2025 WILD Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: WILD's Market Position and Investment Value

Wilder World (WILD) is a massive, photorealistic open-world metaverse platform that fuses high-stakes gameplay, social experiences, and real economic opportunity. Since its launch in 2021, the project has established itself as a blockchain-based virtual world backed by industry leaders including Samsung, Epic Games, NVIDIA, and Polygon. As of December 2025, WILD maintains a market capitalization of approximately $22.35 million with a circulating supply of around 394.13 million tokens, trading at $0.0567 per token. This innovative asset is increasingly playing a pivotal role in the emerging Web3 gaming and metaverse ecosystem.

This article will conduct a comprehensive analysis of WILD's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and broader macroeconomic conditions to provide investors with professional price forecasts and actionable investment strategies.

WILD Token Market Analysis Report

I. WILD Price History Review and Current Market Status

WILD Historical Price Evolution

-

2021: Project launch and early trading phase. WILD was published at $0.7264, then experienced significant appreciation driven by early metaverse enthusiasm and industry backing from major partners including Samsung, Epic Games, NVIDIA, and Polygon.

-

November 2021: All-time high (ATH) reached at $7.44 on November 27, 2021, representing a peak valuation period during the metaverse trend cycle.

-

2022-2024: Extended bear market phase. WILD experienced substantial depreciation from its ATH, declining over 91% year-over-year as market sentiment shifted and the broader crypto market faced headwinds.

-

July 2021: All-time low (ATL) recorded at $0.0008609 on July 11, 2021, representing the lowest point in the token's trading history.

WILD Current Market Status

As of December 20, 2025, WILD is trading at $0.0567 with a 24-hour trading volume of $42,215.81. The token demonstrates mixed short-term momentum with a +1.89% gain in the past 1 hour and +8.3% appreciation over the last 24 hours, reflecting recent positive price action. However, this recovery occurs within a challenging longer-term context, with the token down -29.88% over the past 30 days and -91.16% year-over-year.

The fully diluted market capitalization stands at approximately $28.35 million, with a circulating supply of 394.13 million WILD tokens out of a maximum supply of 500 million tokens. The circulating supply represents 78.83% of total supply. WILD maintains a market dominance of 0.00088% and ranks #820 in the global cryptocurrency market by market capitalization. Currently, 22,481 token holders are recorded across the network.

Market sentiment remains cautious, with the current crypto fear and greed index indicating extreme fear conditions. The token trades on 9 exchanges, with Gate.com providing liquidity for WILD trading pairs.

Click to view current WILD market price

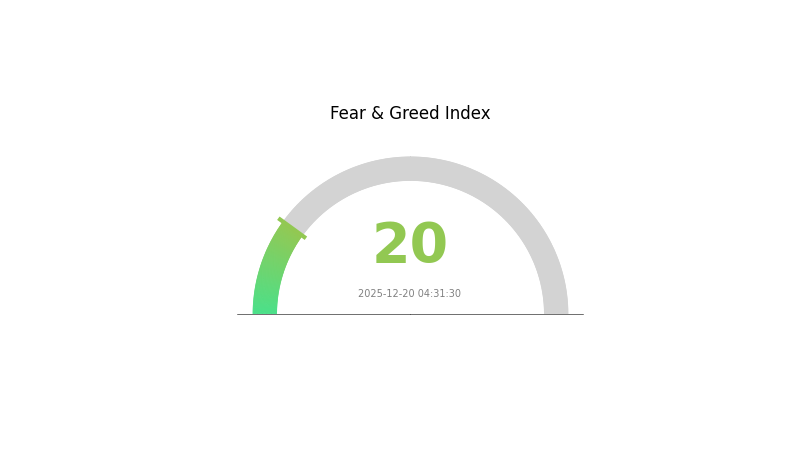

WILD Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 20. This suggests investors are highly risk-averse and pessimistic about market prospects. During such periods, market volatility typically increases as panic selling intensifies. However, extreme fear often presents contrarian opportunities for long-term investors. Consider dollar-cost averaging into quality assets on Gate.com when sentiment reaches these levels, as historical data shows recoveries typically follow periods of extreme fear. Exercise caution with leverage trading during this volatile phase.

