2025 WRX Price Prediction: Expert Analysis and Market Forecast for the Next Generation Subaru Performance Sedan

Introduction: Market Position and Investment Value of WRX

WazirX (WRX) stands as the utility token of WazirX, a centralized cryptocurrency exchange platform with advanced trading capabilities. Since its inception through private token sales and Binance Launchpad in 2018, WRX has established itself as a functional asset within the exchange ecosystem. As of December 2025, WRX maintains a market capitalization of approximately $25.28 million, with a circulating supply of around 456.52 million tokens, currently trading at $0.05537. This token, recognized for its multi-functional role in the exchange platform, continues to play an important part in facilitating trading discounts, transaction mining, margin fee payments, and other exchange operations.

This article will provide a comprehensive analysis of WRX's price trajectory from 2025 through 2030, integrating historical price patterns, market supply dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

WRX Market Analysis Report

I. WRX Price History Review and Current Market Status

WRX Historical Price Evolution

-

2021: WRX reached its all-time high of $5.88 on April 5, 2021, marking the peak of the token's value since its launch through private token sales and Binance Launchpad.

-

2024-2025: The token experienced significant depreciation, declining from its historical highs. On December 25, 2024, WRX touched its all-time low of $0.01565274, representing a dramatic correction from previous valuations.

-

2025: Continued downward pressure, with the token trading at $0.05537 as of December 20, 2025, reflecting a -45.30% decline over the past year.

WRX Current Market Status

As of December 20, 2025, WRX is trading at $0.05537, with the following market metrics:

Price Performance:

- 24-hour change: -1.48% (down $0.000832)

- 7-day change: -19.12%

- 30-day change: -26.70%

- 1-year change: -45.30%

Market Capitalization and Valuation:

- Market capitalization: $25,277,347.80

- Fully diluted valuation: $55,370,000

- Market dominance: 0.0017%

- Market cap rank: 772

Supply Metrics:

- Circulating supply: 456,517,027.33 WRX (47.42% of total supply)

- Total supply: 1,000,000,000 WRX

- Holders: 8,101 addresses

- Token standard: BEP-20 (Binance Smart Chain)

Trading Activity:

- 24-hour trading volume: $15,840.14

- 24-hour high: $0.05803

- 24-hour low: $0.0526

WRX maintains its position as the functional token of the WazirX cryptocurrency exchange platform, utilized for transaction fee discounts, trading rewards through transaction mining, margin fee payments, and other exchange-related functions. The token operates on the Binance Smart Chain network and is listed on select cryptocurrency exchanges.

View current WRX market price

Market Sentiment Indicator

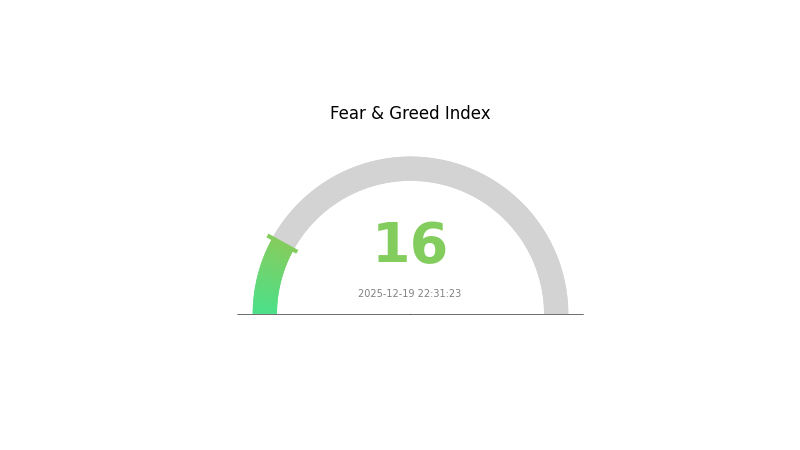

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This indicates severe market pessimism and heightened investor anxiety. When the index reaches such extreme lows, it often signals potential buying opportunities for long-term investors, as markets tend to overreact to negative sentiment. However, traders should exercise caution and conduct thorough research before making investment decisions. Monitor market developments closely on Gate.com for real-time data and analysis to navigate this volatile period effectively.

