2025 WAVES Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of WAVES

Waves (WAVES) is a customized blockchain token platform designed for large-scale business and consumption habits. Since its launch in 2016, it has established itself as an enterprise-ready platform emphasizing security, easy token operations (creation, transfer, and transaction), and straightforward user experience. As of December 2025, WAVES has a market capitalization of approximately $66.52 million with a circulating supply of 100 million tokens, currently trading at around $0.6652 per token. This platform, recognized for its focus on addressing key long-term challenges such as transaction speed and scalability, continues to play an increasingly important role in enabling traditional businesses and end users to benefit from blockchain technology.

This article will provide a comprehensive analysis of WAVES' price trends from 2025 to 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

WAVES Token Analysis Report

I. WAVES Price History Review and Current Market Status

WAVES Historical Price Trajectory

- 2016: Platform launched in August with initial price of $0.1883, marking the beginning of the Waves ecosystem.

- 2022: Reached all-time high (ATH) of $61.30 on March 31st, 2022, representing peak market valuations during the bull market cycle.

- 2025: Significant correction phase, trading at $0.6652 as of December 18th, reflecting a -63.94% decline over the past year from historical peaks.

WAVES Current Market Position

As of December 18, 2025, WAVES is trading at $0.6652 with a 24-hour trading volume of $717,764.67. The token has experienced a -5.7% decline in the past 24 hours, with intraday range between $0.6592 (low) and $0.7376 (high).

Market Capitalization Metrics:

- Total Market Cap: $66.52 million

- Circulating Supply: 100,000,000 WAVES

- Market Dominance: 0.0021%

- Exchange Listings: 19 exchanges

Price Performance Across Timeframes:

- 1-hour change: +0.11%

- 24-hour change: -5.7%

- 7-day change: -10.22%

- 30-day change: +4.46%

- 1-year change: -63.94%

The token has historically traded between an all-time low of $0.130878 (August 2, 2016) and the aforementioned peak of $61.30. Currently, WAVES maintains a market ranking of 427 among all cryptocurrencies, with 2,502 active token holders participating in the network.

Click to view current WAVES market price

WAVES Market Sentiment Indicator

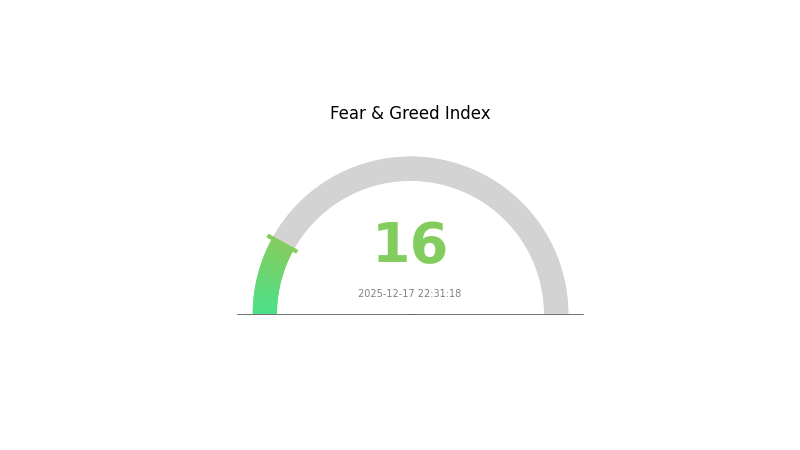

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The WAVES market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 16. This exceptionally low reading indicates severe negative sentiment among investors, suggesting significant market pessimism and risk aversion. Such extreme fear levels historically present contrarian trading opportunities for experienced investors, as markets often rebound when sentiment reaches these extreme lows. However, extreme caution is advised. Consider dollar-cost averaging strategies and maintaining a diversified portfolio on Gate.com to navigate this volatile period effectively.