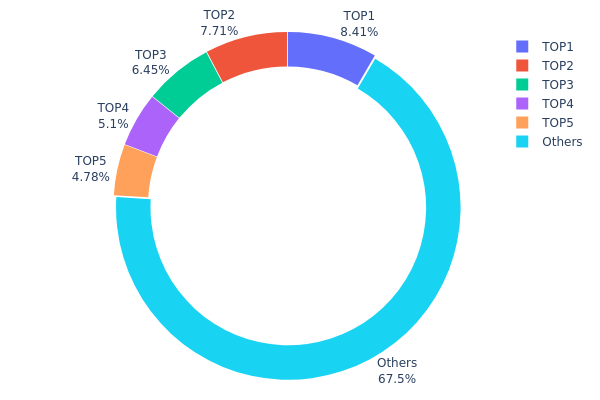

WILD Holdings Distribution

The address holdings distribution chart illustrates the concentration of WILD tokens across the blockchain network by tracking the percentage of total supply held by individual addresses. This metric serves as a critical indicator of token decentralization, market structure integrity, and potential vulnerability to large-scale liquidation events or coordinated market movements.

Current analysis of WILD's top five address holders reveals a moderate concentration pattern. The leading address controls 8.41% of the circulating supply, while the second and third largest holders maintain 7.70% and 6.45% respectively. Collectively, these top five addresses account for approximately 32.43% of total WILD tokens in circulation. While this concentration level suggests some degree of centralization risk, the distribution does not indicate extreme concentration, as no single entity commands a dominant supermajority position. The remaining 67.57% of tokens distributed across other addresses demonstrates a relatively healthy fragmentation of holdings.

The current holdings architecture presents a balanced risk profile for the WILD ecosystem. The dispersed nature of minority holdings among the "Others" category, comprising the vast majority of addresses, suggests meaningful participation from a diverse stakeholder base. However, the concentration of approximately one-third of supply among five addresses warrants monitoring, particularly regarding their accumulation patterns, movement activities, and potential coordinated actions. This distribution framework indicates WILD maintains reasonable decentralization characteristics while retaining structural stability typical of established token ecosystems.

Click to view current WILD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3ac5...71a2b4 | 42062.37K | 8.41% |

| 2 | 0x4eb9...060bb3 | 38526.28K | 7.70% |

| 3 | 0x6b6e...d610aa | 32249.92K | 6.45% |

| 4 | 0xee7a...fecafa | 25509.12K | 5.10% |

| 5 | 0xd247...0a0469 | 23896.08K | 4.77% |

| - | Others | 337725.87K | 67.57% |

II. Core Factors Influencing WILD's Future Price

Supply Mechanism

- Historical Patterns: Supply changes have significantly impacted price volatility in the past. The token was first issued in 2021, reaching an all-time high of $7.44 USD on November 27, 2021.

- Current Impact: The existing supply structure is expected to influence future price movements. Major token holders include several significant addresses, with the top holders collectively controlling a substantial portion of the circulating supply, while the remaining tokens are distributed among other holders.

Macroeconomic Environment

- Monetary Policy Impact: Global economic conditions, inflation rates, and central bank monetary policies affect investor behavior and indirectly influence cryptocurrency prices, including WILD.

- Inflationary Hedge Properties: During inflationary environments, cryptocurrency assets like WILD may serve as alternative stores of value as investors seek to diversify away from traditional fiat currencies facing purchasing power erosion.

- Geopolitical Factors: International geopolitical developments impact overall cryptocurrency market sentiment and capital flows into digital assets.

Technology Development and Ecosystem Building

- Product Adoption and User Growth: Strong product adoption with continuous growth in monthly active users (MAU) and in-game transactions is a key driver pushing token demand. Practical application and actual user expansion are critical factors for token value.

- Deflationary Mechanisms: Successful token burn and deflationary mechanisms work alongside improved liquidity conditions to sustain token demand that exceeds selling pressure, supporting continued price appreciation.

- Ecosystem Applications: WILD is utilized within the Wilder World metaverse ecosystem for in-game transactions, NFT applications, and can be traded and staked on Gate.com platform, providing multiple utility pathways for token adoption.

