20.96% |

| 2 | 0xbf62...50270b | 16387719575.22K | 16.84% |

| 3 | 0xdccd...9564bc | 15272006864.42K | 15.69% |

| 4 | 0x109d...3a38a2 | 12702500000.00K | 13.05% |

| 5 | 0x852f...fb4e49 | 6775466302.87K | 6.96% |

| - | Others | 25760872236.99K | 26.5% |

II. Key Factors Affecting Future VVS Prices

Supply Mechanism

- Cultivation Technology: Advancements in diamond cultivation technology are likely to increase supply and potentially drive prices down.

- Historical Pattern: As cultivation technology has improved, the price gap between natural and cultivated diamonds has narrowed.

- Current Impact: Continued technological progress is expected to further increase supply and put downward pressure on VVS diamond prices.

Macroeconomic Environment

- Inflation Hedging Properties: Diamonds have traditionally been seen as a store of value, but their performance as an inflation hedge may be affected by the increasing supply of cultivated diamonds.

- Geopolitical Factors: Global economic and political stability can influence luxury goods markets, including high-quality diamonds like VVS.

Technological Development and Ecosystem Building

- Quality Improvements: Ongoing advancements in cultivation techniques are enabling the production of higher quality VVS-grade diamonds.

- Market Acceptance: Growing consumer acceptance of cultivated diamonds as a legitimate alternative to natural diamonds is expanding the market.

III. VVS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.000009 - $0.00001

- Neutral prediction: $0.00001

- Optimistic prediction: $0.000011 - $0.000012 (requires significant market growth and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.000011 - $0.000013

- 2028: $0.000013 - $0.000015

- Key catalysts: Expanding DeFi ecosystem, improved tokenomics, and broader market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.000015 - $0.00002 (assuming steady market growth and project development)

- Optimistic scenario: $0.00002 - $0.000025 (with significant ecosystem expansion and partnerships)

- Transformative scenario: $0.000025 - $0.00003 (with groundbreaking technological advancements and mass adoption)

- 2030-12-31: VVS $0.00002 (potential peak based on bullish market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00001 | 0 | 0 | 2 |

| 2026 | 0.00001 | 0.00001 | 0 | 25 |

| 2027 | 0.00001 | 0.00001 | 0 | 27 |

| 2028 | 0.00001 | 0.00001 | 0 | 56 |

| 2029 | 0.00001 | 0.00001 | 0 | 72 |

| 2030 | 0.00001 | 0.00001 | 0 | 101 |

IV. VVS Professional Investment Strategies and Risk Management

VVS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Dollar-cost average into VVS tokens over time

- Hold tokens in a secure wallet for potential long-term value appreciation

- Consider staking VVS tokens on the VVS Finance platform for additional yields

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Helps gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor trading volume for confirmation of price movements

- Set strict stop-loss orders to manage downside risk

VVS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio, depending on risk tolerance

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and asset classes

- Stop-loss orders: Implement to limit potential losses on VVS positions

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Use hardware wallets for long-term storage of large holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be cautious of phishing attempts

V. Potential Risks and Challenges for VVS

VVS Market Risks

- High volatility: VVS price can experience significant fluctuations

- Liquidity risk: Potential difficulty in executing large trades without impacting price

- Competition: Other DeFi protocols may capture market share

VVS Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of DeFi platforms

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Possible limitations on VVS availability in certain jurisdictions

VVS Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Challenges in handling increased transaction volume

- Blockchain dependency: Reliance on the Cronos blockchain's performance and security

VI. Conclusion and Action Recommendations

VVS Investment Value Assessment

VVS Finance offers potential long-term value as a leading DeFi platform on Cronos, but carries significant short-term risks due to market volatility and regulatory uncertainties.

VVS Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the DeFi ecosystem ✅ Experienced investors: Consider allocating a portion of DeFi portfolio to VVS, actively manage positions ✅ Institutional investors: Evaluate VVS as part of a diversified DeFi strategy, conduct thorough due diligence

VVS Participation Methods

- Spot trading: Buy and sell VVS tokens on Gate.com

- Yield farming: Provide liquidity to VVS Finance pools for potential rewards

- Staking: Lock up VVS tokens on the platform to earn additional yields

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for VVS in 2040?

Based on current market analysis, VVS is predicted to reach a peak price of $0.0002189 in 2040.

Will vet reach $1?

It's unlikely VET will reach $1 by 2030. A 35x increase from current value is a long shot, but in crypto, anything can happen. VET hitting $0.50 is more probable given enterprise adoption and potential market growth.

Is VVS a good investment?

VVS shows promise as an investment, with projections indicating a value of $0.00000435 by 2028. Current prices are $0.00000435 per coin, suggesting potential for growth.

Which coin will be the next Bitcoin prediction in 2025?

Ethereum is predicted to be the next major cryptocurrency after Bitcoin in 2025, with strong technological and market support driving its growth and adoption.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential

Ethereum Co-Founder Vitalik on the Creator Token Dilemma: Why Non-Tokenized DAOs Are the Key