WAVES Holdings Distribution

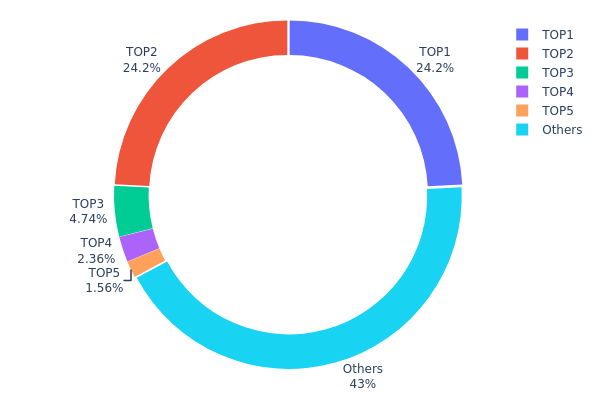

The holdings distribution map illustrates the concentration of WAVES tokens across blockchain addresses, providing critical insights into the asset's ownership structure and market dynamics. By analyzing the proportion of total supply held by top addresses versus dispersed holders, this metric reveals the degree of centralization and potential vulnerabilities in the token's distribution landscape.

The current WAVES distribution exhibits moderate concentration characteristics, with the top two addresses commanding approximately 48.35% of the total supply combined. Address 0x0d07...b492fe holds 214.04K tokens (24.18%), while address 0xc882...84f071 maintains nearly equivalent holdings at 213.90K tokens (24.17%), suggesting potential coordination or similar institutional positioning. The third-largest holder, 0xe736...d462c9, controls 41.99K tokens (4.74%), representing a significant drop-off from the top two positions. The remaining top five addresses collectively account for approximately 53% of concentrated holdings, while the dispersed "Others" category represents 43% of the token supply, distributed across numerous smaller addresses.

This distribution pattern presents both stabilizing and destabilizing implications for market structure. While the relatively significant portion held by retail and smaller addresses (43%) indicates a degree of decentralization, the heavy concentration among the top two holders creates material risks regarding sudden large-scale liquidations, coordinated market movements, or price volatility. The substantial wealth concentration in the top addresses may constrain market liquidity during periods of elevated trading activity and could potentially facilitate coordinated price manipulation or rapid shifts in market sentiment, particularly given the narrow differential between the two largest positions.

View current WAVES holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 214.04K | 24.18% |

| 2 | 0xc882...84f071 | 213.90K | 24.17% |

| 3 | 0xe736...d462c9 | 41.99K | 4.74% |

| 4 | 0xdc54...78d68d | 20.93K | 2.36% |

| 5 | 0x165c...a45e14 | 13.78K | 1.55% |

| - | Others | 380.31K | 43% |

Core Factors Influencing WAVES Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global central bank policy changes, such as interest rate adjustments, may affect the investment attractiveness of WAVES. The cautious and gradual rate-cutting pace of the Federal Reserve, constrained by factors including volatile economic growth momentum, elevated debt pressures, and upward-shifted inflation levels, influences global capital price dynamics in related assets. A looser monetary environment provides support for cryptocurrency prices.

-

Anti-Inflation Attributes: WAVES may be viewed as an inflation-hedging tool, similar to mainstream cryptocurrency assets. The strengthening of financial attributes in commodities and cryptocurrencies, driven by the "de-dollarization" trend triggered by declining US dollar credibility, positions assets with physical or historical credit attributes as important alternative and reserve assets.

-

Geopolitical Factors: International geopolitical situations and major risk events impact investor sentiment and market dynamics, influencing price movements through shifts in risk-off or risk-on trading behaviors.

Macroeconomic Market Dynamics

- Market Sentiment and Trends: Market trends, technological developments, and regulatory changes significantly influence WAVES price forecasts. Technical analysis provides valuable insights into potential future price movements by analyzing market behavior patterns and trading trends.