III. 2025-2030 WILD Price Forecast

2025 Outlook

- Conservative Forecast: $0.03619-$0.05654

- Base Case Forecast: $0.05654

- Optimistic Forecast: $0.08311 (requires sustained market momentum and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing institutional interest and ecosystem expansion

- Price Range Forecast:

- 2026: $0.05796-$0.09427 (23% upside potential)

- 2027: $0.05169-$0.10666 (45% cumulative gains)

- 2028: $0.06416-$0.11039 (66% cumulative gains)

- Key Catalysts: Protocol upgrades, strategic partnerships, growing developer community engagement, and enhanced liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.07567-$0.1353 (assumes steady adoption and market maturation by 2030, with 102% cumulative gains from 2025 levels)

- Optimistic Scenario: $0.12694-$0.1353 (contingent on significant ecosystem expansion, mainstream adoption acceleration, and favorable macroeconomic conditions)

- Transformative Scenario: $0.1353+ (requires breakthrough technological innovations, major institutional adoption wave, and sustained bullish market sentiment)

Note: All price forecasts are based on technical analysis and market modeling. Actual performance may vary significantly based on market conditions, regulatory developments, and broader cryptocurrency market dynamics. Investors should conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.08311 | 0.05654 | 0.03619 | 0 |

| 2026 | 0.09427 | 0.06983 | 0.05796 | 23 |

| 2027 | 0.10666 | 0.08205 | 0.05169 | 45 |

| 2028 | 0.11039 | 0.09435 | 0.06416 | 66 |

| 2029 | 0.12694 | 0.10237 | 0.05221 | 81 |

| 2030 | 0.1353 | 0.11466 | 0.07567 | 102 |

WILD Token Investment Strategy and Risk Management Report

IV. WILD Professional Investment Strategy and Risk Management

WILD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Metaverse enthusiasts and blockchain gaming believers with medium to high risk tolerance

- Operational recommendations:

- Establish a core position during market corrections, targeting accumulation when WILD trades below $0.10

- Set a 2-3 year holding horizon to capture potential ecosystem expansion as Wilder World develops its platform features

- Reinvest any earned in-game rewards or staking yields to compound returns

(2) Active Trading Strategy

- Technical analysis tools:

- Support/Resistance Levels: Monitor the $0.0567 current price level; key resistance at $0.08-0.10, support at $0.04-0.05

- Volume Analysis: Track daily trading volume; breakout confirmed when 24-hour volume exceeds $50,000 with price movement

- Wave operation key points:

- Capitalize on the token's 19.81% 7-day gain momentum for short-term profit-taking near resistance zones

- Monitor correlation with broader blockchain gaming sector sentiment and Polygon network activity

WILD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio allocation

- Active investors: 3-5% of crypto portfolio allocation

- Professional investors: 5-8% of crypto portfolio allocation

(2) Risk Hedging Solutions

- Position Sizing Discipline: Maintain position sizes where any single trade loss does not exceed 2% of total portfolio value

- Dollar-Cost Averaging (DCA): Deploy capital in equal monthly installments to reduce impact of price volatility

(3) Secure Storage Solutions

- Cold Storage: Store long-term holdings in self-custody solutions to eliminate counterparty risk

- Exchange Holdings: Keep only active trading amounts on Gate.com for liquidity and execution efficiency

- Security considerations: Enable two-factor authentication on all accounts, use hardware security keys, and never share private keys or seed phrases

V. WILD Potential Risks and Challenges

WILD Market Risk

- Price Volatility Exposure: WILD has experienced extreme volatility with a 91.16% 1-year decline from peaks, indicating susceptibility to crypto market cycles and sentiment shifts

- Liquidity Constraints: With only $42,215 in 24-hour volume and 22,481 token holders, the market lacks deep liquidity, making large positions difficult to exit without price slippage

- Market Cap Concentration: At $28.3 million fully diluted valuation, WILD remains a micro-cap asset vulnerable to whale manipulation and sudden price movements

WILD Regulatory Risk

- Gaming Industry Uncertainty: Metaverse and play-to-earn gaming face evolving regulatory scrutiny globally regarding gaming licenses and virtual asset classification

- Securities Classification: Potential reclassification as a security by regulatory bodies could trigger compliance obligations and trading restrictions

- Cross-border Compliance: Wilder World's global ambitions may face localized regulatory barriers in key markets restricting token trading or in-game purchases