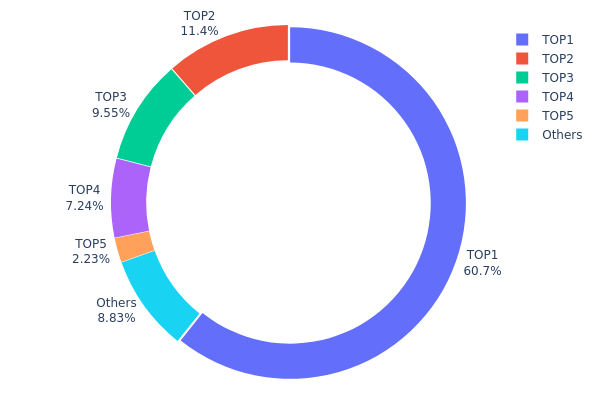

WRX Holdings Distribution

The address holdings distribution chart reveals the concentration of WRX tokens across the blockchain network, providing critical insights into token ownership patterns and market structure. This metric tracks the top token holders and their proportional share of total supply, serving as a key indicator of decentralization levels and potential market vulnerability to large-scale liquidations or coordinated actions.

WRX demonstrates pronounced concentration characteristics, with the top holder commanding 60.70% of the total supply, representing a significant dominance within the ecosystem. The second and third largest holders account for 11.42% and 9.55% respectively, while the top four addresses collectively control 88.91% of all WRX tokens in circulation. This highly skewed distribution pattern raises concerns about the token's decentralization trajectory and governance resilience. The remaining 8.86% dispersed among other addresses underscores the stark imbalance between institutional or major stakeholder positions and retail participation.

Such extreme concentration creates meaningful implications for market dynamics and price stability. The substantial holdings concentrated in a handful of addresses elevate the risk of sudden selling pressure, potential price manipulation through coordinated liquidations, and reduced market liquidity during volatile periods. Furthermore, the dominance of early-stage holders or institutional entities may limit organic market participation and create asymmetric information advantages. The current distribution structure suggests that WRX's on-chain governance and price discovery mechanisms remain heavily influenced by a small subset of participants, constraining the token's progression toward genuine decentralization and independent market equilibrium.

Click to view current WRX holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...001004 | 584414.06K | 60.70% |

| 2 | 0xf977...41acec | 110000.00K | 11.42% |

| 3 | 0x8af3...029943 | 91936.56K | 9.55% |

| 4 | 0xc882...84f071 | 69739.17K | 7.24% |

| 5 | 0x47ac...a6d503 | 21510.90K | 2.23% |

| - | Others | 85045.99K | 8.86% |

II. Core Factors Affecting WRX Future Price

Exchange Operations and Growth

- User Base Expansion: Increases in user numbers and trading volume will enhance WRX demand and value.

- Platform Development: WazirX platform growth is fundamental to WRX token prospects, as the exchange's operational efficiency and market position directly influence token utility.

- Market Liquidity: Trading volume and market liquidity dynamics play crucial roles in determining price movements.

Market Demand and Sentiment

- Market Demand: Overall market demand for WRX tokens is the core factor determining future price movements.

- Investor Sentiment: Market sentiment significantly impacts price volatility across multiple dimensions, influencing buying and selling pressure.

Regulatory Environment

- India Government Policy: Regulatory policies from the Indian government significantly affect WRX token pricing, as WazirX operates primarily in the Indian market.

- Regulatory Dynamics: Monitoring and compliance with regulatory frameworks remain critical factors for platform sustainability and token value.

Macroeconomic Environment

- Macroeconomic Trends: Global economic trends and policy shifts impact WRX price performance.

- Market Cycle: Cryptocurrency market cycles and broader market conditions influence WRX trading patterns and long-term value appreciation.