Three, 2025-2030 WAVES Price Forecast

2025 Outlook

- Conservative Prediction: $0.36 - $0.67

- Neutral Prediction: $0.67 - $0.95

- Optimistic Prediction: $0.95 (pending ecosystem expansion and institutional adoption)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental growth as blockchain infrastructure matures and developer ecosystem expands

- Price Range Predictions:

- 2026: $0.48 - $0.94 (21% upside potential)

- 2027: $0.61 - $0.93 (31% upside potential)

- Key Catalysts: Enhanced smart contract functionality, growing decentralized finance (DeFi) integration, increased enterprise adoption of the WAVES blockchain platform, and strategic partnerships

2028-2030 Long-term Outlook

- Base Case Scenario: $0.80 - $1.05 (assuming steady ecosystem development and moderate market expansion)

- Optimistic Scenario: $0.87 - $1.43 (assuming accelerated institutional investment and significant protocol upgrades)

- Transformational Scenario: $1.41 - $1.43 (assuming breakthrough innovations in scalability, mainstream Web3 adoption, and major enterprise integration)

- 2030-12-18: WAVES expected to trade within $0.85 - $1.41 range (reflecting 81% cumulative upside potential from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.946 | 0.6662 | 0.35975 | 0 |

| 2026 | 0.94314 | 0.8061 | 0.4756 | 21 |

| 2027 | 0.9271 | 0.87462 | 0.61223 | 31 |

| 2028 | 1.045 | 0.90086 | 0.80176 | 35 |

| 2029 | 1.4302 | 0.97293 | 0.87564 | 46 |

| 2030 | 1.40583 | 1.20157 | 0.85311 | 81 |

WAVES (Waves) Professional Investment Strategy and Risk Management Report

IV. WAVES Professional Investment Strategy and Risk Management

WAVES Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Risk-averse investors seeking exposure to enterprise-grade blockchain infrastructure with long-term growth potential

- Operational Recommendations:

- Accumulate WAVES during market downturns when price pulls back from resistance levels, leveraging the platform's enterprise-ready features and security focus

- Hold through market cycles to benefit from potential adoption by traditional businesses adopting blockchain solutions

- Reinvest any staking rewards or platform incentives to compound returns over extended periods

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range (currently $0.6592 - $0.7376) and historical price support zones to identify optimal entry and exit points

- Moving Averages: Use 7-day and 30-day moving averages to identify short-term trend direction; the 30-day performance of +4.46% suggests recent positive momentum

- Wave Trading Key Points:

- Identify consolidation patterns after significant declines (WAVES is down 5.7% in 24 hours and 10.22% over 7 days) as potential reversal opportunities

- Monitor trading volume trends on Gate.com to confirm breakout moves above resistance levels

WAVES Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% maximum allocation to WAVES as part of diversified cryptocurrency portfolio

- Active Investors: 3-8% allocation to WAVES balanced with more established cryptocurrencies

- Professional Investors: Up to 10-15% allocation with hedging strategies and derivatives risk management

(2) Risk Hedging Solutions

- Dollar-Cost Averaging: Spread WAVES purchases over multiple months or quarters to reduce timing risk and mitigate impact of price volatility

- Portfolio Diversification: Balance WAVES holdings with other blockchain infrastructure projects and traditional assets to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and active portfolio management with convenient access

- Cold Storage Approach: For long-term holdings exceeding 6-12 months, utilize hardware security or self-custody solutions to minimize exchange counterparty risk

- Security Precautions: Enable two-factor authentication on all exchange accounts, use strong unique passwords, never share private keys, and regularly verify addresses on official Waves Explorer (wavesexplorer.com) before confirming transactions

V. WAVES Potential Risks and Challenges

WAVES Market Risk

- Price Volatility: WAVES has experienced significant drawdowns, declining 63.94% year-over-year and losing 5.7% in the last 24 hours, indicating high volatility unsuitable for risk-averse investors

- Liquidity Constraints: With 24-hour trading volume of only $717,764.67 and market cap of $66.52 million (ranked 427), liquidity may be insufficient for large position entries or exits without significant price impact

- Market Adoption Risk: Limited marketplace adoption compared to established platforms may constrain long-term growth and token utility expansion