WILD Technology Risk

- Platform Development Execution: The success of WILD token value depends on timely delivery of gameplay features, social systems, and economic mechanisms as promised

- Smart Contract Vulnerabilities: Any bugs or security exploits in the token contract or staking mechanisms could result in fund loss

- Blockchain Network Dependency: Full reliance on Ethereum and Polygon networks means WILD is exposed to network congestion, fee spikes, and potential protocol-level issues

VI. Conclusion and Action Recommendations

WILD Investment Value Assessment

WILD represents a speculative investment thesis centered on the long-term growth of blockchain-based metaverse gaming. The token's 91% annual decline reflects the broader collapse in crypto gaming enthusiasm from 2021 peaks, indicating that early hype cycles have substantially corrected. However, with institutional backing from Samsung, Epic Games, NVIDIA, and Polygon, Wilder World possesses credibility and resources that many competitors lack. The project's core appeal—combining competitive gameplay, social experiences, and decentralized ownership—addresses genuine user demands if execution succeeds. Current price levels ($0.0567) price in significant technical and regulatory risk, offering potential asymmetric returns for contrarian investors with long time horizons, but also carrying substantial downside risk if the platform fails to gain meaningful user adoption.

WILD Investment Recommendations

✅ Beginners: Start with small dollar-amount investments ($50-200) using Gate.com's trading interface to gain exposure without excessive capital risk; educate yourself on the project roadmap and team before expanding positions

✅ Experienced Investors: Consider 3-5% portfolio allocation using disciplined DCA strategies during market weakness; maintain price alerts at key technical levels ($0.08, $0.10) for tactical rebalancing; monitor quarterly development updates for evidence of platform progress

✅ Institutional Investors: Evaluate WILD as part of broader gaming sector exposure; conduct detailed due diligence on Wilder World's tokenomics, revenue model, and user acquisition costs; establish relationships with project developers for governance participation rights

WILD Trading Participation Methods

- Spot Trading on Gate.com: Purchase WILD tokens directly using Gate.com's spot trading pairs; execute limit orders during low-volume periods to minimize slippage

- Scalping Opportunities: Exploit intra-day volatility using 1-4 hour chart timeframes when volume spikes above normal levels

- Staking and Yield Programs: Monitor for official staking or reward distribution mechanisms launched by Wilder World that provide income while holding positions long-term

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial circumstances. Consult professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

What crypto will 1000x prediction?

No crypto guarantees 1000x returns. However, emerging projects like VeChain, Kaspa, and SingularityNET demonstrate strong fundamentals and growth potential. Conduct thorough research before any decision.

What crypto is predicted to skyrocket in 2025?

Ethereum is predicted to reach $5,190 in 2025. Solana, XRP, and Dogecoin also show strong bullish potential. Bitcoin and other major cryptocurrencies are expected to experience significant growth throughout the year.

What is WILD token and what is its current price?

WILD token is the native cryptocurrency of Wilder World, a metaverse platform. As of December 20, 2025, WILD is priced at $0.05388 with a 24-hour trading volume of $789,142, showing strong market activity and investor interest.

What factors could drive WILD price up or down?

WILD price movement is driven by market demand and supply, project development progress, community sentiment, cryptocurrency market trends, and macroeconomic events affecting the broader digital asset ecosystem.

What is the price prediction for WILD in 2025?

Based on market analysis, WILD price prediction for 2025 ranges from $0.8126 to $1.24. The forecast reflects current market trends and bullish factors shaping the token's future value throughout the year.

ESE vs SAND: Comparing Two Novel Approaches to Efficient Data Processing in Cloud Computing

KONET vs SAND: The Battle for Digital Asset Supremacy in the Metaverse

Is Sovrun (SOVRN) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 ATLAS Price Prediction: Comprehensive Analysis of Growth Factors and Market Outlook

Is Cornucopias (COPI) a Good Investment?: Analyzing the Potential and Risks of This Emerging Metaverse Token

BRETT vs SAND: The Ultimate Showdown in Beach Volleyball

Understanding Crypto Lending: Protocols and Methods Explained

Key Attributes of Cryptographic Hash Functions Explained

Top Utility Tokens for Web3 Investment: Essential Guide

Understanding Ethereum: A Beginner's Guide to Staking

Mastering the Closure of Vertical Call Spreads in Digital Asset Trading