2025 WAI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of WAI

WORLD3 (WAI) is a decentralized platform empowering users to create and deploy AI agents that automate tasks across Web2 and Web3 environments. Since its launch in August 2025, WORLD3 has garnered recognition from industry leaders including Ubisoft, Animoca Brands, Sui Foundation, AWS, BNB Chain, and Microsoft for Startups. As of December 2025, WAI maintains a market capitalization of $4.94 million with a circulating supply of 135 million tokens, trading at approximately $0.03656 per token. This innovative asset, often recognized as a "pioneering AI agent infrastructure solution," is playing an increasingly critical role in enabling autonomous task execution and multi-chain interoperability.

This article will provide a comprehensive analysis of WORLD3's price trajectory through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to AI-driven blockchain infrastructure.

WAI (World3) Market Analysis Report

I. WAI Price History Review and Current Market Status

WAI Current Market Conditions

As of December 23, 2025, WAI is trading at $0.03656, reflecting recent market dynamics across multiple timeframes. The token has experienced modest short-term pullback, declining 0.25% over the past hour and 0.32% in the last 24 hours. However, the broader perspective reveals more positive momentum, with WAI up 13.70% over the past 30 days and demonstrating significant strength with a 40.23% year-to-date gain.

The token's recent price range shows a 24-hour high of $0.0377 and a low of $0.03604, indicating moderate volatility within the current trading session. Against its historical benchmarks, WAI reached an all-time high of $0.07198 on August 19, 2025, while establishing a low of $0.02 on August 12, 2025, representing a significant price discovery phase during the token's early trading history.

Market Capitalization and Supply Metrics:

- Current Market Cap: $4,935,600

- Fully Diluted Valuation: $36,560,000

- Circulating Supply: 135,000,000 WAI (13.5% of total supply)

- Total Supply: 1,000,000,000 WAI

- Market Dominance: 0.0011%

- Current Holders: 36,623 addresses

- Trading Volume (24h): $15,322.70

WAI maintains a relatively small market position with a rank of 1,537 among all cryptocurrencies. The token's circulating supply represents only 13.5% of its maximum supply, indicating significant future dilution potential as additional tokens enter circulation.

Click to view current WAI market price

WAI Market Sentiment Index

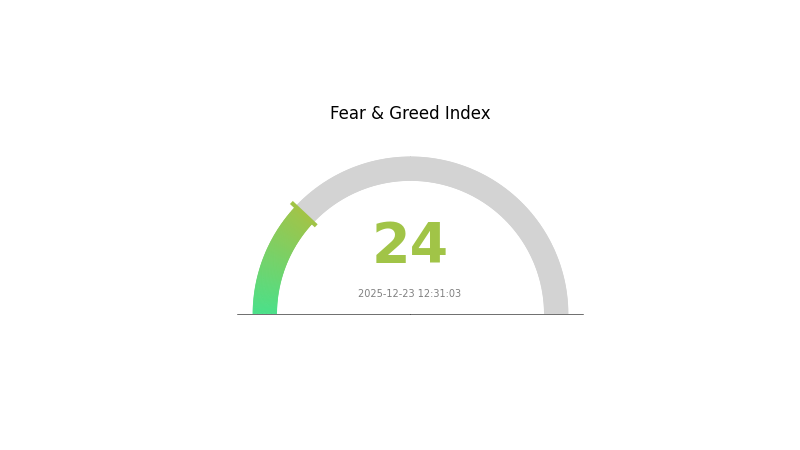

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear sentiment, with the index reading at 24. This indicates severe market pessimism and widespread investor anxiety. During such periods, market volatility typically increases as risk-averse investors reduce exposure. However, extreme fear often presents contrarian opportunities for long-term investors. Consider reviewing your investment strategy and risk tolerance. Monitor key support levels and maintain proper portfolio diversification. On Gate.com, you can track real-time market sentiment and adjust your trading decisions accordingly.

