2025 WNDR Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: WNDR's Market Position and Investment Value

Wonderman Nation (WNDR) is a Play-to-Earn gaming token that combines the ecosystem mechanics of Axie Infinity, the battle system of Final Fantasy, and the breeding mechanics of CryptoKitties. Since its launch in May 2022, the project has established itself as a unique metaverse gaming experience. As of December 2025, WNDR maintains a market capitalization of approximately $928,896.55 with a circulating supply of 46,657,117.52 tokens trading at around $0.019909 per token. This innovative gaming asset is playing an increasingly significant role in the Play-to-Earn gaming ecosystem, enabling players to earn through PvP battles, tournament participation, creature breeding, and cross-game metaverse exploration.

This article will conduct a comprehensive analysis of WNDR's price movements from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies for navigating the evolving gaming token landscape.

WNDR (Wonderman Nation) Market Analysis Report

I. WNDR Price History Review and Current Market Status

WNDR Historical Price Evolution Trajectory

- May 2022: Project launch with initial trading price of $0.099, reaching all-time high of $0.327695 on May 9, 2022

- 2023: Market correction period, with price declining significantly throughout the year to reach all-time low of $0.00779408 on October 21, 2023

- 2024-2025: Recovery and consolidation phase, with token stabilizing in lower price ranges

WNDR Current Market Status

As of December 27, 2025, WNDR is trading at $0.019909 with the following key metrics:

Price Performance:

- 1-hour change: +0.01%

- 24-hour change: +0.13%

- 7-day change: -1.43%

- 30-day change: -29.08%

- 1-year change: +3.79%

Market Capitalization & Supply:

- Market cap (current): $928,896.55

- Fully diluted valuation: $9,954,500

- Circulating supply: 46,657,117.52 WNDR (9.33% of total)

- Total/Max supply: 500,000,000 WNDR

- Market dominance: 0.00031%

Trading Activity:

- 24-hour trading volume: $12,062.35

- Price range (24h): $0.01988 - $0.019914

- Token holders: 1,958

- Listed on 1 exchange

Distance from Historical Levels:

- Distance from all-time high ($0.327695): -93.92%

- Distance from all-time low ($0.00779408): +155.31%

Click to view current WNDR market price

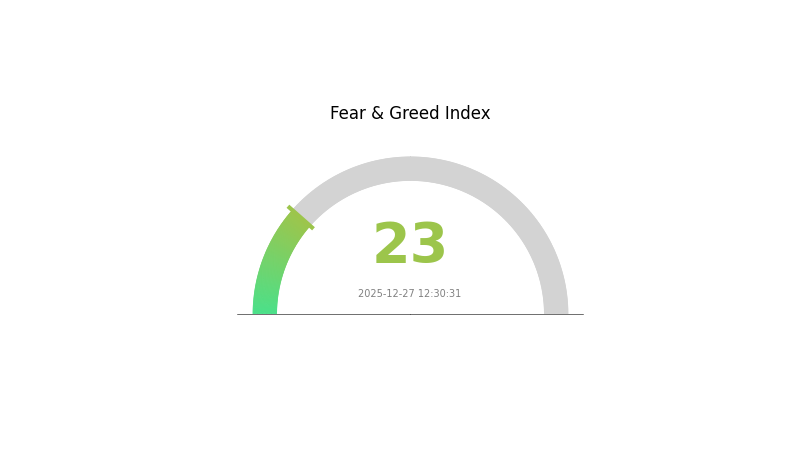

WNDR Market Sentiment Indicator

2025-12-27 Fear and Greed Index: 23(Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 23. This indicates significant bearish sentiment and heightened market anxiety. Such extreme readings often present contrarian opportunities, as panic-driven sell-offs can create favorable entry points for long-term investors. However, caution remains warranted until stabilization signals emerge. Monitor key support levels and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment and adjust your portfolio accordingly during periods of market volatility.

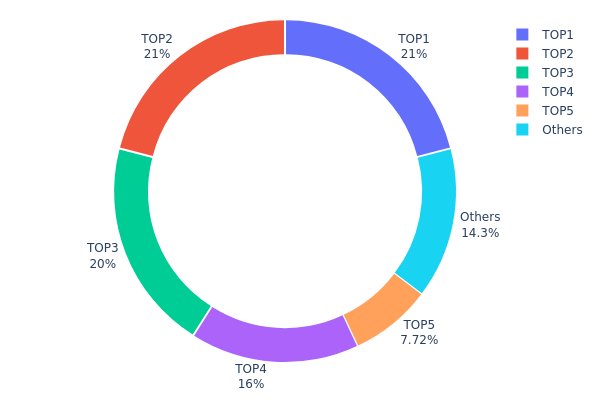

WNDR Holdings Distribution

The address holdings distribution represents a critical on-chain metric that reflects the concentration of token ownership across the WNDR ecosystem. By analyzing the top wallet addresses and their respective holdings as a percentage of total supply, this distribution pattern provides essential insights into market structure, decentralization levels, and potential concentration risks that may influence token dynamics.