Technology Development and Ecosystem

- Technical Innovation: Technology innovation directly impacts the platform's competitiveness and user retention, subsequently affecting WRX demand.

- Ecosystem Building: Development of the WazirX ecosystem, including new features and services, strengthens the platform's value proposition and supports token utility.

III. WRX Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.04586 - $0.05525

- Base Case Forecast: $0.05525 - $0.06022

- Optimistic Forecast: $0.06022 (requiring sustained market sentiment and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth as the asset establishes market presence and utility expansion

- Price Range Predictions:

- 2026: $0.04677 - $0.08083

- 2027: $0.03811 - $0.07413

- 2028: $0.06525 - $0.10183

- Key Catalysts: Enhanced platform adoption, strategic partnerships, ecosystem expansion, and improved market liquidity through major trading platforms such as Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.08677 - $0.11193 (assuming steady adoption and moderate market expansion)

- Optimistic Scenario: $0.11193 - $0.14803 (contingent on mainstream institutional interest and significant ecosystem milestones)

- Transformational Scenario: Above $0.14803 (under conditions of breakthrough technological developments and widespread protocol adoption)

Note: All price forecasts represent technical analysis projections and should not be considered as investment recommendations. Market volatility and unforeseen circumstances may significantly impact actual price movements.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06022 | 0.05525 | 0.04586 | 0 |

| 2026 | 0.08083 | 0.05774 | 0.04677 | 4 |

| 2027 | 0.07413 | 0.06928 | 0.03811 | 25 |

| 2028 | 0.10183 | 0.07171 | 0.06525 | 29 |

| 2029 | 0.11193 | 0.08677 | 0.06768 | 56 |

| 2030 | 0.14803 | 0.09935 | 0.05464 | 79 |

WRX Professional Investment Strategy and Risk Management Report

IV. WRX Professional Investment Strategy and Risk Management

WRX Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Investors seeking exposure to India-focused cryptocurrency infrastructure and exchange tokens with medium to long-term investment horizons

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach to accumulate WRX during market downturns, given the token's significant decline of -45.30% over the past year

- Regular monitoring of WazirX exchange adoption rates and transaction volumes as key performance indicators

- Holding period of 2-3 years minimum to capture potential recovery and platform growth

(2) Active Trading Strategy

- Technical Analysis Indicators:

- Relative Strength Index (RSI): Use RSI readings below 30 to identify oversold conditions and potential entry points

- Moving Average Convergence Divergence (MACD): Monitor MACD crossovers on 4-hour and daily timeframes to confirm trend direction

- Swing Trading Key Points:

- Utilize the recent all-time low of $0.01565274 (December 25, 2024) as a significant support level

- Execute partial take-profit orders at 30%, 50%, and 70% recovery levels toward the historical high of $5.88

WRX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation

- Active Investors: 2-5% of total crypto portfolio allocation

- Professional Investors: 3-8% of total crypto portfolio allocation

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance WRX holdings with established cryptocurrencies to reduce concentration risk from a single exchange token

- Stop-Loss Implementation: Set stop-loss orders at 15-20% below entry points to protect against unexpected downside movements

(3) Secure Storage Solutions

- Hot Wallet Approach: Use Gate.com's integrated wallet for active trading and frequent transactions, as WRX is directly tradable on the platform

- Cold Storage Best Practices: For long-term holdings, transfer WRX to hardware wallets that support BEP-20 tokens on the Binance Smart Chain network

- Security Precautions: Enable two-factor authentication (2FA) on all exchange accounts, maintain encrypted backups of private keys in secure locations, and never share seed phrases or private keys with third parties

V. WRX Potential Risks and Challenges

WRX Market Risks

- Extreme Price Volatility: WRX has experienced a 98.44% decline from its all-time high of $5.88 to the current price of $0.05537, reflecting severe market volatility and loss of investor confidence

- Low Trading Volume: With 24-hour volume of only $15,840.14 against a market capitalization of $25.28 million, liquidity concerns could exacerbate price movements