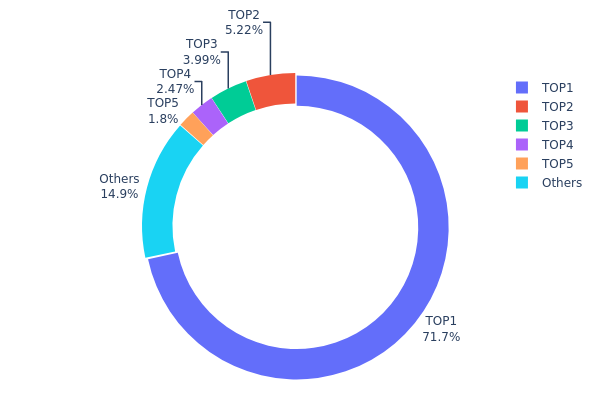

WAI Holdings Distribution

An address holdings distribution chart illustrates the concentration of token ownership across different wallet addresses on the blockchain. It provides critical insights into the decentralization level and potential market structure risks by showing what percentage of total token supply is held by top addresses versus smaller holders.

The current WAI token distribution exhibits pronounced concentration risk. The largest address controls 71.65% of the total supply, representing an extremely high degree of centralization that significantly exceeds healthy decentralization standards. The top five addresses collectively account for 89.12% of all tokens in circulation, leaving only 14.88% distributed among all other holders. This top-heavy distribution pattern indicates that decision-making power and price influence are concentrated in the hands of very few stakeholders. Such extreme concentration typically reflects early-stage projects where founders, early investors, or major backers maintain substantial holdings, creating potential vulnerability to sudden market movements driven by the actions of these major holders.

This concentrated ownership structure presents meaningful implications for market dynamics and stability. With over 71% of tokens held by a single address, the token faces elevated risk of price volatility triggered by large-scale transfers or liquidations. The limited distribution among retail holders suggests reduced organic market participation and liquidity diversification. Furthermore, the ability of major stakeholders to coordinate or execute significant transactions unilaterally raises concerns about potential market manipulation and the sustainability of fair price discovery. From a structural perspective, WAI's current holder distribution reflects a centralized governance model that diverges substantially from the decentralization ideals inherent in blockchain systems.

Click to view current WAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3c68...5a550d | 716577.78K | 71.65% |

| 2 | 0xeb2c...8dc6ea | 52207.69K | 5.22% |

| 3 | 0x84a7...af5e1c | 39920.00K | 3.99% |

| 4 | 0x8bf5...0eddbb | 24694.60K | 2.46% |

| 5 | 0xdf82...011d04 | 18000.00K | 1.80% |

| - | Others | 148599.94K | 14.88% |

II. Core Factors Influencing WAI's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global central banks' interest rate policies significantly affect cryptocurrency valuations. The strength or weakness of monetary cycles influences liquidity available for risk assets like cryptocurrencies. Looser monetary conditions typically support higher asset prices, while tightening cycles can create headwinds for speculative assets.

-

Inflation Hedge Properties: Cryptocurrencies are sometimes considered alternative stores of value in high-inflation environments. However, their effectiveness as inflation hedges remains debated, as crypto prices are more closely tied to risk sentiment and liquidity conditions than traditional inflation dynamics.

-

Geopolitical Factors: International tensions and geopolitical uncertainties can drive investors toward alternative assets. During periods of heightened geopolitical risk, some investors allocate capital to cryptocurrencies as part of portfolio diversification strategies.

Market Demand and Sentiment

-

Supply and Demand Dynamics: The core driver of cryptocurrency prices remains the fundamental balance between market demand and available supply. Increasing institutional adoption and retail interest can push prices higher, while negative sentiment can trigger sell-offs.

-

Regulatory Environment: Changes in regulatory frameworks across major jurisdictions directly impact market confidence and adoption rates. Clearer regulations generally support price appreciation, while restrictive policies can suppress demand.

-

Market Sentiment Indicators: Fear and greed indices, along with broader risk appetite in financial markets, significantly influence short-term price movements in the cryptocurrency space.

III. 2025-2030 WAI Price Forecast

2025 Outlook

- Conservative Forecast: $0.03254 - $0.03656

- Base Case Forecast: $0.03656

- Optimistic Forecast: $0.04278 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery and accumulation period, characterized by increasing institutional interest and ecosystem expansion.