WNDR exhibits a pronounced concentration pattern, with the top five addresses collectively controlling 85.71% of the total token supply. The first two addresses, 0x2ec4...3c2b32 and 0xb064...f9416f, each hold 21% of the total supply, followed by 0x3a42...6616c1 with 20%, 0xeb89...9ca7ab with 16%, and 0xadcd...c137a0 with 7.71%. This distribution indicates significant centralization, where major stakeholders command overwhelming control over token liquidity and governance mechanisms. The remaining 14.29% dispersed among other addresses demonstrates a relatively fragmented retail participation base.

Such elevated concentration presents multifaceted implications for market stability and token economics. The substantial holdings concentrated within a limited number of addresses introduce heightened risks of potential market manipulation and price volatility, as coordinated actions or strategic exits by major holders could disproportionately impact token valuation. Additionally, the stark disparity between top holders and the broader market participant base suggests limited decentralization, which may constrain organic market development and reduce the resilience of the ecosystem against adverse events. This concentration structure necessitates careful monitoring of wallet activity and movement patterns.

Click to view current WNDR holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2ec4...3c2b32 | 105000.00K | 21.00% |

| 2 | 0xb064...f9416f | 105000.00K | 21.00% |

| 3 | 0x3a42...6616c1 | 100000.00K | 20.00% |

| 4 | 0xeb89...9ca7ab | 80000.00K | 16.00% |

| 5 | 0xadcd...c137a0 | 38592.23K | 7.71% |

| - | Others | 71407.77K | 14.29% |

II. Core Factors Impacting WNDR's Future Price

Macro Market Sentiment and Trends

-

Market Sentiment Impact: Investor emotions and confidence directly influence WNDR price movements. Market sentiment regarding the token's future prospects plays a crucial role in price volatility.

-

Macro Economic Trends: WNDR's price is influenced by broader macro-economic trends, policy regulation, and technological innovation across multiple dimensions.

-

Geopolitical Factors: Global instability and potential geopolitical risks create market uncertainty that affects investor outlook on future price movements.

Technology Development and Ecosystem Construction

-

GameFi Industry Trends: By mid-2025, blockchain gaming (GameFi) macro trends emphasize product-market fit, sustainable on-chain economics, and stricter security audits. These factors serve as primary drivers for WNDR's medium-term trajectory.

-

Policy Regulation: Regulatory frameworks and government oversight of blockchain and crypto assets significantly impact WNDR's price outlook and market adoption.

-

Technological Innovation: Continuous technological advancement within the blockchain ecosystem influences WNDR's competitive positioning and long-term value proposition.

Three、2025-2030 WNDR Price Forecast

2025 Outlook

- Conservative Forecast: $0.01035 - $0.02866

- Neutral Forecast: $0.0199 (average expected level)

- Bullish Forecast: $0.02866 (requiring sustained market stability and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Steady growth phase with gradual accumulation and infrastructure development

- Price Range Forecast:

- 2026: $0.02113 - $0.03618 (21% upside potential)

- 2027: $0.01844 - $0.04323 (51% upside potential)

- 2028: $0.02865 - $0.04701 (84% upside potential)

- Key Catalysts: Ecosystem expansion, increased network utility, growing institutional recognition, and enhanced token liquidity on major platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.03547 - $0.07296 (assuming steady ecosystem development and moderate market adoption through 2030)

- Bullish Scenario: $0.04187 - $0.05946 (assuming accelerated protocol upgrades and significant partnership announcements)

- Transformational Scenario: Exceeding $0.07296 (contingent on breakthrough technological innovation, mainstream market penetration, and macro-economic tailwinds)

- December 27, 2030: WNDR projected to potentially reach $0.07296 (representing 154% cumulative growth from 2025 baseline, reflecting five-year compounding adoption curve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02866 | 0.0199 | 0.01035 | 0 |

| 2026 | 0.03618 | 0.02428 | 0.02113 | 21 |

| 2027 | 0.04323 | 0.03023 | 0.01844 | 51 |

| 2028 | 0.04701 | 0.03673 | 0.02865 | 84 |

| 2029 | 0.05946 | 0.04187 | 0.02931 | 110 |

| 2030 | 0.07296 | 0.05067 | 0.03547 | 154 |

Wonderman Nation (WNDR) Professional Investment Analysis Report

I. Executive Summary

Wonderman Nation (WNDR) is a play-to-earn gaming token that combines Final Fantasy battle mechanics, Axie Infinity's dual-token ecosystem, and CryptoKitties breeding mechanics. As of December 27, 2025, WNDR trades at $0.019909 with a market capitalization of approximately $9.95 million and a 24-hour trading volume of $12,062.35.