WAVES Regulatory Risk

- Changing Compliance Landscape: Enterprise blockchain platforms face evolving regulatory requirements across jurisdictions where they operate, potentially impacting token economics and platform functionality

- Securities Classification Uncertainty: Regulatory bodies may reclassify WAVES or related tokens, affecting trading availability and custody options across exchanges and jurisdictions

- Enterprise Client Regulation: Traditional businesses adopting Waves technology may face compliance challenges that delay adoption or reduce market demand

WAVES Technology Risk

- Competitive Pressure: Rapid development of alternative enterprise blockchain solutions and Layer-2 scaling technologies may challenge Waves' market positioning and technology relevance

- Network Security: Any security vulnerabilities in the Waves protocol or smart contract infrastructure could undermine investor confidence and reduce platform adoption

- Scalability Limitations: Inability to achieve performance improvements matching competing platforms may constrain enterprise adoption and token demand growth

VI. Conclusion and Action Recommendations

WAVES Investment Value Assessment

Waves presents a specialized investment opportunity focused on enterprise-grade blockchain infrastructure with emphasis on security, user experience, and transaction scalability. The platform's 2016 launch history and positioning toward traditional businesses differentiates it from consumer-focused alternatives. However, the significant year-over-year decline of 63.94%, current market cap of only $66.52 million, and modest trading volume indicate limited market traction and adoption. Investors should view WAVES as a high-risk, speculative holding requiring strong conviction in enterprise blockchain adoption thesis rather than as a core portfolio component.

WAVES Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1%) on Gate.com as part of learning experience in enterprise blockchain sector; use limit orders at key support levels and maintain strict position sizing discipline

✅ Experienced Investors: Consider 3-5% tactical allocation using technical analysis on Gate.com; implement disciplined stop-losses at 15-20% below entry points and take partial profits on 25-30% gains

✅ Institutional Investors: Evaluate WAVES within broader blockchain infrastructure thesis; conduct due diligence on enterprise client adoption, team execution, and competitive positioning before allocating up to 8-10% of alternative assets budget

WAVES Trading Participation Methods

- Spot Trading on Gate.com: Purchase and hold WAVES directly on Gate.com's spot trading platform with access to the enterprise blockchain ecosystem and real-time price discovery

- Limit Order Strategy: Set predetermined buy orders at support levels identified through technical analysis to accumulate during favorable risk-reward setups

- Portfolio Rebalancing: Periodically adjust WAVES allocation based on performance relative to other holdings and changing market conditions, using Gate.com's trading tools for efficient execution

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make careful decisions based on their personal risk tolerance and consult professional financial advisors. Never invest more capital than you can afford to lose completely. Past performance does not guarantee future results.

FAQ

Can waves reach $100?

Waves is unlikely to reach $100 in the near or mid-term. Current market analysis and prediction models do not support this price level being achieved in the foreseeable future.

Is Waves a good investment?

Waves demonstrates strong fundamentals with robust blockchain technology and growing ecosystem adoption. Its decentralized features and active development make it an attractive long-term investment for crypto enthusiasts seeking diversified portfolio exposure.

How much is Waves worth?

As of today, one Waves is worth approximately $0.65. You could buy about 1.53 Waves for $1.00.

How much will cryptocurrency be worth in 2025?

Cryptocurrency valuations in 2025 are projected to surge significantly, driven by increased institutional adoption, Bitcoin and ETF inflows, and crypto IPOs. Major cryptocurrencies are expected to see substantial growth, with tokenized real-world assets surpassing $50 billion as Wall Street deepens its crypto integration.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How does crypto exchange net inflows and outflows predict market trends: a 2025 analysis

What is WLFI market overview: price, market cap ranking, trading volume and liquidity

What are the SEC compliance risks and regulatory challenges facing TRX and Tron in 2025?

How does TRON (TRX) compare to Ethereum and other smart contract competitors in 2025?

What is Zcash (ZEC) fundamentals: zk-SNARKs technology, tokenomics, and privacy adoption in 2025?