- Price Range Forecast:

- 2026: $0.02340 - $0.05553

- 2027: $0.03808 - $0.05617

- Key Catalysts: Protocol upgrades, strategic partnerships, increased adoption, market sentiment recovery, and expansion of use cases within the ecosystem.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.03373 - $0.06434 (assumes steady ecosystem growth and moderate market expansion through 2028)

- Optimistic Scenario: $0.05146 - $0.07505 (assumes accelerated adoption, successful protocol implementations, and positive macroeconomic conditions)

- Bullish Scenario: $0.07505 - $0.08484 (extreme favorable conditions including significant institutional adoption, major exchange listings on platforms like Gate.com, breakthrough regulatory clarity, and substantial real-world utility expansion)

- 2030-12-31: WAI projected to reach $0.07148 on average (baseline expectation reflecting cumulative growth trajectory with approximately 95% appreciation from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04278 | 0.03656 | 0.03254 | 0 |

| 2026 | 0.05553 | 0.03967 | 0.0234 | 8 |

| 2027 | 0.05617 | 0.0476 | 0.03808 | 30 |

| 2028 | 0.06434 | 0.05189 | 0.03373 | 41 |

| 2029 | 0.08484 | 0.05811 | 0.03603 | 58 |

| 2030 | 0.07505 | 0.07148 | 0.05146 | 95 |

WORLD3 (WAI) Professional Investment Strategy and Risk Management Report

IV. WAI Investment Methodology and Risk Management

WAI Investment Approach

(1) Long-Term Holding Strategy

- Target Investors: Believers in AI agent technology infrastructure and Web3 automation adoption

- Operation Recommendations:

- Accumulate WAI tokens during market downturns to build a long-term position in the AI agent ecosystem

- Hold positions through market volatility cycles, as protocol development and enterprise adoption typically unfold over 2-3 year periods

- Set up automated dollar-cost averaging (DCA) purchases to reduce timing risk and average entry prices over time

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.0360 (24H low) and $0.0377 (24H high); trade breakouts above $0.0377 or accumulate near $0.0360

- Volume Analysis: Track the 24H trading volume of $15,322.70 as an indicator of market interest; increased volume above this level may signal momentum

- Wave Trading Key Points:

- Identify short-term trend reversals using the 7-day decline of -0.71% as a potential accumulation signal before recovery phases

- Execute profit-taking strategies when WAI approaches previous all-time high of $0.07198, established on August 19, 2025

WAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Active Investors: 3-7% of crypto portfolio allocation

- Professional Investors: 7-15% of crypto portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Diversification Approach: Balance WAI holdings with established Layer-1 blockchain tokens to reduce concentration risk in emerging AI agent protocols

- Dollar-Cost Averaging: Spread purchases over multiple months to mitigate the impact of price volatility and reduce the risk of poorly-timed entries

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and frequent transactions with multi-signature security features

- Cold Storage Approach: Transfer WAI tokens to non-custodial wallets for long-term holdings, utilizing BEP-20 standard security protocols on BSC

- Security Best Practices: Enable two-factor authentication on all exchange accounts, never share private keys or recovery phrases, and verify all smart contract addresses before token transfers

V. WAI Potential Risks and Challenges

WAI Market Risks

- Price Volatility: WAI has experienced significant price swings with an all-time high of $0.07198 and all-time low of $0.02, representing a 259.9% range; such extreme volatility can result in substantial losses for unprepared investors

- Liquidity Risk: With 24H trading volume of only $15,322.70 and a market cap of $4.93 million, WAI exhibits relatively low liquidity compared to established cryptocurrencies, potentially causing slippage during large trades

- Early-Stage Project Risk: As an emerging AI agent platform, WAI lacks the operational history and proven product-market fit of mature blockchain projects, increasing uncertainty regarding long-term viability

WAI Regulatory Risks

- Evolving Regulatory Landscape: Governments worldwide are developing AI and cryptocurrency frameworks; new regulations could restrict AI agent deployment or token trading, negatively impacting WAI value

- Compliance Uncertainty: Projects integrating AI with blockchain face dual regulatory scrutiny from both AI governance bodies and financial regulators, creating potential compliance challenges for WORLD3

- International Restrictions: Certain jurisdictions may prohibit trading or holding AI-focused tokens due to national security concerns, limiting market access and adoption