Key Metrics Overview:

- Current Price: $0.019909

- 24H Change: +0.13%

- Market Cap: $9,954,500

- Circulating Supply: 46,657,117.52 WNDR

- Total Supply: 500,000,000 WNDR

- Market Ranking: #2,683

II. Project Overview

Project Background

Wonderman Nation represents an innovative approach to the play-to-earn gaming sector by merging established gaming mechanics from multiple successful franchises. The project aims to realign incentives between gamers and developers through a novel token reward system.

Core Features

Gameplay Mechanics:

- PvP combat system based on Final Fantasy battle mechanics

- Tournament participation opportunities

- Creature breeding and NFT discovery within game progression

- Cross-border metaverse exploration enabling discovery of new creatures on alternate planets

- Genomic breeding rights enabling continuous revenue streams through token staking

Economic Model:

- Dual-token system similar to Axie Infinity

- Zero upfront cost entry for new players

- Percentage-based sustainable reward pools

- Integrated creature staking/yield mechanisms with seamless royalty sharing

- Income generation for creature owners during idle periods

Key Design Principles

The project emphasizes three core principles:

- Accessibility: New players can begin earning immediately with zero initial investment

- Sustainability: Percentage-based reward pools ensure long-term viability

- Community: Blockchain technology integration with built-in creator benefit mechanisms

III. Market Analysis & Performance Metrics

Price Performance Analysis

Historical Price Range:

- All-Time High: $0.327695 (May 9, 2022)

- All-Time Low: $0.00779408 (October 21, 2023)

- Current Price: $0.019909

- Distance from ATH: -93.92%

- Distance from ATL: +155.49%

Price Trend Analysis:

- 1 Hour: +0.01%

- 24 Hours: +0.13%

- 7 Days: -1.43%

- 30 Days: -29.08%

- 1 Year: +3.79%

Market Position & Liquidity

Supply Metrics:

- Circulating Supply: 46,657,117.52 WNDR (9.33% of total supply)

- Total Supply: 500,000,000 WNDR

- Fully Diluted Valuation: $9,954,500

- Market Cap/FDV Ratio: 9.33%

Trading Activity:

- 24H Volume: $12,062.35

- Active Holders: 1,958

- Exchange Listings: 1 (Gate.com)

Market Sentiment

Current market sentiment indicates neutral positioning with moderate trading activity. The token's presence on Gate.com provides traders with access to this emerging gaming asset.

IV. WNDR Professional Investment Strategy & Risk Management

WNDR Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Crypto-native gamers interested in gaming ecosystems, long-term blockchain gaming enthusiasts, and investors seeking exposure to the P2E gaming vertical

-

Operational Recommendations:

- Establish positions during market volatility when entry valuations are attractive

- Participate in gameplay and creature staking mechanisms to generate additional yield beyond token appreciation

- Reinvest earned rewards to compound exposure during early adoption phases

-

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure token storage and staking participation

- Maintain private key security through established best practices

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Volume Analysis: Monitor daily trading volume relative to 30-day average to identify breakout opportunities and liquidity conditions

- Price Action: Track support levels at $0.0198 and resistance near $0.0205 for entry/exit decision-making

-

Trading Considerations:

- Entry points following 30+ day downtrends may present value opportunities

- Position sizing should reflect the token's thin liquidity profile relative to larger exchanges

- Avoid large single orders that could create significant slippage

WNDR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-2% of crypto portfolio allocation maximum

- Active Investors: 2-5% of crypto portfolio allocation

- Professional/Gaming-Focused Investors: 5-10% of crypto portfolio allocation

Allocation percentages should reflect individual risk tolerance and the speculative nature of gaming tokens.