- Exchange Token Risk: As a utility token tied to WazirX platform performance, any decline in exchange trading activity directly impacts token demand and value

WRX Regulatory Risks

- India-Specific Regulatory Uncertainty: WazirX operates primarily in India, where cryptocurrency regulations remain ambiguous and subject to frequent changes from government authorities

- Geographic Concentration: Heavy dependence on the Indian market exposes WRX to localized regulatory crackdowns or policy shifts affecting the crypto industry in that region

- Compliance Changes: Future regulatory actions targeting centralized exchanges or cryptocurrency trading could negatively impact the WazirX platform and WRX token utility

WRX Technical Risks

- Blockchain Dependency: WRX operates as a BEP-20 token on the Binance Smart Chain, creating reliance on BSC's continued security and availability

- Smart Contract Vulnerabilities: Any undetected bugs or security flaws in the token's smart contract could potentially lead to loss of funds or token supply manipulation

- Chain Migration Risk: If WazirX migrates WRX to a different blockchain or implements protocol changes, technical execution risks could affect token holders

VI. Conclusion and Action Recommendations

WRX Investment Value Assessment

WRX represents a high-risk, high-reward investment opportunity tied to the growth of cryptocurrency adoption in India. While the token has suffered significant depreciation (-45.30% annually), it maintains utility within the WazirX ecosystem for trading fee discounts and transaction mining. The token's current valuation near multi-year lows presents potential entry opportunities for risk-tolerant investors, though recovery is contingent on sustained platform growth and favorable regulatory developments in India.

WRX Investment Recommendations

✅ Beginners: Start with micro-cap allocations (under 1% of portfolio) exclusively using dollar-cost averaging to establish a foundation position while learning about exchange tokens and India-focused crypto infrastructure

✅ Experienced Investors: Implement a structured 3-5% portfolio allocation using technical analysis-driven swing trading strategies with strict stop-losses, combined with a core long-term holding position

✅ Institutional Investors: Conduct thorough due diligence on WazirX's regulatory compliance, user metrics, and revenue trends before considering allocation; structure positions to weather potential regulatory headwinds

WRX Trading Participation Methods

- Direct Trading on Gate.com: Access WRX trading pairs directly through Gate.com's platform with competitive fees and high liquidity

- Spot Trading: Purchase WRX tokens outright during weakness and hold for medium-term recovery potential

- P2P Conversion: Utilize WazirX's peer-to-peer functionality to convert between USDT and Indian Rupee (INR) when engaging with Indian users in the ecosystem

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and should consult with qualified financial advisors. Never invest more than you can afford to lose completely.

FAQ

Will WazirX coin recover?

WazirX coin has strong recovery potential driven by improving market conditions and platform developments. With increasing adoption and positive market sentiment, the coin is positioned for significant growth in the coming months.

How much is WRX coin worth today?

As of today, WRX coin is worth $0.05729, down 3.17% in the last 24 hours with a trading volume of $36,301. The price is currently 16.59% below its 7-day high.

Who is the owner of WRX coin?

WRX coin is owned by Nischal Shetty, founder and CEO of WazirX. He created WRX as India's digital asset for the cryptocurrency ecosystem.

MACD & RSI: Essential Indicators for Predicting Quq's Price Trends in 2025

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

why is crypto crashing and will it recover ?

FET Crypto Price Prediction 2025

What Is Alephium (ALPH)? Price Forecast and Growth Outlook

XLM Crypto Price Prediction: Why Stellar Could Surge Beyond AUD $1?

What is the current crypto market overview: market cap rankings, trading volume, and liquidity analysis in 2025?

Understanding Lista: A Comprehensive Guide to Token Megadrops

Strategies to Minimize Blockchain Transaction Costs

What Is Token Economics Model: Complete Guide to Token Distribution, Inflation Design, and Governance Utility

A8 vs QNT: A Comprehensive Comparison of Two Emerging Blockchain Technologies and Their Market Impact