WAI Technology Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, WORLD3 faces risks from unaudited code, potential bugs, or security exploits in the agent VM technology

- Multi-Chain Complexity: The stated multi-chain interoperability capability introduces technical risk through cross-chain bridges and oracle dependencies that could be compromised

- Adoption Execution Risk: Successfully deploying AI agents across Web2 and Web3 environments remains technically challenging; failure to deliver on promised features could diminish token utility

VI. Conclusions and Action Recommendations

WAI Investment Value Assessment

WORLD3 (WAI) represents a speculative investment opportunity in the emerging AI agent infrastructure sector, backed by notable industry partners including Ubisoft, Animoca Brands, Sui Foundation, AWS, BNB Chain, and Microsoft for Startups. With current pricing at $0.03656 and a fully diluted valuation of $36.56 million, WAI operates at only 13.5% of its fully diluted market cap relative to circulating supply, indicating significant dilution ahead. The 40.23% one-year gain demonstrates market interest, though the -0.71% seven-day decline and early project stage warrant caution. Investment value depends critically on WORLD3's ability to deliver functioning AI agents, achieve enterprise adoption, and establish meaningful blockchain integration. The project remains in a high-risk, high-reward category suitable only for investors comfortable with potential total loss.

WAI Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of crypto portfolio) through Gate.com, using dollar-cost averaging over 6-12 months to reduce timing risk; prioritize education on AI agent technology before increasing exposure

✅ Experienced Investors: Allocate 3-7% to WAI as a satellite position; combine long-term holdings with active trading around identified support/resistance levels; implement stop-losses at 20% below entry to limit downside

✅ Institutional Investors: Conduct thorough technical due diligence on the agent VM architecture and multi-chain infrastructure; consider WAI as a 5-15% allocation within an emerging AI protocol fund, with governance participation through community engagement

WAI Trading Participation Methods

- Gate.com Spot Trading: Purchase WAI directly using USD, stablecoins, or other cryptocurrencies available on Gate.com's trading pairs

- DCA Investment Program: Set up recurring purchases through Gate.com to automatically buy WAI at fixed intervals, reducing market timing risk

- Liquidity Pool Participation: Provide liquidity on decentralized platforms (where available) to earn trading fees, accepting additional smart contract and impermanent loss risks

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is recommended to consult with a professional financial advisor before investing. Never invest more than you can afford to lose.

FAQ

Is Wai stock a good buy?

WAI presents mixed opportunities for investors. Current market analysis suggests moderate growth potential with consideration of market volatility. Performance depends on your investment timeline and risk tolerance.

What factors influence WAI token price predictions?

WAI token price predictions are influenced by market demand, trading volume, and overall market sentiment. Technological advancements, regulatory changes, and ecosystem developments also play significant roles in price movements.

What is the historical price trend of WAI and what are the price forecasts for 2024-2025?

WAI forecasts predict an average price of $0.03591 for 2025, with highs reaching $0.04093 and lows at $0.03195. Historical data shows moderate volatility in the Web3 sector.

How does WAI compare to other similar cryptocurrency projects in terms of future potential?

WAI specializes in decentralized AI and DeFi applications with strong growth potential in emerging tech trends. Compared to supply chain projects like VET, WAI offers greater exposure to AI market expansion and DeFi innovation, positioning it for significant future upside as these sectors mature.

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 COOKIE Price Prediction: Market Analysis and Future Outlook for Digital Cookie Economy

2025 SIREN Price Prediction: Future Outlook, Market Analysis, and Key Factors Driving This Emerging Crypto Asset

2025 AVAAIPrice Prediction: Analyzing Market Trends and Growth Potential for AVAAI in the Expanding AI Sector

2025 XNY Price Prediction: Analyzing Market Trends, Technical Indicators and Future Outlook for Cryptocurrency Investors

2025 ACTPrice Prediction: Analyzing Market Trends and Future Valuation of ACT Tokens in the Evolving Crypto Ecosystem

2025 NS Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 DATA Price Prediction: Expert Analysis and Future Market Outlook for Cryptocurrency Investors

2025 TET Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Understanding Crypto Cards: Functionality and Applications

2025 XDB Price Prediction: Expert Analysis and Market Outlook for the Year Ahead