(2) Risk Mitigation Approaches

- Position Sizing: Limit individual position size to amounts that would not materially impact portfolio composition if exposure declined 50-75%

- Diversification Within Gaming: Balance WNDR exposure with exposure to other established gaming blockchain projects to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet provides direct access to trading, staking, and gaming participation while maintaining reasonable security

- Security Best Practices: Enable all available security features, use strong password protocols, and never share seed phrases or private keys

V. Potential Risks & Challenges

Market Risks

- Liquidity Risk: Limited trading volume ($12,062 daily) restricts the ability to execute large orders without significant price impact

- Price Volatility: Historical decline of 93.92% from all-time high reflects high volatility and speculative nature of the asset

- Adoption Risk: Gaming token success depends on sustained player engagement and ecosystem growth, which remains unproven at scale

- Competition Risk: The P2E gaming space faces intense competition from established projects with larger user bases and funding

Regulatory Risks

- Gaming Classification Uncertainty: Regulatory treatment of play-to-earn gaming tokens remains unsettled in multiple jurisdictions

- Rewards Mechanism Scrutiny: Percentage-based reward systems may face regulatory review regarding securities classification

- Geographic Restrictions: Certain jurisdictions may restrict or prohibit participation in blockchain gaming platforms

Technical Risks

- Smart Contract Risk: Blockchain-based token systems remain subject to potential vulnerabilities in smart contract code

- Network Risk: Blockchain network congestion or technical failures could impact gameplay and token transfers

- Maintenance Risk: Ongoing development and updates required to maintain game functionality and player experience present execution risk

VI. Conclusions & Action Recommendations

WNDR Investment Value Assessment

Wonderman Nation represents a speculative opportunity within the play-to-earn gaming sector. The project's combination of established gaming mechanics aims to address accessibility and sustainability concerns in previous gaming token implementations. However, the token's current market position—ranking #2,683 with a $9.95 million market cap and significant decline from historical highs—reflects both the experimental nature of gaming tokens and challenges in sustaining player engagement.

The 30-day decline of -29.08% suggests market uncertainty regarding the project's development trajectory and competitive positioning. Long-term value generation depends on successful ecosystem adoption, active player engagement, and the ability to sustain in-game reward mechanisms without token devaluation.

WNDR Investment Recommendations

✅ Beginners: Consider small, speculative allocations (0.5-1% of crypto portfolio) only after understanding gaming mechanics and the high-risk nature of P2E tokens. Participate in gameplay before investing capital to assess project quality firsthand.

✅ Experienced Investors: Evaluate WNDR as a gaming sector exposure play with strict portfolio allocation limits (2-5%). Consider dollar-cost averaging approaches to reduce timing risk on volatile assets. Monitor development milestones and player engagement metrics as key valuation indicators.

✅ Institutional Investors: WNDR's market cap and liquidity may present challenges for significant institutional deployment. Consider exposure through diversified gaming token baskets rather than concentrated positions. Evaluate the project's tokenomics sustainability model and competitive advantages within the evolving P2E landscape.

WNDR Trading Participation Methods

- Direct Spot Trading: Access WNDR trading pairs through Gate.com with competitive fees and reliable execution

- Strategic Accumulation: Participate in gameplay earning mechanisms while maintaining speculative token positions for potential appreciation

- Portfolio Integration: Include WNDR as a satellite holding within broader gaming and blockchain sector allocations

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and consult professional financial advisors. Never invest capital that you cannot afford to lose completely.

FAQ

Is WNDR stock a good investment?

WNDR shows strong growth potential in the Web3 sector. With increasing adoption and market expansion, it presents compelling investment opportunities. However, conduct thorough research and assess your risk tolerance before investing in this emerging asset.

What factors influence WNDR price movements?

WNDR price movements are influenced by market demand, trading volume, investor sentiment, regulatory developments, and broader cryptocurrency market trends. Company fundamentals and macroeconomic conditions also impact pricing.

What is the price prediction for WNDR in 2025?

WNDR is predicted to average $0.01809 in 2025, with a high of $0.02424 and a low of $0.01067, based on market analysis and historical data trends.

What is WNDR and what is its use case?

WNDR is a cryptocurrency designed for decentralized finance ecosystems, enabling liquidity provision and governance participation. It facilitates trading activities and governance decisions within decentralized platforms.

What are the risks associated with WNDR investment?

WNDR investment carries significant risks including potential total loss of capital, extreme market volatility, and limited regulatory oversight in the crypto sector. Conduct thorough research before investing.

How has WNDR performed historically compared to similar tokens?

WNDR has declined 27.35% over the past week, underperforming the broader crypto market. Its market cap and trading volume have dropped significantly compared to similar tokens in the same category.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential

Ethereum Co-Founder Vitalik on the Creator Token Dilemma: Why Non-Tokenized DAOs Are the Key